Broken Currency: The Mechanics of Regime Change

Throughout history, empires have proudly marched under flags and slogans, but they usually tripped over their own printing presses. While textbooks blame wars or bad leaders, the quieter culprit is almost always the same: monetary decay. When money rots and governments respond with price controls, misery spreads faster than any foreign army—because it’s home-grown and mandatory. Trust dissolves, paper promises are replaced by real assets, and political legitimacy quietly expires. In true Orwellian fashion, inflation becomes “stability,” price controls become “protection,” and institutions insist everything is fine—right up until the moment no one believes them anymore.

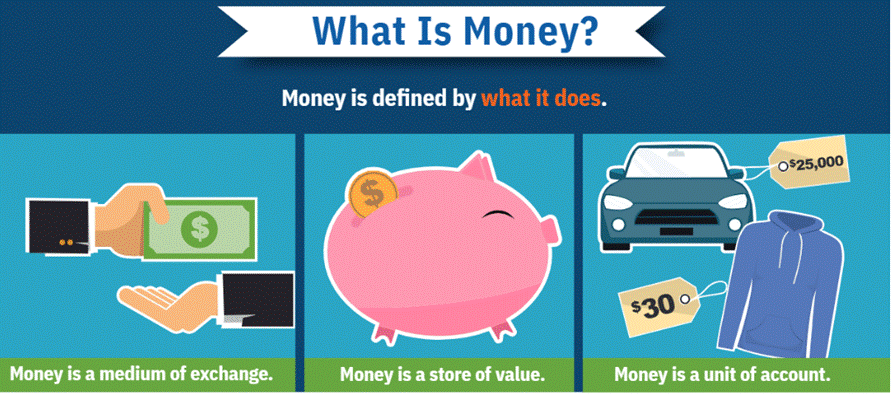

Money is not neutral; it is the bloodstream of an economy and the unwritten constitution of a society. When its value is diluted or administratively distorted, the damage extends far beyond economics into the moral, social, and political fabric. Price controls, invariably imposed as “temporary” measures to protect the public, have instead magnified shortages, fueled black markets, and accelerated the very misery they were meant to prevent—proving once again that good intentions are no substitute for sound money.

https://www.federalreserveeducation.org/teaching-resources/economics/money/money-infographic

From ancient Rome to revolutionary France, from Weimar Germany to modern Venezuela, the pattern is stubbornly consistent: currency collapse followed by price controls breeds scarcity, social unrest, and, eventually, regime change. Empires do not fall because people suddenly revolt; they fall because money stops working—and once it does, legitimacy soon follows.

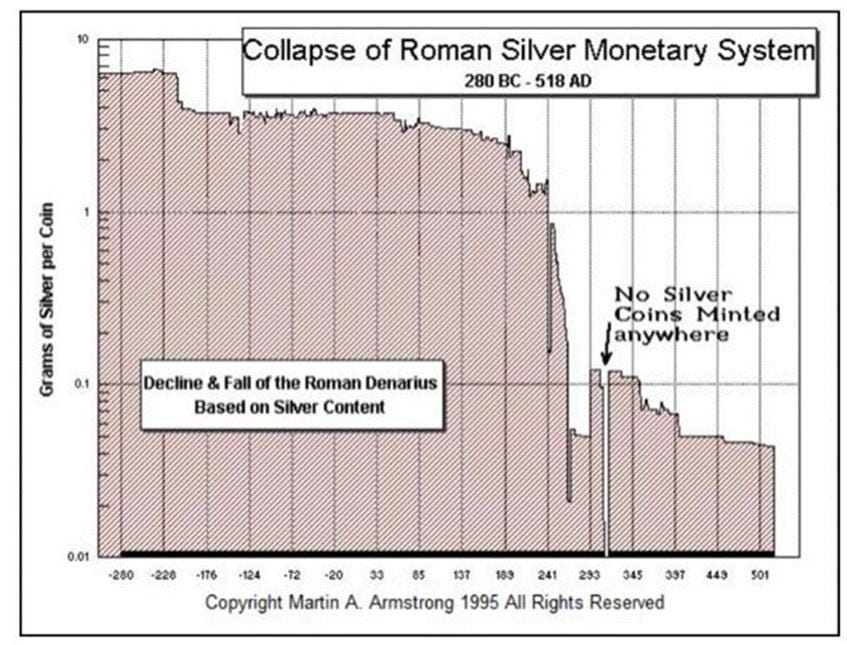

The Roman Empire perfected many things—roads, aqueducts, and, unfortunately, the art of monetary self-sabotage. The denarius began life around 211 BC as a respectable coin with over ten grams of silver and went on to grease the wheels of Mediterranean trade and imperial conquest. But as wars multiplied, bureaucracy bloated, and the bread-and-circuses budget spiraled, emperors opted for the ancient equivalent of financial alchemy: shrinking the silver while pretending nothing had changed. Taxes are unpopular; debasement is discreet. By the third century AD, the denarius contained less than 2% silver—essentially a silver-flavored suggestion. Prices surged, trust evaporated, soldiers demanded to be paid in actual stuff, and merchants decided hoarding goods beat accepting Rome’s increasingly shiny lie.

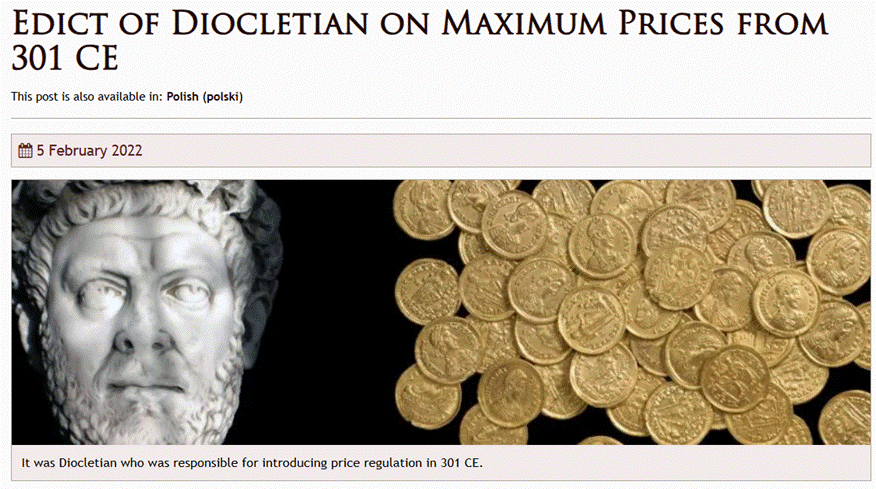

Diocletian, facing the consequences of Rome’s monetary hangover, decided the problem wasn’t bad money—it was bad prices. So in AD 301 he unveiled the Edict on Maximum Prices, a heroic spreadsheet fixing wages and prices for more than a thousand goods, backed by penalties up to and including death (because nothing says “market confidence” like execution). Producers promptly vanished, trade slipped into the shadows, and goods became rarer than honesty in imperial accounting. Price controls didn’t make things cheaper—they made them disappear. Rome didn’t fall overnight, but once trust in money was gone, the empire quietly downgraded to barter, favors, and local strongmen.

https://imperiumromanum.pl/en/article/edict-of-diocletian-on-maximum-prices-from-301-ce/

First the currency failed, then authority fragmented. Lesson learned—and endlessly repeated: debase the money, inflate the prices, cap the prices, empty the shelves, and watch central power dissolve.

In the Middle Ages, when monarchs ran out of money, they didn’t tighten budgets—they shaved coins. Coin clipping became the medieval version of quantitative easing, funding wars and royal lifestyles while quietly hollowing out trust. Henry VIII perfected the art between 1544 and 1551, slashing the silver content of English coinage to pay for military adventures. Inflation followed, wages sulked, food prices soared, and the Crown’s credibility took a long walk off a short pier. As money stopped working, societies didn’t innovate—they regressed. Power drifted back to whoever controlled land, grain, and muscle. When currency failed, feudalism made its comeback—not by choice, but by necessity.

https://www.medievalists.net/2025/11/medieval-england-coin-clipping-scandal/

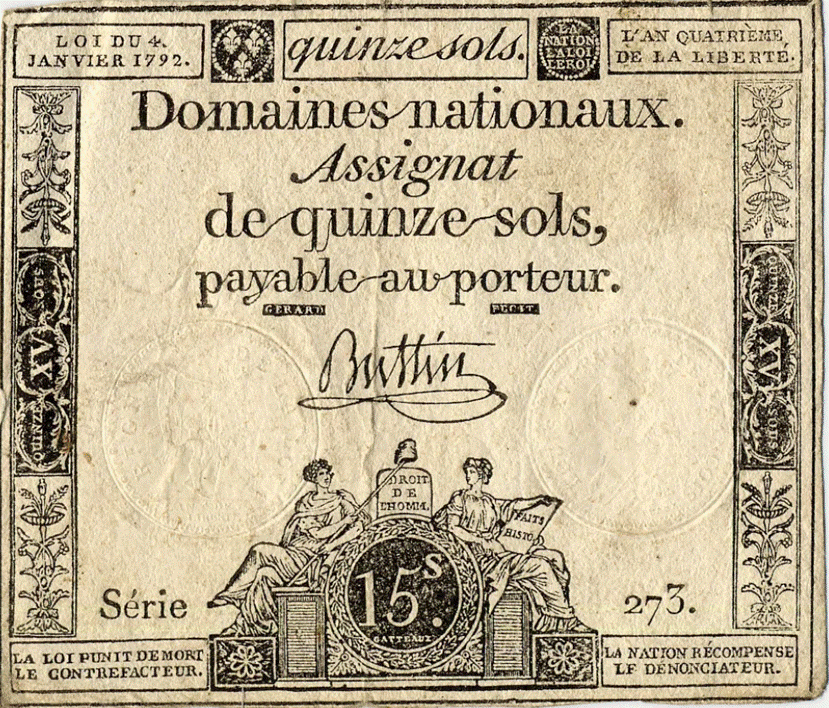

Revolutionary France discovered that liberty, equality, and fraternity don’t print well on paper money. To fix its debt problem, it introduced the assignat—currency backed by confiscated church land and, eventually, blind optimism. Predictably, the printing press went brrrr, and by 1795 the assignat was worth about as much as revolutionary slogans: nearly nothing. To stop inflation, the government imposed the Law of the Maximum, fixing prices and wages. Farmers responded by vanishing, food disappeared, and black markets thrived. As wallets emptied, heads followed. The Terror wasn’t just ideological—it was monetary. The revolution devoured its own, and after the paper burned out, France welcomed Napoleon, who at least understood that stable money beats enthusiastic chaos.

https://www.britannica.com/topic/assignat

Spain learned the hard way that drowning in silver is still drowning. Shiploads of New World bullion poured into Europe, and instead of building productivity, Spain funded wars, palaces, and bad habits. Prices soared, competitiveness evaporated, and domestic industry quietly packed its bags. With inflation doing the invading, Spain defaulted repeatedly and discovered that an empire can collapse without a single enemy at the gates—just too much money and too little discipline.

https://www.itakehistory.com/post/silver-debt-and-empire-spain-s-1557-crisis

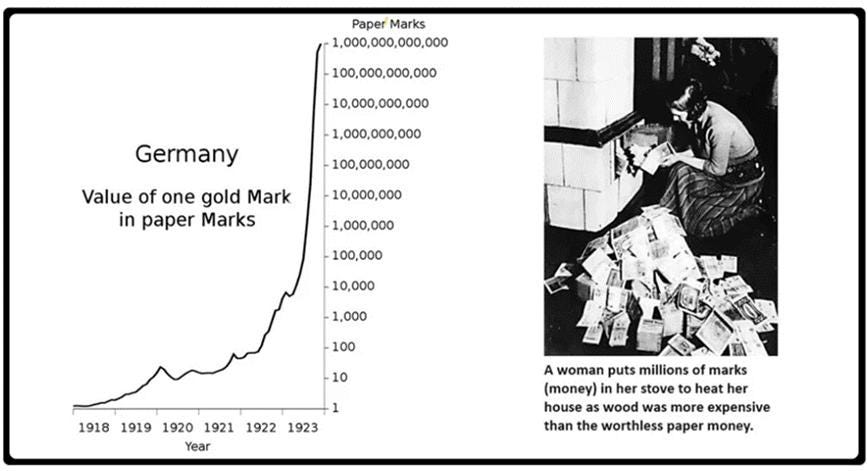

Fast forward to the 20th century, Weimar Germany proved that you don’t need bombs to flatten a society—just a printing press. To pay war reparations, Berlin debased the mark until prices doubled every few days, savings vaporized, and the middle class went extinct. Workers sprinted to shops on payday, price controls collapsed on impact, and money was replaced by cigarettes, gold, and anything that still felt real. The result wasn’t just economic ruin but moral whiplash: once money stopped working, the political center disintegrated, leaving extremism to walk in and claim the ruins.

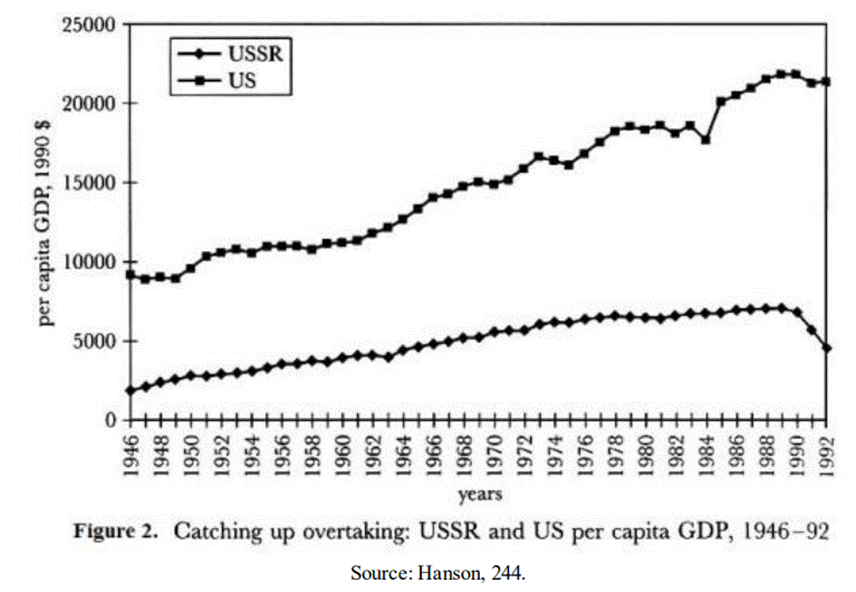

The Soviet Union perfected the illusion of stability: prices never moved—because nothing was ever for sale. By freezing prices, the state also froze reality, replacing inflation with empty shelves, endless queues, and ration cards as a lifestyle choice. Official prices existed only on paper; availability was the real currency. Decades of suppressed inflation and heroic misallocation of capital kept the system cosmetically intact—until controls loosened, truth reappeared, and the entire experiment collapsed under the weight of all the shortages it had carefully hidden.

https://dc.etsu.edu/cgi/viewcontent.cgi?article=2667&context=etd

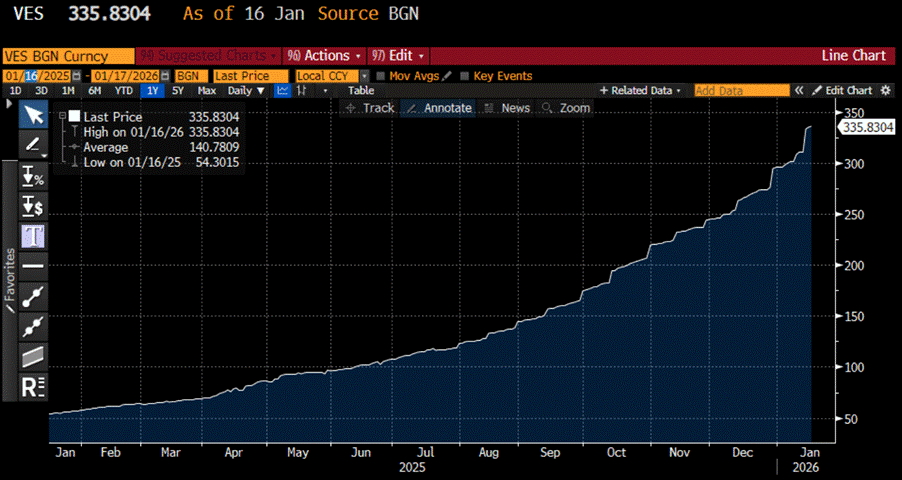

Iran, Zimbabwe and Venezuela offer the modern, high-definition remake of an old classic: print money, fix prices, act surprised. In Zimbabwe, the printing press ran faster than reality, inflation hit cartoon levels, shelves went empty, and the economy quietly adopted the U.S. dollar while the local currency became souvenir wallpaper. Venezuela followed the oil-rich version of the same script—price caps, currency controls, and monetary excess strangled production, until food, dollars, and gold replaced the bolívar. Political power lingered for a while, but economic legitimacy packed its bags and emigrated with the people.

Venezuela Bolivar/USD Spot FX Rate 1-Year Chart.

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/broken-currency-the-mechanics-of

Visit The Macro Butler Website here: https://themacrobutler.com/

Join The Macro Butler on Telegram here : https://t.me/TheMacroButlerSubstack

You can contact The Macro Butler at info@themacrobutler.com

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence