Silver Physical Market Under Strategic Pressure

Josh Phair describes the current silver market as a contest over physical control rather than a textbook short-squeeze narrative. Things are feeling more like a bidding-war as international pricing cooperation begins to collapse and competing sovereigns vie for above-ground supplies. In his view, price behavior is being shaped by sovereign demand, institutional inventory management, and jurisdictional custody preferences, not primarily by retail positioning.

He frames recent volatility as the visible surface of a deeper transition: silver is increasingly valued as a strategic asset whose price is set by who controls supply and where that supply is held.

Attribution

These observations of ours reflect commentary from Josh Phair, CEO of Scottsdale Mint, delivered January 2026, addressing physical silver flows, institutional positioning, and geopolitical resource competition.

China getting Squeezed and Bid Up !

— Josh Philip Phair (@JoshPhilipPhair) January 14, 2026

Here is what is happening with Silver.

...My latest quick take. pic.twitter.com/wvcHh6QfAU

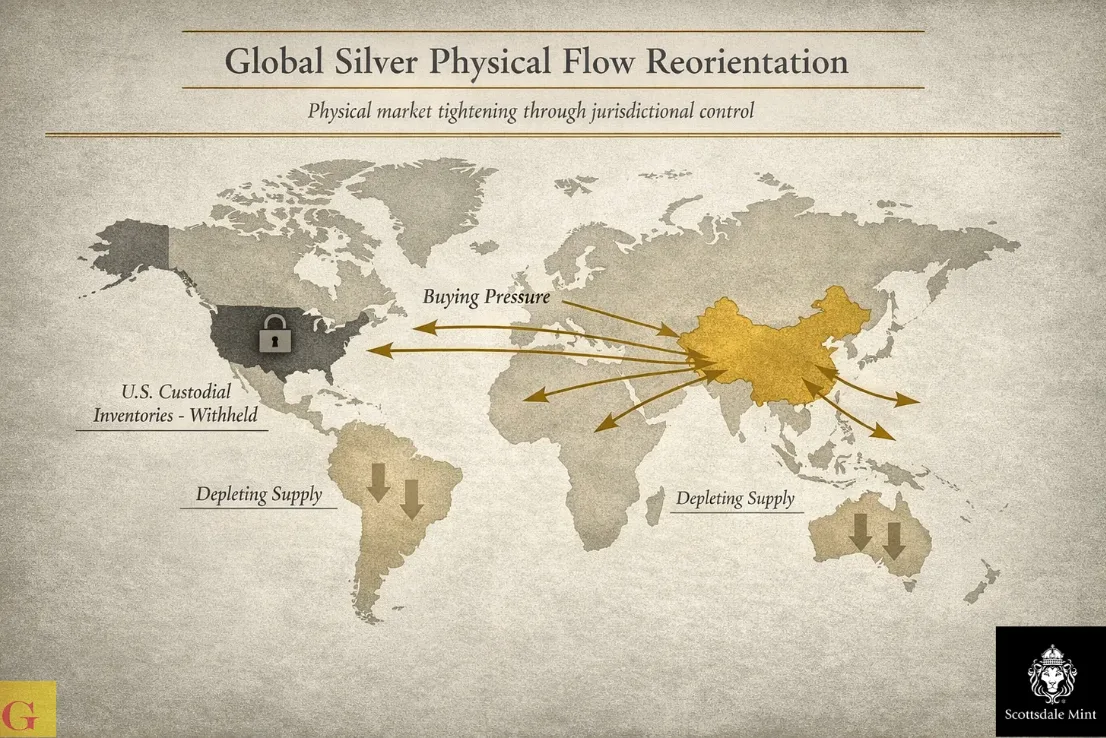

China’s Physical Demand and the Thanksgiving Inflection

Phair traces the present tightening phase back to the period surrounding Thanksgiving. He believes a large Chinese attempt to source substantial quantities of U.S.-held silver was redirected away from American custodial inventories. According to his interpretation, alternative sourcing was offered instead.

From that point, he suggests, China intensified physical accumulation across global markets. Rather than concentrating purchases in one location, buying pressure spread outward, forcing incremental price increases as supply pools narrowed.

In his telling, this was not opportunistic trading. It was strategic procurement, aimed at securing tangible metal within national jurisdiction.

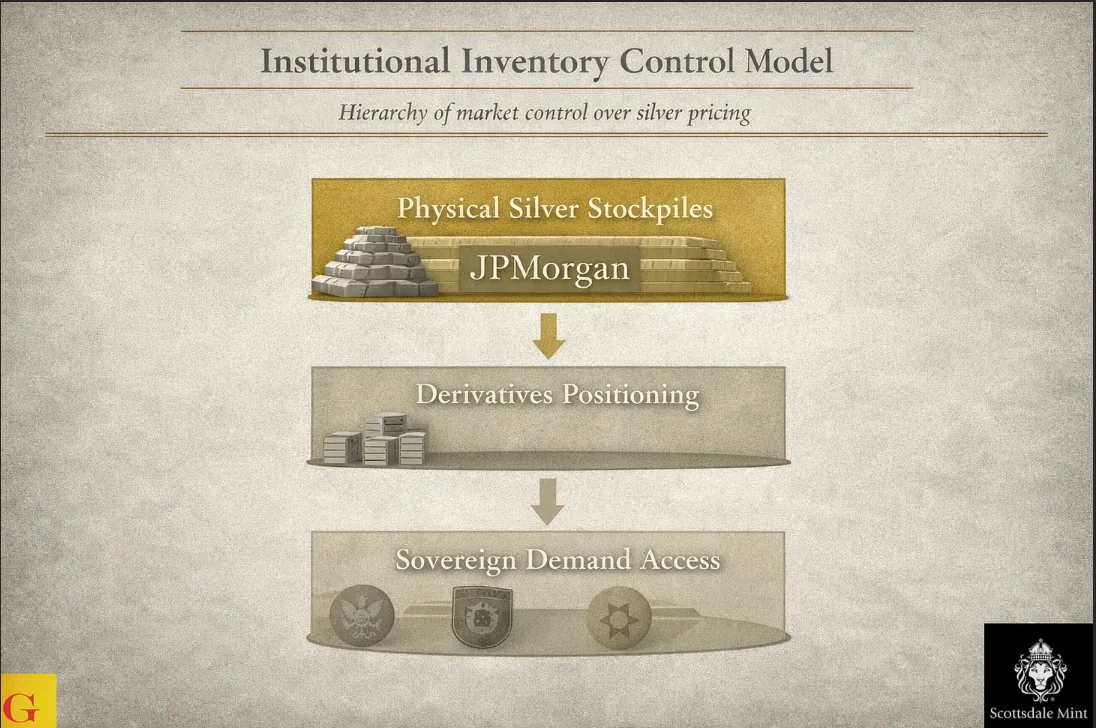

Institutional Inventory Control

The Scottsdale Mint executive repeatedly returns to the role of institutional stockpiles, particularly those held by JPMorgan. He believes this inventory represents the largest concentrated silver holding in the world and that it has effectively been withheld from open access.

In his framework, physical control enables financial control. Derivatives positioning follows inventory positioning, not the other way around.

“JPMorgan controls the largest stockpile of silver in the world.”

“European banks are probably the ones getting squeezed.”

He rejects the popular claim that U.S. banks remain structurally short silver. Instead, he argues that American institutions are positioned either long or neutral, while less strategically aligned European participants may carry disproportionate vulnerability.

Throughout the discussion, he treats JPMorgan not simply as a commercial bank but as an extension of U.S. strategic financial capability, coordinating custody, market access, and policy alignment.

Competing Buyers and Rising Price Discovery

With Chinese accumulation continuing and U.S. custodial supply effectively constrained, he describes a market where multiple sovereign and institutional buyers must compete for diminishing available inventory.

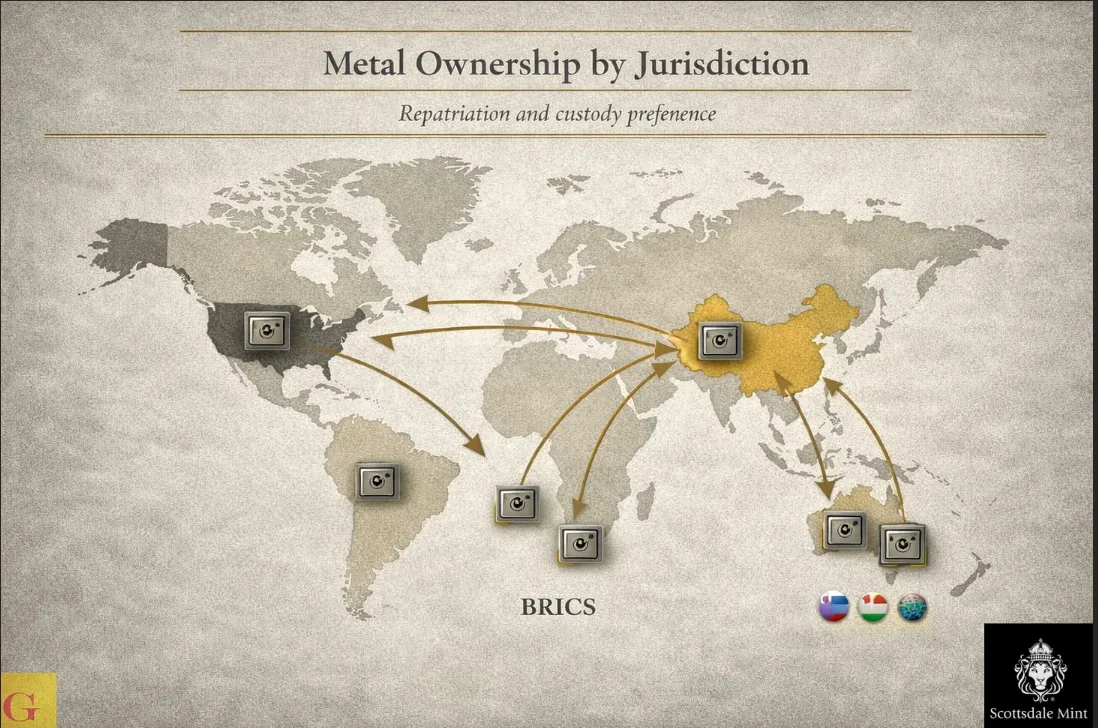

He also points to emerging exchange-traded and crypto-linked products in BRICS jurisdictions that may further increase demand for physical backing. In this environment, he argues, every additional buyer forces prices higher not through speculation, but through scarcity.

Volatility, in his view, is not a sign of dysfunction. It reflects the market attempting to reprice under a new structure.

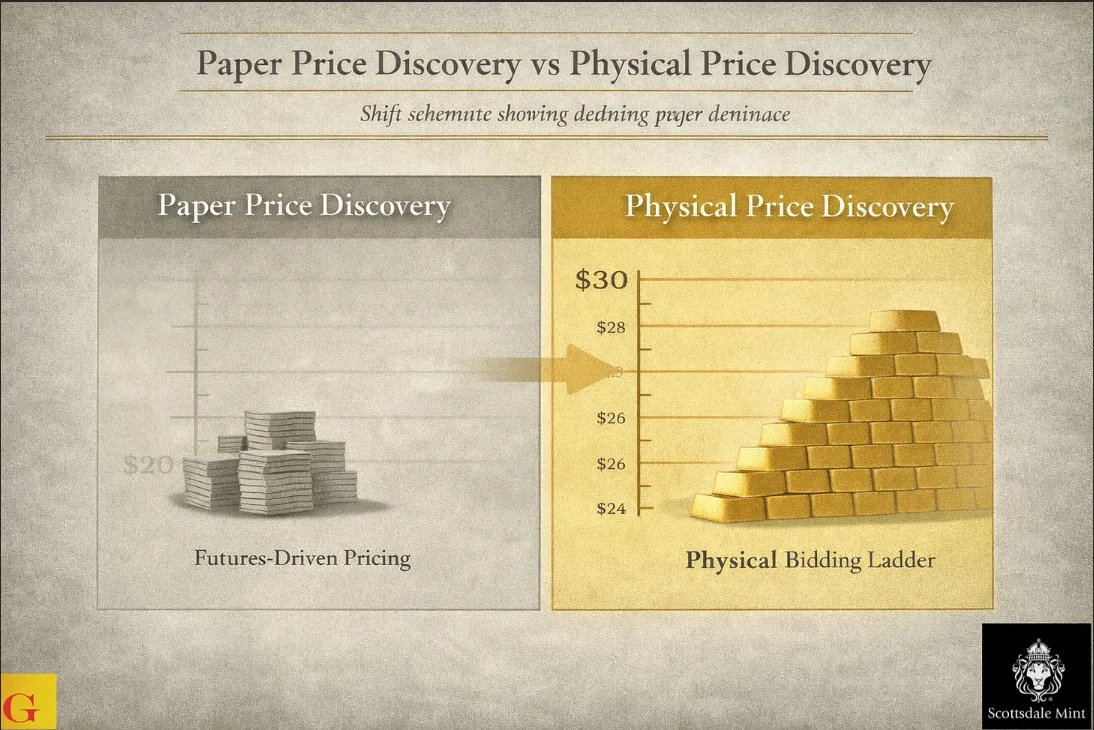

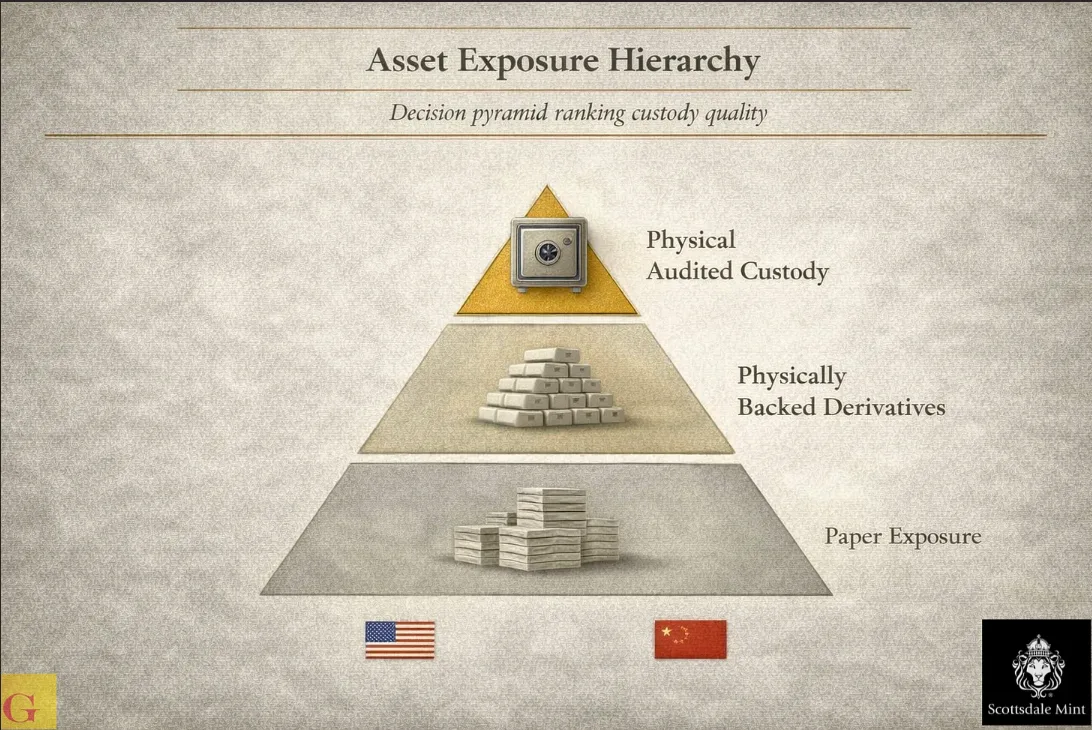

From Paper Pricing to Jurisdictional Control

The core distinction he emphasizes is between financial exposure and physical ownership. He believes price discovery is migrating away from futures-dominated paper systems toward custody-driven bidding for tangible metal.

He argues that nations no longer trust financial claims alone. They want possession, audits, and jurisdictional security.

“People are after the physical tangible metal and they want it in their jurisdiction.”

This shift, he suggests, renders traditional manipulation arguments incomplete. The more relevant issue is not who controls price screens, but who controls vault doors.

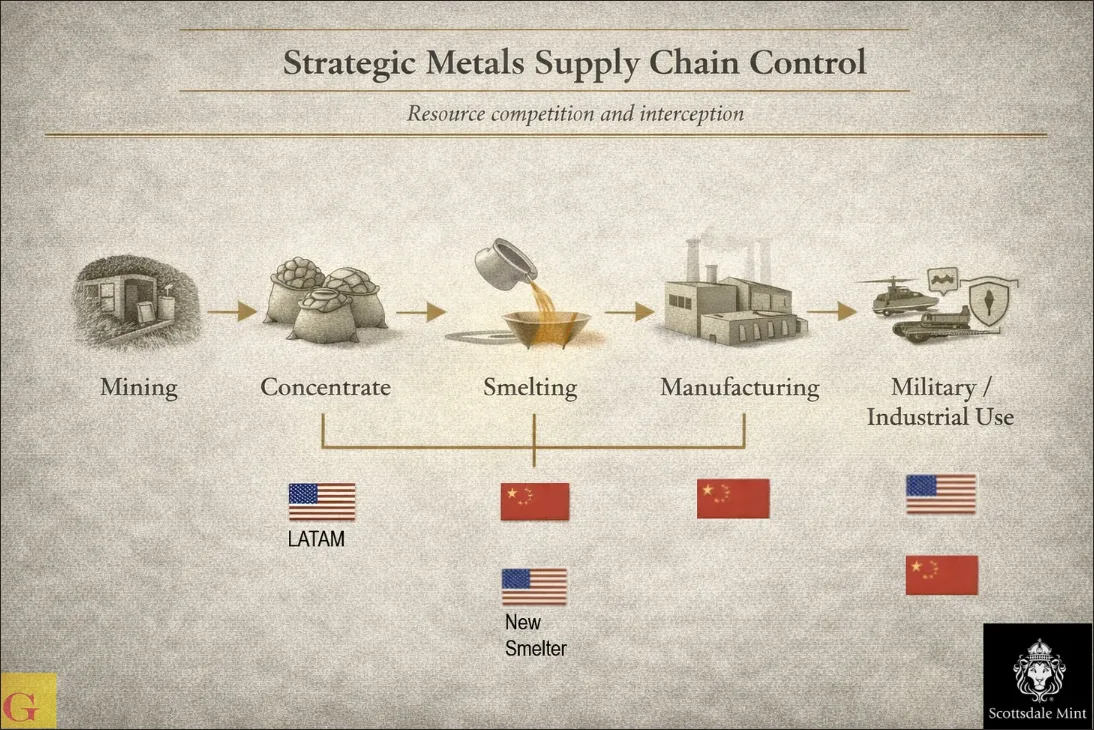

Resource Competition and Supply Chains

Phair extends the silver discussion into a broader resource competition framework. He describes China as increasingly constrained on raw material inputs, including concentrates sourced from Latin America and Venezuela. He believes these flows are being redirected, restricted, or contested.

Silver's New Reality

— VBL’s Ghost (@Sorenthek) January 16, 2026

cc: @Oliver_MSA pic.twitter.com/Led2iDIOLS

At the same time, he argues the United States is aggressively repositioning across the Western Hemisphere to secure upstream access. He cites a major U.S. smelter project in Tennessee, partially funded by the Department of Defense and financed through JPMorgan, as an example of strategic industrial alignment.

That project, he notes, includes arrangements granting the U.S. access to additional South Korean output, reinforcing North American supply security.

In his framing, metals are no longer simply commodities. They are military, industrial, and geopolitical inputs.

Investment Implications Within the Framework

He does not present a price forecast. He openly acknowledges that silver could experience sharp advances or violent corrections within short timeframes.

What he does emphasize is hierarchy. Physical custody matters more than instrument exposure. Audited holdings matter more than paper claims. Jurisdiction matters more than convenience.

“This is why physical metal in the right jurisdiction really matters.”

He allows that some derivatives may offer legitimate physical backing, but he treats those as exceptions rather than substitutes.

Bottom Line

Phair’s framework presents silver as a strategic resource whose price is increasingly governed by sovereign demand, institutional inventory control, and jurisdictional custody rather than retail speculation. He describes a market transitioning from paper-led price discovery toward physical competition, where volatility reflects structural repricing rather than disorder. While he concedes uncertainty in timing and magnitude, his analysis consistently centers on tangible control of metal as the defining variable in silver’s emerging market structure.