30Y JGBs in Full Panic Mode — Global Spillovers Have Started

Parabolic in a pic

Japan 10 year trend line going beyond steep. This is truly extreme, and matters beyond Japan.

Source: LSEG Workspace

Wow

Japan 30 year showing proper panic upside moves.

Source: LSEG Workspace

Breaking

Last week we asked ourselves rhetorically if rates could rise. Since then the US 10 year has shot up higher. We have taken out the triangle like formation, and are trading above the 200 day MA again.

Source: LSEG Workspace

All rise

Japan situation spilling over to global rates, with US the big laggard so far.

Source: LSEG Workspace

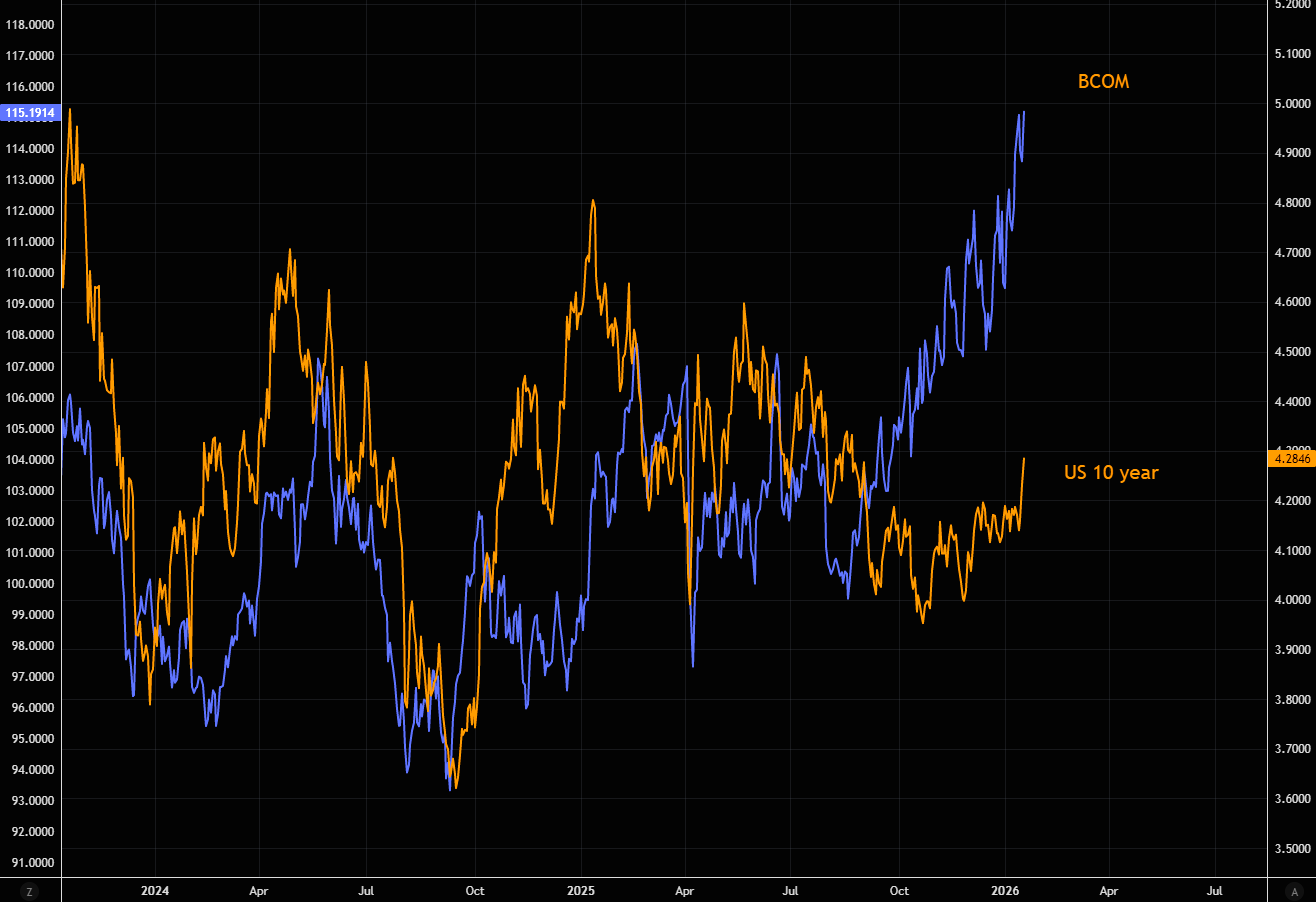

The inflation touch

Once again, there is little inflation unless you need commodities...

Source: LSEG Workspace

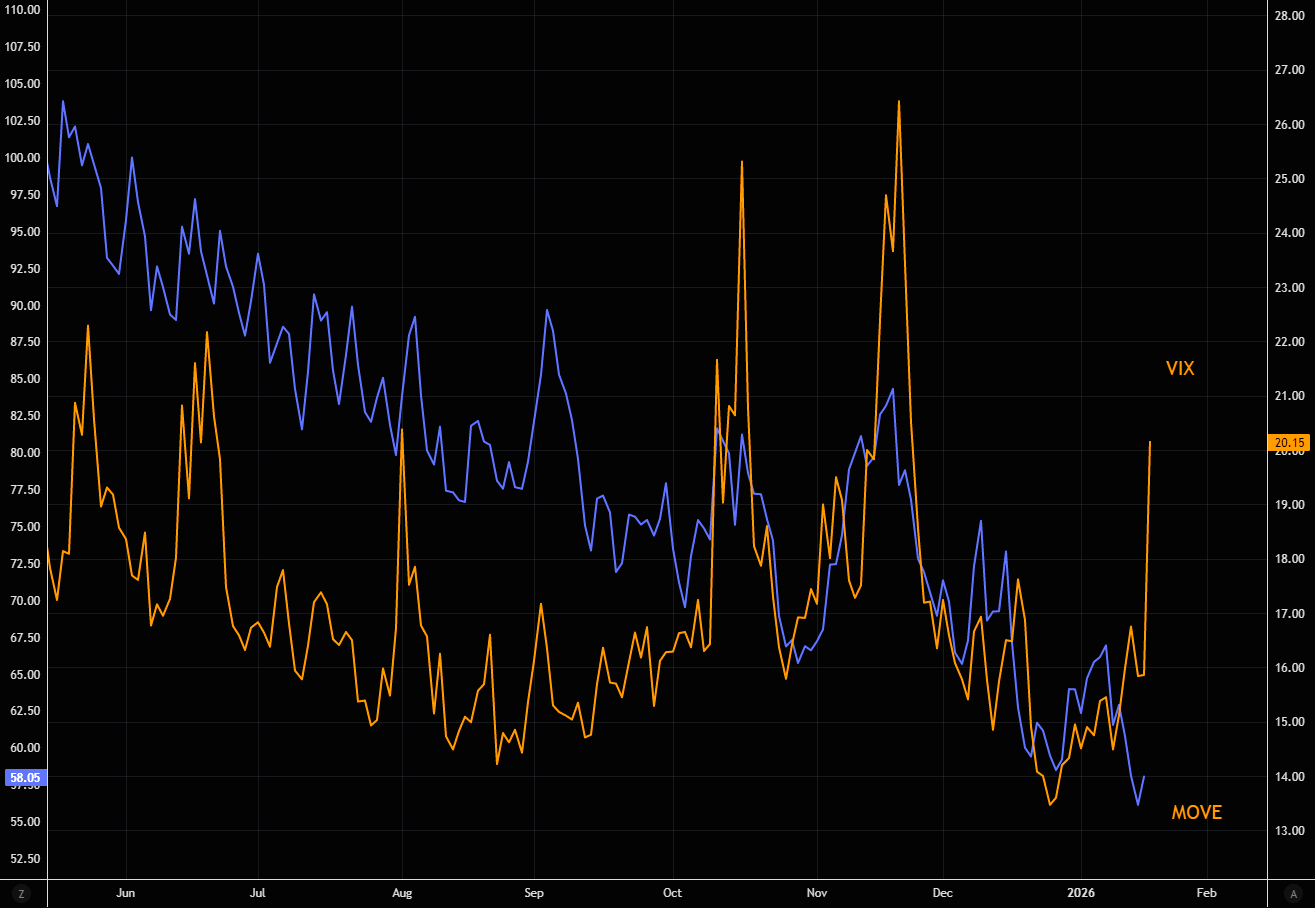

Pricing little MOVEs

Bond volatility has stayed eerily calm, but if the latest move in rates turns into something more than noise, the MOVE should start catching some serious bids.

Source: LSEG Workspace

The great vol divide

Looks like equity volatility traders are pricing a very different set of risks than bond volatility traders.

Source: LSEG Workspace

Don't forget...

Yields up in 3 months after last Fed Chair nominations.