Inflation, Delusion, and the Architects of American Economic Decline

What’s behind the numbers?

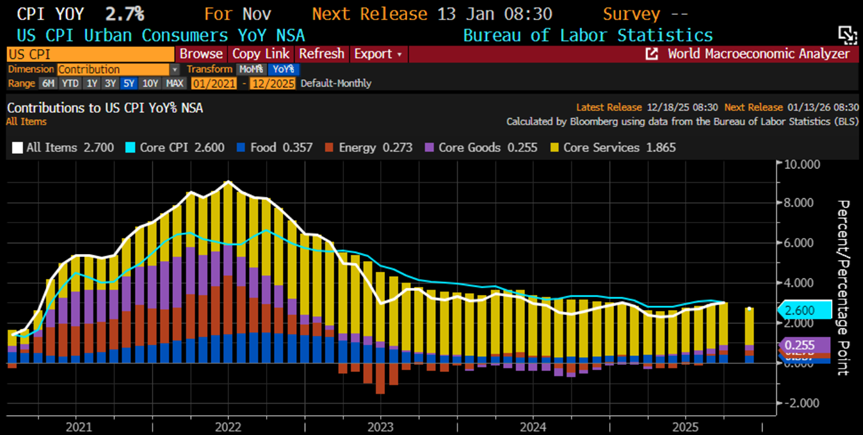

The eleventh CPI print of this so-called Jubilee Year—really just the tenth, thanks to October’s “Shutdown Circus” disappearing act—finally took the stage at a modest +2.7% YoY, cooler than September’s +3.0%, below the +3.1% forecast, and the chilliest reading since July. Energy, however, refused to follow the script: despite victory laps about “cheap gas,” prices quietly re-accelerated year-on-year from +0.18% to +0.27%. Meanwhile, core goods and core services behaved themselves, clocking their lowest YoY increases since last July and September 2021—proof that inflation can cool, but it never quite exits the room.

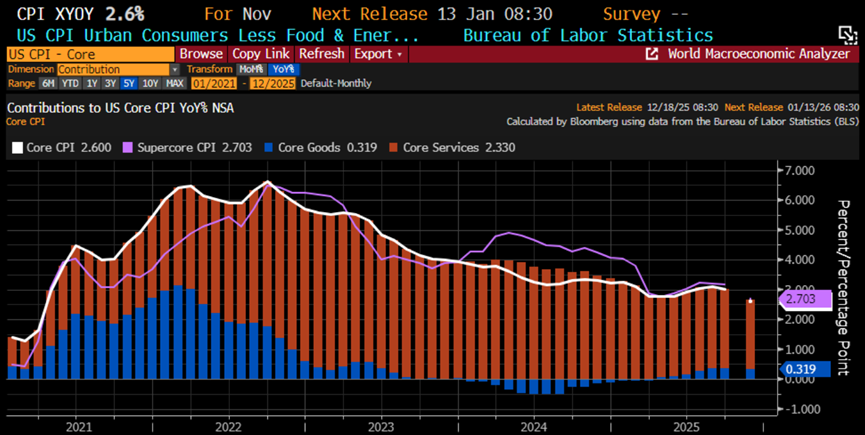

Core CPI in November slipped in at a refreshing +2.6% YoY—cooler than the +3.0% forecast, cooler than September’s +3.0%, and the chilliest reading since March 2021. Core services, the heavyweight champion at 76% of the inflation buffet, eased to 2.33% YoY, while core goods finally caught its breath, cooling to +0.32% after five straight months of trying to re-ignite the fire.

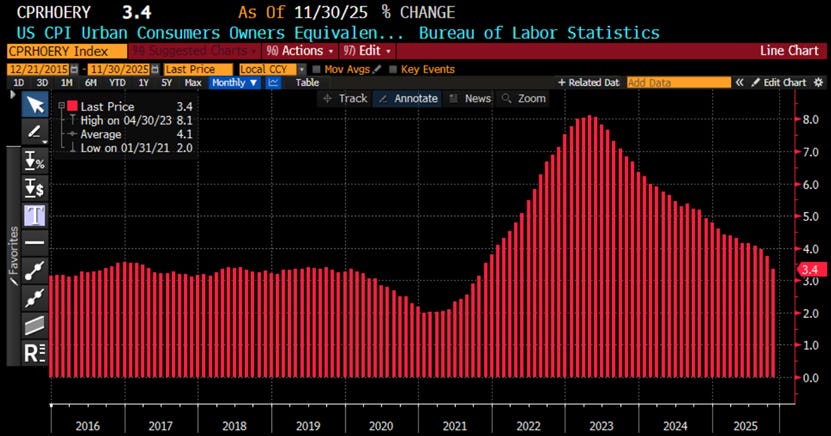

Another standing ovation for the “inflation is dead” fan club: Owners’ Equivalent Rent—the CPI’s resident zombie—shambled in at +3.4% YoY in November, down from September’s +3.8% and triumphantly posting its coldest reading since November 2021… proof that even the undead can slow down without actually dying.

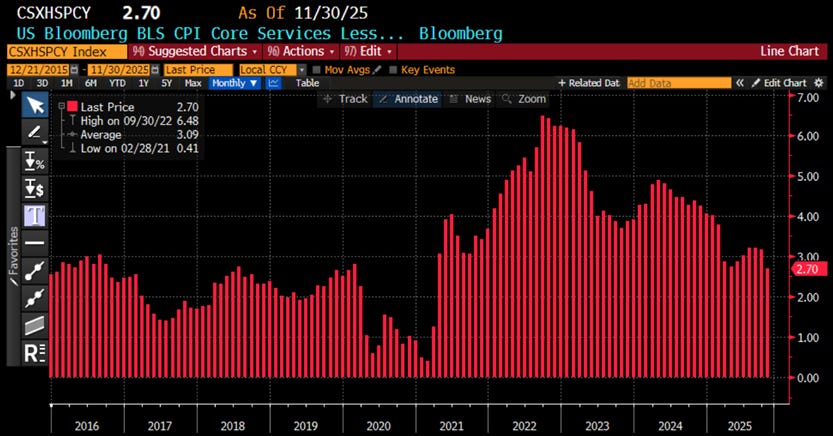

Adding to the ever-optimistic narrative that inflation is “behind us,” the SuperCore CPI—core services ex-housing, the Fed’s favorite vanity mirror—cooled to +2.7% YoY in November, its lowest since April, politely interrupting a five-month reacceleration streak. Translation: no victory parade, just a brief smoke break. But yes, inflation is totally dead… as long as you squint hard, ignore rent, goods, food, and reality, and top up your daily dose of ‘hopium’.

Thoughts.

November’s CPI is being paraded as an inflation victory and wheeled straight into midterm campaign season, but for anyone who actually shops for groceries, inflation is very much alive—just moving a little slower on top of four years of higher prices. While plutocrats toast “cooling data,” the average American keeps paying more for less. And as the ‘Manipulator-in-Chief’ leans on the Fed like a political ATM and flirts with yet another round of forever banker wars, the ‘Trump Reflation’ Express keeps rolling—because inflation and collapsing trust in institutions always travel first class together.

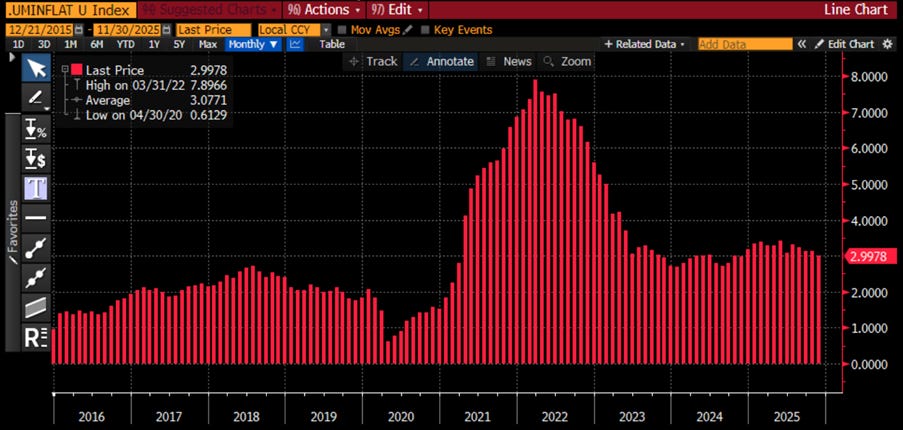

US Umbrella inflation Index (Average of CPI; Core CPI; PPI; Core PPI; Core PCE, 1-year consumer inflation expectations)

Instead of fantasizing about 2% inflation like a Disney fairy tale, seasoned investors—unlike the propagandistic Wall Street bankers—can still do basic math.

-

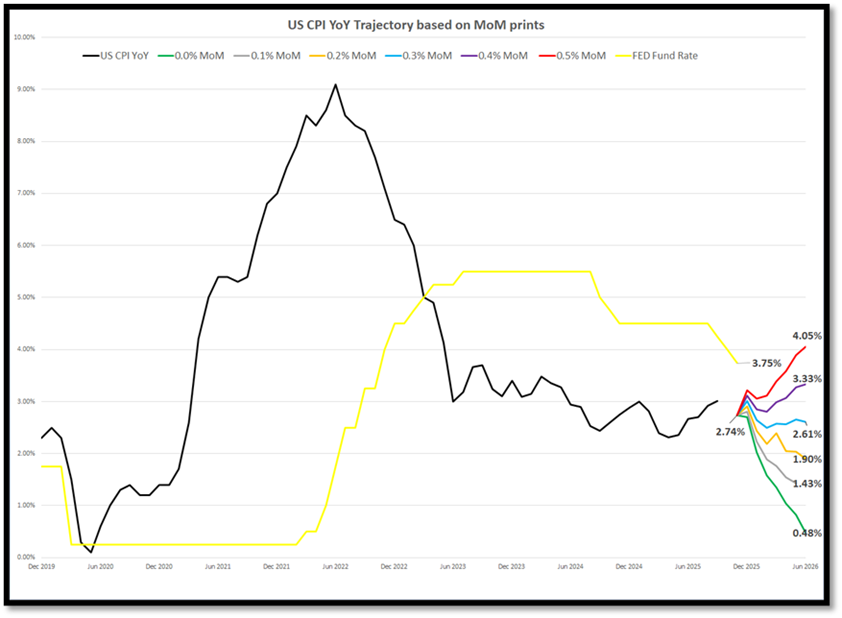

For that miracle to arrive before mid-2026, CPI would need to moonwalk below 0.2% every single month—good luck with a newly politicized Fed chair being enthroned and wars spreading like winter flu.

-

At more realistic 0.3%+ prints, we’re cruising toward 2.6%–4.0% CPI by mid-2026.

And when that reality check lands, not even Donald Copperfield pulling a “Central Banker-in-Chief” out of a hat will disguise the fact that cutting rates into an inflationary boom may go down as one of the Fed’s dumber magic tricks.

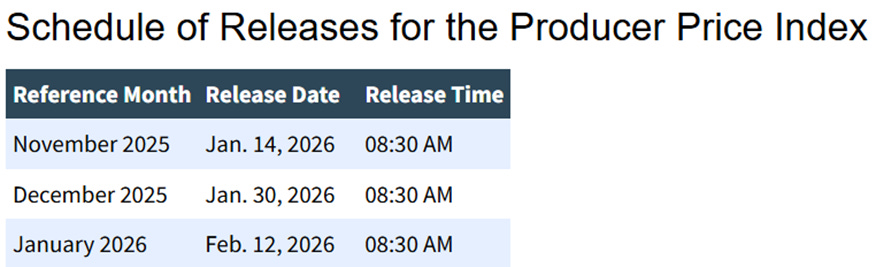

The US government is conveniently blaming the shutdown to delay Core PPI until January 14—just in time to protect the hopes of a Santa Claus rally and the January-effect myths Wall Street still peddles. When manipulating data isn’t enough, they simply stop releasing it. As we move toward the 2026 political panic cycle, this secrecy signals what they won’t say outright: the downturn is accelerating, consumers are cracking, and they fear the markets—and the public—discovering that the emperor has no clothes.

https://www.bls.gov/schedule/news_release/ppi.htm

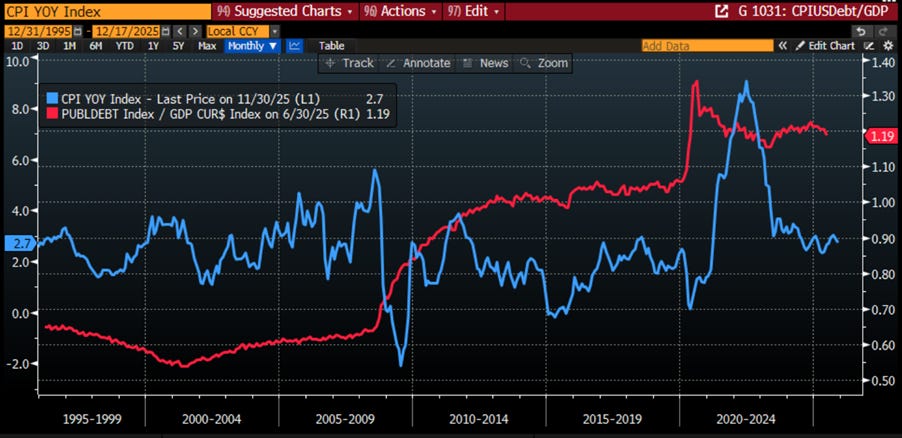

Anyone with a modicum of common sense can see that ever since the Educated-Yet-Idiots took the wheel, inflation hasn’t been driven by monetary policy—it’s been fuelled by reckless government spending and the resulting gargantuan sovereign debt. You don’t need a PhD in economics to grasp that soaring debt-to-GDP ratios have consistently been the catalyst for structurally higher CPI across recent decades.

US CPI YoY Change (blue line); US Debt to GDP ratio (red line).

The true economists—those who understand that inflation erupts from shortages, overheated demand, and failing public institutions—already know the Fed is just the convenient scapegoat. The real culprits are the reckless Educated Yet Idiots who’ve driven Western economies into a ditch with Keynesian fantasies that only work in academic daydreams. The suffering of We the People aligns perfectly with a simple historical truth: as the Debt-to-GDP ratio spirals higher, the US Misery Index rises right alongside it.

US Misery Index (blue line); US Debt to GDP ratio (red line).

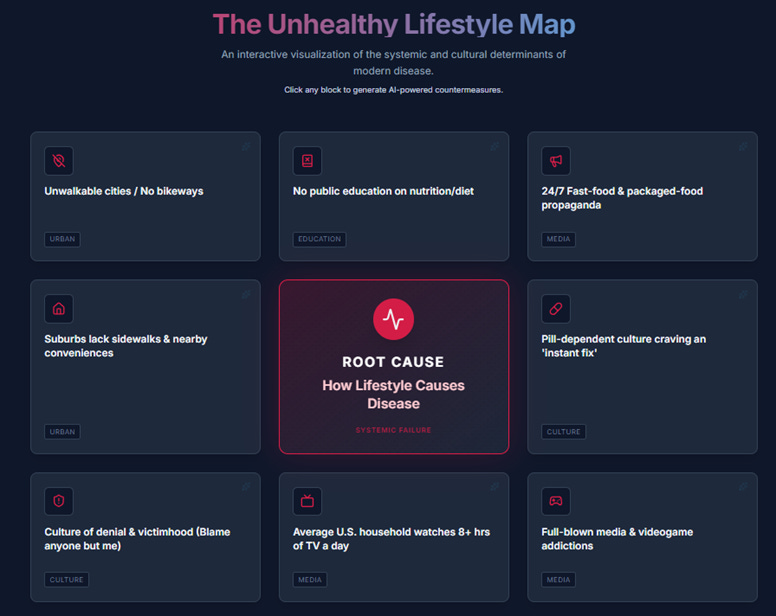

While Wall Street’s finest Educated Yet Idiots obsess over GDP as if it were the heartbeat of the nation, the rest of us know that like the ‘CP-Lie’, GDP is about as useful as diagnosing heart failure with a bathroom scale. We manage what we measure—unfortunately, we’re measuring the wrong thing, so policymakers are flying blind and the public is strapped in for the turbulence. Joseph Stiglitz and others have politely reminded us for years that counting transactions isn’t the same as counting well-being, but Washington still treats GDP like sacred scripture. Meanwhile, most of the modern economy—services, unpaid care, digital shadow work, even clean air—doesn’t show up on the ledger at all. So instead of evaluating whether people are actually healthy, secure, and sane, we tally up how many things were bought and sold. If we judged the economy by real life—physical and mental health, social trust, and financial stability—we’d quickly discover what the charts already whisper: half of the US population is prediabetic, trust in institutions has collapsed, and AI threatens everyone except the people selling it. But sure, let’s celebrate propagandistic government data which are only pleasing the ego of Educated Yet Idiots and plutocrats who have never entered a supermarket to buy their groceries for decades because they consider themselves like an elite for whom the policies are implemented.

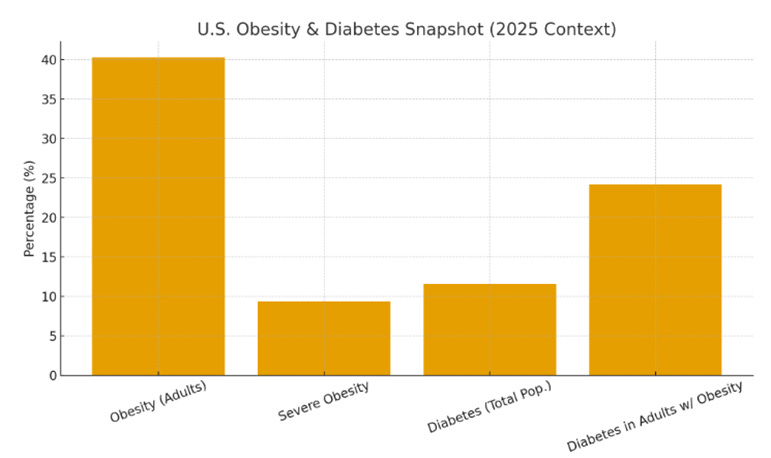

So, only about a quarter of U.S. adults still qualify as “normal” weight—which in America now feels more like a rare genetic mutation than a lifestyle choice. The rest is the predictable result of a national diet built on processed sludge and an exercise routine that begins and ends with opening the fridge. On the mental-health front, teen depression and suicide rates continue climbing, as if to remind everyone that things can, in fact, get worse. Loneliness is surging too, proving that even in a hyperconnected world, Americans have mastered the art of being collectively isolated. This has been the trend since 2008 as a toxic mix of lifestyle and built environment have made America Sick. Nothing has improved. And yes, any politicians can try to sugarcoat it—but given the national addiction to sugar, that probably just makes the problem worse.

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/inflation-delusion-and-the-archit…

Visit The Macro Butler Website here: https://themacrobutler.com/

Join The Macro Butler on Telegram here : https://t.me/TheMacroButlerSubstack

You can contact The Macro Butler at info@themacrobutler.com

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence