Calm Is Crowded — Contrarian Sell Flashes Red

Contrarian sell

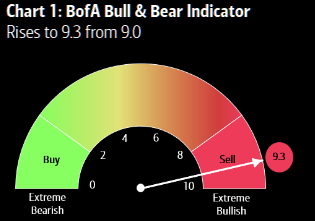

BofA’s bull/bear indicator hits its deepest contrarian sell zone since February 2018.

Source: BofA

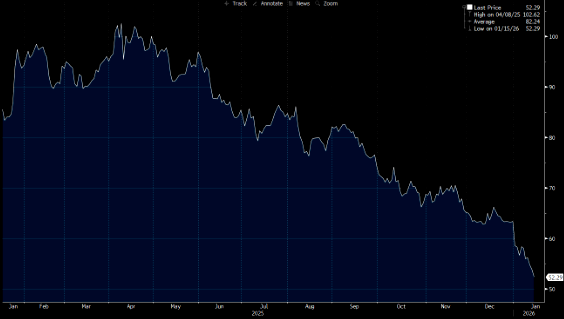

The 10 year

US 10 year flirting with the big 4.2% level. A decisive close above it and rates could move quickly... More on rates here.

Source: LSEG Workspace

The MAG 5 fade

"The Mag5 companies excluding Google have lagged the broader US market excluding the Mag7 (X7)…". Latest MAG 7 charts here.

Source: GS/Bloomberg

Bubble gone

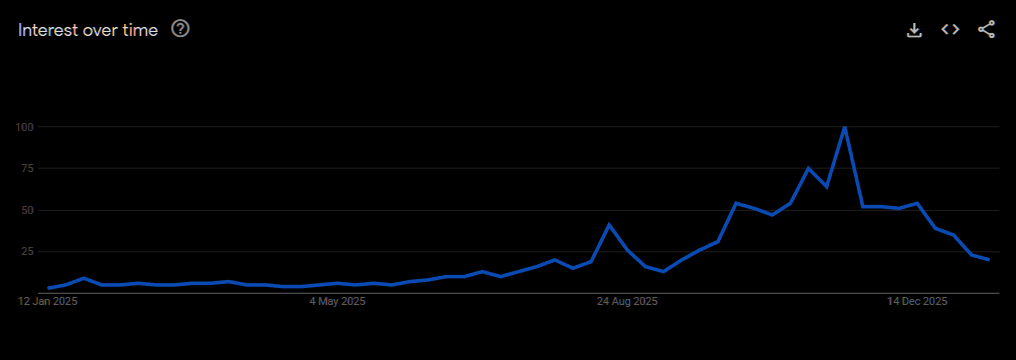

AI bubble as search has crashed...

Source: Google Trends

Semis eating software

Nothing new really, but things are getting increasingly extreme. Chart 2 shows the SOX inside the big trend channel. Still room to move higher before we reach the upper part of the channel, but note RSI at the highest since the October peak.

Source: Bloomberg(GS

Source: LSEG Workspace

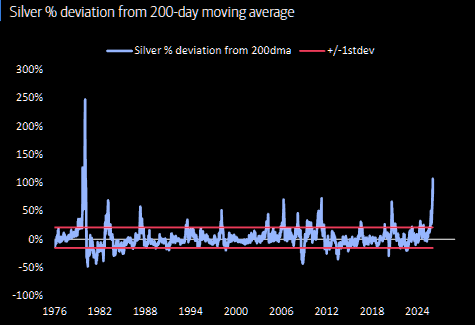

Probably better entry points

Hartnett points it out: "...silver 104% above 200-day moving average = most overbought since 1980." Latest note on silver here.

Source: BofA

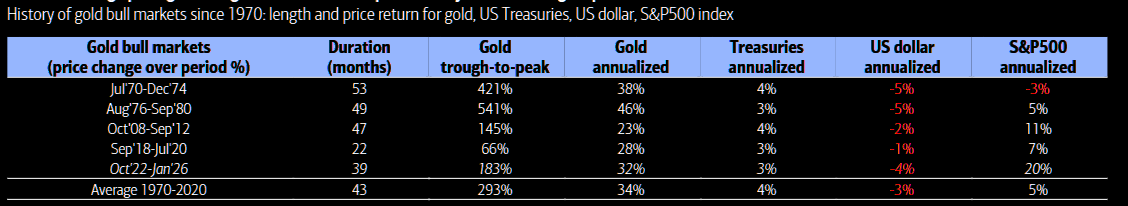

Gold 6k

Hartnett: "...always strong pullbacks in overbought bulls but case for higher allocation to gold (currently 0.6% for BofA private clients) intact; average price gain in 4 gold bull markets of past century ≈300%...i.e. gold peaks >6k."

Source: BofA

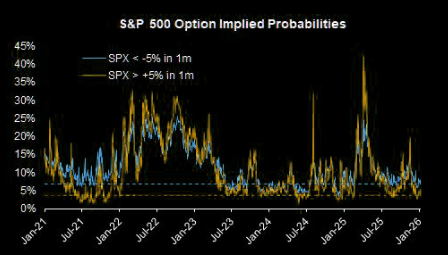

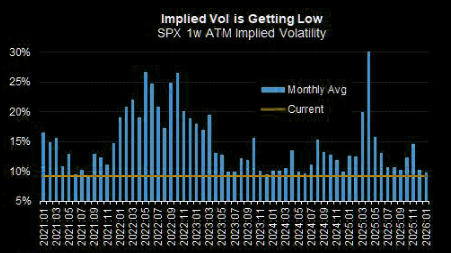

Cheap options

Options markets are pricing just a ~10% chance that the S&P 500 moves more than ±5% over the next month (14th percentile vs. the past five years). One-week SPX implied volatility has dropped below 10%, back to summer-2024 lows. Volatility is suppressed as positioning looks one-sided, but these levels offer an attractive opportunity to add optionality according to MS QDS team - upside or downside.

Source: MQ QDS

Source: MS QDS

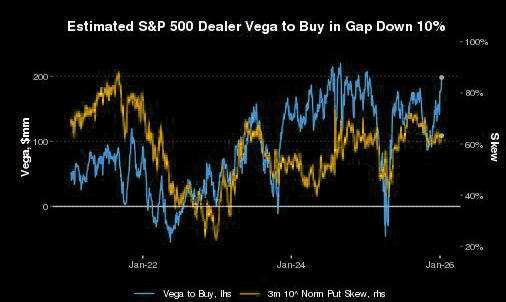

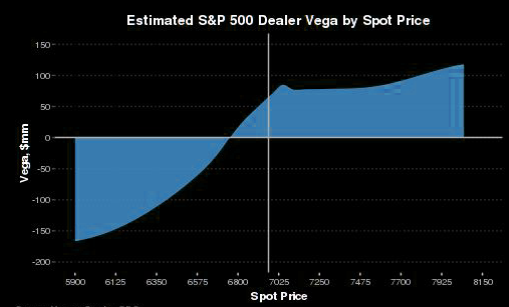

Long VIX calls look increasingly attractive

Dealers are short downside vega, yet skew hasn’t steepened. In a 10% gap lower, dealers would need to buy ~$200mm of SPX vega, similar to levels seen just before the August 2024 volatility spike, suggesting a volatility squeeze isn’t priced. Implied correlation is also near lows, adding further upside convexity to SPX implied volatilities. (MS) Latest note on volatility and VIX protection here.

Source: MS QDS

Source: MS QDS

King King KOSPI

The king of index performance last year has started the year with another bang. Note we are now overshooting the trend chanel, and RSI is at recent peak levels, trading around 85. Full Gangnam style note here.