Explaining Today's Market Flows and Where It Goes Next

By the TightSpreads Substack.

Morgan Stanley’s Quantitative Derivatives Strategy team frames the current S&P 500 dynamics as a fragile balance between stabilizing dealer gamma flows and escalating mechanical supply pressures. MS is blaming much of flows to Microsoft re-igniting ROI fears following their recent earnings report, but I’ll leave it to the comments to argue about including Reuters and Copper in there too.

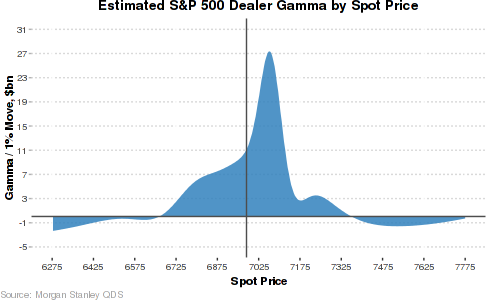

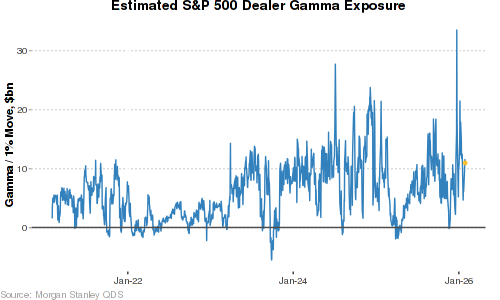

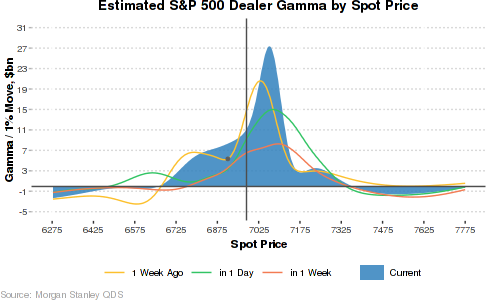

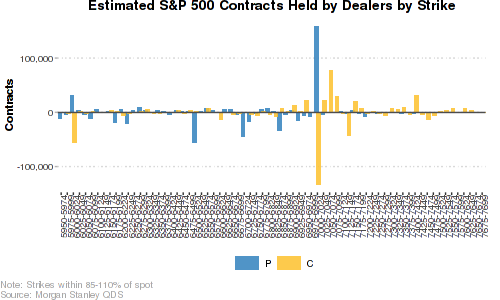

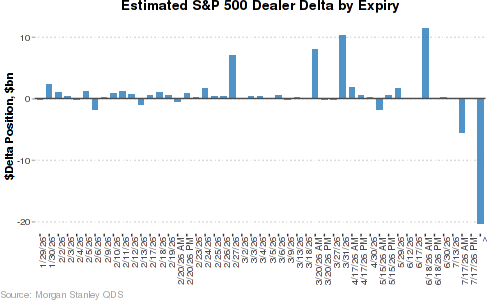

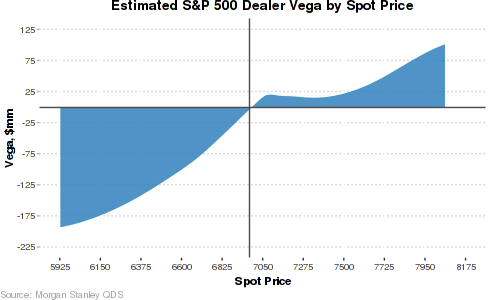

Core dealer positioning shows options market makers long approximately $11 billion in gamma per 1% SPX move—a stable, historically elevated level. Positive gamma means dealers (net short options to clients) hedge delta dynamically: they buy equities/futures on dips (as falling prices increase their positive delta from short puts/long calls) and sell on rallies (to offset the opposite), mechanically dampening realized volatility and providing intraday support near current levels. The gamma curve peaks sharply around 7065, the zone of maximum long exposure where hedging flows turn most aggressively supportive on upside moves—potentially acting as a strong accelerator for rallies. Gamma remains solidly positive through the mid-6900s to low-7000s (aligning with recent ranges), bolstered by concentrated protective put holdings near at-the-money strikes (prominent blue bars in strike-level charts reflecting client downside demand). Vega exposure shifts increasingly positive (long vol) at higher spot levels, offering potential vanna tailwinds—delta gains from volatility changes—on rebounds. However, under static option positioning assumptions, gamma would flip negative below roughly 6660, at which point dealers would sell into weakness and amplify downside momentum in a negative-feedback regime.

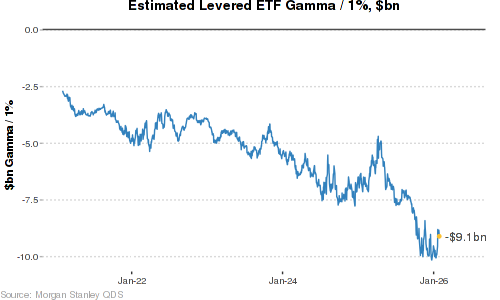

Countervailing pressures dominate near-term supply. Leveraged ETF rebalancing generates acute selling: these vehicles (often 2x/3x levered, heavily tech-benchmarked) must sell underlying equities on declines to maintain fixed leverage ratios. Their estimated gamma is deeply negative at ~-$9.1 billion per 1% move, and with NDX underperforming, recent flows rank among the top-20 largest supply days on record—frequently overwhelming dealer buying capacity and driving choppy, biased-lower intraday action.

Systematic macro strategies (primarily CTAs/trend-followers, volatility-control/vol-target funds, and risk-parity vehicles) hold equity leverage in the 90th percentile versus the past five years—elevated bullish exposure that primes nonlinear de-risking on weakness. The following are key SPX trigger points today that would enable the following selling amounts into the close and beyond (mostly lagged across multiple days):

-

A -1% SPX close yields modest next-week equity selling supply of ~$15 billion (-0.5 z-score magnitude).

-

A -1.5% SPX close escalates sharply to a sale of $25–30 billion (-0.9 z-score).

-

A -2% SPX close deepens to a sale of $40–45 billion (-1.3 z-score).

This convexity will loop risk if momentum persists. Simply, initial and consistent selling leads to further de-risking.

Significance and forward implications:

Taking everything explained so far, the setup reflects a fragile market (no shit). MS reflecting dealer gamma offers the strongest defense near current spot (mid-6900s to low-7000s, check charts below), likely containing realized vol, supporting dip-buying, and favoring range-bound or mean-reverting behavior absent fresh catalysts. Leveraged ETF flows represent immediate downside pressure (especially tech-concentrated), while systematic supply looms as a lagged accelerator.

-

Stabilization/range play: SPX baseline in the near-term

Dealer cushion holds; ETF selling eases on any pause. This will lead to damped swings, potential bounces on oversold conditions.

-

Grinding lower: SPX 6800s or below

ETF supply compounds, systematic flows build. This will lead to a persistent pressure with intermittent dealer support; breaks below key zones increase chop.

-

Accelerated downside: Sustained toward/through 6660 SPX levels

Gamma inversion aligns dealer selling with peak ETF/systematic unwinds. Risks become sharper with more vol-spiking movements (several percent potential in days), though historical extremes often exhaust into reversals so it shouldn’t be the market crash most people are concerned about.

-

Upside breakout: SPX pushes to 7065+

Peak gamma turns hedging aggressively long-delta. This will cap downside, fuel squeezes, and leverage vanna on positive catalysts (macro data, earnings follow-through). An environment most arguably enjoy as “healthier” market conditions.