Goldman Says Central Bank Gold Buying Dip Is 'Temporary' As Russia Sold In January

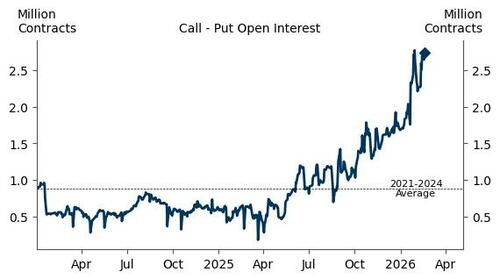

Over recent months, a rise in private sector diversification demand - partly expressed through gold call‑option structures - has driven elevated volatility in gold prices.

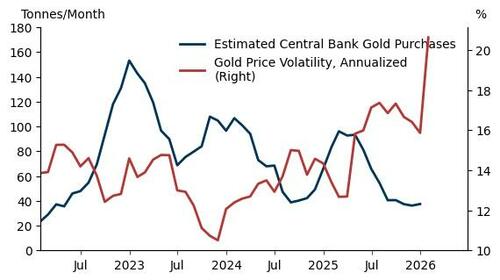

This rise in volatility, in turn, has led to a slowdown in Goldman Sachs' central bank demand nowcast, which they see as temporary.

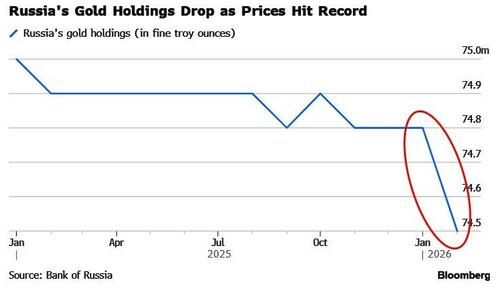

Specifically, we find out today, via a statement from The Bank of Russia that the central bank sold gold from its reserves in January, taking advantage of prices that had climbed to record highs.

The country’s bullion holdings fell by 300,000 ounces to 74.5 million ounces, according to data published Friday by the Bank of Russia.

The sale marked the first decrease in gold reserves since October.

Gold prices hit a record in January, averaging roughly $4,700 per ounce. That suggests the sale could have brought in about $1.4 billion for the budget if transacted at market prices.

As Bloomberg reports, The Bank of Russia began drawing on its bullion last year as part of so-called mirror operations linked to the Finance Ministry’s sales of National Wellbeing Fund assets.

In the first two months of 2025, the ministry spent 419 billion rubles ($5.5 billion) from the fund, selling gold and foreign currency to offset the drop in oil and gas revenue amid an expanding budget deficit.

Despite the sale, the value of Russia’s gold reserves rose 23% in January to $402.7 billion, buoyed by the rally in prices.

With all that in mind, Goldman's Lina Thomas suggests this is temporary.

While we have characterized a sustained slowdown in our central bank demand nowcast as an important marker for the gold price outlook, we believe this slowdown will be temporary based on our conversations with central banks, the structural shift in how reserve managers perceive risks since the freezing of Russia’s reserves in 2022, and our view that large EM central bank gold allocations remain well below their likely targets.

Our conversations suggest that reserve managers remain willing buyers of gold to hedge geopolitical and financial risks but prefer to delay purchases until prices stabilize.

Against this backdrop, we see two scenarios:

-

Our somewhat conservative base case of no additional private sector diversification -- implying a moderation in gold price volatility. Under that base case, we expect central bank buying to re‑accelerate, with accumulation continuing broadly at the pace seen in 2025, while private investors add exposure only in response to Fed rate cuts. Taken together, these two factors drive gold to slowly grind higher to $5,400/toz by end‑2026.

-

Upside risk scenario of further private sector diversification, driven by perceived fiscal risks across several Western economies. When expressed through call option structures, this demand may be inherently more volatile and can--at least temporarily--dampen EM central bank demand in the near term. In this scenario, we see significant upside risk to our forecast, alongside persistently higher volatility.

If the upside scenario of further private sector diversification does not materialize, we would expect the market to revert to the base case: a gradual grind higher in the gold price, supported by a re-acceleration in stickier central bank demand as volatility subsides and private investor demand responding to Fed easing.

Either way, we see the medium-term trajectory for gold prices as upward, potentially with elevated volatility, and we reiterate our long gold recommendation.

Professional subscribers can read Lina Thomas's full note "Precious Comment: Central Bank Buying (Temporarily) Slows on Volatility from Diversification Demand " here at out new MarketDesk.ai portal.