Breakout or Bull Trap? Valuation Hubris Means No Room for Mistakes

To break up, or not to break up

SPX is flirting with range highs, futures closing at ATHs, with VIX sub 15. Ranges demand a mean-reversion mindset, until they don’t. Decision time is approaching, but imploded vol here isn’t rich for directional bets.

Source: LSEG Workspace

King dollar

DXY is snapping the big downtrend line. Yes, the 97/100 range still contains price, but a return above the 200-day, a rare event in this dollar bear, raises the stakes. This may be a bigger deal than it looks...Hartnett on the dollar: "US flip from exceptionalism to expansionism is best case for a contrarian US dollar long". More here.

Source: LSEG Workspace

Black gold

Oil is smashing through the negative trend line. Even more notable, crude is set to close above the 50-day, something we’ve barely seen in recent months.

Source: LSEG Workspace

Juicy gap

That gap vs BCOM index is huge...

Source: LSEG Workspace

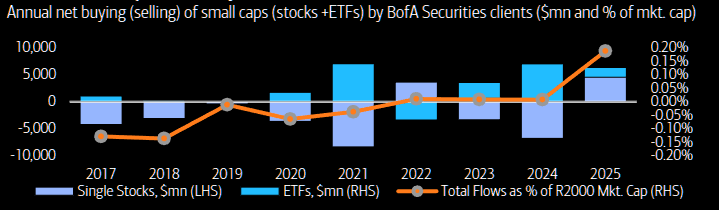

Small cap inflows

Now that's new. Latest note on the Russell squeeze here.

Source: BofA

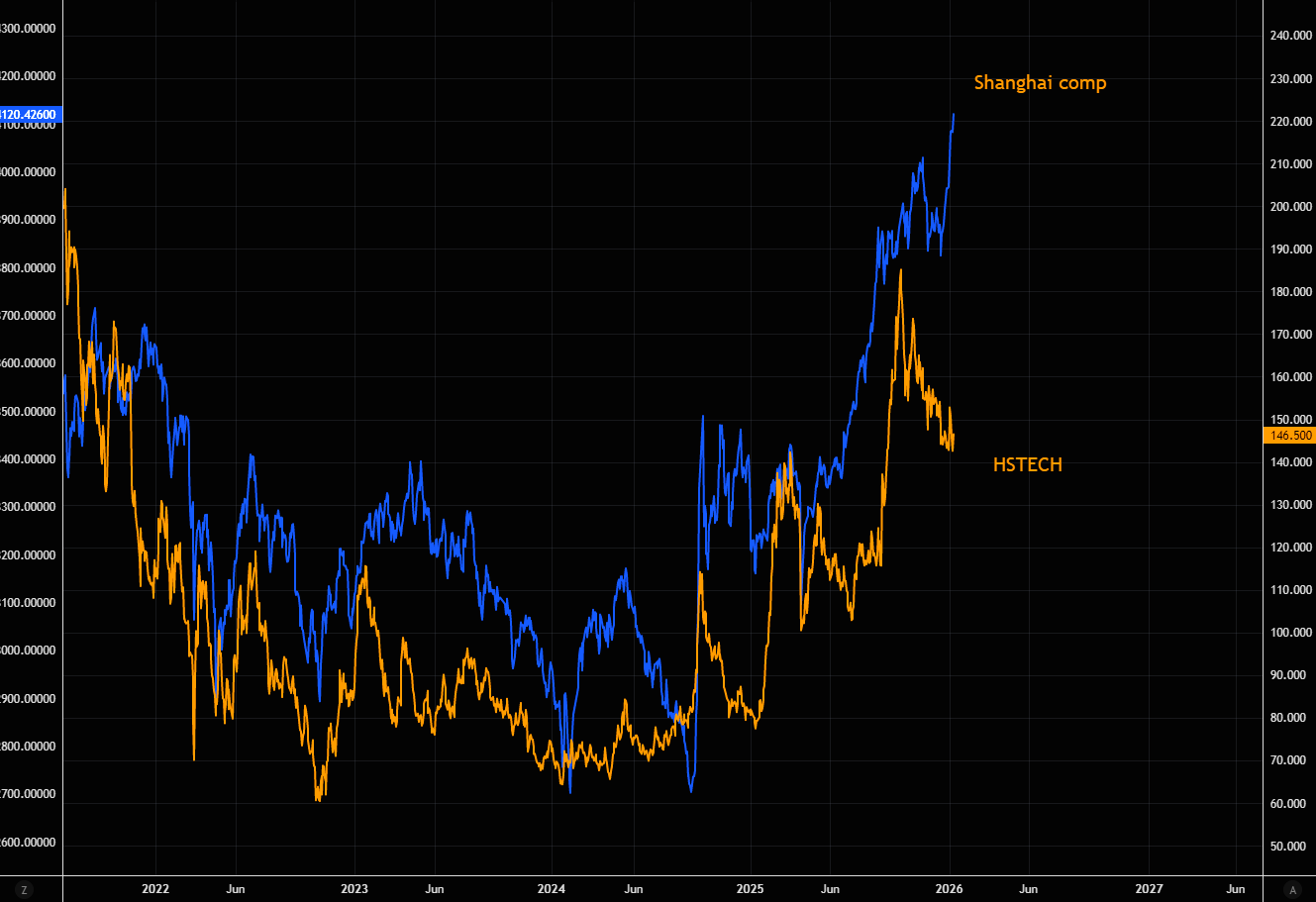

Schhh - Shanghai soaring

The Shanghai Composite keeps ripping, extending the melt-up. Remarkably, the latest China bull is still barely on the radar (for more see here and here). Even a push toward trend-channel highs implies meaningful upside from here. Yes, RSI is stretched, but overbought has a habit of staying overbought much longer than consensus dares to imagine.

Source: LSEG Workspace

The massive laggard

For how much longer can the China bull continue and tech lag? More here.

Source: LSEG Workspace

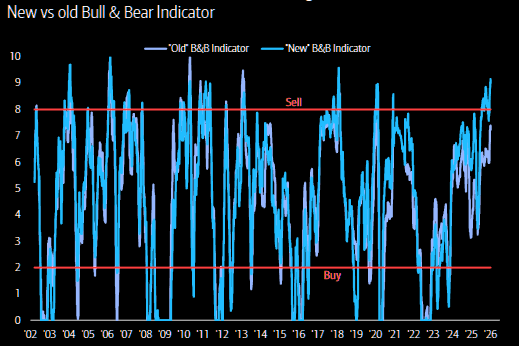

Overshooting

BofA's new modified bull/bear indicator in full blown overshoot mode...

Source: BofA

Valuation hubris.

"US stock market is now trading at a circa 3x ratio vs money supply. This us up 100% since the 2022 trough and above the 2000 dot com peak. Global stocks, commodities, govt bonds and credit combined posted a +50% year..for the best aggregate performance since 2009. Not much margin for error". (Bobby Molavi, GS)

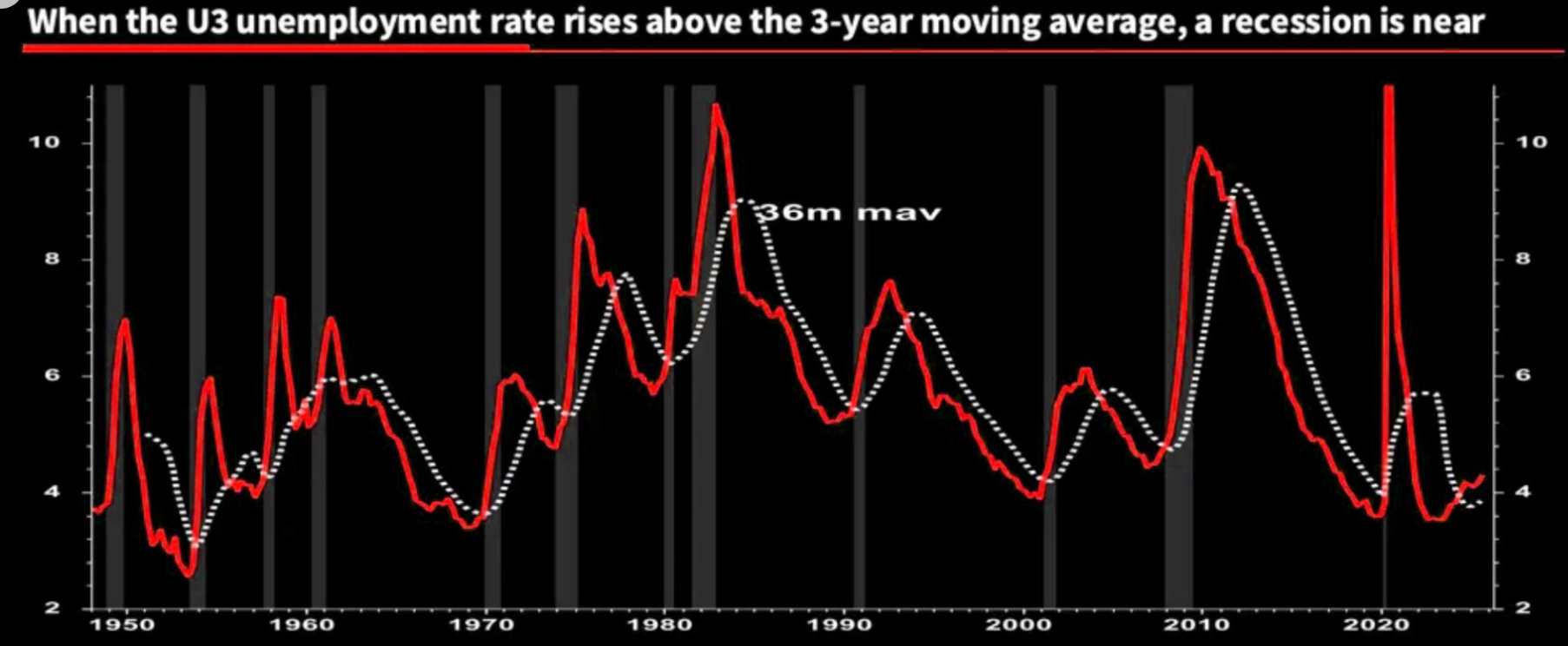

Recession reflections

"No-one is predicting a US recession in 2026 despite this simple indicator having a 100% track record of success. This time may well be different, but you've got to have a bloody good reason to ignore this. Are you feeling confident". More bearish bullets here.