Why You Don't Sell Your Physical Gold & Silver

Sovereign Individual: Gold's Coming Re-Nationalization

Exec Sum

Authored by GoldFix

You think of your money as yours and the government’s debt as something separate. Policymakers don’t view it that way. In macroeconomics, the public and private sectors share one interconnected balance sheet. When the government borrows, the private sector holds that debt as an asset. When the private sector is over-leveraged, the government often has to expand its own balance sheet to stabilize the system. And when government debt becomes too large relative to private-sector capacity, officials look for ways to shift some of that burden back onto households and institutions.

That doesn’t mean confiscation. It means nudging the private sector toward owning assets that hedge or support the national balance sheet. Buying gold is one example. It strengthens your personal position and, at the same time, contributes to the country’s overall financial resilience. In quiet conversations between nations, they don’t just look at official reserves. They look at total national wealth, which includes what citizens hold. The United States does the same.

So the point is simple. Keep some of your savings outside the system and don’t sell your physical gold or silver unless you’re forced to. If the government ever faces a real emergency, private balance sheets become part of the national picture instantly. That’s why you want to stay financially strong on your own terms.

Sovereign Accumulation Through Citizens: The Two-Layer Gold Reserve System

“The result is a two-layer reserve structure in which central bank holdings and household metal form a single strategic perimeter.”

A global structural realignment is underway in the treatment of gold and silver within national financial systems. Governments are constructing legal and institutional frameworks that guide precious metals from private anonymity into regulated domestic channels. The result is a two-layer reserve structure in which central bank holdings and household metal form a single strategic perimeter. This process is not coordinated across countries, yet it is coherent in effect. It reflects a shift toward a more mercantilist orientation as states prepare for increased geopolitical and monetary fragmentation.

Structural Drivers

“States are responding by building deeper metallic buffers inside their borders.”

Geopolitical rivalry, sanctions pressure, commodity insecurity, and declining trust in fiat-denominated reserves have encouraged governments to reinforce their balance sheets with scarce, non-sovereign collateral. Gold and silver satisfy this requirement because they lie outside the liabilities of any foreign nation. The trend is reinforced by supply concentration in a small set of producers and by increased weaponization of payment systems. States are responding by building deeper metallic buffers inside their borders.

Policy Mechanisms

“Countries are using different tools to achieve the same structural outcome.”

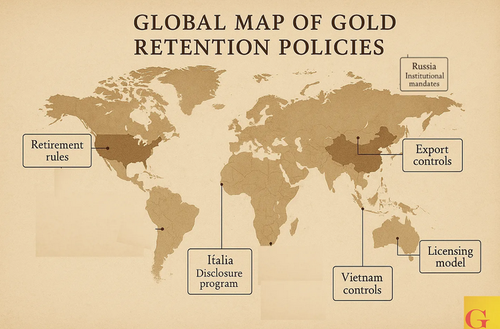

Countries are using different tools to achieve the same structural outcome. The United States has expanded the role of gold within retirement accounts and strengthened the regulatory foundation for tokenized bullion, bringing household gold exposure under institutional supervision. Russia has encouraged retail bar accumulation through tax reform while preparing export restrictions that retain mined gold domestically. India is integrating household gold into the financial system through sovereign gold bonds, collateral rules, and pension channels. China has created a unified gold ecosystem spanning households, banks, and insurers, aligning private accumulation with state supervision.

Italy presents a distinct case. Its political effort to assert national primacy over central bank gold and its proposed one-time disclosure program for undeclared household gold reveal a dual strategy. The state seeks stronger formal control over existing official reserves and greater visibility of a very large private stock.

Southeast Asian nations have adopted rules that retain value domestically. Indonesia uses export duties and foreign-exchange retention rules. Vietnam maintains a state-managed licensing and distribution structure. Cambodia links its reserves to regional custody systems that prioritize controlled mobility.

Common Outcome

“Although ownership remains private, the metal becomes visible, recognizable, and potentially mobilizable.”

Clip: Why You Do Not Sell Physical pic.twitter.com/HlWqLWZLLG

— VBL’s Ghost (@Sorenthek) December 11, 2025

The individual policies converge toward domestic retention of precious metals. Export controls, collateral frameworks, retirement-channel inclusion, licensing regimes, disclosure programs, and institutional mandates all contribute to a larger accessible supply of gold and silver within national borders. Although ownership remains private in most contexts, the metal becomes visible, recognizable, and, under certain conditions, potentially mobilizable.

Strategic Implications

“The sovereign balance sheet extends beyond the central bank to include household and institutional gold.”

The emerging structure resembles a revival of mercantilist logic adapted to contemporary financial plumbing. The sovereign balance sheet extends beyond the central bank to include household and institutional gold held within regulated environments. This provides states with enhanced liquidity flexibility and collateral depth during crises. It also supports the formation of regional settlement and collateral networks that rely on tangible assets rather than foreign currency liabilities.

The global system is transitioning toward a world where gold and silver play a greater role in settlement, financial stability, and strategic resilience. The reconstruction of metallic reserves is occurring through both official channels and diffuse citizen participation. Together, they form the foundation of a new monetary perimeter.

Continues here