Crowded Semis, Software Smoked, Silver Slaughtered

Suddenly in SOX

SOX has seen aggressive downside action over the past few sessions. For now, this still looks like a much-needed pause, with both the 50-day and the steep trend line holding. Let’s see how it develops, but SOX can’t really afford to close meaningfully below the 50-day.

Source: LSEG Workspace

Ehhh

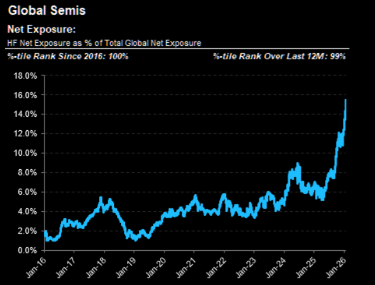

Still confident about that semis long? Yesterday's velocity and contagion have been amplified by extreme crowding in global semis. Heading into today, semis represented 16% of hedge fund exposure versus 6% a year ago. In dollar terms: "YTD buying in semis is over five times larger than any other industry, roughly half of total semis demand seen in all of 2025, and exceeds full-year 2025 demand for every other industry outside semis". Let that sink in. More here.

Source: MS

Do or die?

Absolutely massive levels in software here. More on software here.

Source: LSEG Workspace

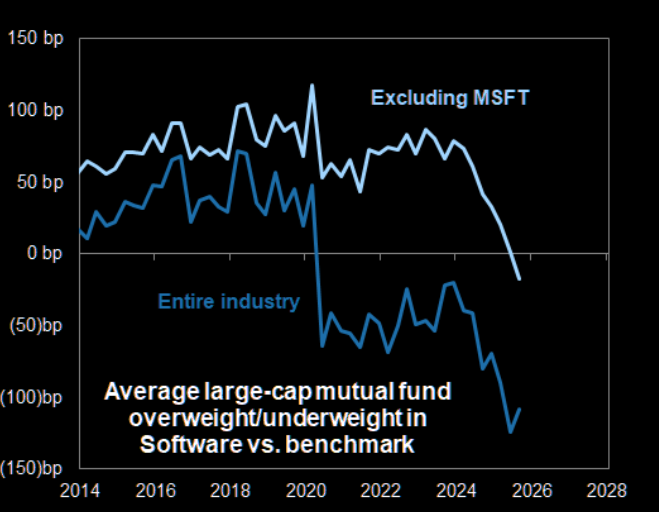

Bear case might simply just become the norm

GS on software: "We expect it will take 2-3 quarters of stable fundamentals for investor sentiment to improve – and even then, there is a scenario where the bear case simply gets pushed out to future years."

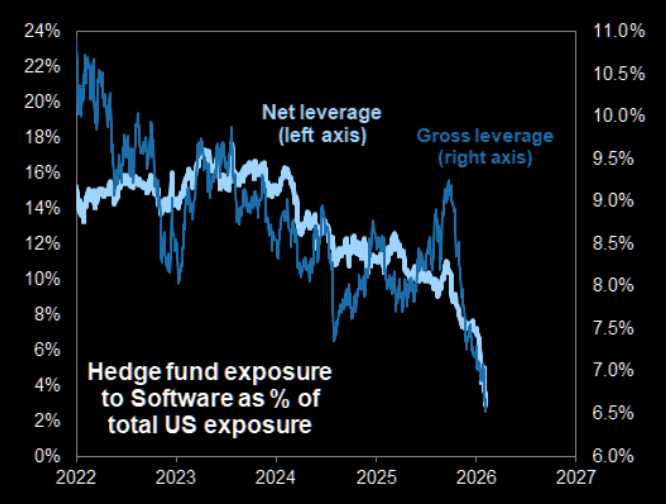

Hedge fund net leverage collapsed

Hedge funds have recently slashed exposure to Software. Net leverage down from 16% to 2%.

Source: GS Prime

Mutual funds now underweight

Mutual funds have reduced their Software exposure.

Source: EPFR

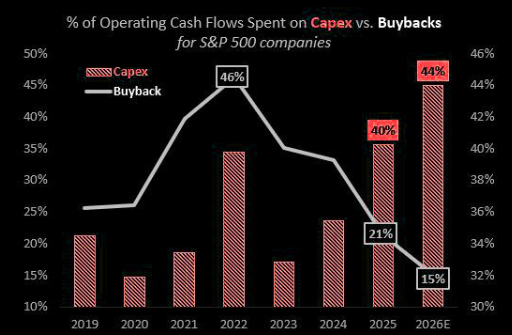

CAPEX eats Buybacks

Can't have both...

Source: Nomura

How low can it go?

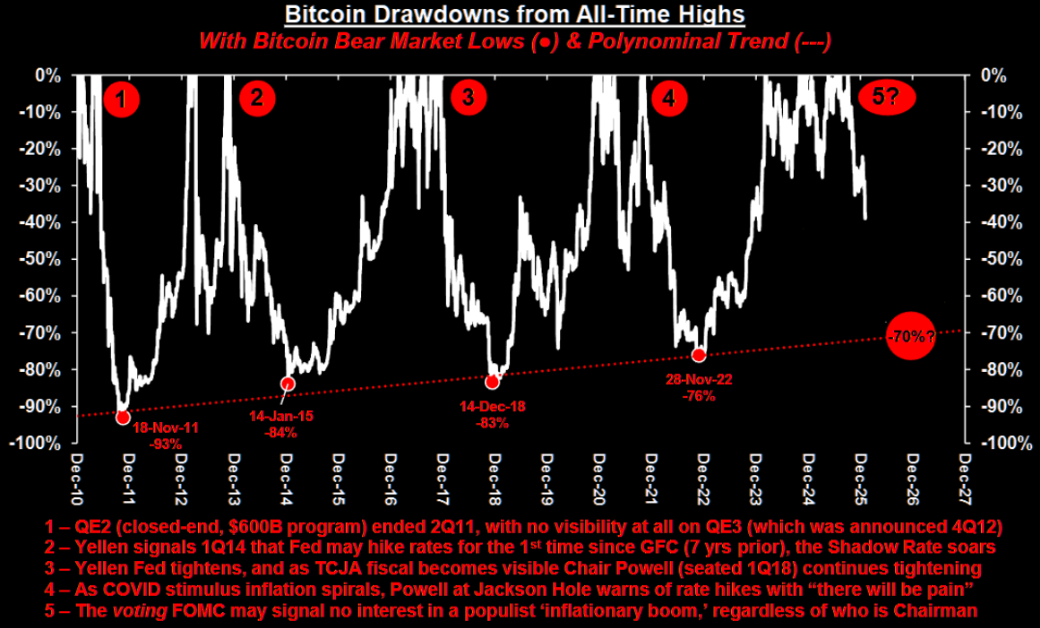

Applying the "normal" 70% drawdown would imply $38k for BTC. More on the BTC crash here.

Source: Stifel

Always

Parabolic moves always end in tears. Back in late January, in Silvergeddon, we flagged the downside risks in silver, writing: “Silver’s super-squeeze is running out of superlatives. Price action now looks more like a meme stock than a ‘serious’ hard asset.” At the time, it was all “fundamentals,” according to the pundits. Now it’s suddenly all psychology and technicals, from the same crowd.

Technically, silver reversed right at the 21-day MA on the bounce and is now taking out the 50-day, printing a nasty down candle as of writing. $72 is the key level to watch. A close below it leaves little meaningful support until much lower, with the 200-day sitting around $50.

Source: LSEG Workspace

Oversold...

...but silver is far from extremely oversold. Latest note on silver bagholders here.