Reset: How To Survive The New Economic Order

Asset Ownership Replaces Debt in the Next Economy

TL;DR

-

Economic regime change: Economic systems persist only while they preserve order; when redistribution and leverage fail, substitution follows rather than reform.

-

Limits of debt reached: Credit no longer delivers mobility as asset prices and essential costs outpace income, turning leverage from stabilizer into source of fragility.

-

Asset regime emerges: Economic security now flows from ownership rather than wages or borrowing, with access determined by existing balance sheets.

-

Inflation enforces order: Inflation functions as the discipline mechanism of this regime, favoring asset holders, restricting entry, and preserving institutional stability through exclusion.

I. Economic Regimes as Engines of Order

Authored by GoldFix

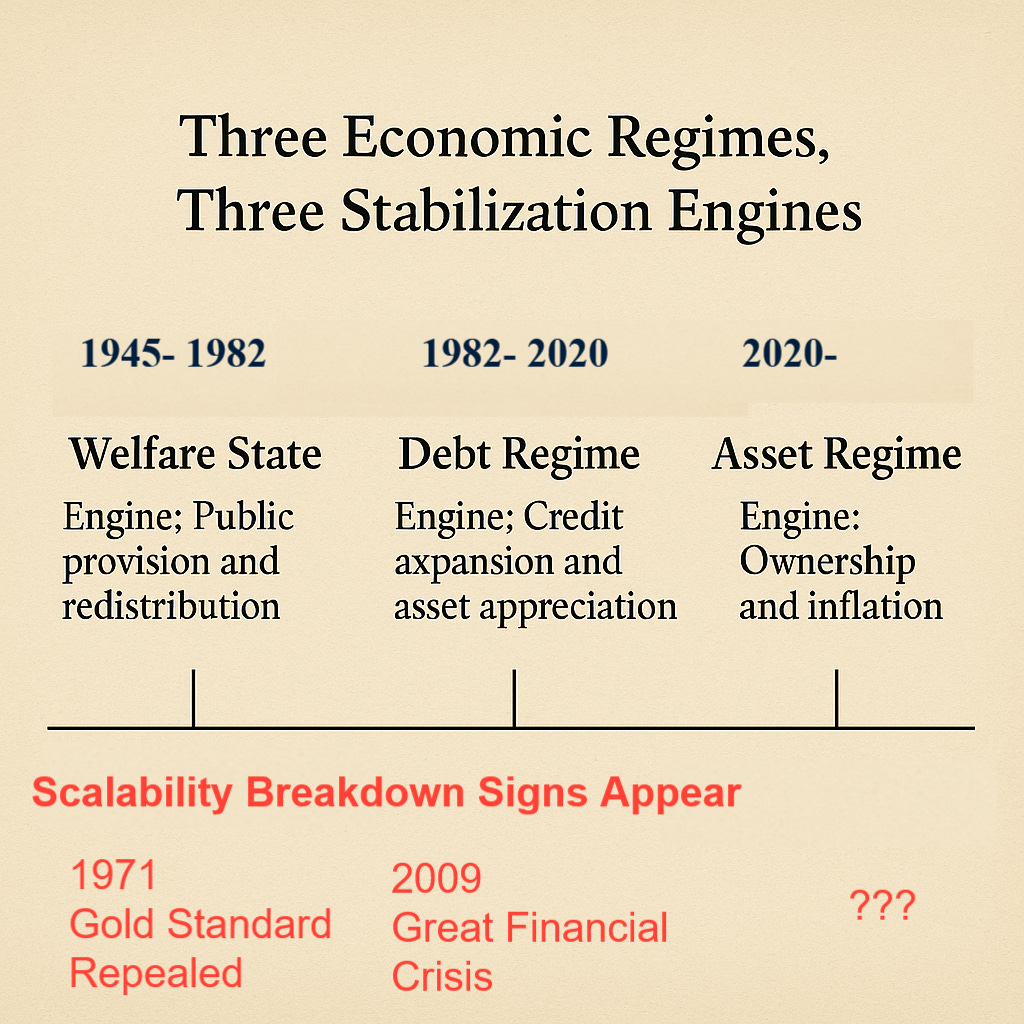

Economic models are best understood as systems designed to maintain order under prevailing constraints. Each regime rests on an internal engine that reconciles growth, social cohesion, and political stability. These engines are not permanent but they are frequently multi-generational and last as long as societal cohesion can be maintained. They are contingent on demographics, technology, geopolitics, and institutional capacity. When an engine no longer performs its stabilizing role, substitution occurs.

The twentieth century provides two clear examples. The postwar welfare state stabilized Western societies through redistribution and public provision. Its successor, often described as neoliberal or neo-Keynesian, stabilized those same societies through credit expansion and demand management. Both models emerged in response to failure, not preference.

The present moment reflects another such transition. The mechanisms that sustained the debt-based order are weakening. A new regime is emerging to replace them. That regime is defined by asset ownership as the primary source of economic security and inflation as the internal discipline mechanism that enforces hierarchy and constraint. it is an exclusionary economic model as opposed to inclusive like its two predecessors. And it will grow as a default economic engine unless some new inclusive model can be concocted that sufficiently placates the masses.

II. 1944-1982: The Welfare State as a Stabilization Technology Kept the Peace

The Promise of Inclusion to Keep Communism at Bay

The postwar welfare state (democratic socialism) functioned as an integrated economic and political system. Its core feature was the broad distribution of public goods financed by sustained productivity growth. Education, housing, healthcare, pensions, and infrastructure reduced volatility at the household level and anchored legitimacy at the institutional level.

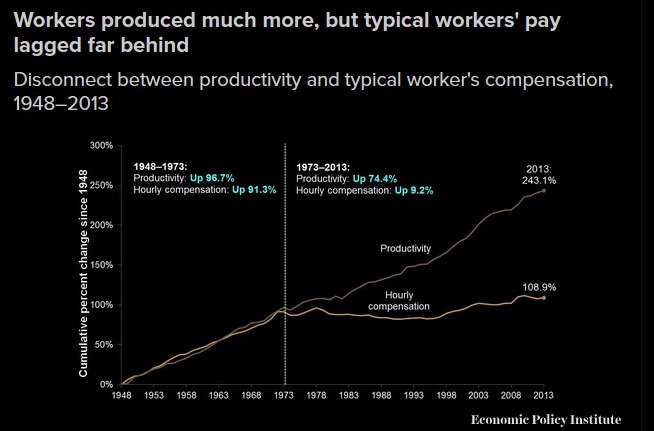

This system rested on favorable structural conditions. Labor held bargaining power. Capital mobility was limited. Demographics were young. Growth rates were high. Under these conditions, redistribution was affordable and effective. Inclusion functioned as the primary stabilizer.

The welfare state also operated within a specific geopolitical context. The presence of the Soviet model imposed discipline on Western capitalism. Social democracy served as proof that mass prosperity could be delivered without revolutionary rupture.

Once productivity growth slowed and fiscal pressures mounted (vis-s-vis the great inflation of the 1970s) the welfare engine weakened. Redistribution became politically contested. Public provision no longer scaled. The stabilizing function deteriorated. Austerity seemed the outcome, or indebtedness to avoid austerity

III. 1982-2020: Neo-Liberalism’s Debt Regime and Financialization of Stability

Or: How the Elites pacified growing inequality with debt

The failure of the welfare state did not produce immediate retrenchment. It produced substitution.

Beginning in the late 1970s, (after the US broke Bretton Woods and extended to survive) Western economies transitioned toward a model in which private credit replaced public provision and wage growth. Consumption and access were preserved through balance sheet expansion rather than income expansion. Earn less, borrow more. The state could no longer deliver on its promises. Thus, people were encouraged to borrow to get them satisfied.

This shift was structural. Student loans replaced subsidized education. Mortgages replaced public housing. Credit cards replaced wage growth. Retirement security migrated from defined benefit systems toward market exposure. Households became increasingly responsible for financing their own participation.

Macroeconomic governance adapted accordingly. Fiscal policy receded. Monetary policy expanded. Demand management operated through financial conditions and asset prices. Neo-Keynesian frameworks provided the intellectual justification for stabilizing output through expectations and interest rates.

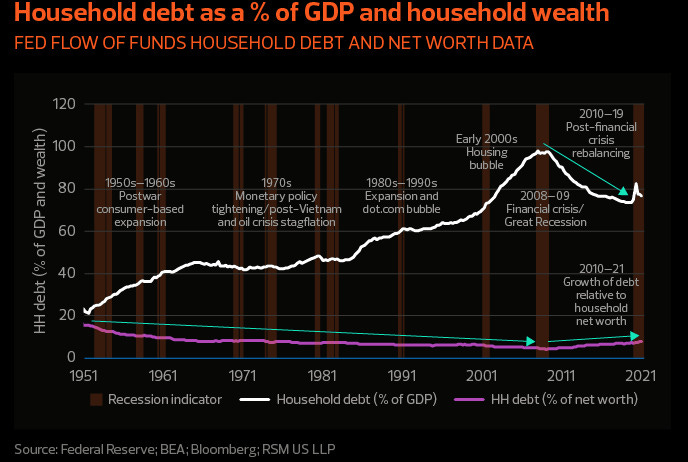

The debt regime functioned as long as leverage could expand faster than costs and as long as asset appreciation validated borrowing.

IV. The Limits of Leverage

Balance Sheets Can only Borrow So Much

The debt model begins to fail when leverage ceases to confer mobility. Simply put, when the GFC occurred, it pointed out a debt ponzi cannot continue forever, and it had reached the breaking point of inclusion economics.

That inflection point is now visible. Asset prices have still outpaced wages for decades. Essential costs such as housing, insurance, healthcare, and education have inflated persistently. Balance sheets are saturated adn crerdit is harder to come by having been outpaced. New entrants face barriers that borrowing cannot overcome without unacceptable fragility.

Debt no longer bridges inequality as substitution for low wages. It magnifies exposure. Households borrow to stand still rather than to advance. Servicing costs absorb income growth. Volatility becomes destabilizing rather than manageable.

At this stage, the debt engine loses its stabilizing function. It cannot expand further without threatening systemic integrity. The conditions that supported the previous regime no longer apply. Diminishing returns and fragility are in play

V. Emergence of the Asset Regime

The exhaustion of the debt model coincides with the emergence of a new exclusive (rather than inclusive) organizing principle.

Economic security increasingly flows from asset ownership rather than income (earned or borrowed). Ownership determines access to stability, optionality, and insulation from macro volatility. Income alone is insufficient. Debt introduces risk rather than opportunity.

Assets provide protection against inflation, policy shifts, and financial disruption. Housing, equities, private businesses, land, and monetary stores of value function as buffers. Those without assets experience rising exposure to cost increases and declining access to essential goods.

In a low-growth environment with persistent inflation, ownership becomes the primary filter through which participation is determined.

Continues here

Free Posts To Your Mailbox