Bitcoin Gets Massacred: Narrative Dead, Structure Broken

Benjamin Bitcoin

Like Benjamin Button, Bitcoin has been sold as anti-fiat money, gaining value as dollars age into dilution. Before 2025, that narrative held: BTC rose with falling USD and expanding global M2. Since 2025, the relationship has flipped. Bitcoin now trades less like anti-fiat money and more like a growth asset, moving with the NASDAQ-100 and reacting positively to dovish Fed pivots and negatively to hawkish ones, leaving the original thesis looking increasingly frayed. (Stifel's great macro team)

Note weekly RSI approaching the lowest reading in "forever".

Source: LSEG Workspace

That HS

We flagged the massive BTC head-and-shoulders not long ago (here). The neckline break was aggressive and the free fall has picked up speed.

Source: LSEG Workspace

Fast market

Bitcoin RSI at 21.5 earlier today was "bad"... but we are now at 17.9, most oversold since June 2022.

Source: LSEG Workspace

Approaching

Bitcoin's 200 weekly MA approaching, currently just below the $60k level.

Source: LSEG Workspace

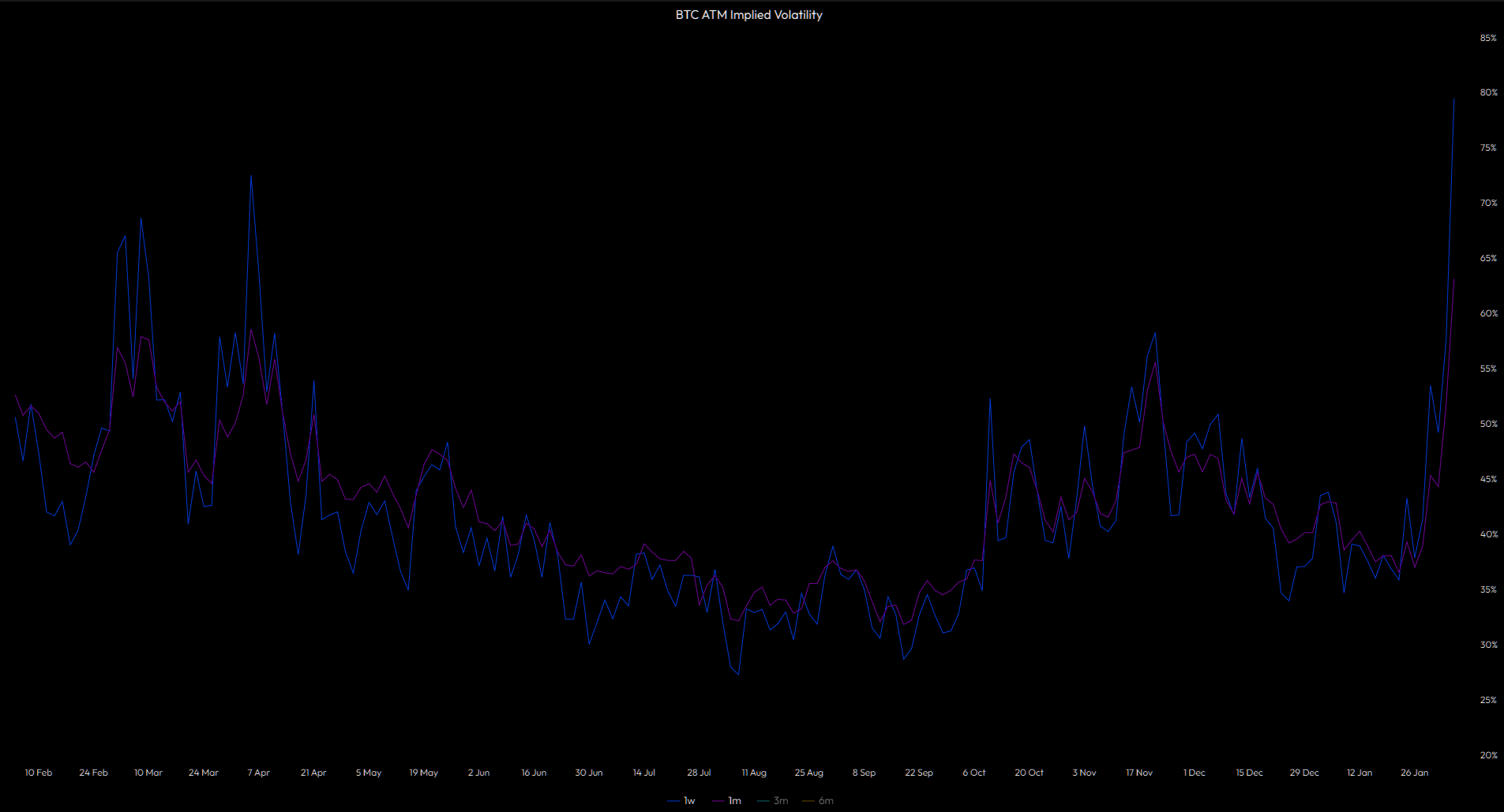

Reviving

Bitcoin volatility finally showing some stress...

Source: LSEG Velodata

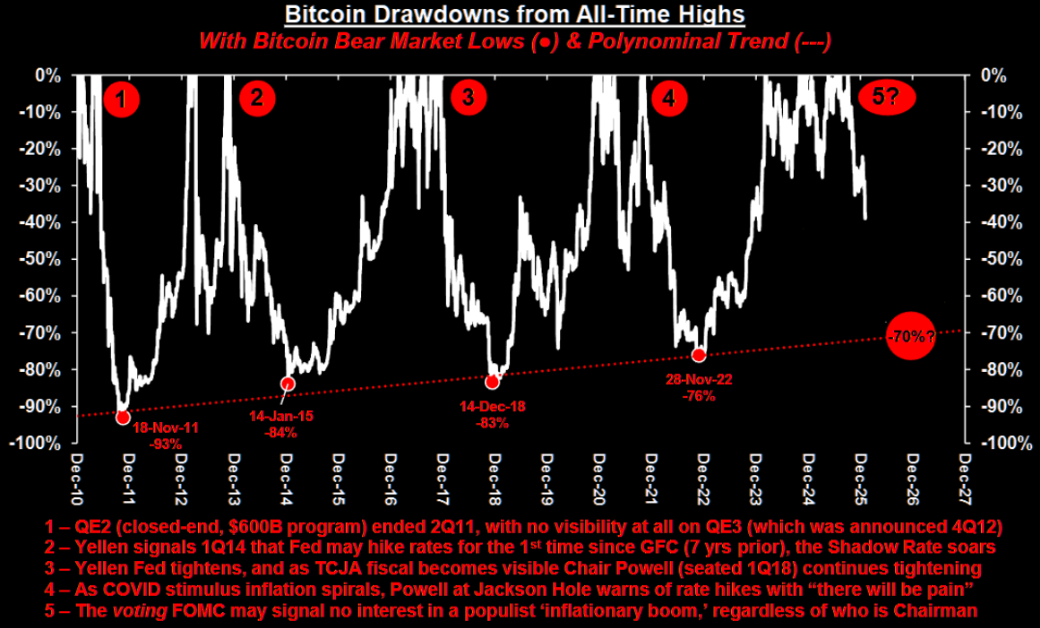

How low can it go?

Applying the "normal" 70% drawdown would imply $38k for BTC.

Source: Stifel

That Jaws gap

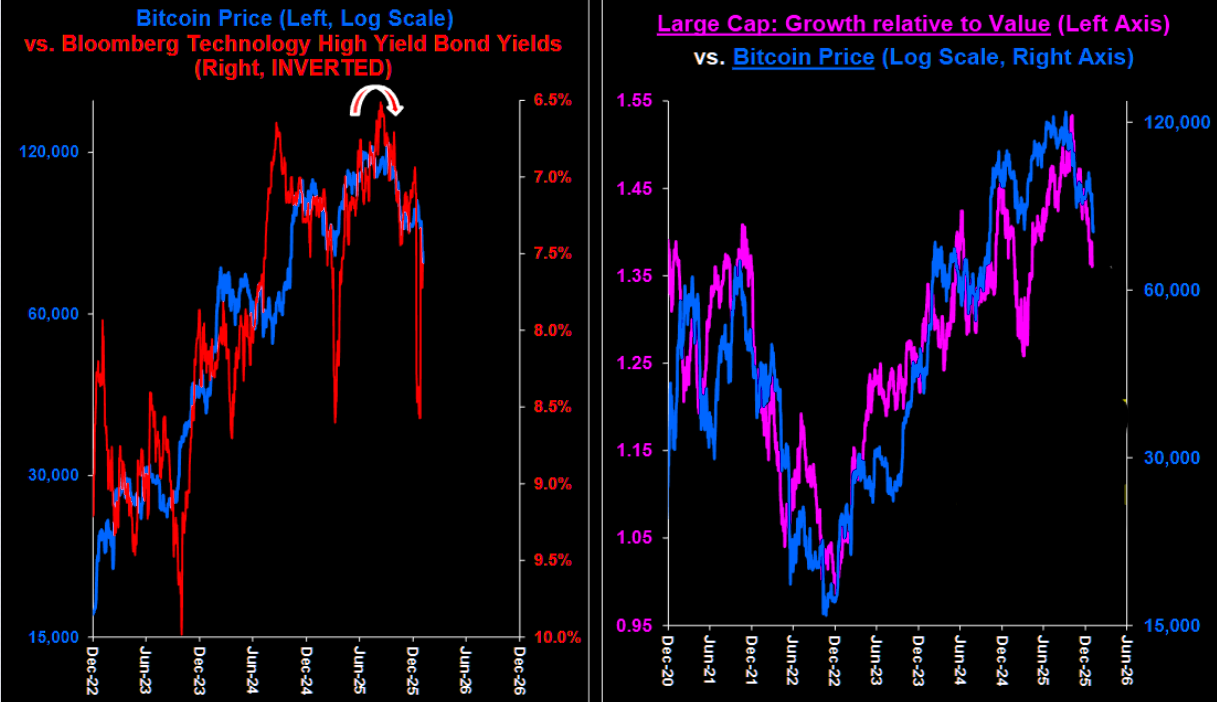

Hard to disagree with Stifel's Bannister: "Bitcoin (like NASDAQ 100) moves with dovish vs. hawkish Fed shifts, and recent ‘hawkish cuts’ are ominous for both".

Source: LSEG Workspace

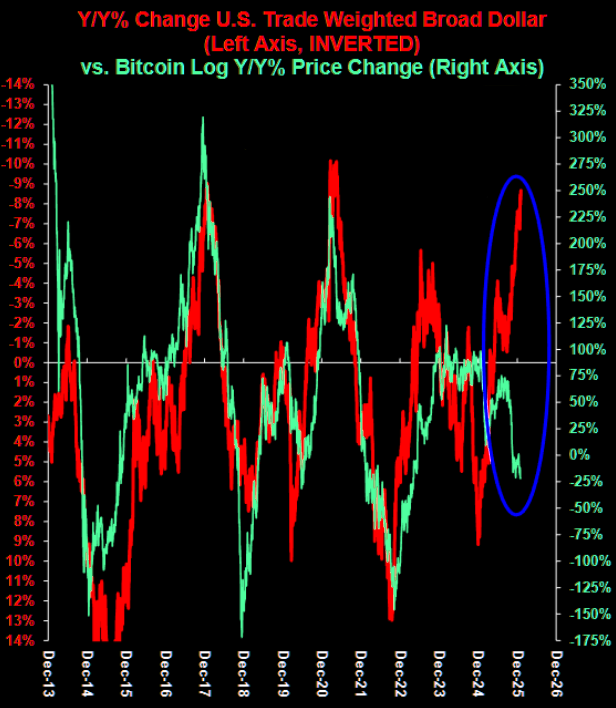

The fiat money hedge

That stopped working a while ago, but people still talk about it as a narrative.

Source: Stifel

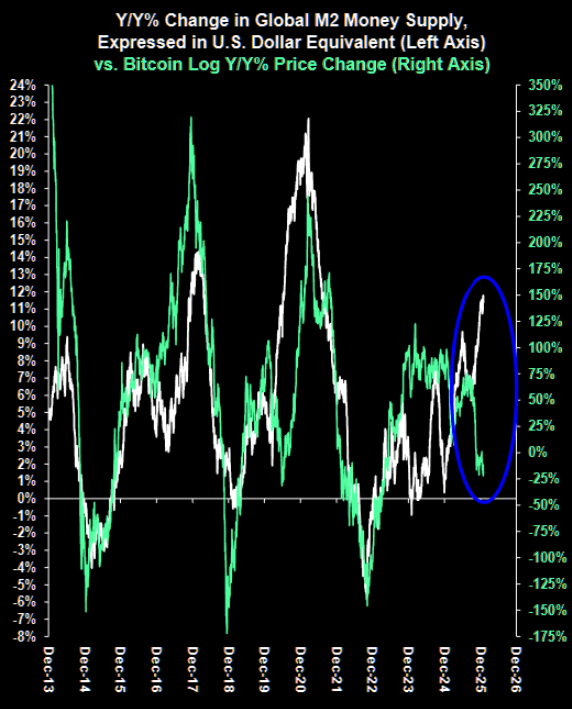

What about the liquidity connection?

Bitcoin once thrived on excess dollar liquidity. That relationship broke in 2025. Trading old narratives is dangerous...

Source: Stifel

Bitcoin and large tech

Since mid-year lows, tech credit stress has risen, dragging Bitcoin lower as it trades like a speculative tech asset. Bitcoin also tracks Large Cap Growth relative to Value, making the joint selloff particularly notable.