China Tech Squeeze Is On, Metals Go Full Upside Panic

Shanghai squeezing

Shanghai is still in full melt-up mode after the textbook breakout. We’ve now gone 17 straight sessions without a single bearish candle. Momentum is undeniable, but with RSI pushing 81, we’re deep into overbought territory, but as we all know, overbought can stay overbought for longer than most think possible.

Source: LSEG Workspace

China tech

HSTECH is printing a big up candle, up more than 3% on the day. We laid out the bull case recently (here). Note the clean bounce off the longer-term trend line and the 200-day not long ago, and now the decisive push back above the 100-day.

Source: LSEG Workspace

Got KWEB?

KWEB bounced on the break out level and is now taking out the negative trend line. This tech laggard has huge catch up potential. More on this set up here.

Source: LSEG Workspace

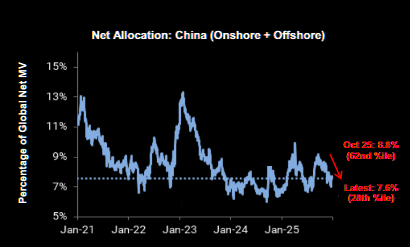

Plenty buy potential

The China long remains rather depressed when zooming out. More on China fundamentals and Goldman's latest bull logic here.

Source: GS

Source: GS

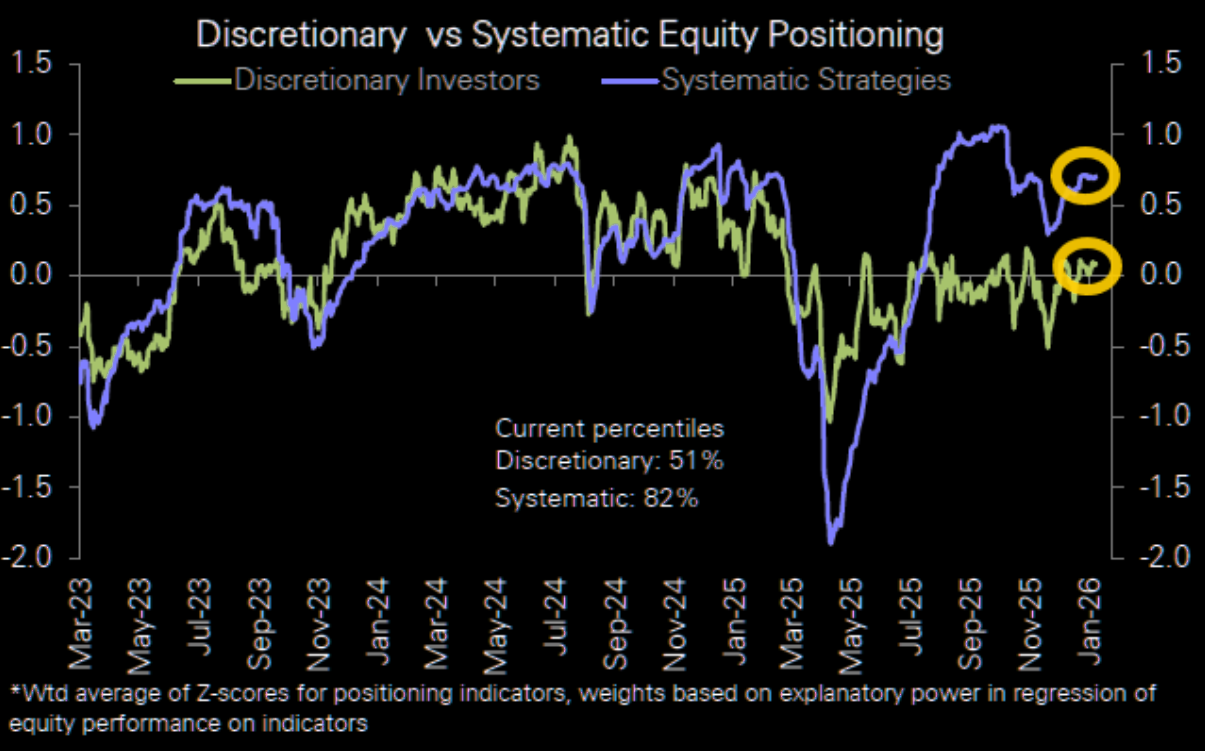

Cautiously near neutral

Deutsche Bank: "Notably, while investor sentiment has risen meaningfully over the last 6 weeks, positioning in our reading has not yet followed, with discretionary investors are still holding cautiously near neutral (0.09sd, 51st percentile). Systematic strategy positioning though is higher (0.71sd, 82nd percentile)." Latest note on positioning here.

Source: Deutsche Bank

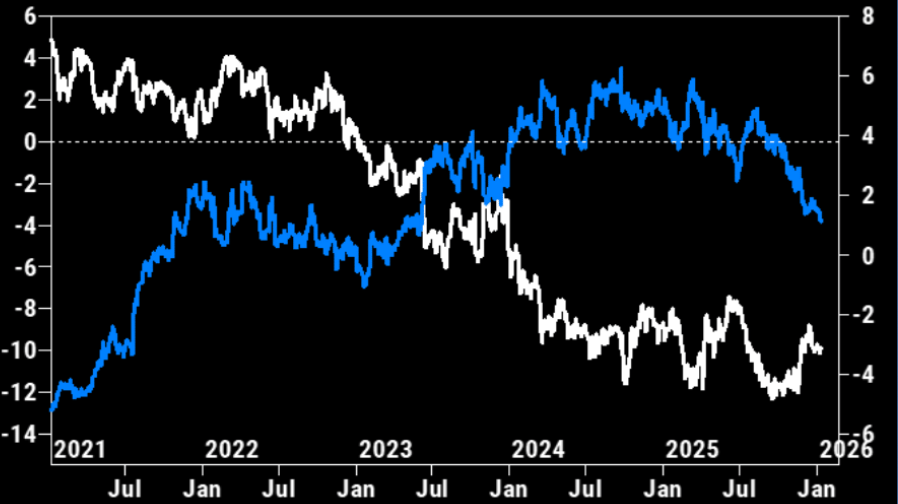

HFs hating

HFs net sold European equities for a 5th straight week (9 of the last 10). More on Europe here.

Source: GS Prime

Will they ever...

...step up and increase the long? Gold net non commercials stay stubbornly underexposed to the great gold bull.

Source: LSEG Workspace

RSI 94!

Gold monthly RSI rounded off trades at 94! Nothing for the short term crowd to care about, but this is extreme. Latest read on gold here.

Source: LSEG Workspace/h/t Edwards

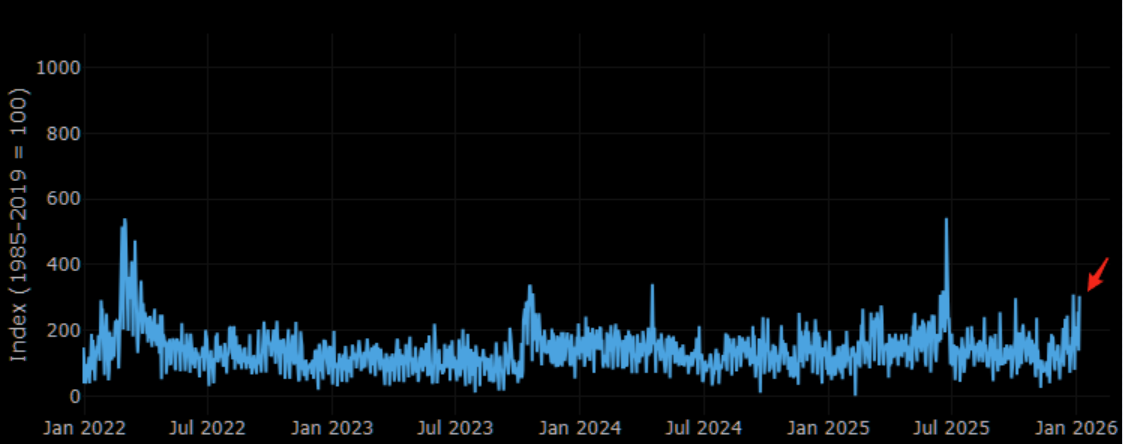

Upside panic in a pic

Silver volatility taking out new highs as well. This is pure panic where underexposed investors grab upside optionality in order to show any exposure. Full silver note here.

Source: LSEG Workspace

Also a geopolitical hedge

Gold remains the primary safe haven, but silver plays the same role, just with more beta. Rising geopolitical stress has been a key driver of silver’s rally, with conflicts and global power tensions pushing investors toward hard assets. Geopolitical risk indicators are now near Ukraine-invasion highs, reinforcing silver’s role as a hedge against both geopolitical and economic uncertainty, writes HSBC.