Why SPX is Crashing Today

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 11,000 subscribers at MktContext.com for our weekly deep dives and analysis!

The below excerpt was posted for paid subscribers in our weekly newsletter on Sunday. We use positioning as an important tool for timing the market.

Positioning Has Risen Sharply

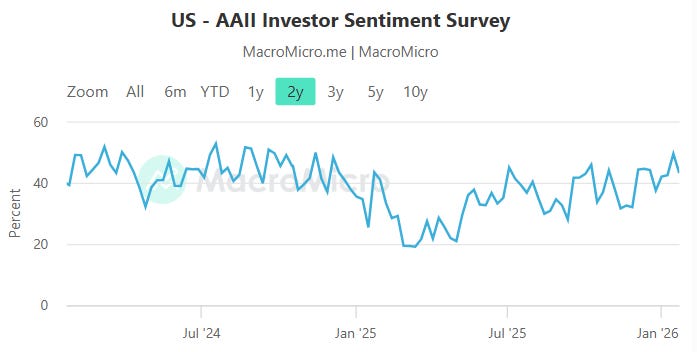

Equity positioning has risen sharply and is now at slightly concerning levels. Let’s go through the data. The AAII (American Association of Individual Investors) sentiment survey reached highs again, with nearly 50% of respondents “bullish” and only 30% “bearish”. A record gap.

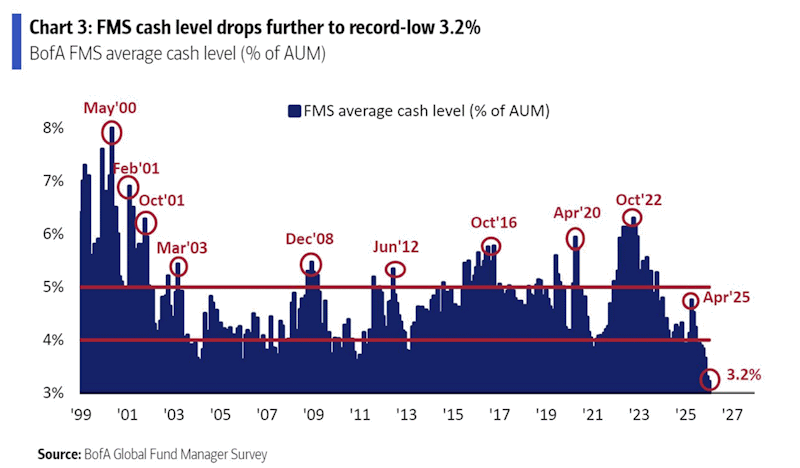

Investors’ cash levels are at record lows. For the last two weeks there have been substantial flows out of money market funds (short-term bills) and into equities.

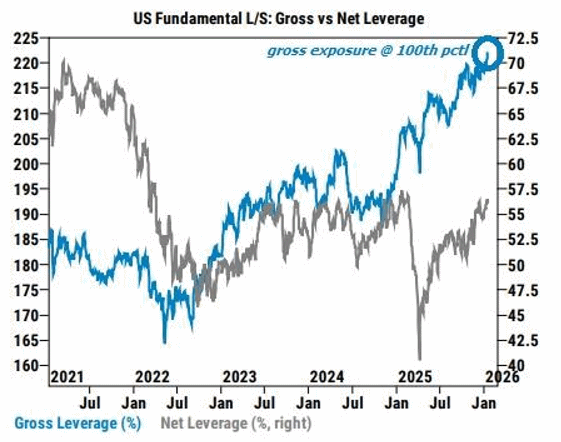

Hedge funds have the highest amount of leverage they’ve had in years. It appears everyone is chasing the new all-time highs in SPX and/or buying into the economic reacceleration. When everyone has already bought, there is no one left to buy.

Investors report being under-hedged against a sharp fall in stocks. When people are fully exposed to the market, a sudden shock forces everyone to run for a tight exit. They unwind positions at the same time, causing a sharp correction in markets.

Read the full macro analysis and stock positioning report at MktContext.com.

Join 11,000+ investors who get these insights before the mainstream media catches on!