A "Quite Extraordinary Day" In Gold - What Happened?

Goldman Sachs trader, Adam Gillard pointed out that yesterday felt similar to 21st October sell-off (albeit more extreme), where he thinks the vol move from a large short-dated GLD block triggered model liquidation, which was exacerbated by high-frequency market-makers (on GLD).

The salient point around the October sell-off was that the GLD did not cut despite then record volume.

This will be an important signal if holdings again remain broadly unchanged after yesterday’s ~10% drop.

The expiry of February Comex futures was the opportunity for beleaguered shorts to square their books.

Almost certainly, it was a one-off scare, because nothing else has changed.

As Alasdair Macleod details here, examination of the facts show that Friday’s action in gold, silver, and platinum was designed to flush out weak holders of paper contracts.

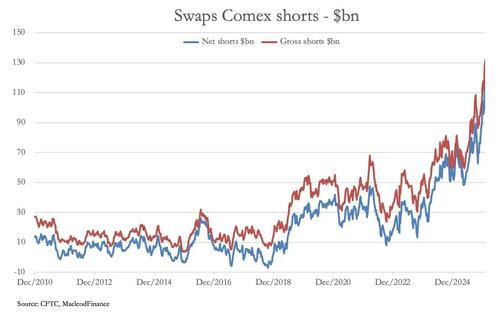

This was for the benefit of establishment players in Comex’s swaps category, who being desperately short are losing huge sums on mark-to-market valuations.

Below, Gillard lays out the numbers behind a quite extraordinary day...

Price:

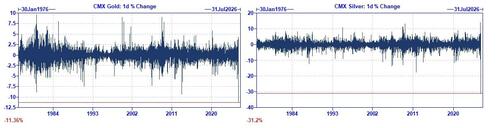

Largest d/d % decline on CMX gold and silver since the early 1980s (using rolling 3rd and 2nd CMX contracts respectively, although you start to face data issues around active contracts that far back).

Shanghai silver spent most of yesterday afternoon at limit down.

Vol:

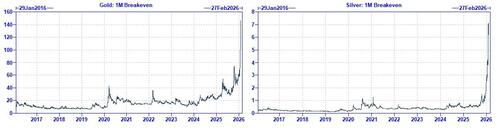

1M LBMA breakevens (unsurprisingly) making new highs.

At various points throughout the day CMX option liquidity ceased to exist.

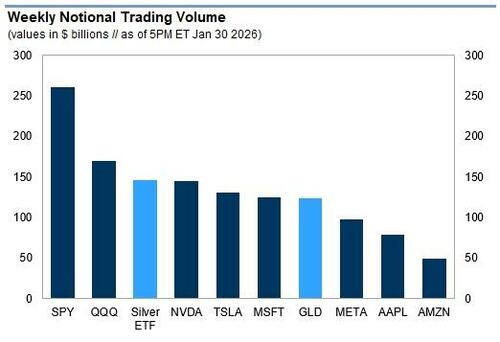

ETF volume:

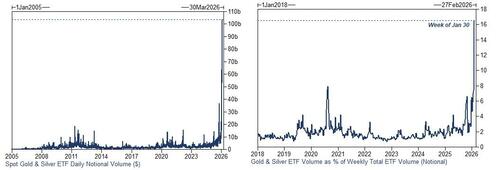

This week was a record for notional trading volume of spot-gold and silver ETFs, along with a record share of ETF volumes.(ty Chris Lucas and Brian Garrett)

SLV vs Mag 7:

Whilst SLV and GLD outpaced most of the Mag 7 this week.

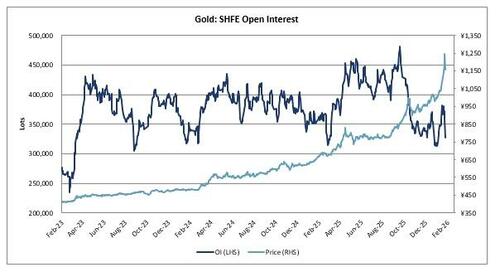

China:

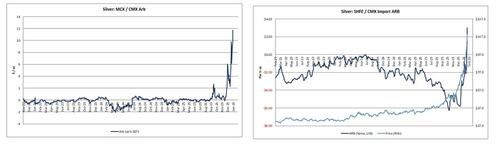

Cut length on Shanghai during yesterday’s night session; worth watching SGE OI and domestic ETF length on Monday, and how SHFE / CMX import ARB performs (was previously open)

Physical:

We think a significant driver of the rally, especially in silver, was Chinese and Indian physical bids, we think from retail (but acknowledge opaqueness of those markets).

Again. will be interesting to see whether regional basis narrows on Monday.

Circling back to where we started, Macleod concludes that the operation had limited success, because speculative positions in non-commercial Commitment of Traders categories are remarkably low. Therefore, the swaps on Comex will continue to be squeezed, and we can reasonably expect higher prices for precious metals in the coming weeks.

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal