Amazon Trades at a Discount to Walmart — Let That Sink In

Two retail giants, two very different stories

Faster growth, cloud dominance, AI exposure… yet the market is paying more for Walmart. Walmart’s shares have surged to peak multiples, while Amazon’s valuation has compressed despite improving fundamentals. Sometimes the market’s favorite trade isn’t the best one. Let's have a look at the divergence and some aspects for the AMZN bull case.

Cheaper than Walmart

AMZN now trades at >10x discount to retail peer WMT, despite a faster earnings growth profile over 25-27.

Source: Deutsche Bank

Christmas came but only for one

AMZN has basically been flat-lining since late November, while WMT is up some 25%.

Source: LSEG Workspace

WMT crushing it

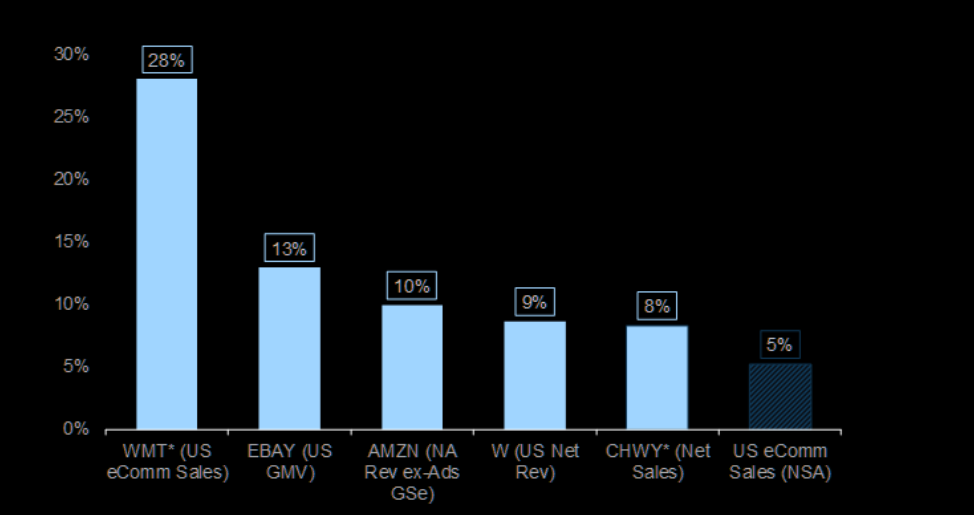

Massive market share gains.

Source: GS

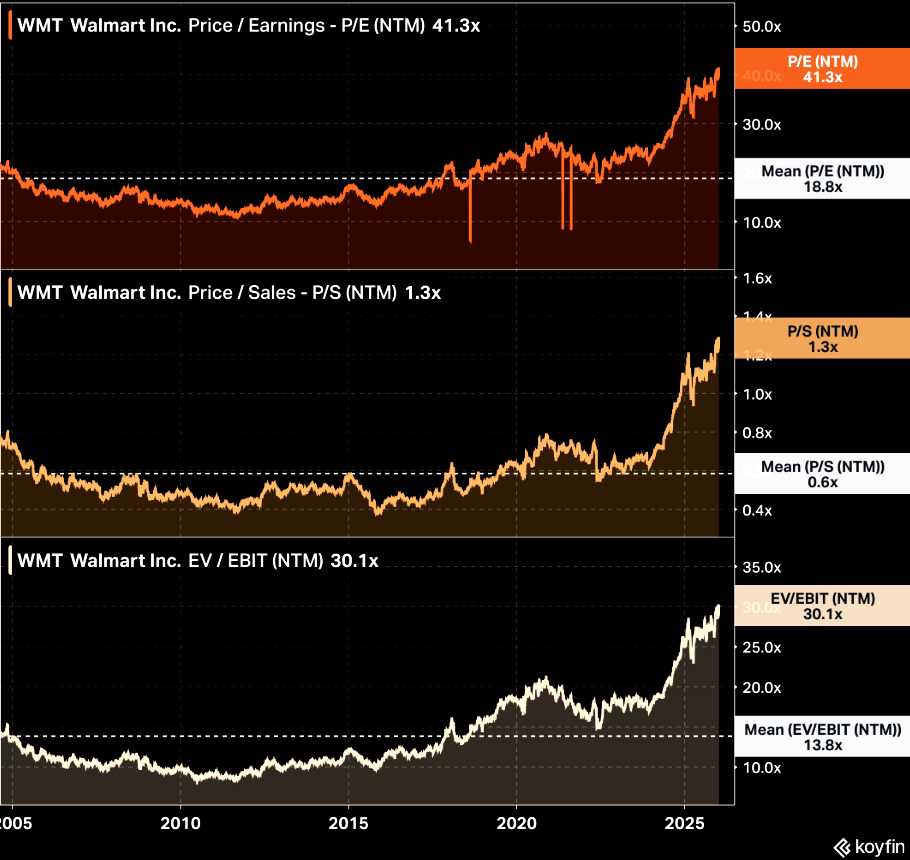

Peak WMT

Walmart is trading at peak valuation multiples right now.

Source: Koyfin

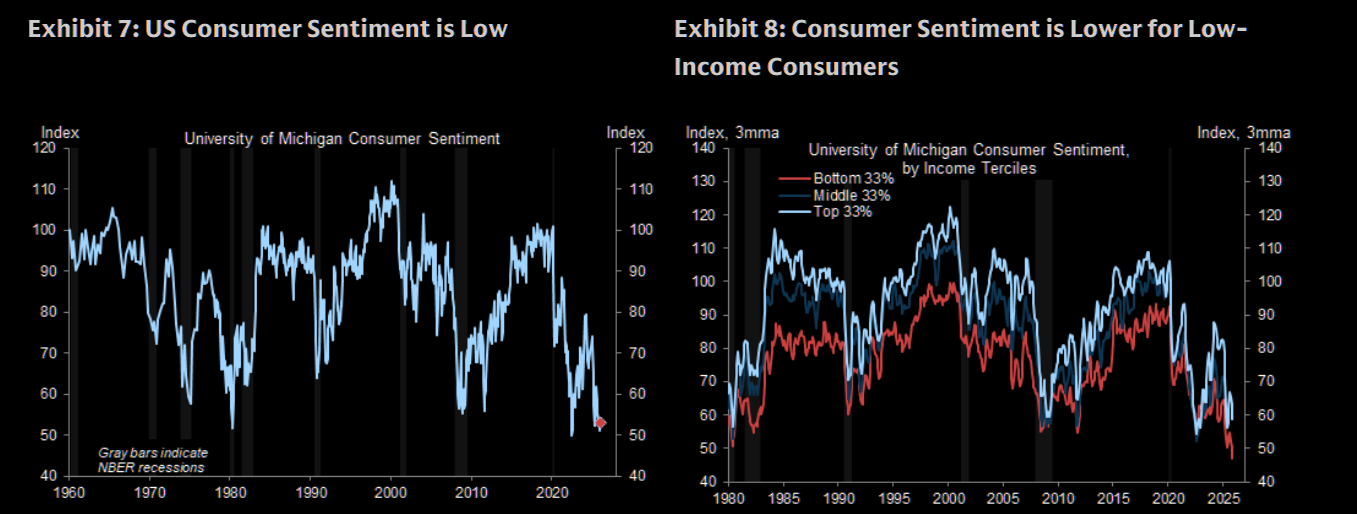

Bifurcated consumer

This macro snippet does not really help to explain what is going on.

GS: "Consumer confidence remains relatively depressed (relative to historical levels) and remains below GFC levels. Looking more closely, consumer sentiment also remains bifurcated by income and remains elevated for higher-income consumers and more depressed for lower-income cohorts."

Source: Goldman

Zooming out

Pretty solid 3 year performance for both of them though.

Source: LSEG Workspace

Looking just at AMZN

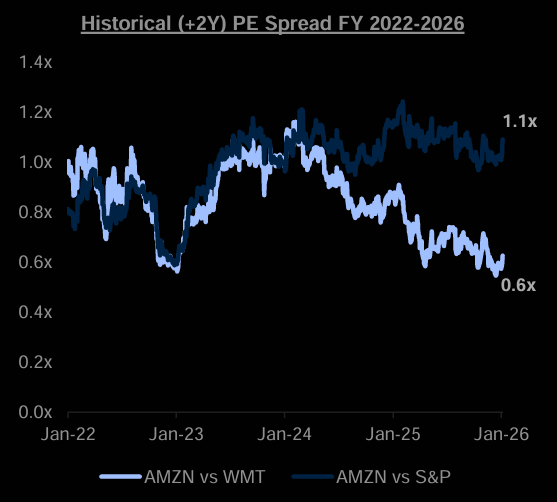

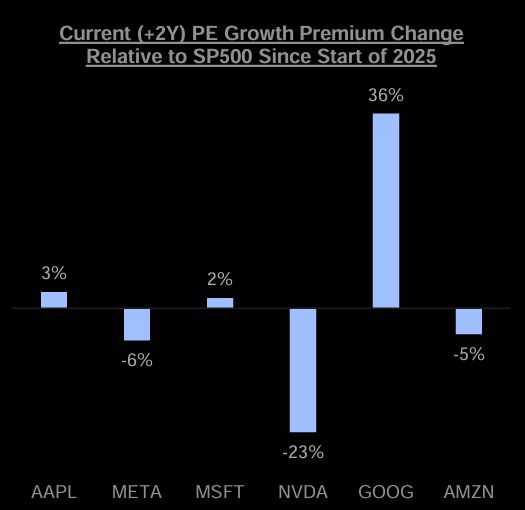

Contracted premium

Not only vs. WMT... AMZN’s premium versus the market has contracted by ~5% substantially below other Mag 7 names like GOOG and AAPL and MSFT.

Source: Deutsche Bank

The bull case

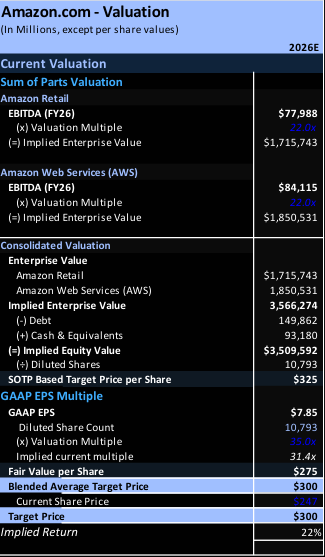

Deutsche Bank sees AMZN as a $300 stock (Goldman too BTW).

"With earnings that we expect to compound at a mid-to-high teens rate consistently over the coming years, leverage/market leadership to two of the largest secular shifts in the global economy (shift to e-commerce & shift the cloud / AI), growing market leadership in digital ads / connected TV, multiple other potential sources of incremental profitability (AI enabled home assistants, delivery of off platform goods, satellite delivered broadband, etc), and consistent downward pressure on the company’s cost to serve in its e-commerce business, Amazon earnings potential screens as robust as it has been in several years in our view."

Source: Deutsche

The No1 hyperscaler

Deutsche Bank says that Amazon is likely to add the most data center capacity amongst hyper scalers peers in the next 12-24 months. Here are some AMZN quotes:

1. “We've been focused on accelerating capacity the last several months, adding more than 3.8 gigawatts of power in the past 12 months, more than any other cloud provider.”

2. “3.8 gigawatts of capacity in the last year with another gigawatt plus coming in the fourth quarter, and we expect to double our overall capacity by the end of 2027.”

3. “To put that into perspective, we're now double the power capacity that AWS was in 2022, and we're on track to double again by 2027."

Deutsche Bank: "Closer to 6-7GW added in 2026, and incremental revenue / GW added between $1.2bn and $1.4bn would drive between 200 and 650bps of revenue upside to Street AWS estimates in 2026."