Silver is not “running hot” by accident.

Latin America, Silver, and the Coming Taiwan Flashpoint

Authored by GoldFix

Overview: Silver’s recent price behavior reflects geopolitical stress rather than speculation. It links contested Latin American supply chains, China’s diplomatic strategy, and UN alignment to Taiwan as a core flashpoint risk, showing how material access, diplomacy, and institutional power reinforce each other amid rising U.S.–China rivalry. Part 1 here.

Silver: Most Hated Rally Ever

— VBL’s Ghost (@Sorenthek) January 2, 2026

Next Time someone tells you Silver is being driven by speculative froth. show them this chart from Founder @Between2Beats

Translation: Banks covered shorts in the first leg.. It's all physical pic.twitter.com/oqfCZThexq

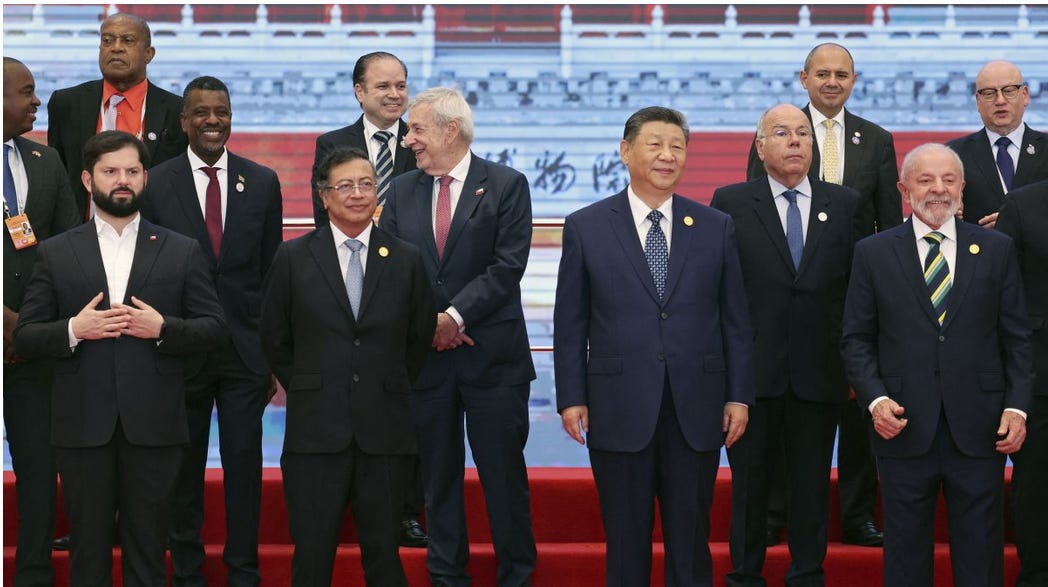

Latin America as Strategic Terrain

Recent reporting by The Wall Street Journal has highlighted China’s efforts to preserve and deepen its access to Latin American supply chains as U.S. policy shifts toward tighter economic and security alignment in the Western Hemisphere. The Journal frames Latin America as a core market for Beijing, but as a region whose alignment affects access to raw materials, ports, infrastructure, and trade routes at a time when globalization is fragmenting under security pressures.¹

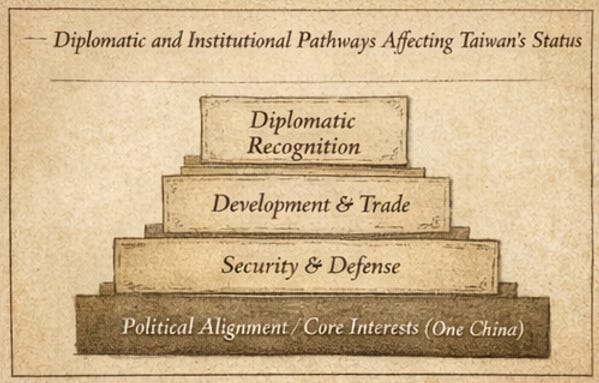

China's Policy Paper on LATAM and Taiwan Hardens

In December 2025, China released its third policy paper on Latin America and the Caribbean, following similar documents in 2008 and 2016. The document is notably expansive and structured in a way that places political alignment ahead of economic cooperation. While development, trade, and infrastructure feature prominently, they are presented as instruments rather than endpoints. Respect for China’s “core interests” is explicitly identified as foundational to deeper engagement.² Read full story

This sequencing is deliberate. It reflects a strategic prioritization that becomes clearer when viewed alongside contemporaneous Chinese commentary.

Taiwan as the Flashpoint Risk

Within Chinese strategic doctrine, the one-China principle is treated as a red line. Taiwan is framed as a matter of sovereignty, legitimacy, and regime security. Beijing’s objective is not limited to territorial reunification in the abstract. It is to ensure that no durable international legal or multilateral framework emerges that could constrain China’s freedom of action in the future.

Chinese state-aligned commentary following the release of the 2025 LAC policy paper explicitly links the document to changes in U.S. strategy toward Taiwan. Domestic analysis emphasizes that the updated U.S. National Security Strategy places increased weight on Taiwan, including repeated references to deterrence in the Taiwan Strait and a more explicit security framing of the issue.³

From Beijing’s perspective, this raises the risk that Taiwan could be internationalized through multilateral institutions, legal narratives, or alliance politics. The Chinese response, as articulated domestically, is global.

Latin America features prominently in that response. Chinese commentary frames deeper engagement in the region as a means of countering U.S. pressure by reinforcing political solidarity, securing diplomatic support, and ensuring continued adherence to the one-China principle. The logic is explicit: if Washington elevates Taiwan within its global strategy, Beijing must ensure that no corresponding coalition forms elsewhere that could create legal or institutional obstacles.

This framing matters. It clarifies that Taiwan is an end goal and a flashpoint risk around which broader diplomatic behavior is organized.

A Proven Diplomatic Playbook

China has executed this strategy before.

In Africa, Beijing spent decades building economic relationships through infrastructure finance, trade access, debt relief, and development assistance. Over time, those relationships translated into consistent diplomatic alignment at the United Nations and related forums. On issues ranging from Taiwan to Hong Kong, Xinjiang, and the South China Sea, African states have frequently supported China’s positions, signed joint statements backing Beijing, or abstained in ways that diluted Western initiatives.⁴

[Figure 5: Africa as precedent for economic alignment translating into institutional support

The mechanism is well documented. Economic alignment precedes diplomatic alignment, which in turn reinforces institutional outcomes. This approach is not unique to China, but China has implemented it at scale and with notable discipline.

Latin America increasingly shows signs of being the next theater where this playbook is applied. Since 2016, nine countries have severed diplomatic ties with Taiwan and recognized Beijing, often following periods of fiscal stress, infrastructure need, or political transition. These recognition decisions affect UN seating, agency participation, and the perceived legitimacy of Taiwan’s international standing.

China’s 2025 LAC policy paper goes further than its predecessors by integrating Taiwan support into an operational action plan rather than treating it as a background principle. Passive non-recognition is no longer sufficient; active alignment is increasingly expected.

Silver as a Market Signal

Against this geopolitical backdrop, silver’s behavior takes on a different meaning.

Silver occupies a unique position among commodities. It is both an industrial input and a strategic material, embedded in energy systems, electronics, and defense-adjacent technologies. Its supply chain is geographically concentrated and politically exposed. When access becomes contested, procurement behavior changes before official policy does.

**Silver Reckoning: The US is Squeezing China Out

Silver, Supply Chains, and the Reassertion of the Monroe Doctrine

This is what a Silver Reckoning looks like. Markets are repricing access as supply chains get reshored and geo-economics again outranks ideology. Silver reflects that shift in real time more than other assets. It’s price movement is being registered before policy formalizes changes already visible in physical flows.Read full story

In recent commentary, CEO of Scottsdale metals Josh Phair has described what he terms a “metals war,” in which states and industrial actors move upstream in supply chains, bypass traditional market mechanisms, and prioritize security of access over price optimization. In that framework, price volatility is the symptom.⁵

Continues here unlocked