What Bank Earnings Tell Us About the Economy

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 11,000 subscribers at MktContext.com for our weekly deep dives and analysis!

Several major banks reported this week (JP Morgan, Citigroup, Wells Fargo, Bank of America). We follow banks closely as they are a barometer of economic health. The banks are saying the economy is slowing but not falling apart. They still see growth, but it’s not booming like in 2021-2022.

“Account balances for the US consumer were stable through the year. Delinquencies and charge-offs improved in 2025.”

“Consumer spending grew 5% over 2024 levels.”

-Bank of America CEO Brian Moynihan

“If you asked me in the short run, call it six months and nine months and even a year, it’s pretty positive. Consumers have money.”

-JP Morgan CEO Jamie Dimon

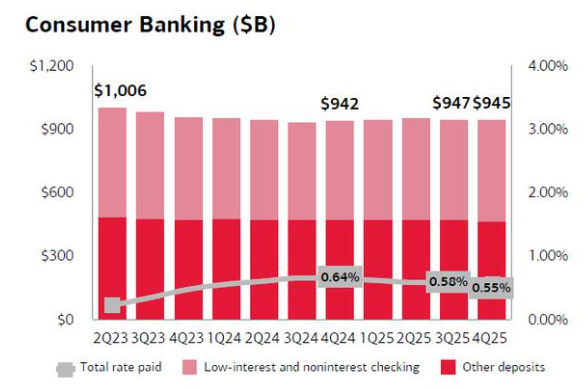

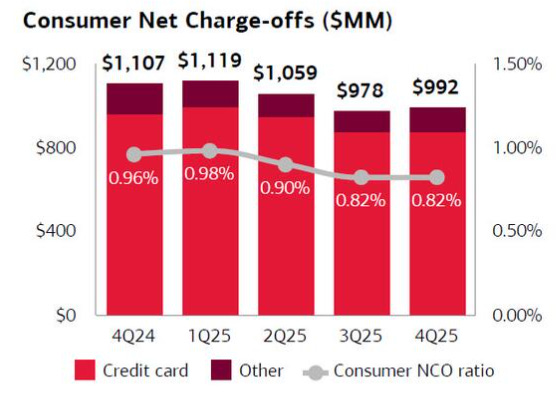

The consumer is holding up. People are still spending because they remain employed and checking account balances are stable. However, pandemic-era “excess savings” are spent, so people are selective with their spending. Credit card charge-offs are rising from very low levels but not at crisis levels yet.

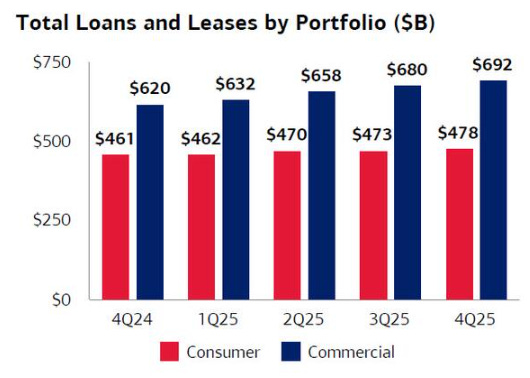

The banks are seeing loan growth, but it’s uneven. For example commercial and industrial lending is growing faster than consumer loans. That jibes with our view that the economy is reaccelerating even as the job market slows down.

Higher interest rates from prior years are still weighing on mortgage activity and the housing markets. So banks are not seeing a boom in new home lending. However, ongoing demand is still inching up, even if volumes are not strong. It will likely take some time for our housing thesis to play out.

The overall message is clear: slow but steady growth, not a boom, not a recession. Consumers are still spending and paying debts, but with less of a savings cushion, so any big shock (job losses or jump in rates) would hurt more. Businesses are cautious about borrowing, which fits a “wait and see” mood on the economy.

To read the rest of this article, and to see our portfolios and get more market timing content, head over to MktContext.com and subscribe today!