'No Smoking Gun': Traders Search For Catalysts Amid Silver's Sudden Slump

Silver tumbled dramatically overnight after initially smashing through $80 an ounce for the first time (topping $84 at its highs), halting a near vertical recent rise driven by Chinese speculative demand.

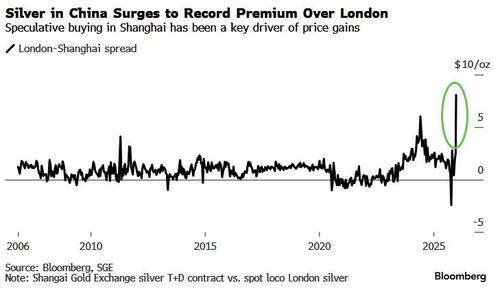

Surging Chinese investment demand has pulled the metal higher, with premiums for spot silver in Shanghai rising above $8 an ounce over London prices, the biggest spread on record...

As Bloomberg reports, the blistering rally has provoked extreme measures in China’s investment landscape, with the country’s only pure-play silver fund turning away new customers after its repeated risk warnings went unheeded.

The fund’s manager announced the unusual step Friday after multiple actions - from tighter trading rules to cautionary advice about “unsustainable” gains - failed to quell an eruption of interest fueled by social media.

However, Goldman Sachs Asia trading desk noted 'no smoking gun' for the reversal:

While there are only 3 days ahead of New Year, China commodities remain volatile. Silver surged 9.25% by lunch break and people are asking what factors investors are pricing for silver.

However, risk off in the afternoon without smoking gun. Precious had significant correction.

Palladium and platinum both ended at limit down and silver’s early gain was almost wiped out and ended +0.51% only while gold lost 0.91%.

Open interest across the 4 precious metal contract all declined.

Although they do point out that GFEX tightened measure to curb excessive trading of palladium and platinum a few days ago and investors were leaving the market and prices corrected notably today.

Bloomberg macro strategist Adam Linton agrees with Goldman on 'no smoking gun', but...

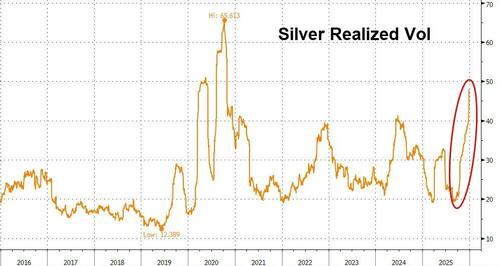

“While there was no clear driver for the silver pullback, the low levels of liquidity and silver’s parabolic rise means that it is vulnerable to a snap back.

Macro drivers and liquidity remain light, meaning that such erratic price action in the metals space could be a feature of trade for what is left of 2025.”

The Chinese measures are effectively a rollover of previous policies and were first announced by the Ministry of Commerce on Oct. 30.

Although the country ranks among the top three global producers of silver - largely as a byproduct of industrial metals - it’s also the world’s largest consumer and therefore not a major exporter.

“The speculative atmosphere is very strong,” said Wang Yanqing, an analyst with China Futures Ltd.

“There’s hype around tight spot supply, and it’s a bit extreme now.”

Additionally, as we warned previously, some exchanges are moving to rein in risk.

The margins for some Comex silver futures contracts will be raised from Monday, according to a statement from CME - a move that Wang said would help reduce speculation.

Arguably, silver's rapid ascent needed a breather - perhaps this is it.

PFR ExtremeHurst, a model for spotting herd behavior that generates a self-reinforcing frenzy, has triggered a top exhaustion signal on silver, echoing a similar alert on gold that preceded its 11% correction in October.

Some attributed the sudden downward shift to comments during the weekend from Elon Musk, who highlighted the growing investor frenzy around precious metals, replying to a tweet on Chinese export restrictions by saying on X:

“This is not good. Silver is needed in many industrial processes.”

Finally, Goldman's top futures trader, Robbie Dwyer agrees that there is no one clear driver for price action over the past few days, but some factors which we’re watching include;

Export Restrictions

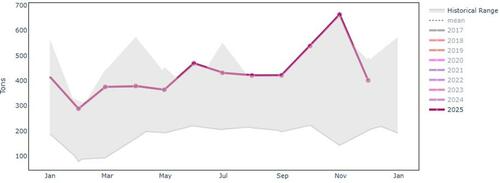

A Telegraph headline which appeared on Bloomberg mentioned “Silver set for best year since 1979 as China crackdown fuels rally”, which referred to Silver Export restrictions from China which have been known about since 15Oct25, so this is not new. For context on the upcoming restrictions, China has net exported 1,993 Tons of unwrought silver YTD, with Total exports making highs vs. previous 10 years in Oct25 at 600 Tons (see chart). For now, we are waiting to see the scope and depth of export quotas to be made available (will need to be released prior to 1Jan implementation).

Seasonal China Silver Total Export Volumes

Source: GS FICC & Equities a/o close yesterday. Past performance is not indicative of future results.

Margin Increases

It’s worth noting the increase in CME margin a/o 29Dec, from 3.2usd/oz to 4.4usd/oz (last changed Sep25, when the future was trading 44 so this is bringing it back in line with previous levels). While increased margin requirements may have contributed to the sell-off, elevated vol and price in the past week has likely already led to funds reducing length.

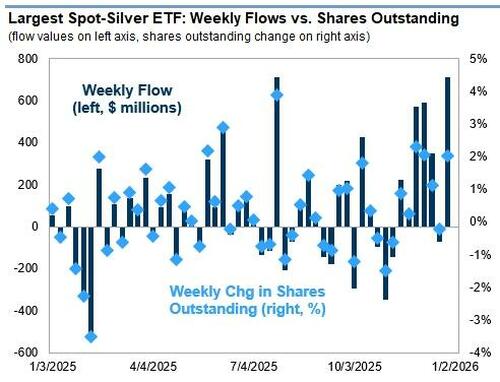

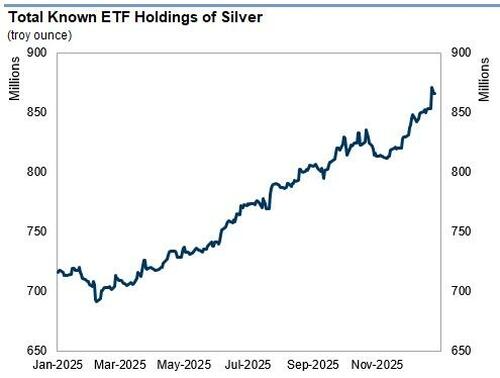

ETF Buying

ETFs bought 13moz of Silver w/w from 19Dec to 26Dec (a/o 23Dec the w/w change was +19moz, the 3rd biggest 1w jump of 2025).

This needs to come from the already tight London Free Float. In Physical Silver (loco London), further out the curve remains backwardated (3m is at -3%), but Tom/Next is trading at full carry (due to reduced appetite to hold physical on balance sheet over year-end). This suggests the very front of the physical curve is not currently under extreme pressure, as the LBMA free float slowly is rebuilding from Sep lows. Any sharp increase in retail participation in ETFs could see significant further moves in lease rates which would see spot rally sharply.

How Much Went Through Friday?

In silver, volumes were highly outsized (95th+ percentile) on both Chinese exchanges (SGE//SHFE) and on CMX (call volumes from Friday session were the 7th highest of the previous 5 years, despite London’s absence, and overall options volumes were 10x previous Boxing Day volumes). Vol liquidity picked up once US got in Friday to within normal levels.

Where Are We Now?

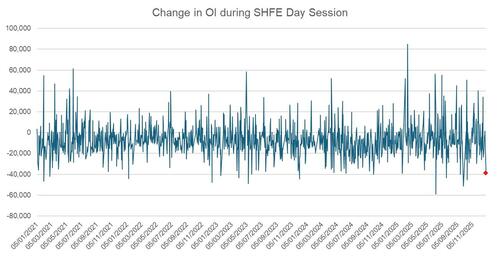

This morning saw a sharp Chinese liquidation, selling 40k lots through the day session in early London morning. Latest vol changes d/d (from Christmas Eve to now) is

2w -- +24v

1m -- +14v

6m -- +3v

Source: GS FICC & Equities a/o close yesterday. Past performance is not indicative of future results.

The vol rally has persisted despite todays the reversion in flatprice, down ~6v since London open this morning in the front. PGMs are seeing even steeper liquidation, with extremely concentrated buying from Friday reverting (for context, 2.5k lots of the active Plat contract went through at ~6pm London on Friday, the largest 10-minute window of volume over the Quarter despite London, the primary hub of PGM physical trading, being out).

What Flows is the Desk Seeing?

Flows have tended to rolling strikes upwards, with this morning seeing some profit on the move. This morning vol liquidity returned to challenging post-Christmas conditions, with OTC the main source of liquidity and 15v wide across the curve. As the US enters, this is slowly starting to change.

In conclusion, Alasdair Macleod warns that the derivative difficulties advertised so loudly in silver contracts tell us that there is a wider and larger commodity pricing problem. Baskets of other commodity and raw material categories are also telling us that if they are to normalise, their dollar prices will rise dramatically in 2026—2027.

It is the currencies which are the problem. Meanwhile, there is nothing likely to stop silver prices rising much further. We can only hope it happens in an orderly fashion.

For now, the decline is stable and hardly indicative of a herd rushing for the exits. But a thin liquidity holiday-shortened week could exacerbate any moves.