SHFE Terminates Improper Selling During Silver Downdraft

GFN – SHANGHAI: The Shanghai Futures Exchange imposed restrictions on opening new positions for six groups of accounts under “actual control relationships” after they exceeded intraday opening-volume limits, according to a Feb. 5 exchange notice, as domestic futures markets experienced a sharp and accelerated downside move.

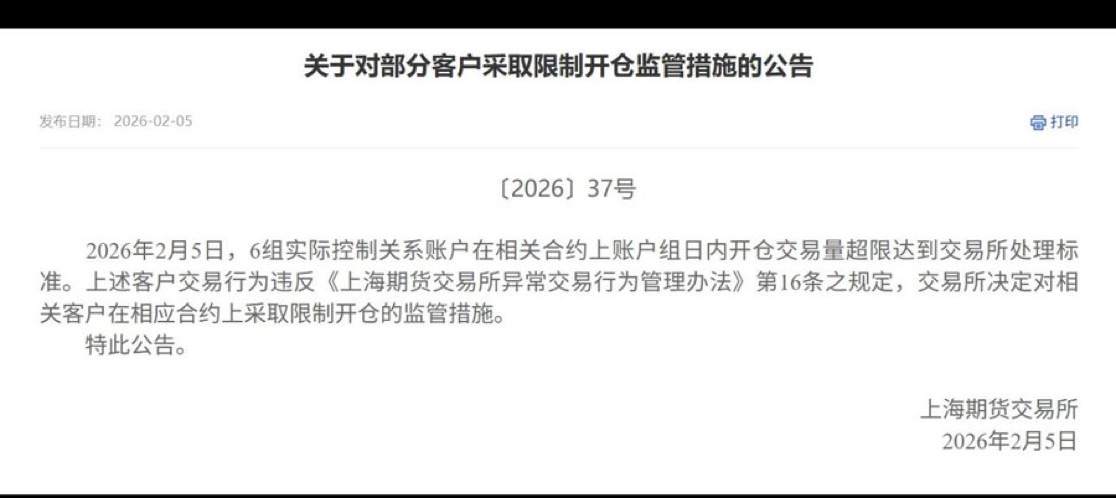

In Notice [2026] No. 37, the exchange said the account groups breached intraday opening transaction thresholds in related contracts, violating Article 16 of the Shanghai Futures Exchange Measures for the Administration of Abnormal Trading Behavior. The exchange imposed regulatory measures restricting the opening of new positions in the affected contracts.

The notice does not disclose whether the excessive opening activity reflected net short selling, long accumulation, or two-sided trading. Under SHFE rules, abnormal-trading notices are triggered by volume thresholds and account control relationships rather than directional exposure, and the exchange does not publish net positioning data for sanctioned accounts.

However, market analysts said the flow was decidedly skewed toward short positioning, with aggressive new shorts entering the market during the period covered by the enforcement action.

“While the exchange does not disclose direction, the flow characteristics over the past 48 hours point clearly to shorts piling into the market rather than longs adding exposure,” said one analyst familiar with SHFE trading patterns.

Analysts added that the concentration of intraday opening volume, combined with the timing of the restrictions, suggests the sanctioned activity likely exacerbated the speed and depth of the recent market decline, particularly as leverage was being unwound across multiple contracts.

Under the exchange’s regulatory framework, clients or actual-control account groups that exceed intraday opening limits are typically subject to next-day restrictions on opening new positions, often lasting several trading sessions.