Goldman's Gold Guru Sees "Significant Upside Risk" To $5400 Forecast

Gold surged significantly in 2025 and into 2026, driven by competition for limited physical bullion between central banks (especially emerging markets diversifying reserves) and private investors.

"We've seen actually an acceleration in the gold value in 2025... private investors join central banks in competing for the same limited gold bullion."

However, the last couple of weeks have seen the precious metal get caught up in the equities rout (tumbling below $5,000 on Thursday).

When looking at flows, Goldman Sachs head of commodities institutional sales, Adam Gillard, notes the biggest price mover - China - was not responsible for the correction on the day, given regional spreads vs Shanghai improved and there was no significant open interest drop.

So what could explain the move in metals?

Goldman's commodities strategist Lina Thomas and the team's Gold Primer from last year:

"In sharp equity drawdowns, gold's liquidity makes it a source of funds for margin calls. This can cause an initial drop in price and positioning before rebounding if uncertainty persists – as in the GFC (2008), March 2020 (Covid), and April 2025 (Liberation Day)."

Margin calls were one side of the coin, heightened gold price volatility due to elevated options activity YTD could be another, and low liquidity due to Chinese Lunar New Year may have given an additional boost to the price move.

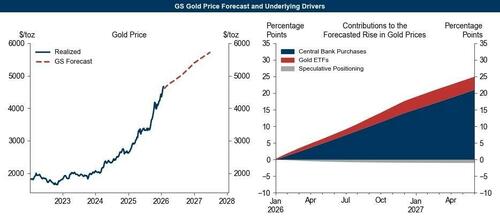

However, amid the very recent turmoil, Thomas remains bullish, forecasting gold at $5,400 per ounce by end-2026 (with significant upside risk from further private diversification flows not yet fully priced in).

Central bank buying is expected to continue steadily, supporting structural demand, though volatility from options activity may persist.

Key factors include lower opportunity costs from Fed rate cuts and the "debasement trade"-fears over fiscal sustainability in Western economies, prompting hedging via gold purchases and call options on ETFs.

"Our forecast only takes into account that central banks keep buying at the pace that they have been buying...

And that private investors will just buy on the back of the Fed cuts...

...we're not taking into account any further diversification flows into gold. And that source of demand can really feed a lot of upside risk to our gold forecast."

This has fueled self-reinforcing rallies as dealers hedge options by buying gold, but also sharp pullbacks (e.g., a 15% dip recently) when worries eased (like post-Warsh Fed announcements) and positions unwound, triggering cascading sales.

Silver, by contrast, faces extreme swings due to a liquidity squeeze in London vaults: half the silver is allocated, and much of the unallocated buffer has shifted to the US amid tariff fears.

Investor enthusiasm (Fed cuts, catch-up to gold, debasement spillovers) has hit low liquidity, causing spikes and sharp drops (nearly 35% in recent volatility).

Thomas expects this extreme price action to continue, with lower conviction in silver versus gold's more stable structural bid.

Broader commodities show "insurance demand" (stockpiling, tariffs, geopolitics), but unlike gold - whose production is constrained - others like copper can ramp up supply, limiting supercycle potential.

Thomas prefers gold over silver for its reliability amid volatility.

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal