Altman Goes Full YOLO While China Builds Top-Tier AI for Pennies

Big spender

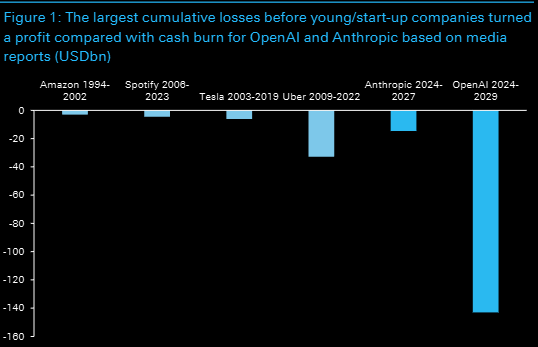

1. OpenAI's cumulative cash burn projected to exceed $488bn by 2029 (vs. $143bn free cash flow), with $200bn potential by 2030 (HSBC) from data center commitments, surpassing historical tech giants' losses (Amazon 1994-2002, Spotify 2006-2023).

2. No startup in history has operated with losses approaching OpenAI's current scale.

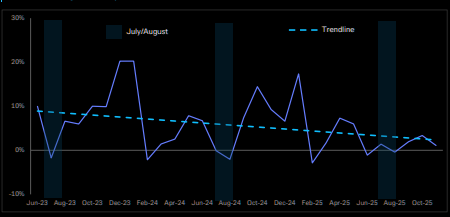

3. European subscription markets flatlined since May, with updated data indicating early OpenAI subscription figures were likely anomalous, signaling weaker market reception than initially projected. (DB)

Source: DB

Source: DB

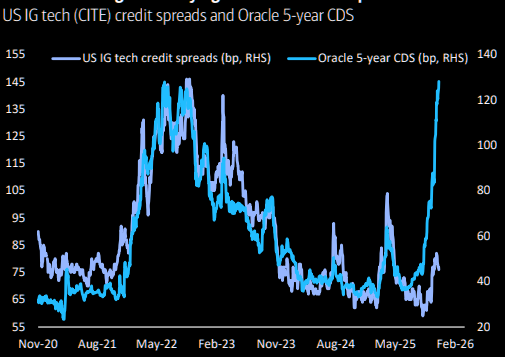

Easy AI tiger

"Bond vigilantes saying slow down on AI capex."

Source: BofA

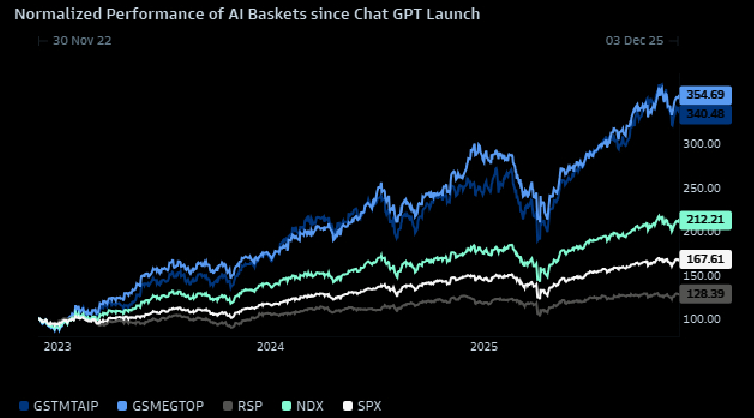

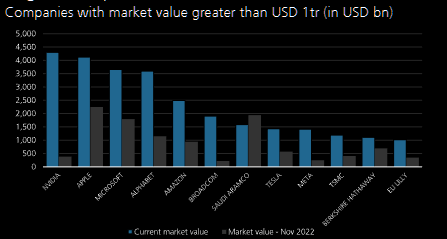

With or without you

AI matters... and will matter. GS points out spending tail risk: Capex reverting to 2022 levels could reduce S&P 500 valuation multiples 15-20% and lower long-term growth estimates (6%→4%), with AI stocks representing ~40% of S&P 500 return since ChatGPT.

Source: GS

Source: GS

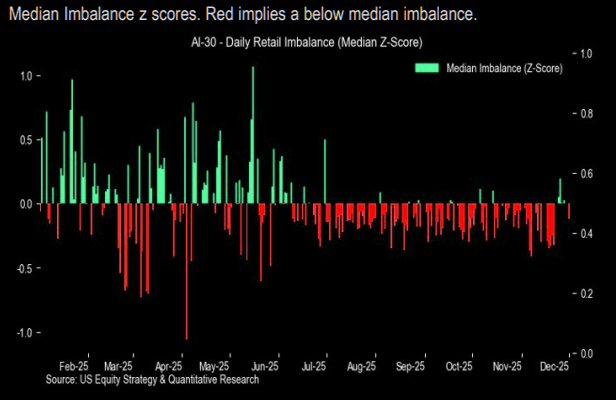

Less AI love from retail

"Buying JPM AI30 Stocks at a below Median Pace Since July."

Source: JPM

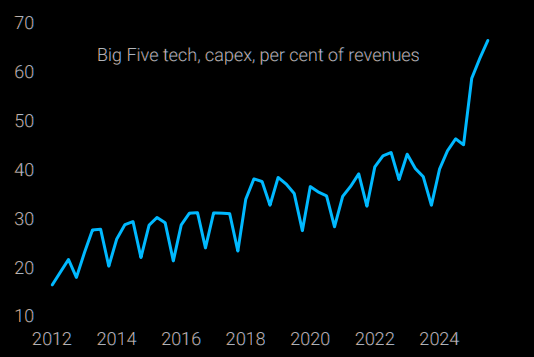

The AI boom

Needs a bigger chart...

Source: TS Lombard

AltMode

The Information on Altman vs. Amodei

1. Anthropic looks increasingly like the steadier, more disciplined AI bet, with a business-first strategy, earlier profitability prospects, and Dario Amodei’s risk-aware leadership contrasting sharply with OpenAI’s approach.

2. Sam Altman’s “YOLO” expansion spree, from chips and data centers to devices, robots, search, and even exploring a rocket-company acquisition, has stretched OpenAI far beyond ChatGPT despite no clear path to profitability and $1.4T in compute commitments.

3. OpenAI’s new “code red” may force strategic focus, but unless Altman can abandon his moonshot mindset, investors might prefer he become chair while someone more grounded runs the company, “OpenAI’s own Dario Amodei”.

DeepSeek can

This is not nanoseconds behind... "We expect the V3.2 model will further boost GenAI adoption in China in the next few quarters. Within JPM’s China AI coverage, beneficiaries include: Alibaba, Tencent, Baidu, AMEC, NAURA, Huaqin and Inspur." (JPM)

Source: JPM

At a fraction of the price

China continues to deliver top notch AI models at a fraction of the price...

Source: JPM

AI matters

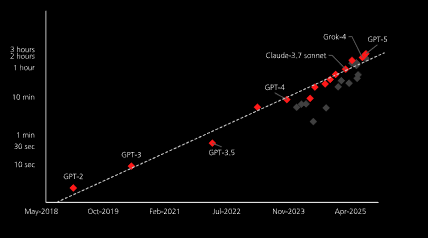

A rather self explanatory chart.

Source: UBS

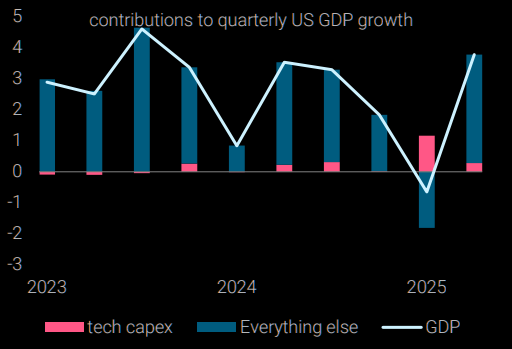

More to it than AI

US economy isn't only about AI...

Source: TS Lombard

Good luck (hu)man

"The longest human task (by duration) that an LLM can complete with at least 50% success rate is doubling every 7 months."