AI Panic Crushes Software — But Is The Market Dead Wrong?

Can AI replace AI software?

The debate is flawed and "illogical" according to HSBC. Main bullets:

1. Software vendors embed AI into enterprise applications for complementary value, expanding TAMs without displacement; AI augments rather than replaces core software functions.

2. Control of private client data, domain expertise, and optimized code creates decades-long barriers, making incumbents (e.g., SAP, Oracle) superior to AI-generated solutions for enterprise systems.

3. AI’s hallucinations and non-repeatability make it unsuitable for core enterprise systems requiring exactness, countering narratives of AI replacing software.

4. Persistent "AI vs. software" hype stems from media echo-chambers, but enterprise fundamentals ensure software resilience as AI focuses on augmentation.

5. AI integration with Global 2,000 firms drives rapid TAM growth, cost efficiency, and new revenue streams through embedded AI in legacy platforms.

IGV back to massive must hold area...

Source: LSEG Workspace

AI adoption showing up in numbers

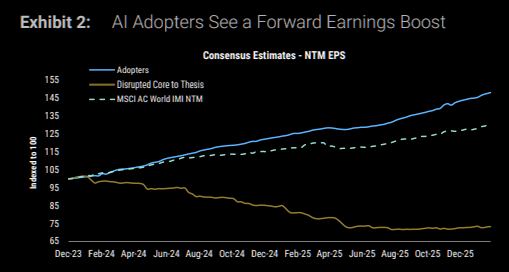

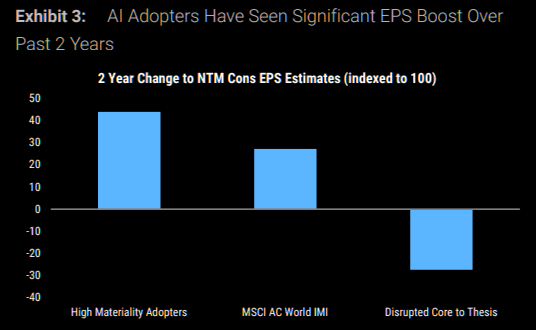

Companies embracing AI are seeing much stronger forward earnings revisions and faster EBIT margin expansion than the broader MSCI World, while firms viewed as AI-disrupted face downgrades and margin pressure.

Since end-2023, adopters’ earnings revisions have outpaced the disrupted group by 102%, with margins expanding significantly more than the index, reinforcing the shift from AI hype to measurable ROI and earnings power. (MS)

Source: MS

Source: MS

Cost efficiency

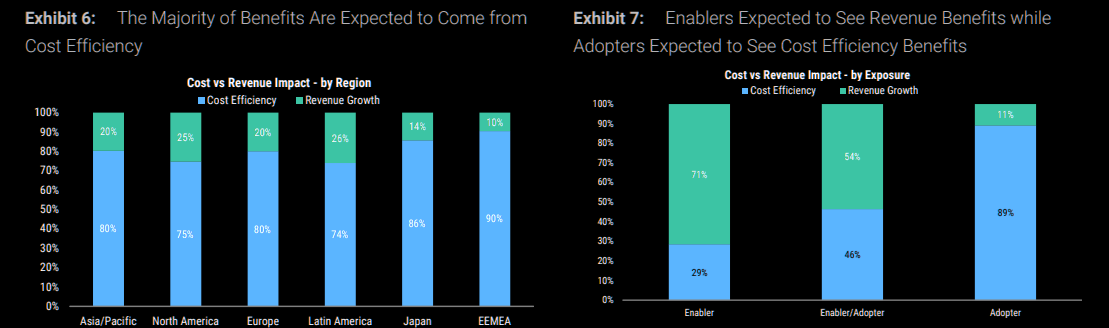

AI benefits are expected to skew heavily toward cost efficiency, not revenue growth, over the next 12–24 months. Across regions, 74–90% of analysts see AI driving margin improvement via cost savings, while just 10–26% expect meaningful topline acceleration.

Revenue gains are concentrated among AI Enablers (e.g., data center infrastructure), while 89% of AI Adopters are expected to benefit primarily from efficiency, reinforcing that AI’s early impact is margin-driven, not growth-led.

Source: MS

Mispriced

In recent weeks, markets have sharply sold off sectors seen as vulnerable to AI disruption, with Software & Services facing the steepest de-ratings. As AI capabilities scale non-linearly, disruption-driven volatility is likely to persist.

That said, the latest move was broad and largely indiscriminate, with little regard for business model quality or fundamentals, leaving several names, in Morgan Stanley's view, disproportionately punished despite intact underlying strength.Table shows top 5 names per continent, with the highest price target potential.

Source: TME/MS

The Software pairs trade

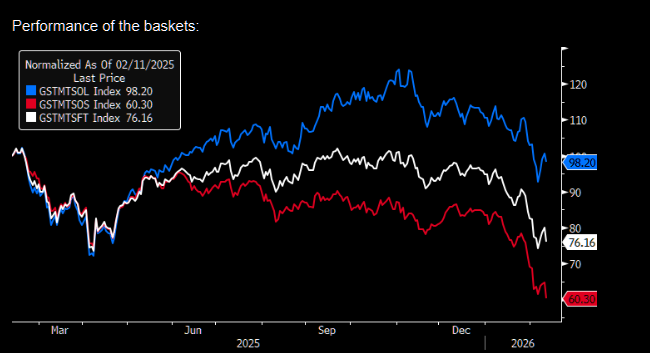

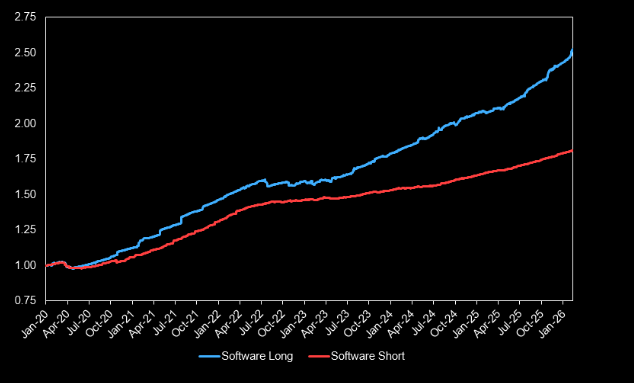

GS is launching a Software pair trade (GSPUSFTX): long structurally insulated and AI-enabling software (GSTMTSOL) vs. short software workflows increasingly vulnerable to AI automation or in-house rebuilds (GSTMTSOS).

GS expects the AI-levered and defensible cohort to recover from the recent sell-off, while the more disreputable names continue to lag. Chart 2 shows performance of the pair. Components for each basket here and here.

Source: GS

Source: GS

Sales and P/Es

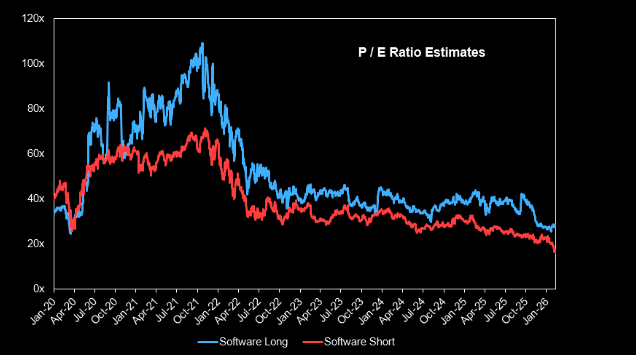

Sales of the long basket have more than doubled since 2023, while sales for the short basket have stagnated. Chart 2 shows that PEs have started to diverge.

Source: GS

Source: GS

Fast market

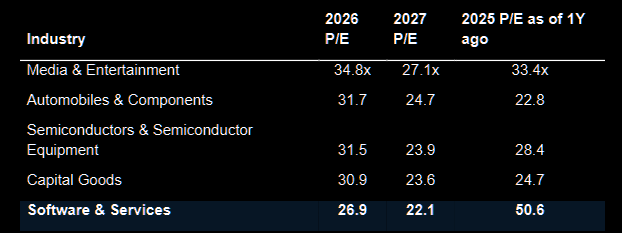

"Exactly one year ago, software was trading at a P/E multiple of 51x, making it the most expensive industry in the equity market. Today, software trades at a P/E multiple of 27x and is not the most expensive industry. Media, autos, semis, and capital goods are trading at a higher multiple."

Source: GS

DB weighs in

DB on the software opportunity through the AI lense:

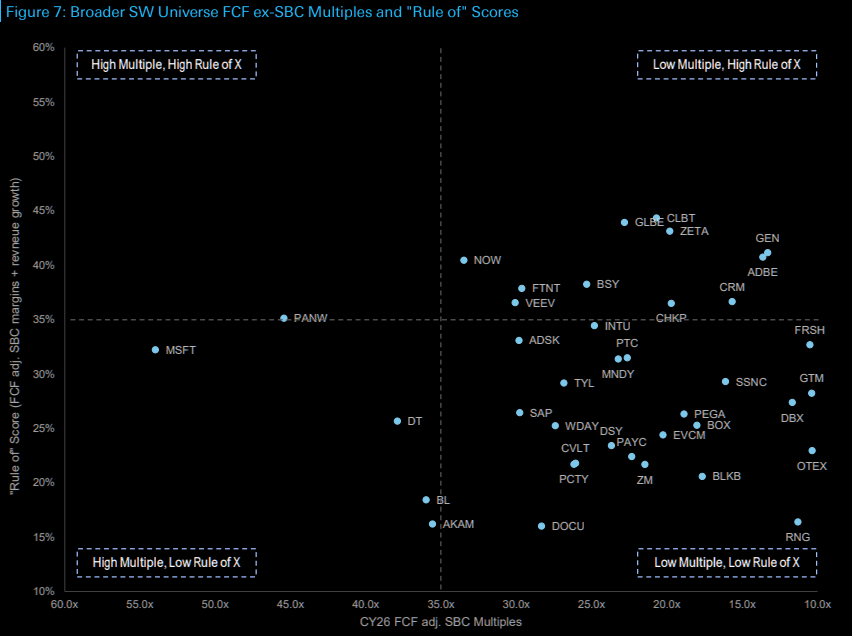

1. Software Sector Over-Discounted on AI: Stocks down over 20% YTD with 21% multiple compression; DB identifies CLBT, CRM, INTU, NOW as compelling Buys using GenAI resilience scorecard and valuation metrics (GAAP EPS/FCF, SBC multiples).

2. Barriers to Exit Drive Disruption Risk: Primary factor determining resilience; lower scores (retention rates, data moats, ecosystem strength) signal higher AI disruption vulnerability, overriding product innovation focus.