Precious Metal Cage-Match: Platinum Vs Gold

After a stellar Q1 performance, Gold has been relegated to the sidelines, with Platinum and Silver taking center-stage over the past two months.

Liberation day is far behind us as US equities broke ATH last week and geopolitics proved insufficient to keep Gold thematic.

Platinum is up close to 40% since mid-May on the back of strong Chinese imports and a compelling narrative that the market happily bought after Gold started exhibiting signs of slowing.

While undervalued at the beginning of the year, Goldman Sachs precious metals team believes Platinum’s rally has gone too far too fast and a correction is due.

Platinum is the winner of 2025 H1

First time in five years that Gold is not winning but don’t count it out just yet

Source: GS FICC & Equities as of 30th June. Past performance is not indicative of futures results

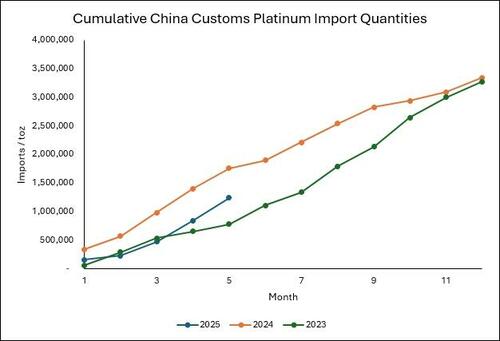

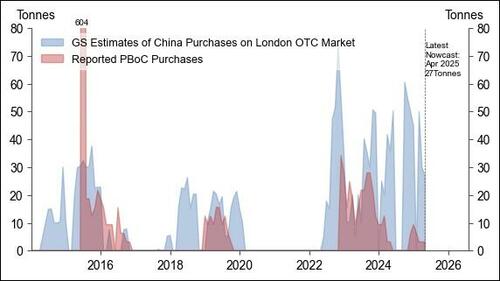

China is over-importing Platinum again.

While 2025 YTD numbers remain below 2024, China is still in buying mode since April and the timely release of strong Apr25 numbers at the beginning of Platinum week brought a lot of attention to an underinvested space

Source: GS FICC & Equities as of 30th June. Past performance is not indicative of futures results

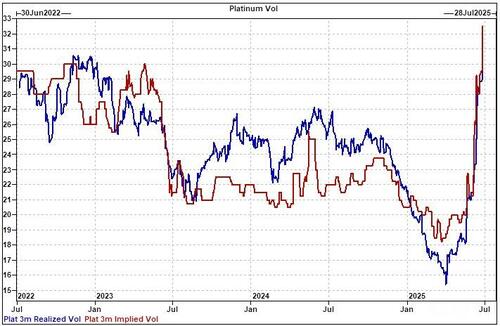

Platinum vols doubled over the past two months

3m Realised went from 15% to 32% in the sharp rally observed since mid-May while implied vols followed in tandem

Source: GS FICC & Equities as of 30th June. Past performance is not indicative of futures results

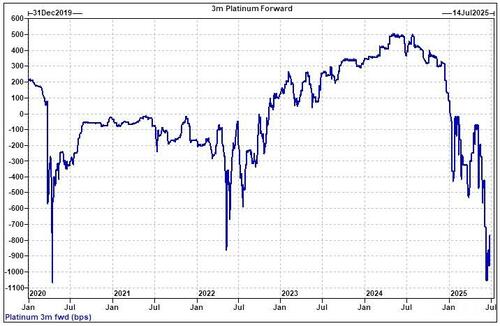

Platinum’s tightness is back to COVID levels

-

Structural high inventories maintained at industrials since the 2020-2021 SA disruptions

-

Metal leaving London for COMEX in Q1 (EFP story) & China in Q2 (Higher imports)

-

Dealers hedging curve risk aggressively – as illustrated by the local EFP / forwards disconnection observed over the past month

Source: GS FICC & Equities as of 30th June. Past performance is not indicative of futures results

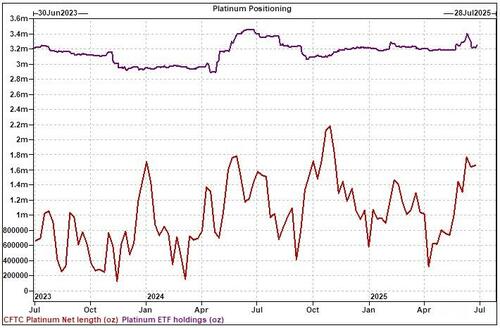

Platinum Positioning

-

ETFs bought 200k ounces mid-May and shed the same amount at the beginning of June – flat over the 2-month period

-

COMEX length is up 1.3mm ounces over the same timeframe. CTA length is getting close to max deployable given the recent volatility jump

Source: GS FICC & Equities as of 30th June. Past performance is not indicative of futures results

What we do not know

-

Is China buying Platinum part of a restocking effort or increased jewellery demand? Chinese e-commerce platforms are showing encouraging signs of jewellery demand pick-up but the recent price appreciation observed will likely contain this excitement. Platinum went up 40% in seven weeks which in Gold terms would imply a price appreciation from $2350 to $3300, a move that took a year to happen

-

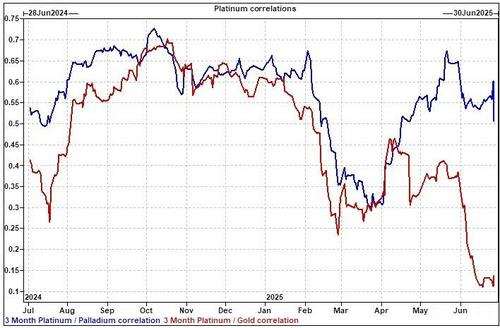

Why is Palladium up 20%? Fundamentally speaking, jewellery demand is much smaller than in Platinum and the cost curve arguments are far away at $1150/oz. The best explanations I have heard include a combination of PGM-basket correlation and position squaring. Platinum / Palladium correlation remains above 50% while Platinum / Gold correlation is hovering around 10%

Source: GS FICC & Equities as of 30th June. Past performance is not indicative of futures results

Gold

A precious note would be incomplete without a word on Gold. We are back to the middle of the range but this time flows are quieter as the rest of the commodity complex offers more compelling narratives

-

Forwards are back to 2024 levels, 1m realised vol has halved over the past month and geopolitics didn’t offer a sustainable and convincing story to own Gold from an investor standpoint

-

CB demand remains intact according to our GIR team (h/t Lina Thomas) and this will remain the driving theme for the second half of this year

Source: GS FICC & Equities as of 30th June. Past performance is not indicative of futures results

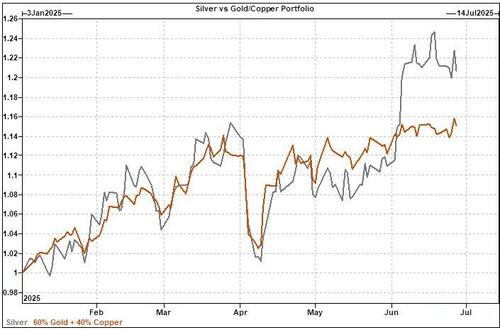

Silver quietly reached a 12-year high.

This time India importing, Reddit frenzy, or solar demand cannot be blamed, instead it seems to gently follow the 60% Gold + 40% Copper basket with the exception of the day it broke $35/oz, a key level to watch into Q3 (h/t James Perman)

In a world where Platinum’s greatest ally is jewellery demand while Gold continues to benefit from the long-term narrative of de-dollarisation and diversification, Goldman's preference leans with the yellow metal.

More here from Goldman Sachs research team available to pro subs.