Silver Touches $92.16 As Signs Point To Supply Disruption

Silver Rallies As High As $92.16 As Signs Point To Potential Supply Disruption

Submitted by GoldFix, Authored by Chris Marcus

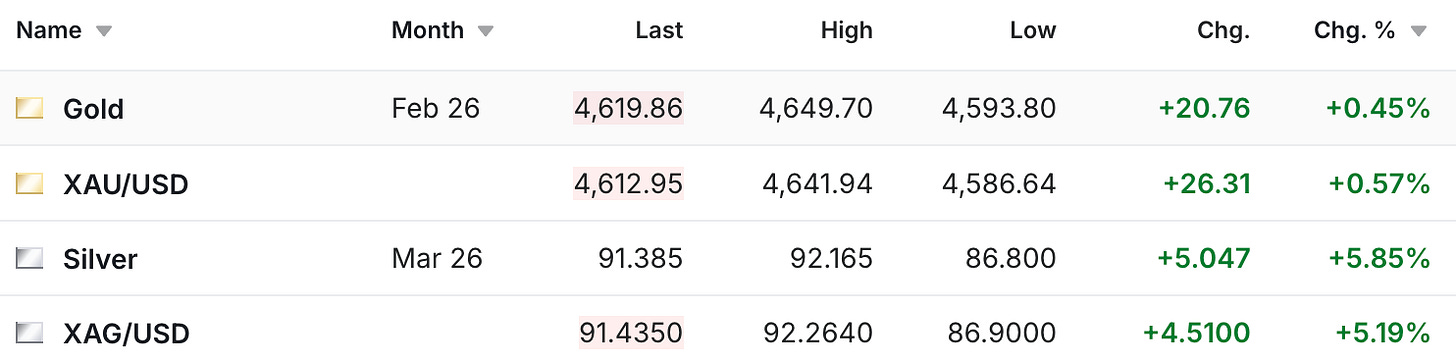

The historic run in the silver market has continued again on Wednesday, with both the silver futures and spot prices breaking through the $92 mark earlier this morning, and currently trading just under that level.

The gold futures are also up another $21 today, although the majority of the attention is on silver again, and perhaps rightly so.

Of course, to see the silver price up another $5, especially after what we’ve just witnessed over the past few weeks and months, is beyond unprecedented. However, in terms of what the root driving cause of the move is, as well as what that could imply going forward, the evidence continues to suggest that the silver supply concerns might be even more serious than many are realizing.

To be clear, we’re dealing with incomplete information, and I still think it’s slightly premature to state this as a definitive conclusion. Although with that said, the indications that we may well have a more significant disruption here are continuing to mount.

A few weeks ago I noted how a friend of mine who runs a producing silver mining company in Peru had received phone calls from groups in China that were interested in buying his production at an $8-$10 premium over the Comex price in New York.

Just a few days after that, he was contacted by a similar group in India, who would later say that, ‘China is soaking up all the silver and making it difficult for India to get the raw materials they need for manufacturing.’ Which would suggest that there are legitimate concerns that there is a serious supply issue going on in China.

This shouldn’t come as a complete surprise, as we reported back on November 10th how China was running into supply issues after they sent silver over to London to address the supply gap that had popped up there.

Yet perhaps the most significant piece of evidence supporting that there’s a supply issue in China is that the silver price in Shanghai is currently trading at $103.80, while the LBMA and Comex are saying just under $92.

This also means that the spread between New York and Shanghai, which had surged to about $8 right around Christmas, has now widened out even further since then.

Also supporting that this is a physically driven supply issue in the East, more than speculation in the West, is the fact that while retail sales by the dealers have picked up, they are also continuing to report a large amount of selling. Although as we have found out and been reminded of multiple times in past years and decades, the retail order flow is often not in alignment with what’s happening on the Comex, and it doesn’t appear as if this rally is being driven by retail.

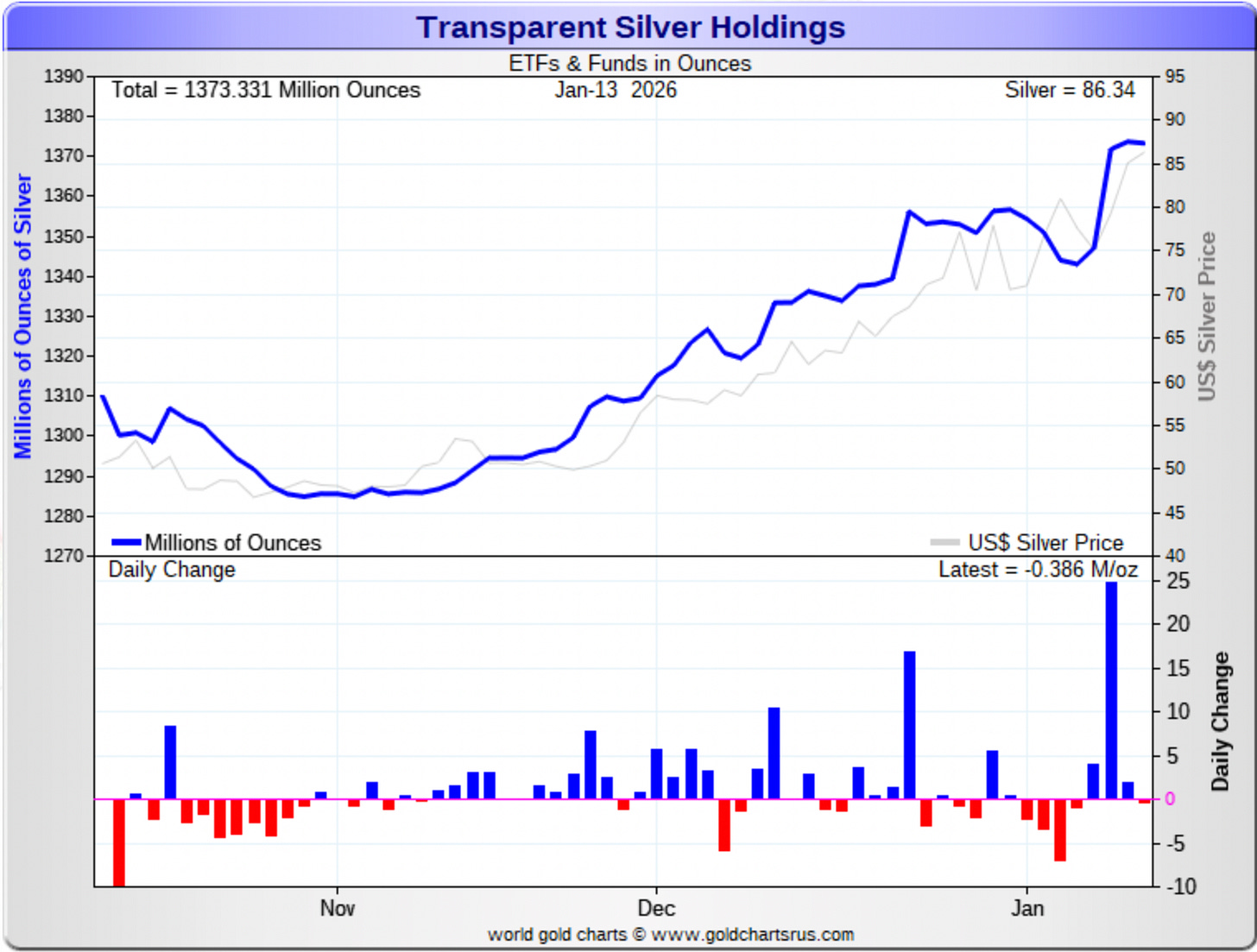

There has been a large recent addition to the amount of silver being reported in the ETFs, although that did follow a few days of significant withdrawals, and leaves the additions largely on about the same pace that they’ve been on since November. However, that 25 million ounce addition 3 days ago may well have exacerbated the tightness that we’re seeing.

You can see in the next chart how the silver price has risen over $18 in the past week, and that occurred at a time when it had already rallied over $25 in the previous month. And while I wouldn’t rule out that there are some groups out there that have been caught short during this latest leg of the rally and are getting their clocks cleaned, what we’ve seen in the past week doesn’t strike me as just a short squeeze. I can’t say it’s impossible, but given everything we’ve seen in the past 15-20 years, it seems like whatever is going on is more than just one or more groups trying to cover a short position.

Continues here

Free Posts To Your Mailbox