Rate Cuts Are Priced In—Forward Guidance Is the Catalyst

Rate Cuts Are Priced In—Forward Guidance Is the Catalyst

-

Recent hiring data points to a weakening labor market.

-

The Fed will start reinvesting more in Treasurys.

-

The 2026 voting makeup will likely favor more easing.

The Federal Reserve’s monetary policy path should remain dovish…

Today brings a much-anticipated catalyst for investors across the globe. The Federal Reserve is set to release its last monetary policy decision for 2025. Wall Street expects a 25 basis point rate cut. It will bring the federal funds target to a range of 3.50% to 3.75%.

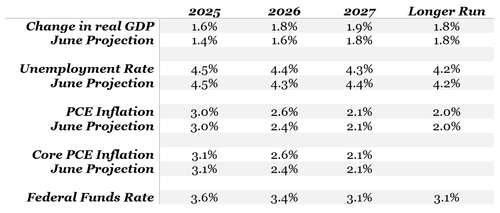

But the cut itself isn’t the story. It’s already priced in. What matters most is the Fed’s outlook on monetary policy moving forward. As you can see from the table above, Wall Street expects the fed funds target range to drop by a total of 50 basis points to a range of 3% to 3.25% by September 2026.

As a result, the most anticipated release tomorrow will be the Summary of Economic Projections (“SEP”) from policymakers. It will show where they believe the path of interest rates is headed over the next few years. The details will indicate the pace of policy easing by year-end and whether Wall Street’s current assumptions are correct.

Based on recent dynamics, it appears the Fed’s outlook should remain dovish when forward guidance is released. Don’t be surprised if the data endorses two more rate cuts in 2026. That should underpin the outlook for economic growth and a steady rally in the S&P 500 Index.

But don’t take my word for it, let’s look at what the data’s telling us…

The Federal Open Market Committee (“FOMC”) meets eight times a year to set rates. It’s made up of seven board members and five rotating regional bank presidents—twelve voting members in total. But once a quarter, all nineteen officials (including non-voting district presidents) submit their forecasts for key economic indicators. These are aggregated and released in the SEP.

Here’s what they projected at the September meeting…

Compare that to where we are currently: GDP is tracking close to 1.6%, unemployment sits at 4.4%, PCE inflation is 2.8%, and core PCE is 2.8%. The fed funds rate is currently 3.9%. So, most of the projections aren’t far off, but the rate path is likely to remain lower for three key reasons: weak employment, balance sheet expansion, and a more dovish Fed board.

The Labor Market

Earlier this month, payroll processor ADP reported a loss of 32,000 jobs in November. October’s numbers were revised from an increase of 42,000 to a gain of 47,000. More importantly, this marked the third time in the last four months that the data has indicated the economy is shedding jobs.

The kicker: small businesses shed 120,000 workers last month. That’s critical. Small firms employ nearly half of private-sector workers, drove 53% of hiring from 2021–2024, and account for 44% of U.S. output. If the trend continues, fallout is inevitable.

Several Fed officials have already voiced concern that rates have stayed too high for too long. San Francisco’s Mary Daly and New York’s John Williams, among others, have expressed this view. Board Members Christopher Waller and Michelle Bowman expressed the same concern when they dissented at the July policy meeting in favor of a rate cut and continue to do so.

At least seven of the twelve voting members appear willing to tolerate a temporary rise in inflation to protect the labor market. Chairman Jerome Powell has warned that a lack of action could force the Fed to cut more aggressively later. So, a rate cut today is likely a foregone conclusion.

The Balance Sheet

At the October policy meeting, the Fed said it would end Treasury quantitative tightening (“QT”) in early December. Policymakers said they would still let mortgage-backed securities mature and hold onto the cash. However, they will start to reinvest the proceeds of maturing Treasury securities once more.

Fed officials are worried about liquidity in overnight lending markets. Governor Waller and others have warned that continued QT could drain reserves and push interbank rates above the Fed’s target range. That would undermine monetary stability.

That’s why the Fed’s pivoting. A shift toward shorter-duration assets gives the Fed more flexibility and helps manage liquidity more precisely. Short-duration Treasury yields set the benchmark for short-term borrowing costs across the economy. That stimulates growth and encourages hiring. Any commentary about expanding those purchases should be a positive.

The Outlook

This is the last monetary policy meeting for the regional Fed presidents who vote this year. They include Jeffrey Schmid (Kansas City), Alberto Musalem (St. Louis), Austan Goolsbee (Chicago), and Susan Collins (Boston). All of them have recently made statements favoring a pause. They're being replaced by Beth Hammack (Cleveland), Lorie Logan (Dallas), Neel Kashkari (Minneapolis), and Anna Paulson (Philadelphia), two of whom are more dovish.

In addition, the board will have two changes next year. Powell’s term's up in May. He's likely to be replaced by someone more inclined to ease. Stephen Miran’s term ends in January, and the next person who fills that role will probably be as dovish.

Bringing It All Together

As I said at the top, the rate cut itself isn’t the story. It’s the Fed’s evolving stance that will drive market expectations. If the SEP confirms a lower path for rates, it signals an improved liquidity outlook. That makes it cheaper for households and businesses to borrow, invest, and spend. That should underpin economic growth, stabilize employment, and support a steady rally in the S&P 500.

If you'd like to see how I'd invest, check out the BentPine Moderate Portfolio here.