How To Go Bankrupt Betting On Silver

How To Go Bankrupt Betting On Silver

Today's guest post, by our friend David Janello, PhD, CFA, addresses that question.

Dr. Janello is the founder of SpreadHunter, and the author of The Nuclear Option: Trading To Win With Options Momentum Strategies.

Before we get to Dr. Janello's post, two quick programming notes.

- We've got an exciting options trade teed up for later today, a bullish bet on one of our current top names, an AI chipmaker with 25% short interest. If you want a heads up when we place it, you can subscribe to our trading Substack/occasional email list below.

- If you want to hedge market risk here, you can use the Portfolio Armor website or iPhone app to scan for the optimal ones given your risk tolerance and time frame.

Monday Morning Update

Today's trade alert is out:

⚡️Swinging For The Fences⚡️

— Portfolio Armor (@PortfolioArmor) December 8, 2025

A bullish bet on one of our top ten names from Friday: an AI equipment stock with 25% short interest.https://t.co/8DhlnrTC5w

Now on to Dr. Janello's post.

Authored by David Janello, PhD, CFA, at Nuclear's Substack

Today's Darwin Award Trade

Ratio Spreads in SLV

Back in the early years of the Internet long before the World Wide Web, an a imaginative group of pranksters started handing out ‘Darwin Awards.’ Here is the original description:

“In the spirit of Charles Darwin, the Darwin Awards commemorate individuals who protect our gene pool by making the ultimate sacrifice of their own lives. Darwin Award winners eliminate themselves in an extraordinarily idiotic manner, thereby improving our species’ chances of long-term survival.”

Above: Charles Darwin, the historical figure who inspired the Darwin Awards.

In the world of financial instruments, options are in a class of their own in terms of Darwinian destruction. Starting with Nick Leeson, who wiped out Barings Bank — the Queen of England’s Bank, for younger readers — using Short Option Straddles on the Nikei Index, and a few years later there was Nobel Laureate Myron Scholes, who incinerated even more cash at his firm Long Term Capital Management, in large part because of a multi billion dollar Short Straddle position in VIX Index Options.

In more recent years, hedge funds trading Call Ratio Spreads booked huge losses in 2017 after the surprise election of Donald Trump pushed stock prices higher than the traders expected.

What is a Call Ratio Spread? It consists of two legs:

-

One Long Call at a Closer to the Money Strike

-

More Than One Call at a Further Away from the Money Strike.

Example:

-

Long One 350 Strike Call Option In IBM

-

Short Two 370 Strike Call Options in IBM, at the same expiration date

Astute readers might note that this trade is exactly the same as a Long Call Butterfly Spread, without the top leg. Readers who dabbled in Butterflies a bit probably remember the part where the stock rallied too much too soon and they were staring at a 100% loss. Yes, 100% losses are no fun. Especially the first couple of times it happens. It’s hard to get used to having the stock go up and losing all of your investment. But without the protective upper long call leg in the Butterfly Spread, the losses can be worse than 100%. A lot, lot worse. For you, for your broker dealer, for your Clearing Firm, and if you really screw up, for the Options Clearing Corporation itself.

Naive traders usually say “But it’s just a small position size!”

This mindset leads directly to becoming a Darwin Reward Recipient. Or at least an Honorable Mention.

Which leads us to today’s Darwinian trade: Soaring Silver Prices Set Up An Options Trade On This Fund , published yesterday in the distinguished mainstream outlet Investors Business Daily.

The trade that IBD describes is a Call Ratio Spread in the SLV Silver ETF, which costs only 20- per spread with a maximum profit of 980- if SLV lands at the 65 strike price. The spread doesn’t lose money until SLV reaches 74.80, which is way above its current price of 53.25.

The key passage in the article is this:

While this trade can generate a substantial profit, if silver continues to rally sharply above 65, investors effectively become short a call option. This means the risk of an explosive upside move is unlimited.

While this risk is low, investors should take caution and only take a small position despite the appealing payoff structure.

The key word to focus on here is the word unlimited. This doesn’t mean a million dollars. It doesn’t men one billion dollars. It means INFINITY dollars. A one lot of an infinite loss is exactly the same as a thousand lot infinite loss. This is why position size does not protect you.

Moving from the mainstream media, to the alternate universe here on Substack, look at this image from David Jensen’s Precious Metals Mining Substack.

This shows what happens when a real short squeeze happens. Here, Volkswagen, AG (the German car company) got hit in a massive short squeeze back in 2008 when speculators betting on the outcome of a complex merger between Porsche and Volkswagen built up huge short positions in Volkswagen, offset by long positions in Porsche. Because the delivery mechanics shifted mid-stream, the short sellers were caught when their easy-to-borrow shares suddenly became impossible to borrow, forcing them to go into the market and buy in all of the shares to cover their short position. Who was selling the shares to them? The usual group of famous (and ruthless) investment banks. What price can they charge? Whatever they want. In this case, the 60- shares ended up spiking to 1100- overnight with no chance to cover at a modest loss. Needless to say, this blew out a lot of merger arbitrage funds and follow on speculators hoping to profit from a return to normal.

If the same thing happens in SLV, traders holding the ratio spread recommended by IBD are looking at a loss of 110,000- per spread. Not bad for a 20- debit. A ten lot costs 200- and loses over a million. Of course, there is nothing preventing the SLV price from going a lot higher than Volkswagen did. If there is a creation/redemption halt in SLV because no physical silver is available to create new fund units, the remaining units are free to trade at a premium or discount to the net asset value. Once the premium above NAV kicks in, the long positions in SLV can make even more than the physical stackers do.

The key insight in this example is this:

If the Options Market is Offering 980- in Potential Profit for a 20- Debit, something is really, really wrong with this trade.

What can you do to fix the IBD Darwin Award Trade?

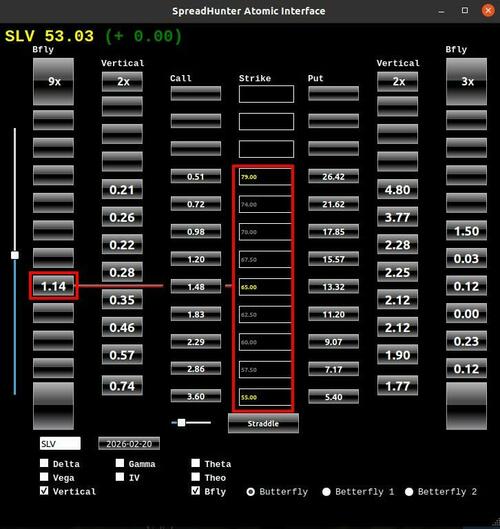

The simplest thing to do is to buy an extra leg at the 75 strike and create a Butterfly Spread. Here is an example:

Do you see the problem here? The Butterfly Spread costs 1.14, close to six times the debit of the Ratio Spread. And you can still lose 100% of this if SLV stays flat or goes down. Not a good risk/reward.

This is one of those cases where the market is speaking (loudly) and it is a good idea to shut up and listen. The market is telling us that tail risk hedges are expensive. This suggests that tail risk events are on the table and could happen at any time.

Predicting the future when the tail risk option price is high is like predicting a Tornado when there is already a Tornado Watch or Tornado Warning issued.

It does not mean that a Tornado will arrive, just that it is a lot more likely than when there has been a streak of normal weather.

What can traders who are bullish on SLV do to capitalize on this? As we pointed out in previous articles, using Long In The Money Call Options provides a way to capture unlimited profit for a very modest price.

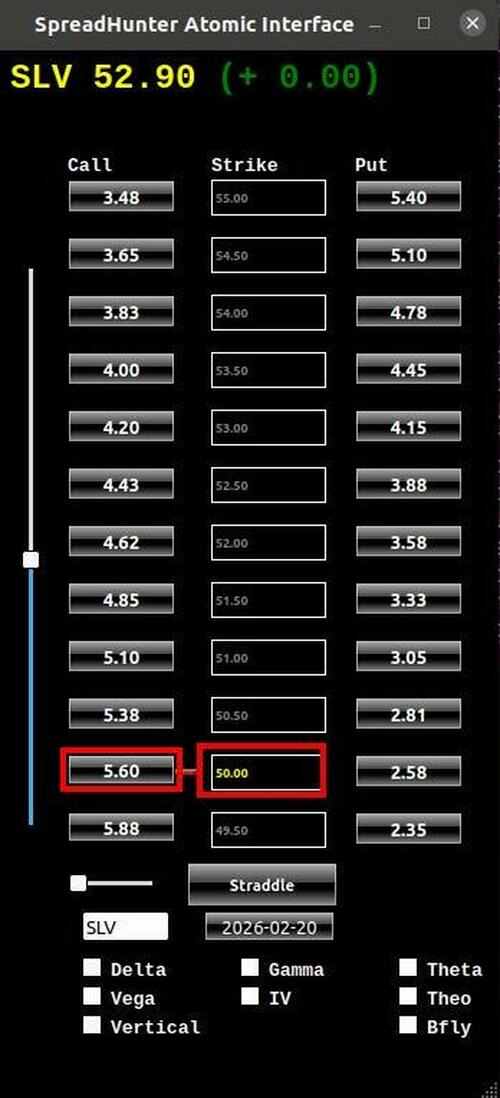

Here is the SLV Matrix for February with the In the Money 50 Strike Call Option highlighed:

Instead of paying 20- like the IBD ratio spread, we are paying 560- for a Call Options with unlimited upside and defined maximum risk of 560- per option. This costs only about 200- in premium over intrinsic value for 2 1/2 months of time. And reduces the risk greatly in comparison the holding 100 shares of SLV underlying. The At The Money or Out of The Money Options are cheaper in absolute terms, but cost more in terms of premium than the In the Money Options. Vertical Spreads are a more conservative option, however, given the tail risk prices it would be a shame to cap the profit if something big materializes.

Conclusion: Sometimes it is better to pay up and take an unhedged position. The potential profit is a lot more and the risk is a lot less than many of the alternatives.

******************************************************************