End Cap-Gains on Bullion to Secure Critical Supply

How a capital-gains holiday on gold and silver in combination with permanent removal of sales tax could strengthen U.S. monetary resilience and strategic mineral security.

Gold and Silver as Strategic Assets: Tax Policy as a Supply Lever

Authored by GoldFix

Years ago, when asked informally how much gold China really has, one PBoC official reportedly replied that “China owns gold through its people.” The remark has since become shorthand for Beijing’s view that privately held bullion inside China is effectively part of the state’s latent reserve base.

The United States now stands at an economic crossroads where a similar reality exists, albeit with a fundamentally different governing ethos. America also owns gold through its citizens. The question is whether public tax-policy will recognize this reality and adopt an incentive structure that mobilizes, rather than suppresses, private bullion supply.

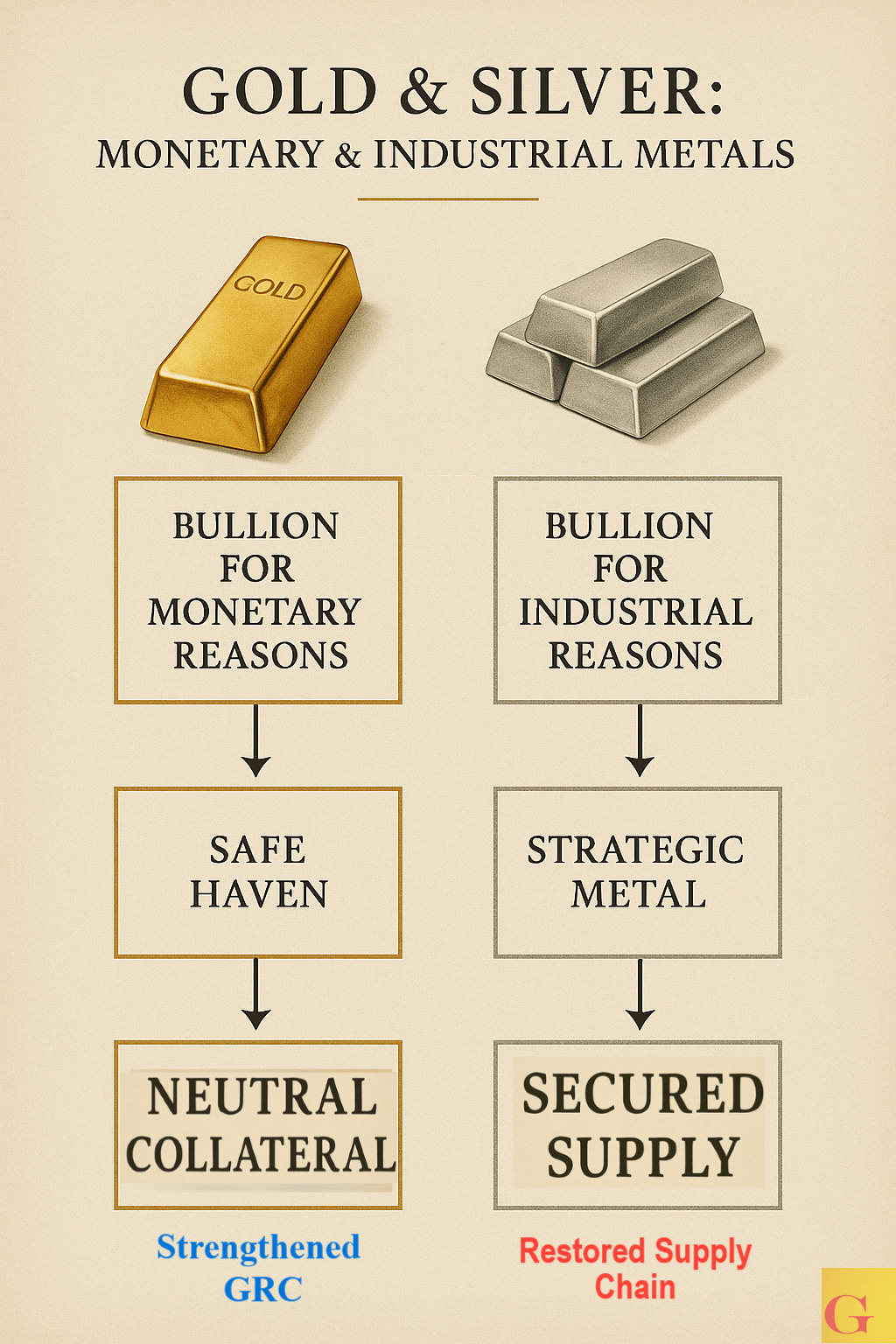

With both gold and silver now occupying renewed strategic relevance within U.S. policy circles, the framework for securing domestic bullion supply is beginning to look less theoretical and more operational. Gold retains its monetary role as a reserve asset, collateral anchor, and trust base for financial markets. Silver, newly designated as a critical mineral, has become essential to industrial electrification, solar deployment, defense applications, and next-generation electronics.

The problem Washington faces is the same for both metals: supply is structurally rigid while demand is becoming policy-driven.

Mine production cannot ramp quickly. Permits stretch over decades. Environmental opposition limits domestic scalability. Silver production is overwhelmingly a byproduct of base-metal mining outside U.S. borders. Gold development is equally capital-bound and slow. In neither case does the industrial-subsidy model used for lithium or copper translate effectively into near-term supply gains.

If policymakers wish to boost domestic access without triggering commodity price spikes or overt government accumulation programs, the most expedient lever is not extraction. It is taxation. Specifically the removal of it.

⸻

The Current Tax Regime: A Structural Supply Lock

At the federal level, both gold and silver bullion are classified as “collectibles.” Long-term capital gains are taxed at a maximum statutory rate of 28%, rather than the standard 15–20% applicable to equities and most financial assets. For higher-income households, this rate is augmented by the 3.8% Net Investment Income Tax (NIIT), driving the effective federal tax burden on long-term precious-metal sales to approximately 31.8%, commonly rounded to ~32% of realized gains.

Short-term gains (positions held one year or less) are taxed as ordinary income, subject to marginal rates up to 37%, again with the potential addition of the 3.8% NIIT, producing an effective top federal burden approaching 40.8%.

This classification places precious metals among the most heavily taxed capital assets in the U.S. system.

The behavioral outcome is predictable. Holders of both metals, particularly long-term owners with deep embedded gains acquired during prior price cycles, are reluctant to liquidate and surrender roughly one-third of their profits to federal taxation. For silver, the effect is magnified by a strong retail hoarding culture and long-held speculative accumulation. For gold, it manifests through extended holding periods among high-net-worth custodial and vaulting accounts.

In both cases the result is identical: large stocks of above-ground bullion remain immobilized, isolated from both industrial consumption channels in the case of silver and from sovereign accumulation channels in the case of gold.

⸻

Policy Reversal: Incentivized Liquidity Release

We believe the most efficient method for mobilizing this inventory is a temporary capital-gains tax holiday covering both gold and silver bullion sales, specifically suspending the 28% collectibles rate plus the 3.8% NIIT, reducing realized tax liability to zero for a defined window.

The incentive mechanism is powerful. A seller currently facing a ~32% tax haircut on gains would instantly see realized sale prices jump by nearly 30% net, collapsing breakeven thresholds and eliminating the psychological resistance to liquidation. What had previously felt confiscatory becomes opportunistic.

This is not abstraction. Italy has recently proposed reduced taxation and one-time disclosure mechanisms encouraging citizens to report and surrender privately held gold. The purpose is to mobilize dormant reserves at a discount to future penalties. The logic is identical: lower taxes now to flush metal into circulation, discourage hoarding behavior, and rebuild national stockpiles.

We believe the U.S. model would differ in tone but not function. Rather than pairing incentives with future penalties, a U.S. tax holiday could remain purely voluntary. Citizens sell bullion tax-free, unlock liquidity, and redeploy capital. No confiscation. No future punishment. Just a powerful incentive aligned with both market behavior and national strategic need.

The supply response would be rapid and front-loaded. Retail and private bullion hoards represent the largest marginal pool of mobilizable metal in both silver and gold markets. These reserves remain idle solely due to adverse tax economics. A credible, time-limited exemption would funnel vast volumes into dealer networks, refiners, and reallocators almost immediately.

⸻

Remaining Sections

- Back-of-the-Napkin Supply Mobilization

- Tax-Policy Normalization and Domestic Accumulation

- Strategic Aftermath: Permanent Tightening Through Tax-Free Purchases

- Conclusion: One Tool Serving Two Objectives

Continues here

Free Posts To Your Mailbox