Gold Tops $5000 For First Time: "The Inverse Of Confidence"

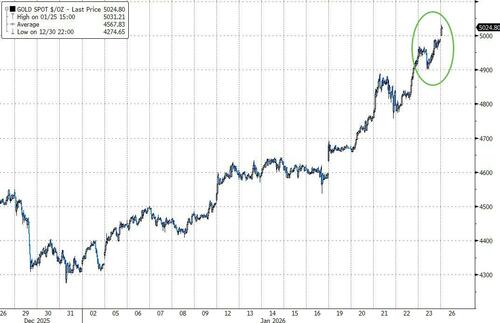

In early Asia trading, Gold just traded above $5000 (and is holding it) for the first time ever...

Gold’s record-breaking rally – the metal has more than doubled over the last two years – drives home bullion’s historic role as a gauge of fear in markets.

Fresh from its best annual performance since 1979, it’s gained a further 15% so far this year as heightened geopolitical risks have added impetus to the so-called debasement trade, whereby investors retreat from currencies and Treasuries.

“Gold is the inverse of confidence,” said Max Belmont, a portfolio manager at First Eagle Investment Management.

“It’s a hedge against unexpected bouts of inflation, unanticipated drawdowns in the market, flare-ups in geopolitical risk.”

And Goldman Sachs Precious Metals Research team believe there is more room to run.

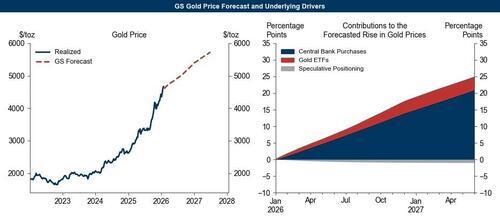

They just upgraded their Dec2026 gold price forecast to $5,400/toz (vs. $4,900 prior) because the key upside risk they had flagged - private sector diversification into gold - has started to realize...

Daan Struyven and team assume that private sector diversification buyers - whose purchases hedge global policy risks and have driven the upside surprise to our price forecast - don't liquidate their gold holdings in 2026, effectively lifting the starting point of their price forecast.

There are three key questions that led them to revise their already bullish outlook higher: what has driven the rally so far, what's behind the new forecast, and what factors may lead them to revise their bullish outlook.

Q1. What has driven the recent gold rally?

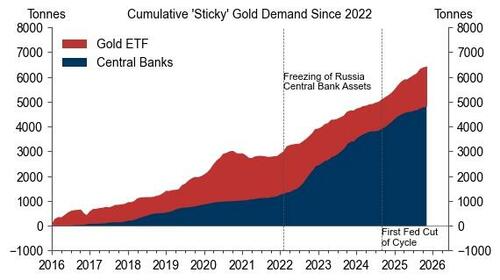

The acceleration in central bank purchases following the freezing of Russia's central bank reserves in February 2022 drove solid gold price increases in 2023 (+15%) and 2024 (+26%) (Exhibit 2). However, the rally accelerated in 2025 (+67%) and has continued year-to-date with the gold price now at $4,787 because central banks started competing in 2025 with private sector investors for limited bullion.

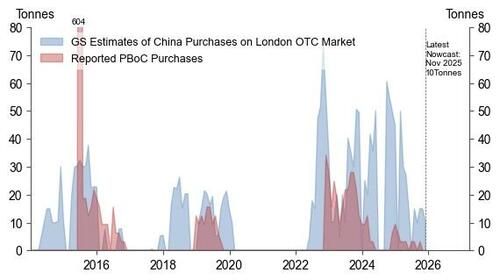

Our central bank nowcast for November 2025 was 24 tonnes (with a 10 tonnes contribution from China (Exhibit 6)) with the 12-month average now around 60 tonnes per month, well above the pre-2022 monthly average of 17 tonnes.

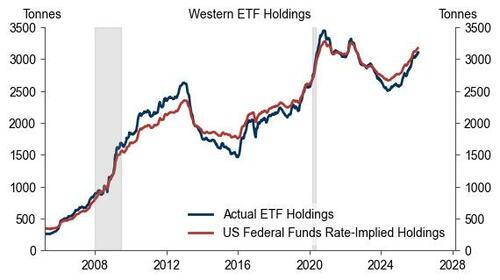

Traditional ETF gold holdings picked up after the Fed started easing rates in late 2024.

Private Sector Diversification

Two developments suggests that the key upside risk to our gold price forecast we have flagged--the broadening of diversification into gold from the official to the private sector--has started to realize.

First, Western ETF holdings have increased by around 500 tonnes since the start of 2025, and by more than a simple model based on fed rate cuts predicts. After undershooting in 2024, actual Western ETF holdings (Exhibit 3, blue line) have now essentially caught up with our estimate based on the funds rate (Exhibit 3, red line).

Second, newer channels for hedging macro policy tail risks, often tied to the "debasement theme", have expanded.

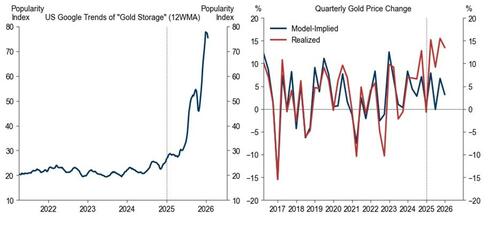

Our client conversations and several data points suggest that these flows--ranging from increased physical purchases (and thus physical gold storage, Exhibit 4, left panel) by high net-worth families to a rise in investor call‑option demand--have become a significant incremental source of demand. While these macro policy hedges conceptually fully fit in our gold price framework where three conviction buyer groups set the gold price by allocating to gold on a macro- or risk hedging views (i.e. patient long-run investors, speculators, and central banks), these newer instruments/flows are hard to track. Hence, price residuals--the difference between the realized monthly price change and the predicted change (based on measured ETF inflows, the change in speculative net managed money, and our central bank nowcast)--have widened since 2025 (Exhibit 4).

Our Assumption That Hedges of Global Macro Policy Risks Remain Stable in 2026

We assume that the hedges tied to global macro policy tail risks would remain in place through 2026, implying no reversal of the residuals and effectively raising the starting point for our price forecast.

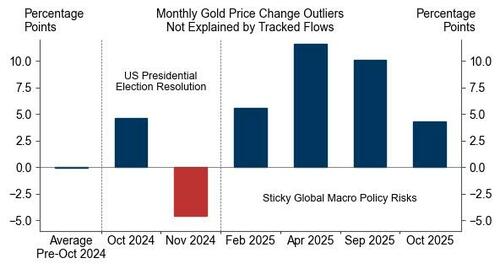

This stands in contrast to the hedges related to the November 2024 US election process, which pushed realized gold prices above our model-implied estimates based on observed flows in October 2024 but unwound rapidly once the electoral outcome in November provided a clean resolution, reversing the residual (Exhibit 5). By comparison, the rise in the gold price beyond what tracked flows can explain during periods of elevated perceived macro policy risk in 2025 has not reversed.

The perception of these macro policy risks appears stickier. We thus assume that hedges of global macro policy risks remain stable as these perceived risks (e.g. fiscal sustainability) may not fully resolve in 2026.

Q2. What underpins your revised gold price forecast of $5,400/toz by Dec2026?

Our forecasted 17% price increase from the January month-to-date average of $4,600 (or 13% from spot) by end-2026 reflects:

-

Central bank buying to average 60/50 tonnes in 2026/2027 as EM central banks are likely to continue the structural diversification of their reserves into gold (contributing 14pp to the 17% price increase we expect by Dec26)

-

Western ETF holdings to rise as the Fed cuts the funds rate by 50bp in 2026 (contributing 3pp by Dec26)

-

We assume that hedges of global macro policy risks remain stable as these perceived risks (e.g. fiscal sustainability) may not fully resolve in 2026, implying that the high early 2026 gold price forecast is a sustainable starting point for our forecast.

-

Consistent with recent market behavior, we apply the upper end of our rule of thumb that 100 tonnes of net monthly demand from conviction holders corresponds to 1.5-2% price appreciation; given the acceleration from dealer delta‑hedging of existing call structures, a 2% beta has empirically been more accurate than 1.7% since 2025.

While our baseline assumes no reversal of existing macro‑policy‑risk hedges, it does not incorporate additional private‑sector diversification in response to lingering macro policy uncertainty.

We therefore see the risks to our upgraded $5,400/toz forecast by Dec2026 forecast as two-sided but still significantly skewed to the upside because private sector investors may diversify further on lingering global policy uncertainty. That said, a sharp reduction in perceived risks around the long-run path for global fiscal/monetary policy would pose downside risk if it were to cause liquidation of macro policy hedges.

Q3. What would lead you to revise your structural bullish call on gold, and what markers would signal a potential top?

In commodities, the usual maxim that “high prices cure high prices” does not apply to gold.

Gold supply -- comprising existing‑stock sales and new mine output -- is largely price‑inelastic. Mining output is limited, stable, and price inelastic and worth only about 1% of the global gold stock outstanding.

As a result, gold rallies typically only reverse when gold demand starts falling, because 1) geopolitical risks (which drive central bank diversification) ease, or 2) macro policy risks (which drive diversification by private investors) ease, or 3) the Fed switches from cutting rates (driving ETF inflows) to hiking rates.

On the central bank demand side, a sustained drop in our central bank nowcast toward pre‑2022 levels (=17 tonnes per month) or lower would be a key marker. Historically, central bank gold demand moves in long cycles. Net buying has tended to accelerate when the perceived monetary or geopolitical neutrality of reserve assets diminished, as happened in the 1970s or in 2022 after the freezing of Russian reserves. But once perceived hedging needs diminish, the urgency to accumulate gold tends to fall, as seen in the 1990s/2000s era of increased openness to international trade, when central banks were net sellers as the opportunity cost of holding gold outweighed its strategic hedging benefits.

On the private sector demand side, Fed rate hikes (especially if inflation/economic activity data don’t require very aggressive hikes) could reduce gold demand both via the traditional opportunity cost channel, and by easing investor concerns about global central bank independence.

Professional subscribers can read much more from Goldman's Research team here at our new Marketdesk.ai portal