Silver: What's Happening Under The Hood?

The price of silver is at an all-time-high yet Goldman's commodity trading desk notes that spec positioning in New York and Shanghai remains close to the lows.

Adam Gillard thinks Chinese and Indian physical demand (partly from retail) has been the driver behind the last leg of the rally.

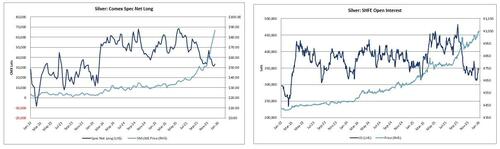

Positioning:

Surprisingly low on both CMX and SHFE, despite record prices and macro focus.

Managed money positioning is at 1y lows in NY, and increasing OI in CMX silver puts is sharply outpacing calls; Friday's close was the highest OI in silver puts as a % of calls in the last 10 years.

Indian physical:

Appears strong despite price strength, we think due to strong physical demand from Indian retail (typically physical bids drop on rapid (derivative) price rallies).

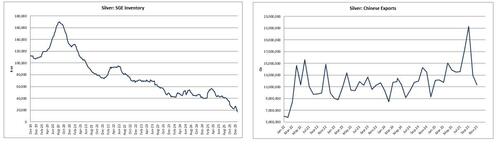

Chinese physical:

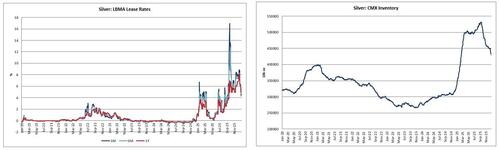

Remains tight because strong exports in October (21mn oz, an ATH high) due to the LBMA lease rate strength tightened the domestic market, sending SGE inventory to record lows.

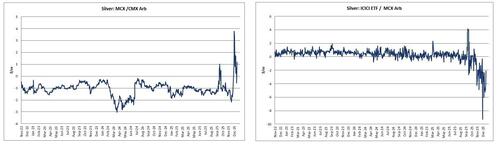

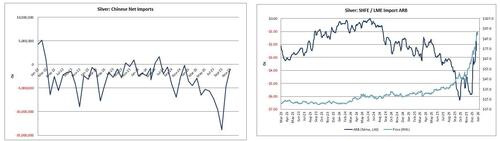

Chinese import / export arbitrage economics:

Domestic tightness has caused significant SHFE / CMX strength, which resulted in Dec25 net imports of 1mn toz vs Jan25-Nov25 monthly average of 5.8mn toz.

~90% of Chinese silver exports flow to India via Hong Kong, which explains the current HK physical premium.

LBMA physical:

All whilst the LBMA system remains relatively tight due to previous US import strength from tariff concerns (although this flow is starting to reverse now)

So, to sum it all up, Goldman's commodity desk view is that price has run too far but they’re reluctant to short until we see physical premia ease.

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal