Nuclear Stocks Earnings Preview

From the TightSpreads Substack.

Nuclear Earnings Preview 4Q25

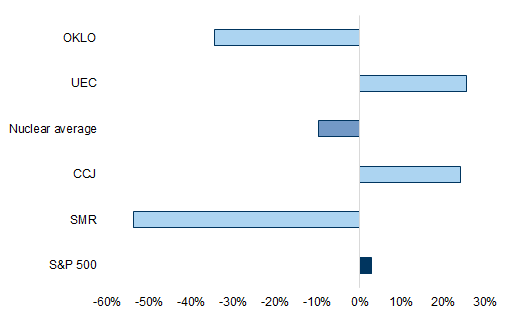

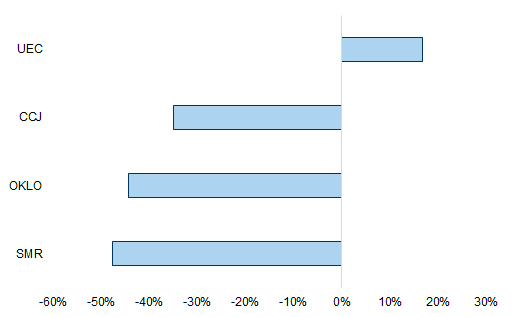

Nuclear stocks have seen mixed performance over the past three months, with our nuclear coverage averaging a -13% return over the period compared to the S&P which returned 3%. Performance was collectively positive across uranium-levered names (CCJ/UEC), likely in large part owing to the recent rally in spot uranium pricing, while SMR technology players have traded significantly off. With respect to investor positioning, UEC was the only stock in our coverage which saw an increase in short interest, as the stock continues to rally, up 26%/35% over the past 3mo/12mo. Across the remainder of our coverage, short interest decreased across both CCJ and OKLO while SMR saw the largest decrease in short interest.

Exhibit 12: Our nuclear coverage has underperformed the S&P 500 by 13% over the last quarter

Trailing 3-mo stock performance

data as of 2/2/2026

Source: FactSet, Data compiled by Goldman Sachs Global Investment Research

Exhibit 13: We saw increase in short interest in UEC, while seeing incremental short covering in CCJ, OKLO, and SMR

1-mo change in short interest

Source: FactSet, Data compiled by Goldman Sachs Global Investment Research

UEC, CCJ, OKLO, SMR previews are available to Premium Subscribers.