Macro Butler Monthly Meditation: 10 Financial Forecasts for a Fiery 2026

It is that magical time of the year when investors turn into historians of the last 12 months and prophets for the next 12—armed with conviction, confidence, and a remarkably short memory. This time last year, the consensus was clear: equities were destined for a nap, gold was a relic, and the future belonged to phantasmagorical digital assets powered by vibes, narratives, and unlimited PowerPoint slides.

Fast forward, and 2025 will be remembered quite differently. Inflation stubbornly refused to behave—not because of tariffs, but thanks to the steady erosion of public institutions. The Fed, true to form, kept cutting rates, while the U.S. economy marched on in a full-blown inflationary boom, ignoring every recession call along the way thanks to another tsunami of AI capex which will, for most of them, proved to be the biggest ever bubble set to try to transform mankind.

In that familiar environment, reality once again intruded. Gold and equities did what they always do during inflationary booms: they crushed cash and bonds. Safe, boring, and old-fashioned assets quietly outperformed, while the grand digital utopias were—once again—pushed into the “maybe next year” drawer.

As ever, markets reminded investors of an eternal truth: cycles matter, narratives expire, and inflation has a cruel sense of humor.

Nominal (non CP-Lie adusted) return in USD of Gold (blue line); S&P 500 index (red line); Bloomberg US Ag Total Return Index (green line); Bloomberg US Treasury Bills 1-3 months Index (purple) since December 31st, 2024.

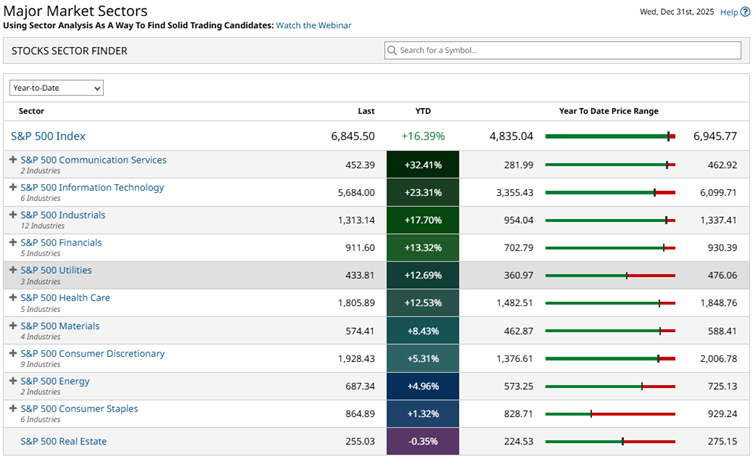

Looking at sector performance over the Jubilee Year, and very much as most Wall Street parrots would have predicted, the year will be remembered for the dominance of AI-related sectors such as Communication Services and Information Technology, while Real Estate stood out as the only sector to post negative performance over the past 12 months.

https://www.barchart.com/stocks/sectors/rankings?timeFrame=Ytd

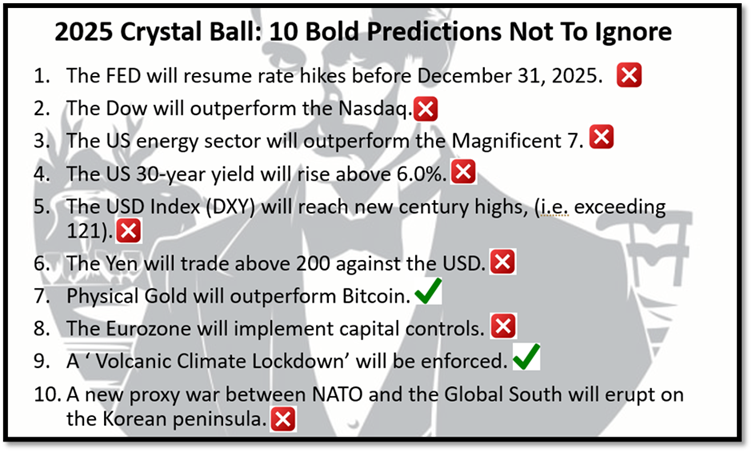

Because humility is the foundation of all investors, a review of The Macro Butler’s bold predictions for 2025 invites restraint rather than triumph. Many did not fully materialize during the Jubilee Year, though it remains likely that several may unfold in time. In markets, as in life, timing is often the teacher: outcomes delayed are not always outcomes denied, and patience remains as important as conviction.

Having closed the books on the Jubilee Year, 2026 (MMXXVI) arrives as a Universal Year 1—numerology’s way of saying “new cycle, new rules, no excuses.” After the emotional wrap-up of 2025’s Universal 9 (the long exhale), 2026 is supposed to be the sunrise after a very long night—or the first coffee after a brutal hangover. Add it up (2+0+2+6 = 10 → 1), and the message is clear: Year 1 means independence, initiative, and bold moves. This is the year for fresh starts, self-reinvention, and launching big ideas—preferably before someone else does.

In short, 2026 is numerology’s green light: lead, act, and trust yourself—hesitation is so last cycle.

https://www.crystals.com/blogs/news/guides-2026-numerology-fire-horse-personal-year-crystals

In the Buddhist calendar, 2026 corresponds to year 2569, a number that speaks quietly of balance, change, responsibility, and completion. Its essence invites harmony amid transformation, care in stewardship, and wisdom in letting old cycles end so new ones may begin. Reduced to the Master Number 22, and further to 4, it reminds us that great visions are realized not through haste, but through discipline, patience, and steady work. In Confucian spirit, it teaches that prosperity follows those who cultivate order within themselves, act with purpose, and align ambition with virtue.

https://sacredscribesangelnumbers.blogspot.com/2015/12/angel-number-2569.html

Beginning 17 February 2026, the calendar turns to the Year of the Fire Horse, a rare alignment that appears only once every sixty years. The Horse brings speed, independence, and movement; Fire adds intensity, ambition, and transformation. Together, they create a time of swift action and uncompromising will. This is a Double Fire year—Fire ruling both the element and the animal—amplifying momentum and change. Such periods favor the decisive, reward the prepared, and expose the hesitant. Talent, intelligence, and courage advance quickly; recklessness is punished just as fast.

In the wisdom of the ancients, Fire on Fire does not wait. One must act with clarity, discipline passion, and move with purpose. Those who align their environment and conduct with this energy may prosper; those who resist it will be carried by events rather than shaping them.

With 2025 behind us, it is time to look ahead—and to question what Wall Street bankers and their parrots are not telling their clients. Most annual outlooks are not written to build client wealth, but to protect and promote Wall Street’s own interests.

Forecasting is inherently uncertain, and sound portfolio management is not about predictions alone, but about risk management, adaptability, and navigating the prevailing environment to achieve superior risk-adjusted returns.

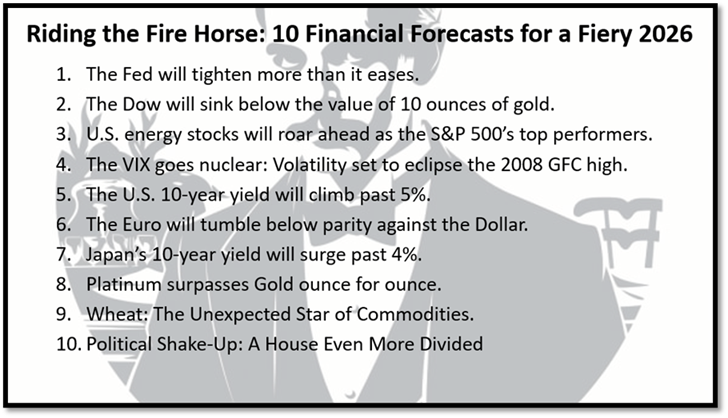

Against this backdrop, here are 10 bold predictions investors should not ignore as they look toward the next 12 months.

Since January 1, 2026, The Macro Butler Monthly Meditation has become a subscribers-only edge.

Unlock the framework, understand the signals, and learn how to trade it—subscribe here to gain access.

https://themacrobutler.com/monthly-meditation/

Join The Macro Butler on Telegram here : https://t.me/TheMacroButlerSubstack

You can contact The Macro Butler at info@themacrobutler.com

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.