A 3 Sigma Week: When Everyone Hit the Risk Button

A 3-sigma event should only happen 0.3% of the time

Here are this week’s top 10 quotes and they read like a checklist for late-cycle euphoria: CTAs re-lever, retail buys everything in sight, bears capitulate, and leverage hits cycle highs. If this is “cautious” positioning, imagine what full-blown mania will look like.

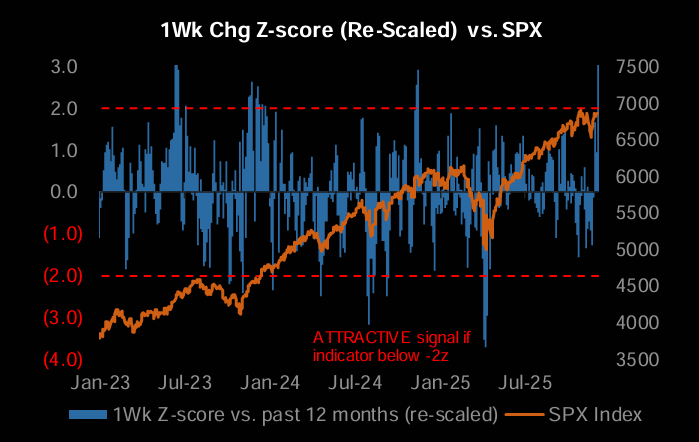

1 - 3 sigma

"...things have flipped as buying has picked up strongly across multiple cohorts such that the 1wk change metric for our US Tactical Positioning Monitor is at +3z." (JPM)

Source: JPM PI

2 - Begun to re-add

"The wave of systematic selling has faded, and vol-targeting strategies are starting to re-lever ... After two weeks of steady non-fundamental supply, CTA, Vol-Control, and Risk-Parity strategies have begun to re-add exposure as realized volatility declines." (Citadel)

Source: Scott Rubner

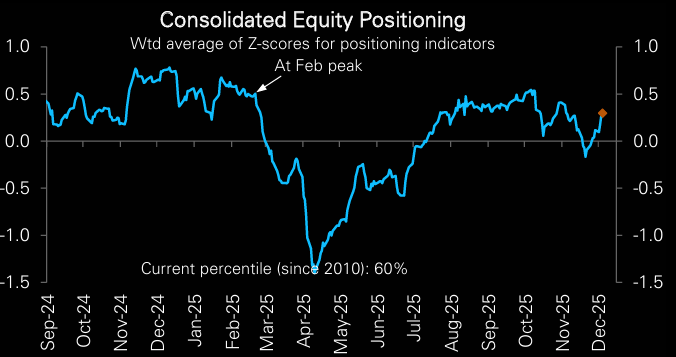

3 - Modestly overweight again

"Over the last two weeks, equity positioning has rebounded to turn modestly overweight again (0.30sd, 60th percentile), close to levels seen in late October." (Deutsche Bank)

Source: Deutsche

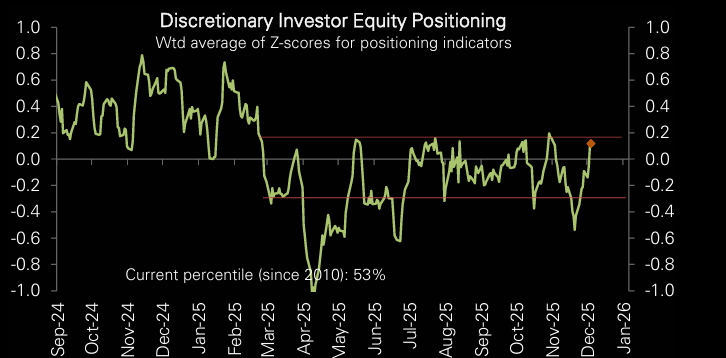

4 - Top of range

"Discretionary investors have raised exposure only to the top of the cautious range they have been in since March." (Deutsche Bank)

Source: Deutsche Bank

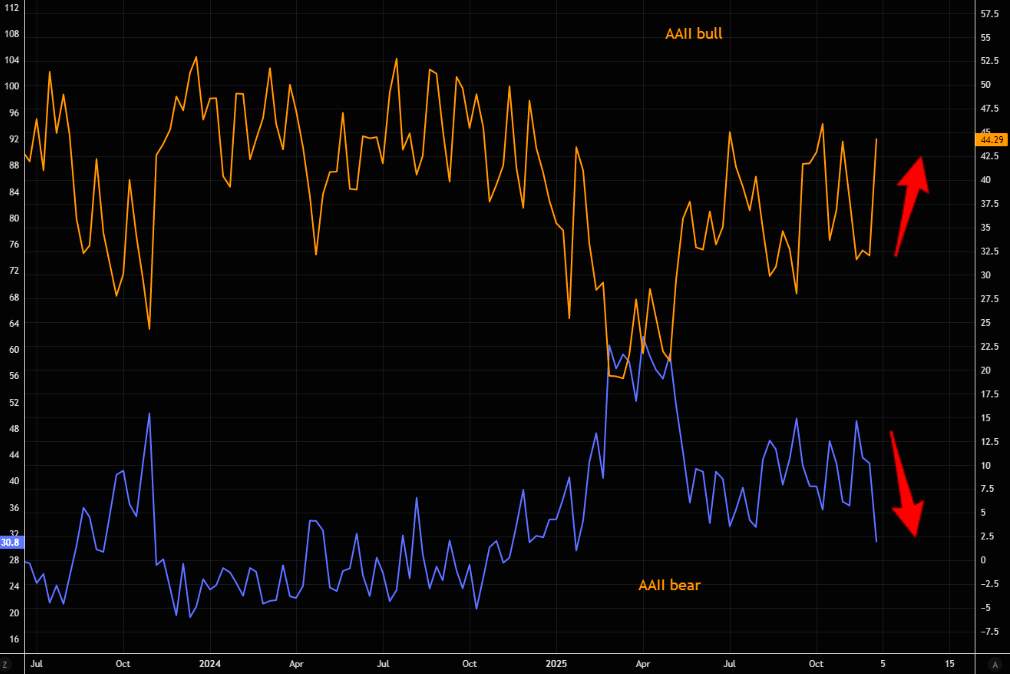

5 - Throwing in the towel

"AAII bull getting very bullish, and bears throwing in the towel, "printing" close to lowest levels of the year." (TME - sorry for obnoxiously quoting ourselves)

Source: LSEG Workspace

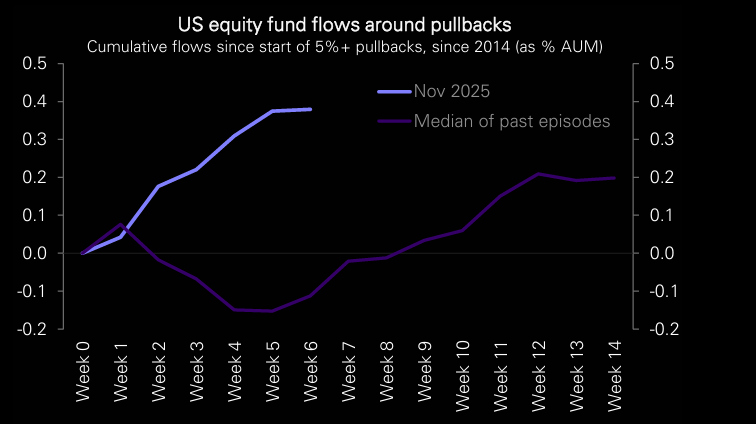

6 - BTD: The inflow beat

"The equity inflows boom continued through the November pullback, in sharp contrast to past pullbacks which typically saw outflows. This week however saw inflows continue but slow sharply." (EPFR)

Source: EPFR

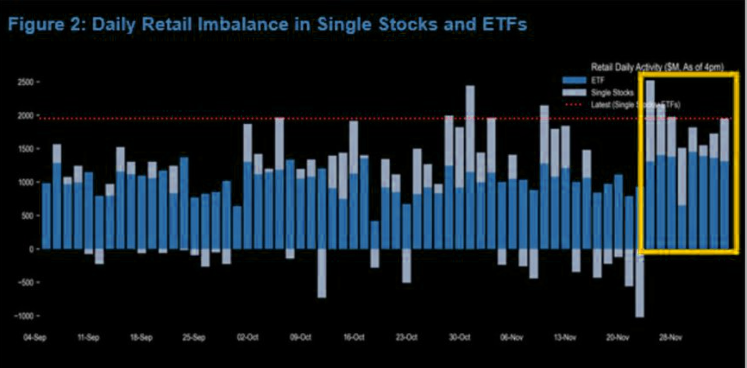

7 - Retail roaring

"Since November 25th, coming into Friday's session, we have seen 8 consecutive days of retail net buying close to or above $2bn per day [the most over that length since at least Sep." (JPM)

Source: JPM Retail Radar

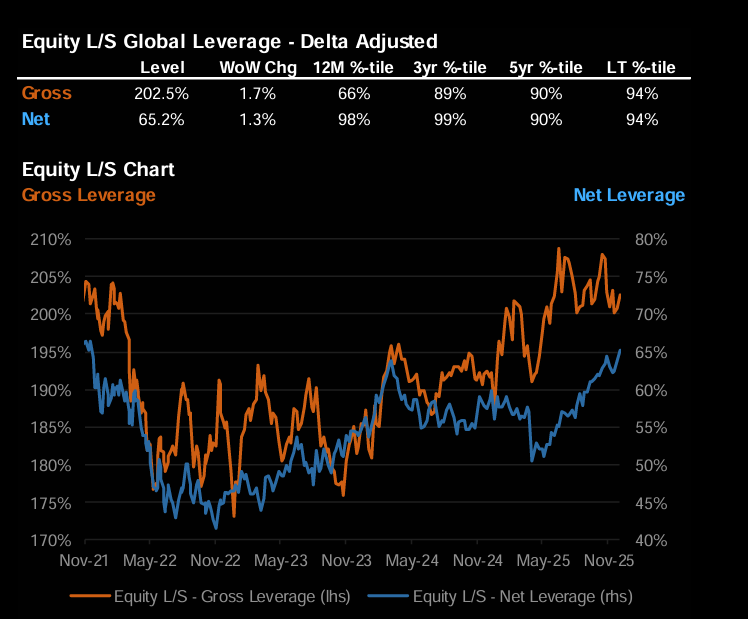

8 - Lever up

"Among Eq L/S funds, gross and net both ticked up 1-2% and are at the 90th %-tile on a 5yr basis." (JPM)

Source: JPM PI

9 - Run it hot

"Cyclicals vs Defensives are on their best run since 2016." (Morgan Stanley)

Source: Morgan Stanley

10 - Bull bodies: VIX and S&P 500 P/E

"Risk appetite is improving, volatility compressed across asset classes, positive for equities." (SEB X-Asset)