SMR Licensing Approvals & SMR company-specific progress

From the TightSpreads Substack.

To receive commercial licensing for a Small Modular Reactor (SMR) in the U.S., a developer must navigate a regulatory landscape that has shifted significantly within the last few months. While the Nuclear Regulatory Commission (NRC) remains the sole authority for “commercial” licenses, the Department of Energy (DOE) and Department of War (DoW/DOD) now provide critical “upstream” pathways to accelerate that final approval.

This article is split into two sections:

-

The pathways explained

-

Where are the current SMR companies in this timeline

Part 1: Pathways Explained

The NRC: The Commercial Gatekeeper

For an SMR to sell power to the grid or a private customer, it must follow one of three primary pathways under Title 10 of the Code of Federal Regulations (CFR):

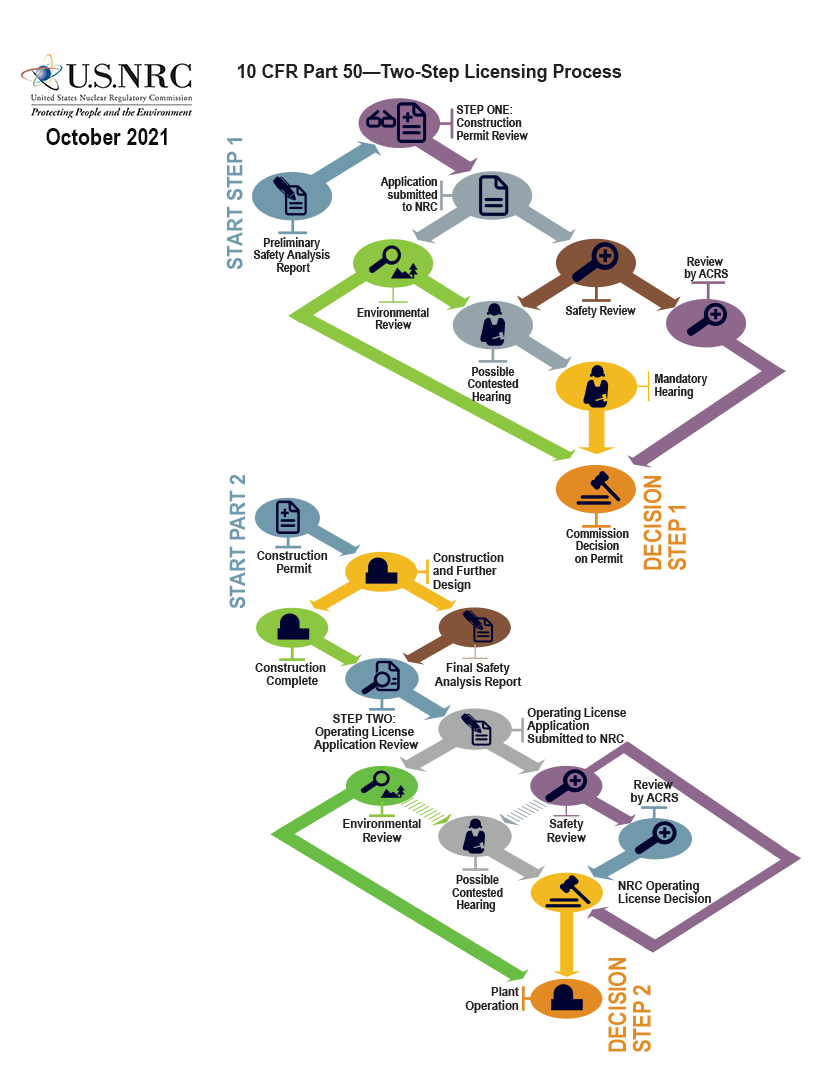

10 CFR Part 50 (Two-Step Process): The traditional route. Developers first apply for a Construction Permit (CP) and later for an Operating License (OL). This is often preferred by first-of-a-kind (FOAK) reactors because it allows construction to begin before the final design details are fully frozen.

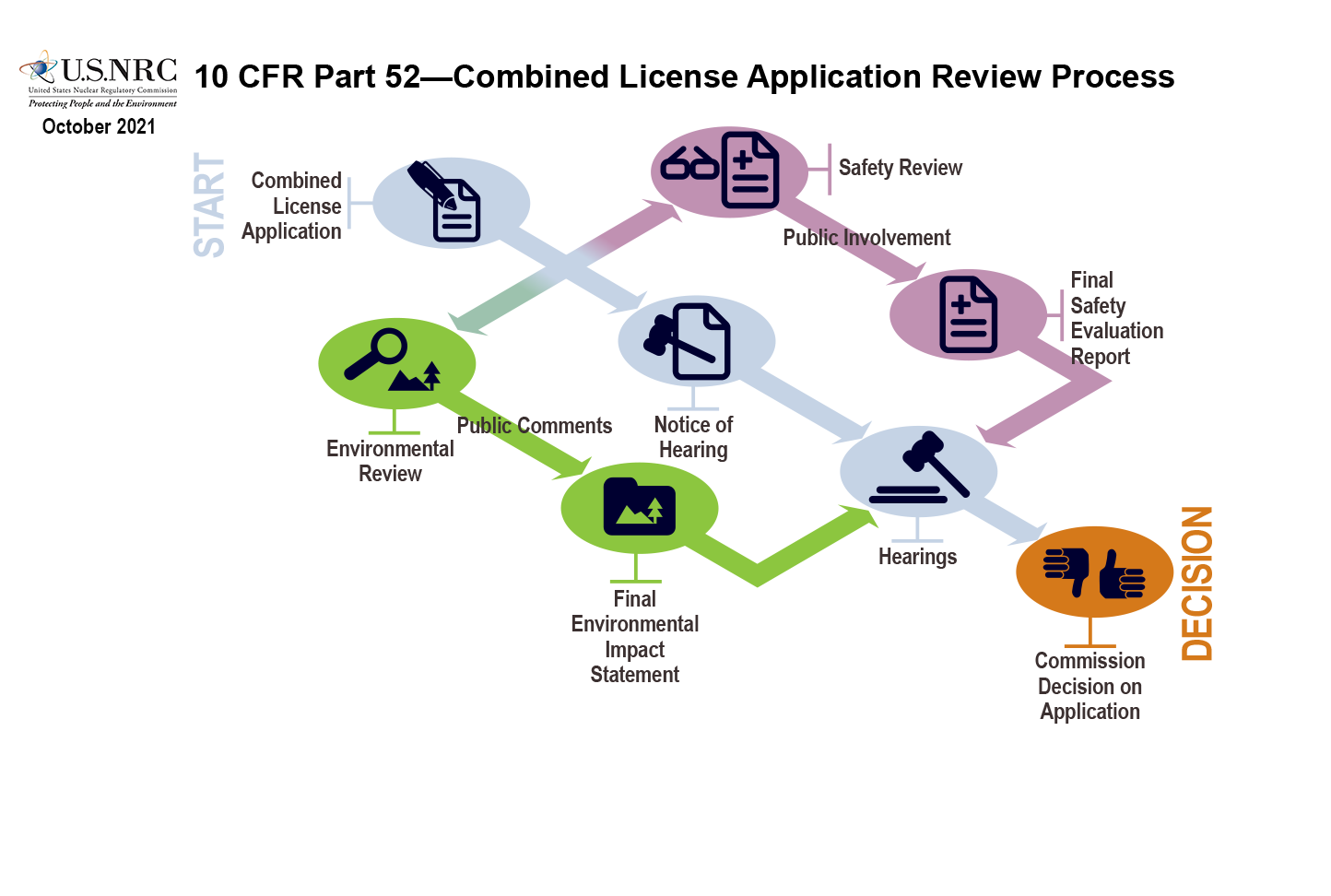

10 CFR Part 52 (Combined License - COL): A streamlined, “one-step” process that issues a single license to construct and operate. This is most efficient if the developer uses a Design Certification (DC)—a pre-approved, standardized design that can be referenced in multiple applications to avoid re-reviewing the technology.

-

10 CFR Part 53 (Risk-Informed Framework): Finalized in late 2025/early 2026, this is a new, technology-inclusive pathway specifically for advanced SMRs. It focuses on performance-based outcomes (e.g., “how safe is it?”) rather than prescriptive rules (e.g., “how many pumps must it have?”).

The DOE: The “Fast-Track” Authorization Pathway

The DOE cannot grant a commercial license, but it uses its authority under the Atomic Energy Act (AEA) to act as a safety and testing incubator.

-

Reactor Pilot Program (RPP): Established via Executive Order 14301, this allows companies (like Oklo, X-energy, and Kairos) to build and operate test reactors on DOE sites (like Idaho National Lab) without an NRC license.

-

Safety Data Sharing (Addendum No. 9): Under a 2025 MOU, data gathered during DOE-authorized operations is shared directly with the NRC. This creates a “Fast Track” to Commercialization: the NRC is mandated to credit the safety performance observed during the DOE pilot phase, potentially reducing the commercial licensing timeline from 7 years to just 18 months.

-

Advanced Reactor Demonstration Program (ARDP): DOE provides cost-sharing grants to help SMR developers finish their “Safety Analysis Reports,” which are the most expensive and complex parts of the NRC application.

The DoW: The National Security Launchpad

The DoW provides a unique pathway for “Dual-Use” SMRs (reactors intended for both military and eventually commercial use).

-

Advanced Nuclear Power for Installations (ANPI): The DoW (via the Defense Innovation Unit) selects SMRs to power domestic military bases.

-

Section 91/110 Authority: Like the DOE, the DoW can self-authorize reactors for “national security purposes.” By acting as the first customer, the DoW pays for the initial deployment.

Regulatory Bridge: A developer can build a micro-reactor for a military base under DoW authority while simultaneously using that project as the “lead plant” for an NRC commercial license. This proves the manufacturing and operational reliability on the government’s dime before seeking private utility customers.

Where are the SMRs in this process?

As of January 2026, the SMR landscape is divided between “Fast-Track” Generation IV reactors (sodium, gas, salt) and “Proven-Tech” Light Water Reactors. The ADVANCE Act (2024) and the NRC Part 53 framework have fundamentally shifted the speed of these pathways.

1. Oklo Inc. (Aurora)

-

Type, Capacity, Partners & Investors:

-

Type/Capacity: 75 MWe (scaled up from the original 1.5 MWe); Liquid Metal Fast Reactor (metal-fueled). Explained here.

-

Strategic Partners:

-

Meta: A multi-year agreement to develop a 1.2 GW “Nuclear Campus” in Pike County, Ohio. Pre-paid in cash to help with financing the NRC licensing paths.

-

Siemens Energy: Signed a binding contract to manufacture the Power Conversion System (the non-nuclear part that turns heat into electricity + turbines), ensuring a ready-made supply chain.

-

Kiewit: Lead constructor for the first commercial unit at Idaho National Laboratory.

-

Vertiv: Integrated power and cooling solutions tailored to nuclear-powered data centers.

-

Liberty Energy: Phased hybrid power delivery combining natural gas with future nuclear baseload.

-

ABB: Digital monitoring and automation

-

Lightbridge: Co-located advanced fuel fabrication and Los Alamos National Laboratory for plutonium criticality testing.

-

Sweden’s Blykalla and Europe’s newcleo: Technology sharing and U.S. fuel infrastructure investment

-

Fun one to add to include, Zeno Power: for radioisotope MOU to provide +$65 million worth of contracts for nuclear batteries and power systems for agencies like NASA, the U.S. Navy, and the U.S. Space Force

-

Southern Ohio Diversification Initiative (SODI): Facilitated the purchase of 206 acres of former DOE land in Ohio for the Meta project.

-

Centrus Energy: Working on diversified supply for domestic HALEU fuel enrichment.

-

-

Investors and Chairmen: Publicly traded (NYSE: OKLO). Sam Altman, Peter Thiel, Chris Wright, and Newcleo

-

-

Licensing Pathways:

-

DOE Reactor Pilot Program (RPP): Currently building the Aurora-INL at Idaho National Lab. This project is authorized by the DOE, bypassing the NRC for this initial “test” unit.

-

NRC 10 CFR Part 53 (Commercial): Engaged in “Pre-application” for their commercial fleet. They are using a “Phased Combined License Application” (COLA) strategy.

-

-

Progress, Strategy & Timeline:

-

Progress (DOE): Groundbreaking at INL occurred in September 2025. On January 7, 2026, they signed a new agreement for a Radioisotope Pilot Plant.

-

Progress (NRC): The NRC completed a Readiness Assessment in mid-2025 with “no significant gaps” found. They are currently clearing “Topical Reports” (the building blocks of the license) in record time—their Principal Design Criteria (PDC) report is expected to be approved by the NRC in early 2026.

-

Strategy: Use the DOE Idaho plant to achieve criticality by July 4, 2026. But even if they miss this deadline, the data from this operating plant will be used to “auto-fill” the safety evidence for the NRC license.

-

Commercialization: 2028. Meta units by 2030.

-

-

Funding NRC Application Fees:

-

Meta Pre-payment: The Jan 2026 Meta deal includes a “mechanism for Meta to prepay for power” specifically to fund project certainty, fuel procurement, and regulatory fees.

-

ADVANCE Act Savings: Oklo is a primary beneficiary of the $148/hour reduced fee rate.

-

-

DOE “Fuel Line” Support: Received a first-of-its-kind approval in Nov 2025 for a Nuclear Safety Design Agreement that allows the DOE to pay for part of the fuel facility oversight.

2. TerraPower (Natrium)

-

Type, Capacity, Partners & Investors:

-

Type/Capacity: 345 MWe Sodium-Cooled Fast Reactor (SFR) with a molten salt energy storage system that can “boost” output to 500 MWe for 5.5+ hours to meet peak demand. Explained here.

-

Strategic Partners:

-

Meta (Jan 2026): Agreement for up to 8 Natrium plants (2.8 GW baseload / 4 GW peak).

-

GE Vernova Hitachi Nuclear Energy: Primary technology and co-development partner for the Natrium design.

-

PacifiCorp (Berkshire Hathaway Energy): The utility partner for the Kemmerer, WY plant; exploring 5 additional units.

-

Bechtel: The lead Engineering, Procurement, and Construction (EPC) partner.

-

Framatome: Partnered to build a HALEU metallization plant to secure the fuel supply chain.

-

HD Hyundai: Strategic investor and global supply chain partner (shipbuilding and module manufacturing).

-

-

Investors: Bill Gates, NVIDIA (via NVentures), SK Group; completed a recent $650M Series D (June 2025).

-

-

Licensing Pathways:

-

NRC 10 CFR Part 50 (Two-Step Process): TerraPower chose this “traditional” route because it allows for earlier construction.

-

DOE ARDP (Advanced Reactor Demonstration Program): A 50/50 cost-share program providing up to $2 billion in federal matching funds.

-

UK GDA (International): Formally submitted for the UK’s Generic Design Assessment in October 2025.

-

-

Progress, Strategy & Timeline:

-

Progress: On December 1, 2025, the NRC completed its Final Safety Evaluation Report (SER) for the Kemmerer plant—one month ahead of an already expedited 18-month schedule.

-

Strategy: TerraPower utilized a “Construction Permit Exemption” to break ground on the “Energy Island” (non-nuclear portions like storage tanks and turbines) in June 2024 while the NRC reviewed the nuclear island. This concurrent work shaves ~2 years off the traditional timeline.

-

Upcoming Steps: * Feb 2026: Final vote by the NRC Commission to issue the Construction Permit (CP).

-

2026: Start of “Nuclear Concrete” pour at the Kemmerer site.

-

2027: Submission of the Operating License (OL) application.

-

-

Commercialization: Kemmerer Unit 1 is targeted for full grid operation by 2030. The first Meta units are targeted for 2032.

-

-

Funding NRC Application Fees:

-

DOE ARDP: 50% of all licensing and regulatory costs are reimbursed by the Department of Energy.

-

Meta Pre-payment: The Jan 2026 agreement includes funding to support the development of the first two units, acting as a “down payment” that covers regulatory overhead.

-

Private Capital: Bill Gates’ personal multi-billion dollar commitment and the $650M 2025 fundraise provide a massive “regulatory cushion.”

-

-

ADVANCE Act: TerraPower is currently paying the reduced $148/hour NRC fee (down from $318), saving an estimated $15M–$20M over the course of the review.

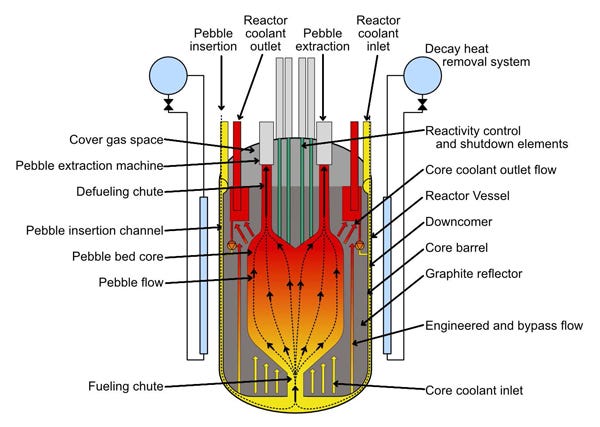

X-energy (Xe-100)

-

Type, Capacity, Partners & Investors:

-

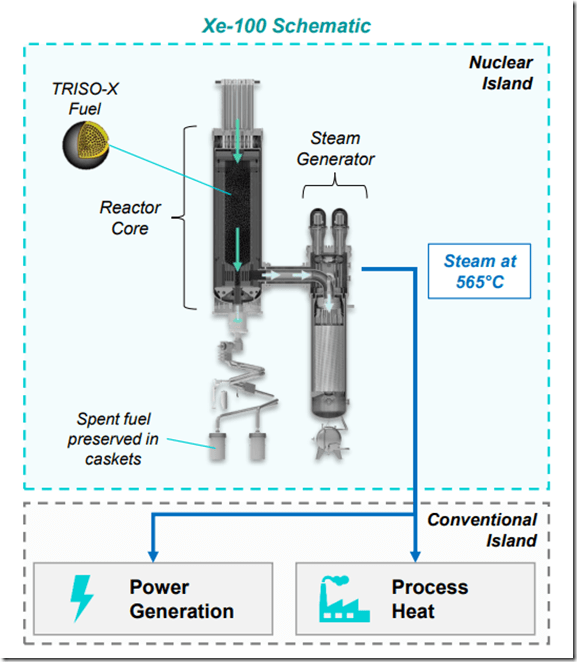

Type/Capacity: 80 MWe High-Temperature Gas-Cooled Reactor (HTGR); Pebble Bed design. Typically deployed in a “four-pack” for 320 MWe. Explained here.

-

Strategic Partners:

-

Amazon (Oct 2025): Anchored a $500M+ investment to deploy 5 GW of power by 2039.

-

Dow Inc. (Lead Partner): Partnered for the Seadrift, Texas project to replace fossil-fuel steam plants with carbon-free nuclear process heat.

-

Energy Northwest: Utility partner for the “Cascade Advanced Energy Facility” in Washington state.

-

Centrica (UK): Partnered to deploy 6 GW of Xe-100 reactors in the United Kingdom.

-

Doosan Enerbility (South Korea): Signed a 2025 Reservation Agreement to build a dedicated manufacturing facility for Xe-100 components.

-

-

Investors: Amazon (Climate Pledge Fund), Jane Street (Led $700M Series D in Nov 2025), Ares Management, Citadel (Ken Griffin), and the University of Michigan.

-

-

Licensing Pathways:

-

NRC 10 CFR Part 50 (Two-Step Process): Currently in the Construction Permit (CP) phase for the Seadrift, TX site.

-

DOE ARDP (Advanced Reactor Demonstration Program): Recipient of a $1.2B federal cost-share grant.

-

NRC Part 70 (Fuel Fabrication): Their subsidiary, TRISO-X, is in a separate, critical licensing path for the fuel facility in Oak Ridge, TN.

-

-

Progress, Strategy & Timeline:

-

Progress (Reactor): The NRC formally “docketed” the Seadrift Construction Permit in 2024 and issued an expedited 18-month review timeline in June 2025.

-

Progress (Fuel): Vertical construction of the TRISO-X Fuel Facility began in late 2025. The NRC is expected to issue the final fuel facility license by May 2026.

-

Strategy: Vertical Integration. By owning the fuel supply (TRISO-X) and the reactor design, X-energy eliminates the “fuel risk” that plagues other SMRs. They are leveraging the Dow Seadrift project as the commercial “proof of concept” to unlock the 5 GW Amazon pipeline.

-

Upcoming Steps: * Late 2026: Target for NRC Construction Permit approval for Seadrift.

-

2027: Start of reactor module manufacturing at the new Doosan facility.

-

-

Commercialization: Seadrift (Texas) targeted for startup in 2030. Amazon’s Washington units (Cascade Facility) targeted for early 2030s.

-

-

Funding NRC Application Fees:

-

ARDP Cost-Share: 50% of NRC fees are currently reimbursed by the DOE.

-

Series D Capital: The $700M raised in Nov 2025 provides a decade of regulatory runway, specifically earmarked for expanding the engineering team to handle NRC “Requests for Additional Information” (RAIs).

-

ADVANCE Act: Benefiting from the $148/hour reduced fee rate as of October 2025.

-

Amazon Pre-payment: The 2025 deal includes “capacity reservation fees” that act as working capital for the Washington state licensing process.

-

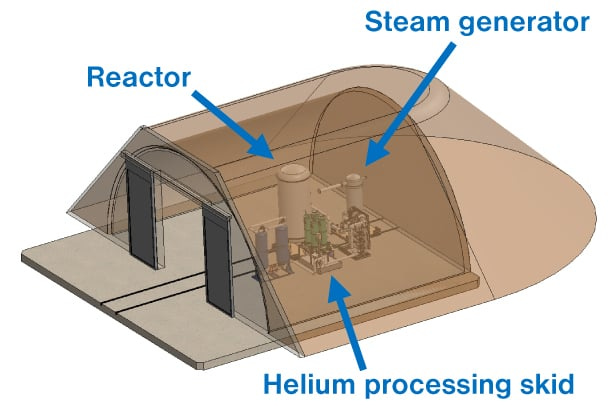

4. BWXT (Project Pele / BANR)

-

Type, Capacity, Partners & Investors:

-

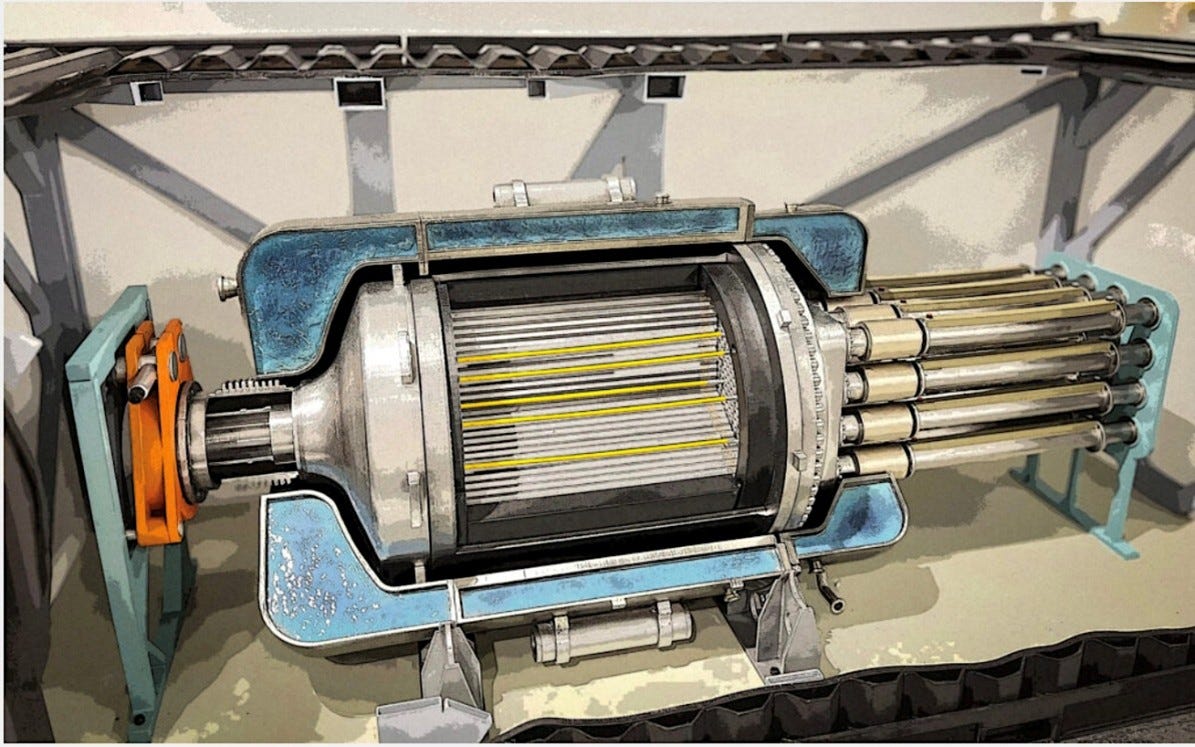

Type/Capacity: * Project Pele: 1–5 MWe; Transportable, High-Temperature Gas-Cooled Microreactor (HTGR). Fits in 20-foot shipping containers.

-

BANR (BWXT Advanced Nuclear Reactor): 50 MWe; A “scaled-up” commercial version of the Pele technology.

-

-

Strategic Partners:

-

U.S. Department of Defense (DoD): The primary customer and funder for Project Pele.

-

Rolls-Royce SMR (Oct 2025): A major manufacturing partnership where BWXT will build the nuclear steam generators for Rolls-Royce’s global fleet.

-

Kairos Power (Oct 2025): Agreement to manufacture fuel for Kairos’s Hermes 2 demonstration plant using BWXT’s TRISO production line.

-

Purdue University (Nov 2025): Signed an MOU to research microreactor deployment for university and regional grids.

-

-

Investors: Publicly traded (NYSE: BWXT). Major institutional backers include BlackRock and Vanguard; significantly funded by a $1.5B NNSA contract (Sept 2025) and a $2.6B Naval Nuclear contract.

-

-

Licensing Pathways:

-

DoD Section 91 Authorization: Project Pele is being built and tested under military authority at Idaho National Lab (INL), bypassing the NRC for its initial “proof of life.”

-

NRC Part 53 (Commercial): BWXT is in pre-application for the BANR commercial reactor, using the “Performance-Based” framework.

-

NRC Part 70 (Fuel): Their Lynchburg, VA facility is the only NRC Category 1-licensed site currently capable of high-scale TRISO fuel production.

-

-

Progress, Strategy & Timeline:

-

Progress: Groundbreaking at INL occurred in late 2024. In December 2025, BWXT delivered the full core of TRISO fuel to INL. The reactor module itself is scheduled for delivery and final assembly in February–March 2026.

-

Strategy (The “Military Pathfinder”): BWXT’s strategy is to let the DoD pay for the “expensive” first unit. They are using the 2026–2028 test run at Idaho to collect the safety data required for an NRC commercial license for BANR, effectively letting the Pentagon act as their R&D department.

-

Steps Ahead: Initial criticality at INL (Targeted late 2027/early 2028); formal NRC commercial filing for BANR expected in 2027.

-

Commercialization: First military deployment by Sept 2028 (per EO 14299); first commercial unit (BANR) by 2031–2032.

-

-

Funding NRC Application Fees:

-

Federal Funding: Project Pele is 100% government-funded (~$300M+ for the prototype).

-

DOE ARDP: BWXT’s BANR project receives cost-sharing grants for the commercial licensing work.

-

Cash Flow: BWXT funds its commercial NRC fees through the profits of its massive $4B+ annual naval nuclear business (submarines and carriers). They are the only SMR player that is already a multi-billion dollar profitable enterprise.

-

ADVANCE Act: Taking advantage of the $148/hour fee reduction for their commercial BANR filings.

-

Project Pele:

BANR:

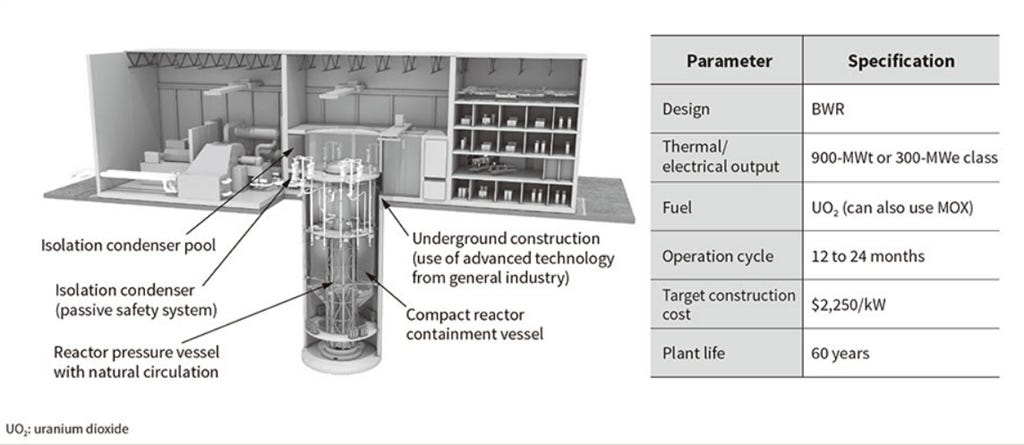

5. GE Hitachi (BWRX-300)

-

Type, Capacity, Partners & Investors:

-

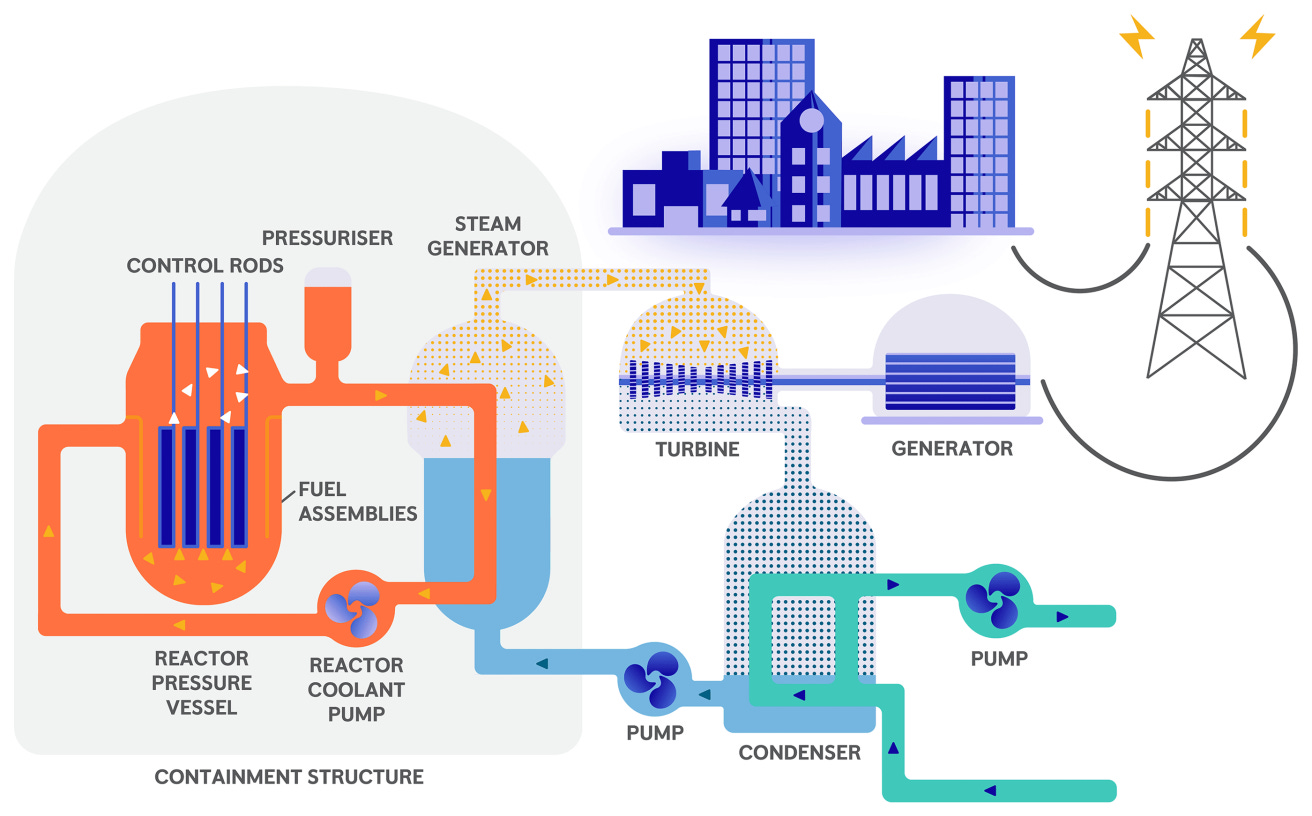

Type/Capacity: 300 MWe Boiling Water Reactor (BWR). It is the 10th generation of GE’s boiling water tech, designed for “extreme simplification” (90% smaller footprint than traditional plants). Explained here.

-

Strategic Partners:

-

Tennessee Valley Authority (TVA): The lead U.S. utility partner; currently licensing the first U.S. unit at the Clinch River site.

-

Ontario Power Generation (OPG): The lead Canadian partner; currently building the first of four units at the Darlington site.

-

Samsung C&T: Strategic alliance to build a global supply chain and potentially deploy 5 units in Sweden.

-

Orlen Synthos Green Energy (OSGE): Partner for massive deployment in Poland (targeting up to 70 units by 2038).

-

BWXT: Contracted to manufacture the Reactor Pressure Vessel (RPV) and other long-lead components.

-

-

Investors: GE Vernova (recently spun off as a standalone energy company), Hitachi Ltd., and co-investments from TVA, OPG, and OSGE into the “Standard Design.”

-

-

Licensing Pathways:

-

NRC 10 CFR Part 50 (Two-Step Process): Currently under Construction Permit (CP) review for the Clinch River Unit 1.

-

Canada CNSC (VDR): Vendor Design Review completed; currently under a Construction License at Darlington.

-

UK GDA: Completed Step 2 in December 2025; currently in the final Step 3 review.

-

-

Progress, Strategy & Timeline:

-

Progress (U.S.): The NRC formally docketed TVA’s Construction Permit application in July 2025. The NRC safety review is scheduled for completion by November 2026.

-

Progress (Canada): Construction is underway. As of early 2026, the reactor building shaft excavation at Darlington is nearly 90% complete, and the first “nuclear concrete” (the basemat) is being poured this quarter.

-

Strategy (The “Design Center” Approach): GEH is the first to successfully use the “North American Standard Design.” They submit identical technical documents to both the U.S. NRC and Canada’s CNSC. When one regulator approves a part of the design, the other “reciprocates,” cutting hundreds of hours of redundant review.

-

Upcoming Steps: * Late 2026: Target for NRC Construction Permit for Clinch River.

-

2028: Target for Darlington Unit 1 mechanical completion.

-

-

Commercialization: Darlington Unit 1 (Canada) is targeted for grid connection by late 2029. Clinch River (U.S.) is targeted for early 2030s.

-

-

Funding NRC Application Fees:

-

DOE Grants: In December 2025, the DOE awarded a $400 million grant to TVA specifically to accelerate the BWRX-300 deployment, much of which covers NRC licensing costs.

-

Utility Coalition: TVA, OPG, and OSGE created a “licensing fund” where they share the costs of the NRC/CNSC fees, reducing the burden on any single company.

-

ADVANCE Act: GEH benefits from the $148/hour fee cap, which is critical given the massive volume of technical data they are submitting for a 300 MWe plant.

BWRX-300:

-

6. Kairos Power (Hermes)

-

Type, Capacity, Partners & Investors:

-

Type/Capacity: Fluoride Salt-Cooled High-Temperature Reactor (KP-FHR). It uses TRISO fuel pebbles and molten fluoride salt (Flibe) as a coolant. Explained here.

-

Hermes 1: 35 MWt (Thermal) / No grid power.

-

Hermes 2: Two reactors (50 MWe total) / Grid-connected demonstration.

-

Commercial Fleet: 75 MWe per module.

-

-

Strategic Partners:

-

Google: The cornerstone partner. Signed a Master Plant Development Agreement to deploy a fleet of SMRs totaling 500 MW by 2035.

-

Tennessee Valley Authority (TVA): Signed the first-ever U.S. utility PPA for a Gen IV reactor (Aug 2025) to buy power from Hermes 2 and deliver it to Google’s data centers.

-

BWXT: Strategic manufacturing partner for commercial TRISO fuel production and reactor components.

-

Materion: Partner for the molten salt supply chain.

-

-

Investors: Google (via PPA and development support), Innovation Endeavors (Eric Schmidt’s fund), and substantial DOE backing via the ARDP.

-

-

Licensing Pathways:

-

NRC 10 CFR Part 50 (Two-Step): Currently using this for both Hermes 1 and Hermes 2.

-

Pathway Synergy: They use “Iterative Licensing.” Hermes 1 (test) provides the safety data for Hermes 2 (demonstration), which in turn creates the “standard design” for the 500 MW Google fleet.

-

-

Progress, Strategy & Timeline:

-

Progress: * Hermes 1: “First concrete” was poured in May 2024; reactor vessel installed in 2025.

-

Hermes 2: Received NRC Construction Permits in November 2024. Construction is currently scaling up in Oak Ridge, TN.

-

-

Strategy: Rapid Prototyping. Before building the nuclear versions, Kairos built three Engineering Test Units (ETU)—full-scale, non-nuclear mockups. This allowed them to “fail fast” on mechanical issues before the NRC was involved.

-

Upcoming Steps: * Late 2026: Submission of the Operating License application for Hermes 1.

-

2027: Expected criticality of Hermes 1 (First Gen IV reactor online in the U.S.).

-

-

Commercialization: Hermes 2 is targeted for grid operation by 2030. The first full-scale commercial units for Google are targeted for 2031–2032.

-

-

Funding NRC Application Fees:

-

DOE ARDP: Recipient of a $303 million performance-based award where the DOE pays for specific milestones, including licensing achievements.

-

Google “Order Book”: The multi-plant agreement with Google provides a “demand signal” that allows Kairos to secure private financing specifically to cover the high volume of NRC topical reports.

-

ADVANCE Act: Taking advantage of the $148/hour fee reduction. Kairos has been very aggressive in submitting 12+ Topical Reports, and this fee cut saved them millions in 2025 alone.

-

Kairos:

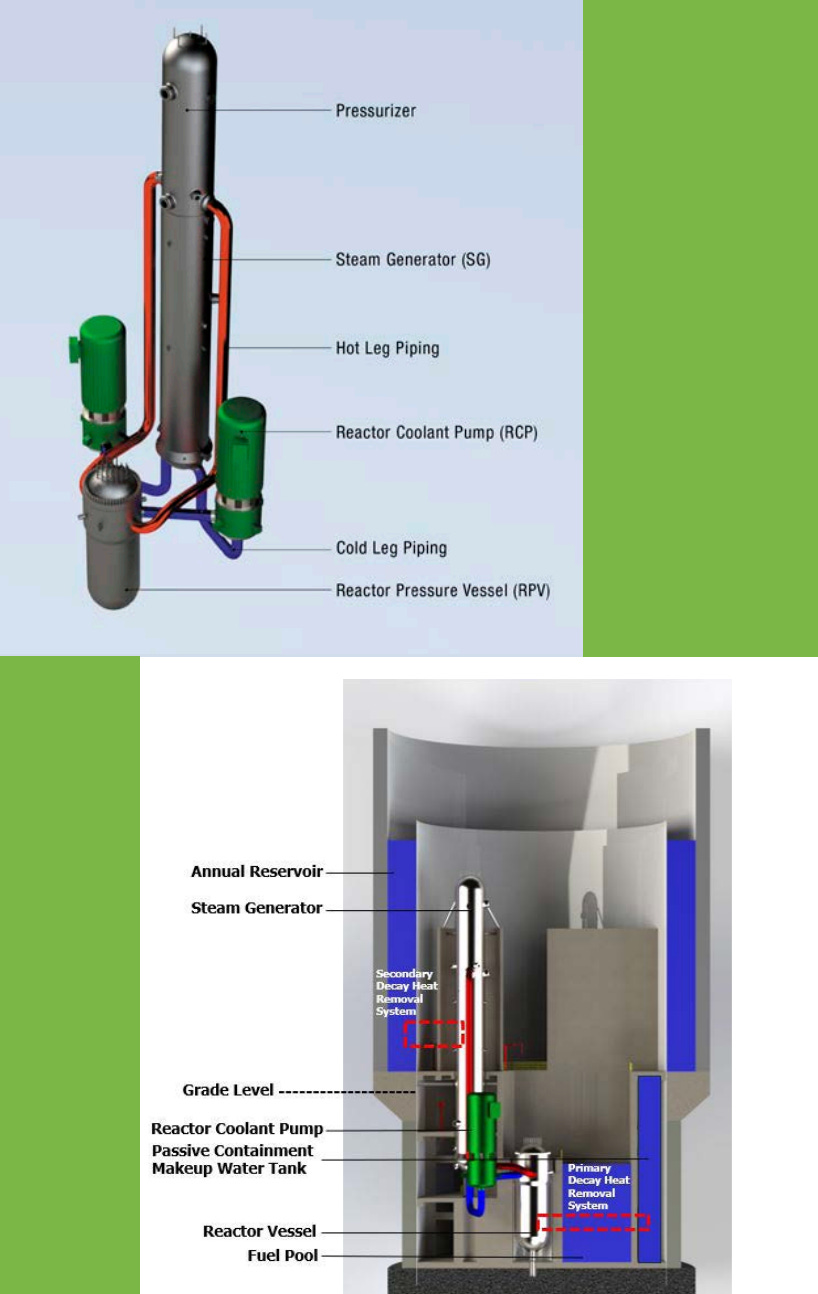

7. Holtec (SMR-300)

-

Type, Capacity, Partners & Investors:

-

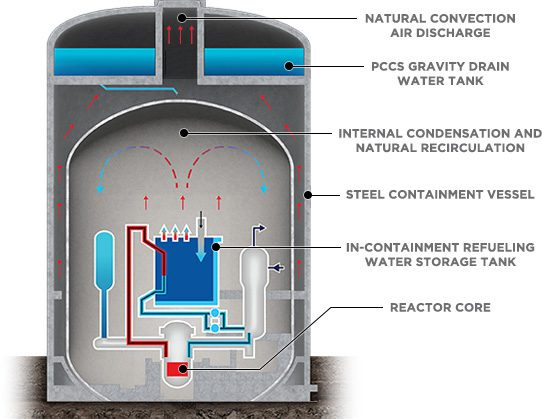

Type/Capacity: 300 MWe (340 MWe gross); Pressurized Water Reactor (PWR). It uses a “walk-away safe” design where the reactor can shut down and stay cool indefinitely without operator action or external power. Explained here.

-

Strategic Partners:

-

Hyundai Engineering & Construction (E&C): The exclusive global partner for the “one-stop-shop” construction of the SMR-300. Hyundai is managing the modular manufacturing and site execution.

-

Wolverine Power Cooperative & Hoosier Energy: Signed long-term Power Purchase Agreements (PPAs) that include the option to purchase power from the new SMR-300 units once completed.

-

EDF (UK): Signed an MOU to explore building SMR-300s at the former coal-powered Cottam site in the United Kingdom.

-

Enercon Services: Supporting the development of the complex NRC Construction Permit Application.

-

-

Investors/Financial Backers: Primarily self-funded through Holtec’s massive decommissioning business, with massive government leverage including a $1.52 billion DOE Loan (for the site restart) and $300 million in Michigan state grants.

-

-

Licensing Pathways:

-

NRC 10 CFR Part 50 (Two-Step Process): Holtec is using a “staged” Part 50 application to allow construction work to begin as early as possible.

-

UK GDA (International): Actively undergoing the Generic Design Assessment; expected to complete Step 2 in early 2026.

-

Limited Work Authorization (LWA): A specific sub-pathway to the NRC permit that allows for ground-breaking before the full safety review is done.

-

-

Progress, Strategy & Timeline:

-

Progress: On December 31, 2025, Holtec formally submitted Part 1 of its Construction Permit Application (CPA) to the NRC for the two “Pioneer” units at the Palisades site.

-

Strategy (The “Pioneer” Strategy): Holtec is leveraging the Palisades Restart (the 800 MW large reactor) as a regulatory “icebreaker.” By restarting the old plant (expected grid sync by February 2026), they re-establish the site’s environmental and security credentials, making the SMR licensing much smoother.

-

Steps Ahead: * Dec 2026: Target for NRC approval of the LWA (allowing civil construction/foundation work to begin).

-

Mid-2027: Submission of Part 2 (Final Safety Analysis) of the Construction Permit.

-

-

Commercialization: Under their “Mission 2030” plan, Holtec aims to have Pioneer 1 grid-connected by late 2030.

-

-

4. Funding NRC Application Fees:

-

DOE “Tier 1 First Mover” Award: In December 2025, the DOE awarded Holtec $400 million in cost-shared funding specifically to “catalyze” the licensing and pre-construction of the Palisades SMR-300 project.

-

ADVANCE Act: Like other Gen III+ applicants, they benefit from the $148/hour fee cap, which Holtec explicitly cited as a factor in their ability to file the “Pioneer” application on schedule.

-

State Support: Portions of the $150M Michigan grant were allocated to site characterization and regulatory preparation.

-

SMR-300:

8. NuScale Power (VOYGR)

-

Type, Capacity, Partners & Investors:

-

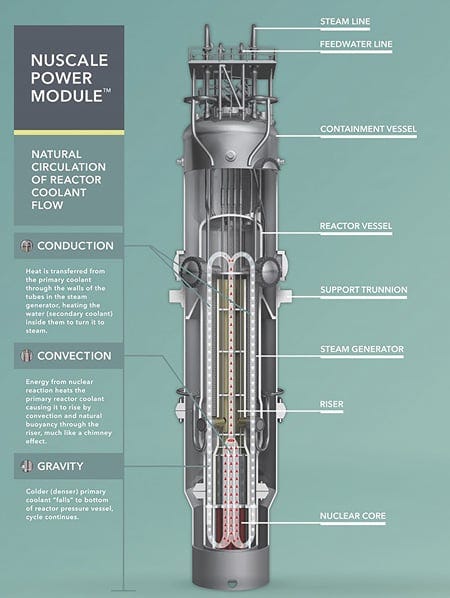

Type/Capacity: Light Water SMR; 77 MWe per NuScale Power Module (NPM). Their flagship VOYGR-6 plant delivers 462 MWe. Explained here.

-

Strategic Partners:

-

ENTRA1 Energy: The exclusive global strategic partner for commercialization and deployment. In November 2025, ENTRA1 signed a landmark agreement with the Tennessee Valley Authority (TVA) to develop up to 6 GW of NuScale capacity—the largest SMR program in U.S. history.

-

RoPower (Romania): A joint venture between Nuclearelectrica and Nova Power & Gas. They are currently in the FEED 2 (Front-End Engineering Design) phase for a 6-module plant in Doicești.

-

Fluor Corporation: Majority shareholder and lead EPC (Engineering, Procurement, Fabrication, and Construction) partner. However, as of January 2026, Fluor is in the process of monetizing its remaining 39% stake to strengthen its own capital structure.

-

Doosan Enerbility & Samsung C&T: Strategic Korean partners handling long-lead heavy forging and construction expertise.

-

-

Investors: Following an ATM (at-the-market) offering in Q3 2025, NuScale ended the year with approximately $754 million in cash, providing a substantial runway. Major institutional holders include Vanguard and BlackRock.

-

-

Licensing Pathways:

-

10 CFR Part 52 (Design Certification): NuScale holds the industry’s only full Design Certification (for the 50 MWe module).

-

Standard Design Approval (SDA): In May 2025, the NRC approved the uprated 77 MWe (US460) design. This allows customers (like TVA or RoPower) to reference the pre-approved design in their specific site licenses.

-

NRC Part 50/52 (Combined License): They are now supporting their partners (ENTRA1/TVA) in preparing site-specific applications.

-

-

Progress, Strategy & Timeline:

-

Progress: The NRC completed the technical review of the 77 MWe design ahead of schedule and under budget in May 2025. In December 2025, RoPower selected Studsvik for the core design software, a key technical milestone for the Romanian project.

-

Strategy (The “Off-the-Shelf” License): NuScale’s core strategy is being the “only one ready now.” By having a certified design, they argue that a customer can skip the 3–5 year design-review phase and move straight to site-specific environmental and construction permits.

-

Upcoming Steps: * 2026: Final Investment Decision (FID) for the Romanian RoPower project (expected mid-to-late 2026).

-

2026: Selection of the first specific site for the 6-GW TVA/ENTRA1 rollout.

-

-

Commercialization: Target for the first VOYGR plant in Romania to be operational by 2030.

-

-

Funding NRC Application Fees:

-

Commercial Contracts: In Q3 2025, NuScale recognized a $495 million “Milestone Contribution” from ENTRA1, which directly funds the engineering and regulatory work required to move designs into the “project phase.”

-

ADVANCE Act: As a “first-mover,” they benefit from the $148/hour fee rate for any new amendments or site-specific support work (down from the $318 rate they paid during the original 10-year certification process).

-

Equity: Their $754M cash position (bolstered by the 2025 stock sales) ensures they are not dependent on government grants to pay NRC bills.

-

VOYGR:

9. Westinghouse (AP300)

-

Type, Capacity, Partners & Investors:

-

Type/Capacity: 300 MWe Pressurized Water Reactor (PWR). It is a direct “one-loop” scale-down of the AP1000, using the same passive safety systems, fuel, and supply chain. Explained here.

-

Strategic Partners:

-

U.S. Government (Oct 2025): A historic $80 billion Strategic Partnership between the Department of Commerce, Westinghouse, Brookfield, and Cameco. This deal reclassifies AI data centers as “critical defense facilities” and commits the U.S. to deploying a fleet of AP1000 and AP300 reactors.

-

Fermi America (Aug 2025): Partnered to deploy four AP1000 units in Texas, with an option to add AP300 units for smaller hyperscale clusters.

-

Community Nuclear Power (UK): Selected to build four AP300 SMRs in Northeast England.

-

PROMATION & Chemetics (Canada): Signed manufacturing MOUs in late 2025 to build the robotics and pressure vessels for the global AP300 fleet.

-

-

Owners/Investors: Brookfield Asset Management (51%) and Cameco (49%). In October 2025, the U.S. Government secured a “participation interest” (20% of cash distributions over $17.5B) in exchange for financing the rollout.

-

-

2. Licensing Pathways:

-

NRC 10 CFR Part 52 (Leveraging AP1000): Westinghouse is using a “Reference Design” strategy. Since the AP1000 is already certified (and was extended to 2046 in Aug 2025), they are asking the NRC to only review the changes made to shrink it to 300 MWe.

-

UK GDA: Formally entered the final stage of the UK’s Generic Design Assessment in late 2024.

-

Section 207 (ADVANCE Act): Westinghouse is the first to apply for the “Expedited Procedure for Combined License Applications” specifically for standardized designs.

-

-

3. Progress, Strategy & Timeline:

-

Progress: As of January 2026, Westinghouse has completed the Pre-application Regulatory Engagement Plan with the NRC. They have submitted all Long-Lead topical reports (Seismic, Core Design, Passive Cooling).

-

Strategy (The Legacy Fast-Track): Westinghouse’s tagline is “No First-of-a-Kind Risk.” They are telling the NRC: “You already spent 20 years safety-checking this design in the AP1000; just check the pipes for the AP300.” This has allowed them to bypass the “Basic Research” phase that companies like Oklo or TerraPower had to endure.

-

Upcoming Steps: * Late 2026: Target for formal Design Certification application filing.

-

2027: Expected “Safety Evaluation Report” (SER) from the NRC, leveraging the 18-month fast track.

-

-

Commercialization: First AP300 grid-connection targeted for 2030–2031 in the UK and 2032 in the U.S.

-

-

4. Funding NRC Application Fees:

-

The $80B Federal Package: Under the 2025 partnership, the U.S. government is facilitating the financing of long-lead items and regulatory fees.

-

Corporate Cash: Brookfield and Cameco have committed billions in “bridge financing” to ensure the NRC review never pauses for lack of funds.

-

ADVANCE Act Savings: Paying the $148/hour rate. Because their application is essentially a “delta” (change-only) review, their total bill is expected to be 40% lower than a “from-scratch” design like NuScale’s.

-

AP300:

10. NANO Nuclear Energy

-

NANO Nuclear Energy

-

1. Type, Capacity, Partners & Investors:

-

Type/Capacity: * KRONOS MMR: 1–5 MWe (45 MWth); Stationary High-Temperature Gas-Cooled Reactor (HTGR).

-

ZEUS: Portable, solid-core battery reactor designed to fit in a standard 20-foot shipping container.

-

Explained here.

-

-

Strategic Partners:

-

DS Dansuk (South Korea - Jan 13, 2026): Signed an MOU to localize NANO’s technology for the “One Factory, One MMR” initiative in South Korea, targeting industrial sites.

-

Ameresco (Jan 12, 2026): Partnered to explore deployment on U.S. Federal and Commercial sites, with Ameresco potentially leading the Engineering, Procurement, and Construction (EPC) efforts.

-

University of Illinois Urbana-Champaign (UIUC): Partnered to construct and operate the first KRONOS MMR research reactor on campus (Dec 31, 2025 update).

-

LIS Technologies: Strategic laser uranium enrichment partner at the Oak Ridge K-25 site.

-

-

Investors: Publicly traded ($NNE). Recently closed a $400 million private placement (Oct 2025) with institutional investors, bringing their cash position to approximately $600 million.

-

-

2. Licensing Pathways:

-

NRC 10 CFR Part 50 (via UIUC): The KRONOS reactor is in Pre-application engagement for a Construction Permit (CP) in collaboration with the University of Illinois.

-

Canadian CNSC: Actively pursuing developmental licensing in Ontario.

-

NRC Part 53 (Commercial): Targeting this new framework for their eventual portable ZEUS fleet.

-

-

3. Progress, Strategy & Timeline:

-

Progress: In January 2026, NANO Nuclear was cleared of a major legal hurdle after a federal court dismissed a securities class action lawsuit regarding their team’s qualifications. This has restored market confidence just as they prepare their first formal NRC filings.

-

Strategy (Vertical Integration): NANO isn’t just building a reactor; they are building the infrastructure. Their subsidiaries (Advanced Fuel Transportation and HALEU Energy Fuel) are developing the “baskets” and fabrication lines needed to move nuclear fuel legally across state lines.

-

Upcoming Steps: * Early 2026: Formal submission of the KRONOS Construction Permit application to the NRC.

-

July 4, 2026: Goal to have test components operational at the UIUC facility.

-

-

Commercialization: Targeting initial test operations at UIUC by 2028; full commercial rollout for factory-level deployment by 2030–2031.

-

-

4. Funding NRC Application Fees:

-

Cash Runway: With $600 million in cash as of late 2025, NANO Nuclear has a multi-year runway. They have stated they are “laser-focused” on using this capital to clear the NRC docketing phase.

-

ADVANCE Act: As a developer of “advanced” microreactors, they qualify for the $148/hour reduced NRC fee. Given the complexity of licensing a “portable” reactor (a first for the NRC), this 50%+ reduction is vital to their burn rate.

-

State Funding: Leveraging Illinois state funding for their manufacturing and research center in Oak Brook to offset regulatory overhead.

-

-

11. Rolls Royce

-

Type, Capacity, Partners & Investors:

-

Type/Capacity: 470 MWe; Pressurized Water Reactor (PWR). This is the largest “Small” Modular Reactor, specifically sized to compete with 500 MW-class coal plant replacements and large-scale AI data center campuses. Explained here.

-

Strategic Partners:

-

Great British Energy – Nuclear (GBE-N): Named Rolls-Royce as the Preferred Bidder in June 2025. This state-backed partnership includes a plan to deploy the first three units by the mid-2030s.

-

ČEZ Group (Czech Republic): Signed a strategic partnership in October 2024 (solidified with an “Early Works Agreement” in July 2025) to deploy up to 3 GW of power at the Temelín and Tušimice sites.

-

BWXT (Oct 2025): A critical manufacturing deal where BWXT will design and build the nuclear steam generators for the global Rolls-Royce fleet.

-

Skanska UK (Jan 2026): Contracted to deliver the “Aseismic Bearing Pedestal Demonstrator,” proving the plant’s ability to withstand earthquakes—a key requirement for NRC licensing.

-

-

Investors: Rolls-Royce PLC, Qatar Investment Authority (QIA), Exelon (via Constellation), and the UK Government (which has provided over £210 million in direct grants).

-

-

Licensing Pathways:

-

UK GDA (Lead Pathway): Currently in the third and final step of the Generic Design Assessment (GDA).

-

NRC Pre-Application (USA): Formally entered the U.S. regulatory process in late 2025. On January 14, 2026, Rolls-Royce held a partially closed technical meeting with the NRC to discuss “proprietary design information” and coordinate with their manufacturing partner, BWXT.

-

Atlantic Partnership for Advanced Nuclear Energy: A 2025 treaty between the US and UK that allows the NRC and UK regulators to share safety data, potentially shortening the U.S. review time.

-

-

Progress, Strategy & Timeline:

-

Progress: Successfully completed UK GDA Step 2 in July 2024. They are currently the only SMR design in the final “Detailed Assessment” phase (Step 3) in the UK, which is scheduled to conclude by December 2026.

-

Strategy (The “Factory-to-Grid” Model): Rolls-Royce intends to build 90% of the reactor in a factory. Their strategy for the NRC is to use the Design Center approach: they are arguing that because the UK regulator has already vetted the 470 MWe design, the NRC should “credit” those findings to move straight to a Combined License (COL) review.

-

Upcoming Steps: * Dec 2026: Target for UK “Design Acceptance Confirmation” (DAC).

-

Mid-2026: Formal submission of the U.S. NRC Design Certification or “Standard Design Approval” application.

-

-

Commercialization: First-of-a-kind (FOAK) grid connection in the UK targeted for 2030–2031. Deployment in the Czech Republic and potential U.S. pilot sites targeted for 2032–2033.

-

-

Funding NRC Application Fees:

-

UK Export Finance: Much of the early U.S. regulatory work is being subsidized by UK government export grants designed to make British tech competitive in North America.

-

BWXT Teaming: Under their Oct 2025 agreement, BWXT is sharing the “regulatory burden” for U.S. NRC fees, as they will be the primary manufacturer for the U.S. market.

-

ADVANCE Act: Benefiting from the $148/hour fee cap. For a large 470 MWe reactor with thousands of pages of documentation, this fee reduction is expected to save Rolls-Royce over $12 million in application costs.

-