Private Credit Could Be Ready To Implode

Submitted by QTR's Fringe Finance

Regular readers of my blog know that I have been repeatedly warning about certain sectors of the market for years as hidden time bombs.

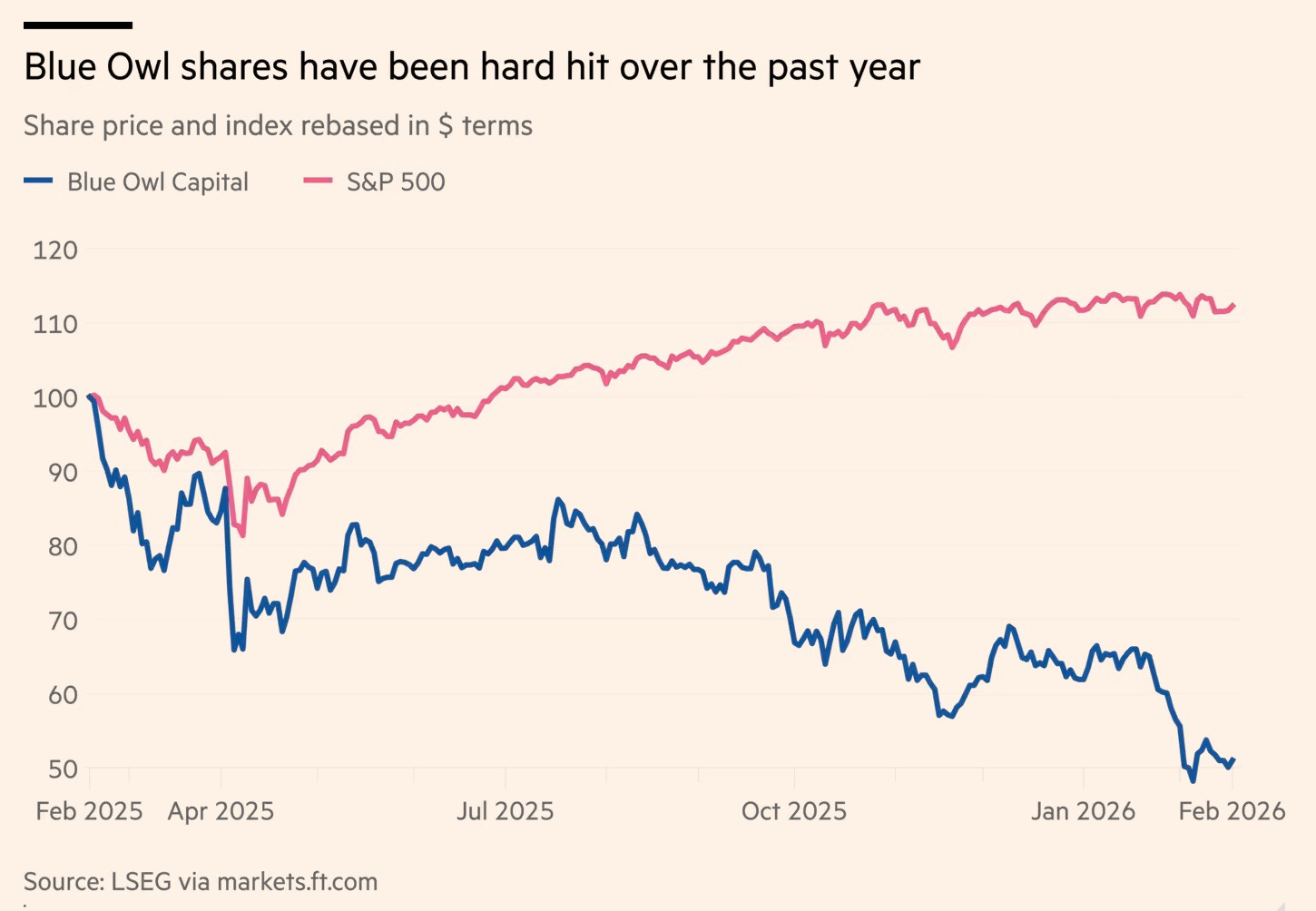

Yesterday, one company began to show cracks in the surface of a sector that I believe may sit atop what could be a crumbling foundation of the broader market.

That sector is private credit, and the company was Blue Owl (OWL). According to the Financial Times, Blue Owl has permanently restricted redemptions from its retail private credit fund, Blue Owl Capital Corp II (OBDC II), reversing earlier plans to reopen quarterly withdrawals. Instead of allowing investors to redeem up to 5 per cent of net assets each quarter at stated value, the firm will now return capital through episodic distributions as it sells down assets over time.

The move follows rising withdrawal requests and comes after the fund had already been closed to redemptions since November, when Blue Owl scrapped a proposed merger that would have imposed steep mark-to-market losses on investors.

Redemptions in OBDC II had been climbing, with $150mn withdrawn in the first nine months of 2025 and third-quarter withdrawals nearly doubling year over year, heightening pressure on the fund’s limited liquidity structure, the report notes.

Since last year I’ve been warning that private credit is far more fragile than its marketing suggests. What has been promoted as a stable, defensive, yield-generating alternative to traditional lending increasingly looks like a highly leveraged, lightly regulated system that benefited from an unusually easy financial environment.

And the key in private credit is companies can essentially make up valuations via Level 3 accounting for investments they carry on their books out of thin air, since most of them aren’t publicly traded. Level 3 accounting refers to assets valued using unobservable inputs—meaning there is little to no active market data available, so firms rely on internal models and assumptions to estimate fair value.

Unlike Level 1 assets (quoted market prices) or Level 2 assets (observable market-based inputs), Level 3 valuations depend heavily on management’s projections about cash flows, discount rates, and future market conditions. This makes them inherently subjective and harder to verify, which can be problematic during periods of stress. And when shit hits the fan, management’s “projections” can always change for the better to put lipstick on a NAV pig.

And here's where the implosion comes in, because these assets...(READ THIS FULL ANALYSIS HERE).