AI Can’t Run Without Silver

Big picture

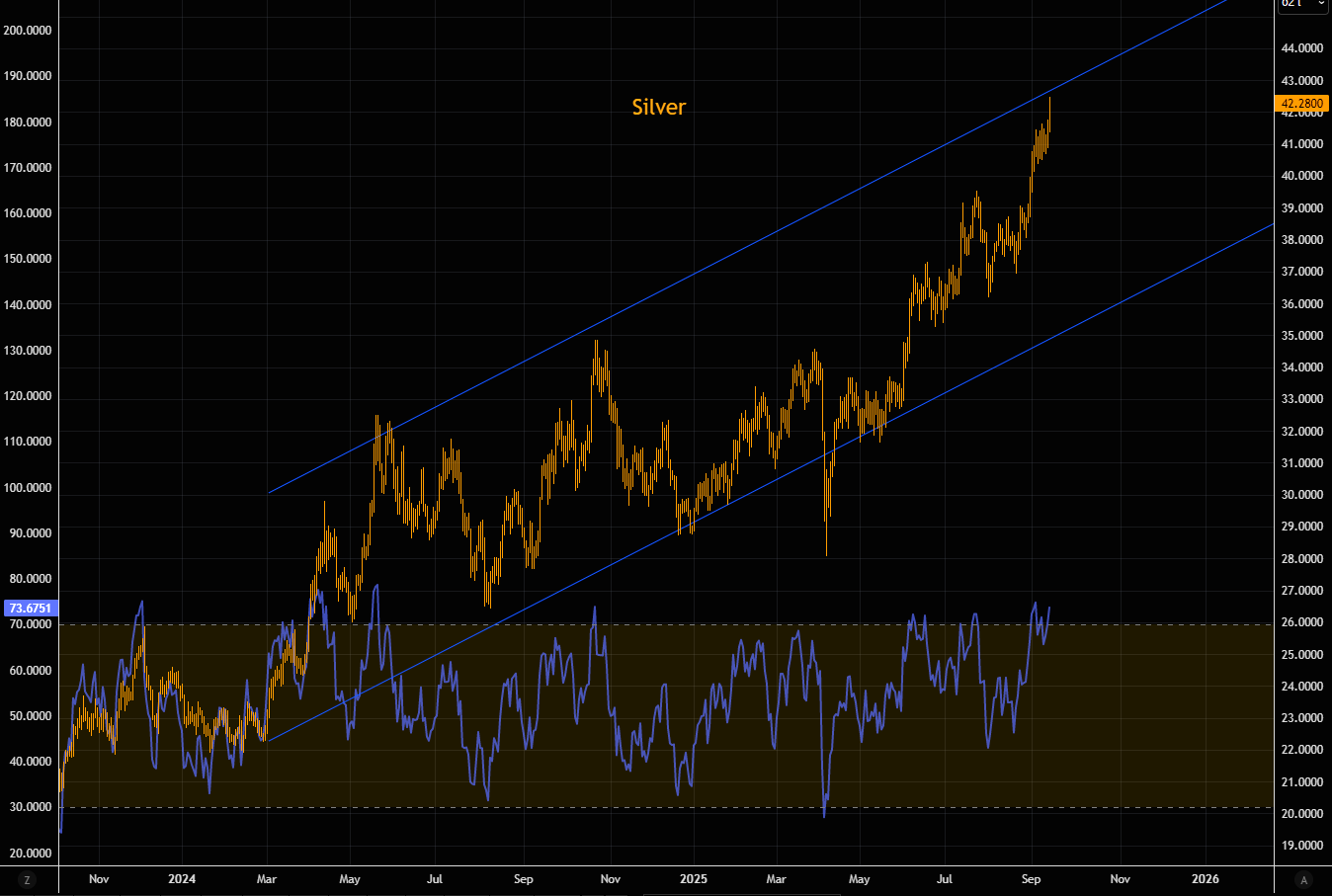

Silver is approaching the upper part of the big trend channel that has been in place since lows last year. RSI is overbought, but as we all know, overbought can stay overbought for longer than most think possible.

Source: LSEG Workspace

Close up

Silver has also traded inside a steep short term channel. Note we are approaching the upper part of that channel as well. Momentum is very strong, but we are getting a bit "dislocated" from the 50 day.

Source: LSEG Workspace

"Speculators"

Silver net non commercials have been forced to buy lately, but we are far from exuberant levels of speculator longs.

Source: LSEG Workspace

ETFs

The buy is on...

Source: ANZ

Use options

In early June (here) we outlined our SLV call spreads logic, and have been pointing out to roll those into higher strikes dynamically (in order to capture "max" optionality). Silver volatility has remained calm and offers great setups for rolling into higher strikes (while booking profits) or replacing longs with relatively cheap option plays.

Source: LSEG Workspace

You need silver...

...to run those AI machines, and AI momentum is huge at the moment.