AI Was the Trade, Now It’s the Problem

Pulse on AI

Goldman's Bartlett on AI disappointment: ORCL spent too much (higher FY26 capex with less reward for off-balance-sheet spend), AVGO didn’t raise AI revenue guidance enough, ChatGPT-5.2 failed to spark the same excitement as Gemini 3 in early November, and reports of ORCL datacenter pushouts (later refuted) added to the pressure. After a strong two-week rally, air is coming out of the trade, leaving most AI stocks roughly flat on a 2-month+ basis.

Source: LSEG Workspace

Flat is the new up?

AMZN flat since start of the year, META flat since late Jan, MSFT flat since June, NVDA flat since July, AVGO flat since mid Sep.

Source: LSEG Workspace

The SOX puke

SOX put in a massive down candle yesterday. 50 day is slightly lower. The question is whether this is a double top in the making?

Source: LSEG Workspace

Just in time

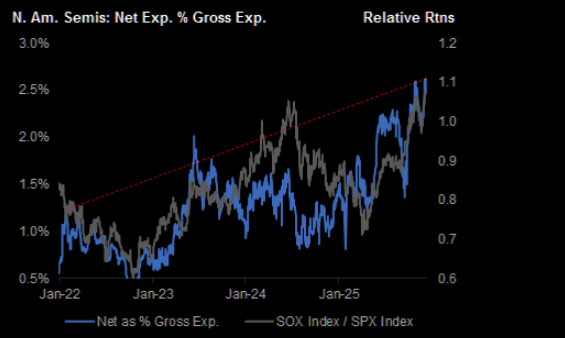

Hedge fund positioning in North American semis got back to peak levels just in time for the biggest SOX puke in a very long time. Pain is huge.

Source: JPM

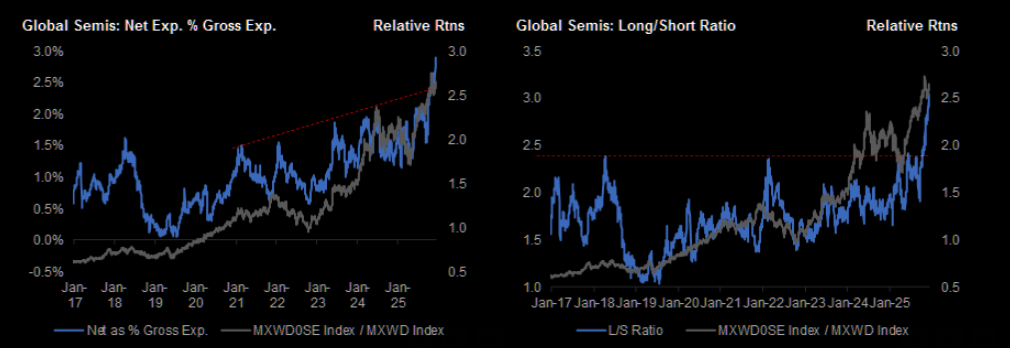

Global semis

Positioning reached new highs lately... bit stretched.

Source: JPM

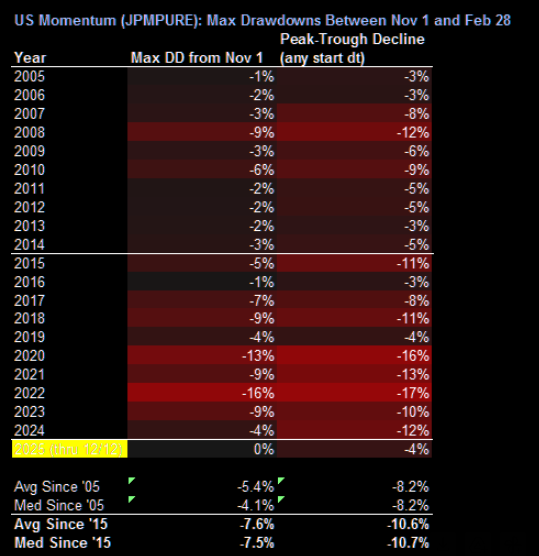

More to go in momentum

Weakness in AI weighed on US Momentum on Friday (JPMPURE), with losses concentrated in TMT and Industrials. The drag came mainly from the long side, while shorts fell broadly with the market. If AI weakness persists, momentum could see further drawdowns. Historically, JPMPURE averages a -10.6% peak-to-trough decline between Nov–Feb (vs -4% so far), with Momentum still above its Nov 1 level.

Source: JPM

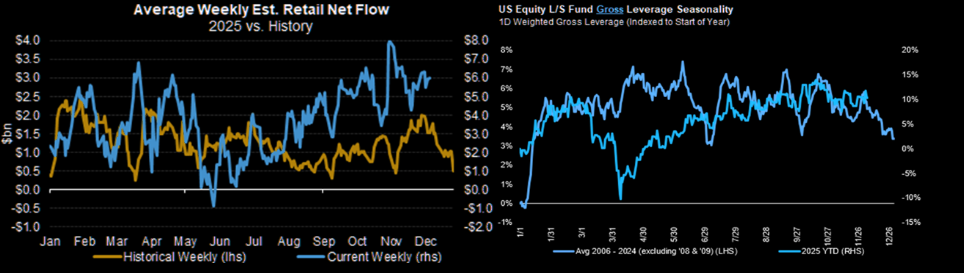

De-gross

Time for some de-grossing into year end? History says yes.

Source: MS

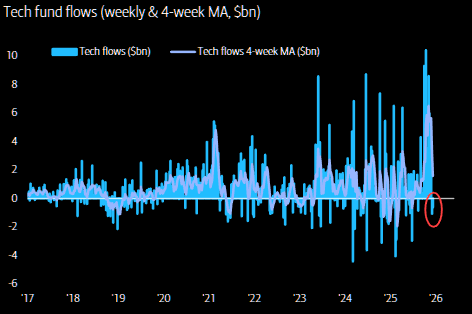

Tech blues

Biggest 2 week outflow in tech since February 2025.

Source: BofA

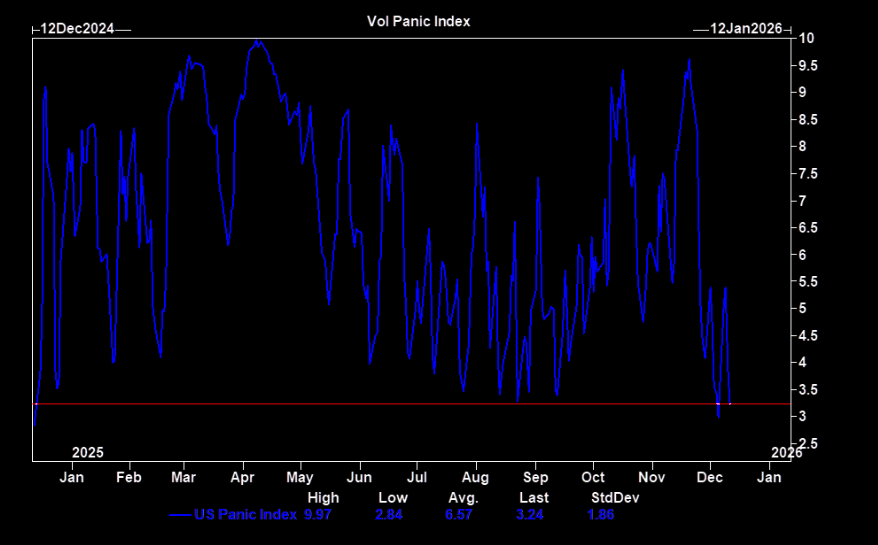

Another just in time

GS US volatility panic index was sitting at year lows going into Friday.

Source: GS

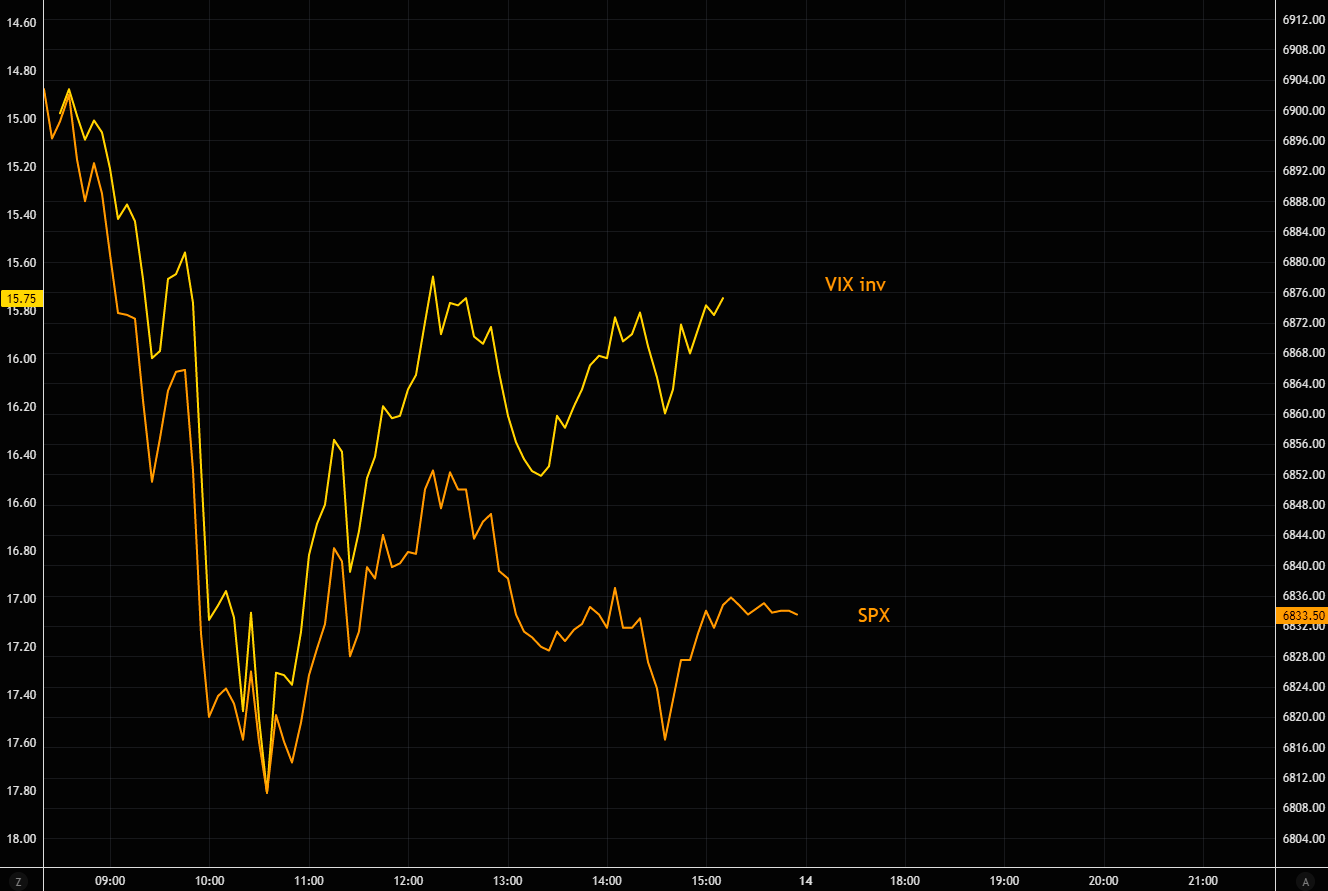

Mini green shoots

VIX managed shrugging off the initial big panic move and actually "decoupled" from the SPX in the end. Chart shows SPX vs. VIX (inverted) on Friday.