2/18 Market Wrap: Soft Bounce, Crucial Earnings for 2/19

From the TightSpreads Substack.

February 18, 2026

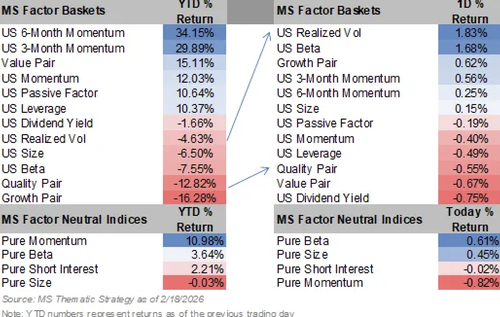

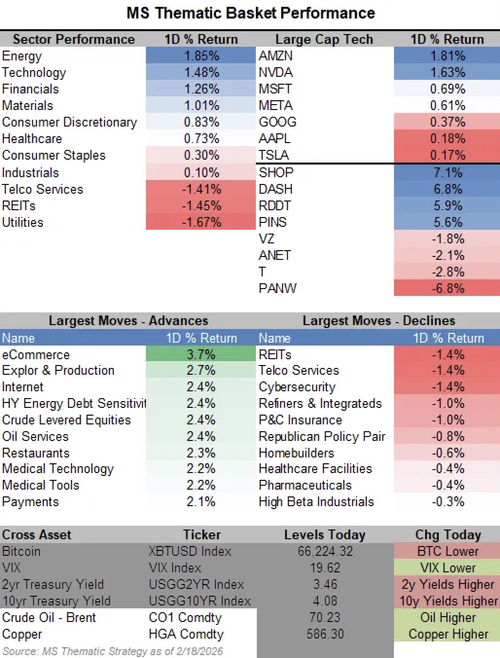

US equities traded modestly higher in a constructive but capped session. The Nasdaq-100 (NDX) led with a +0.8% gain, the S&P 500 finished up modestly (exact close not specified but clearly positive), the Dow and Russell 2000 also closed higher, though all major indexes gave back some of their early gains into the close. We did soft bounce across AI and rotational names as I forecasted in my last note. This was a risk-on rotation day: money flowed into both high-growth tech/AI names and economically sensitive cyclicals, but concerns over US-Iran nuclear talks and hawkish-sounding FOMC minutes (which raised the bar for future rate cuts) kept the upside in check and pushed 2-year Treasury yields +3 basis points higher.

What drove the gains – simple breakdown

Tech and AI led the way. AI Tech stocks (MSXXAIB) rose +1.8% and Software (MXXSOFT) +1.1%. Every single Magnificent 7 name closed higher, led by Amazon (+1.8%) after management talked about 30%+ AWS growth “for quite some time.” This shows investors are still willing to pay up for the biggest AI winners when the narrative stays intact.

At the same time, cyclicals participated nicely — a healthy sign of broadening. The Cyclical basket (MSXXHBC) gained +0.8%, led by Energy (+1.9%), Financials (+1.3%), Materials (+1%), and Discretionary (+0.8%). Energy was actually the best-performing sector of the day. Small-cap E&Ps jumped +4% in sympathy with crude oil rallying +4.5% after Vice President Vance said Iran ignored key US demands in nuclear talks.

Simple explanation: When oil prices jump on geopolitical headlines, energy producers (especially smaller ones) tend to move even more because their profits are very sensitive to the price of crude.

Financials also gained broadly: Payments names rose +2% after a strong earnings beat from one of the leaders (GFN), Alternative Asset Managers (MSXXALTS) +1.3%, and Banks (MSXXBANK) +1%. Fed Vice Chair for Supervision Bowman said the Basel III endgame proposal is still on track for end of 1Q — markets took this as a “not as bad as feared” signal, so banks rallied.

Early-session rally in out-of-favor names

One of the most interesting parts was a sharp early rally in stocks that had been left behind (the “out of favor” or high-short-interest pocket). The High Short Interest basket (MSXXSHRT) spiked +2.6% from 9:30 to 10:00 a.m. and held most of those gains, closing +1.7%. Single-name examples included APP +7%, INTU +2.7%, IQV +4%, and DASH +6.8% — some of the strongest performers in the entire S&P 500. The Realized Volatility pair (MSZZRVOL) also tried to stabilize, up +1.8% after a brutal -20% correction from recent highs.

Simple explanation of “out of favor” stocks

These are companies whose prices have been falling or going nowhere while the market was chasing hot momentum names. When they suddenly start rising together it often signals the beginning of a rotation — money rotating from expensive winners into cheaper, beaten-down names. Today’s move in high-short-interest stocks was a “short squeeze” or rotation signal.

Earnings highlights

On the company-specific front, Analog Devices (ADI) rose +2.6% after guiding April-quarter revenue well above Street expectations ($3.4–3.6bn vs $3.2bn consensus). Wingstop (WING) exploded +10% (now +26% for the week) after reporting better-than-feared same-store sales (-5.8% vs -6.8% expected) and “stable” trends heading into January before the storms hit.

Looking ahead

Tomorrow’s (2/19) focus shifts to a heavy earnings slate: Walmart (WMT), Deere (DE), Southern Company (SO), Quanta Services (PWR), Comfort Systems (FIX), Copart (CPRT), Live Nation (LYV), and Akamai (AKAM). These names span retail, industrials, utilities, and tech services — so the market will get fresh reads on consumer spending, capital spending, and cloud/internet demand.