The Dangerous AI Trade

The shift

1. Investors are moving away from the “AI lifts all boats” growth story and starting to separate likely winners from potential losers.

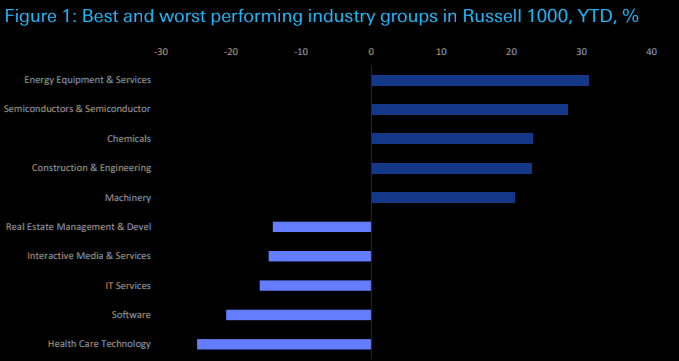

2. Since ChatGPT launched in November 2022, AI “picks and shovels” (hardware, infrastructure) have outperformed, while software and services, where disruption risk is unclear, have lagged.

3. In the Russell 1000 this year, energy equipment and semiconductors are up ~30%, while software and healthcare tech are down more than 20%. (DB)

Source: DB

Vibe coding not enough

1. A wave of real-world AI launches has intensified fears that model makers will disintermediate specialist customers by offering cheap, general-purpose tools directly to end users.

2. Anthropic’s Claude Opus 4.6 and its rapidly built Claude Cowork agent show how advanced AI can automate complex multi-step professional tasks like legal analysis and documentation.

3. Disruption is spreading across sectors: Algorhythm says its SemiCab AI can scale freight volumes without extra headcount, while Altruist claims its Hazel platform can deliver tax strategies in minutes.

4. Although many SaaS firms have strong data and workflow moats, “vibe coding” and a slick AI interface won’t be enough, they must deeply embed integrated AI into their core systems or risk being reduced to back-end plumbing as model makers move closer to the customer.

Chart shows the IGV trading in huge make or break levels. Think vibe coding is enough to crush that support level?

Source: LSEG Workspace

Risk

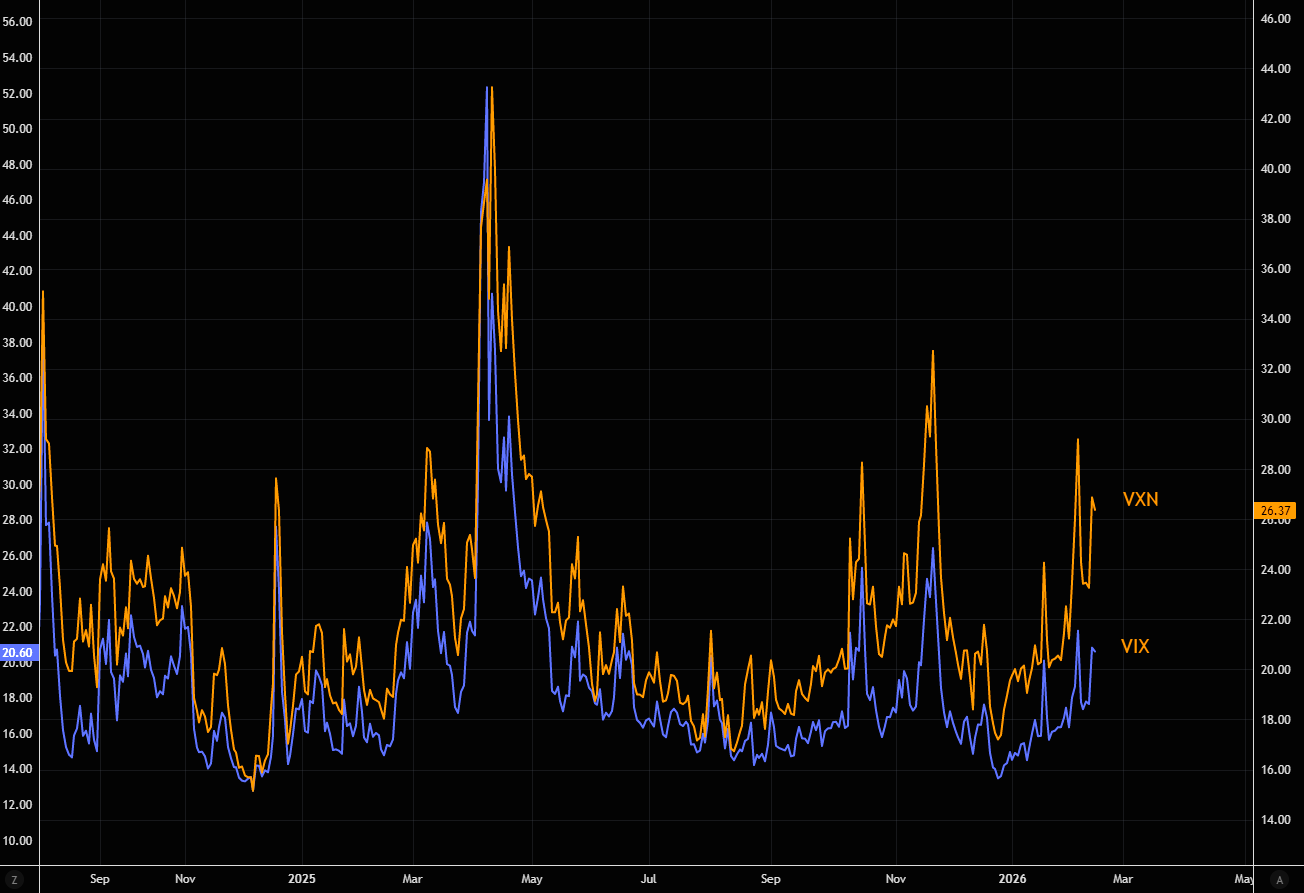

1. AI valuation is getting trickier as markets move beyond the Magnificent Seven dominance (still ~30% of the S&P 500) and question whether AI is overhyped, even as adoption in coding, agents, and labor markets accelerates.

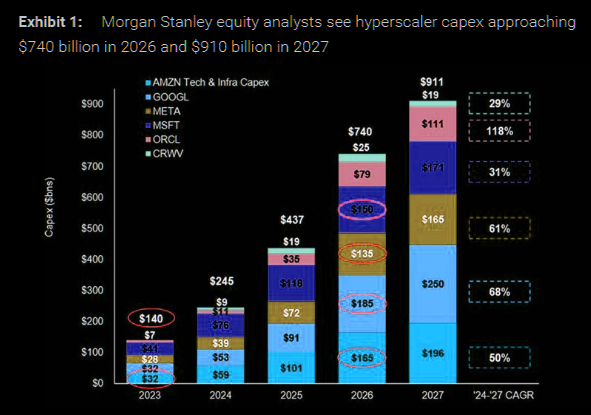

2. Capex is exploding, with hyperscalers potentially spending $700bn+ on AI data centres this year and trillions by decade-end, increasingly funded not just by cash flow, but by rising debt issuance.

3. Credit markets are flashing early stress signals: while overall spreads remain tight, AI-linked names like Oracle and CoreWeave have seen sharply widening CDS, suggesting investors are starting to price in risk.

4. Equity volatility is also diverging, with Nasdaq volatility (VXN) showing far more fear relative to the VIX, a sign that stress is increasingly concentrated in tech and AI-linked names.

Source: LSEG Workspace/DB

AI commoditised

1. AI feels suddenly more imminent, increasing both upside for those who adopt it aggressively and downside for those who don’t. Industry voices like Matt Shumer (OthersideAI) warn that AI is already replacing core technical work and must be used seriously to avoid being left behind.

2. Productivity gains may be materialising, with Stanford’s Erik Brynjolfsson arguing that rising US productivity reflects a shift from AI experimentation to structural utility, the upward side of the “J-curve” effect.

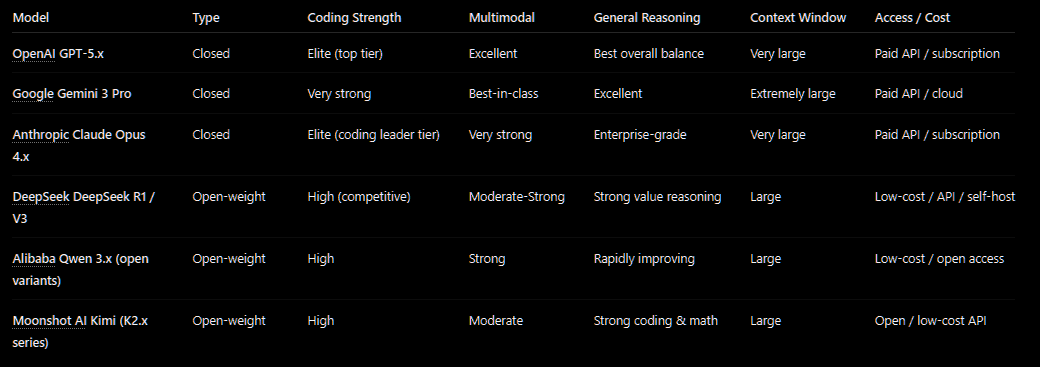

3. The competitive landscape is fragmenting: OpenAI faces monetisation pressure and IPO speculation, while Anthropic gains enterprise traction, Microsoft partnerships evolve, and Google leverages scale, with low-cost Chinese open-weight models adding further pressure.

4. AI models may be commoditising, implying that long-term value could shift away from foundation models toward yet-to-be-built applications, adding uncertainty and giving investors reason to pause. (DB macro)

Table shows top 3 closed vs open (Chinese) models. Closed models still lead the absolute frontier, particularly in multimodal capability and deep reasoning. Open-weight models are now highly competitive in coding and cost-efficiency, with the main gap increasingly about deployment flexibility and price rather than raw performance.

Source: DB/TME

Where do we go from here?

Sector sentiment is likely to remain fragile, with no clear catalyst to decisively shift the narrative, a view echoed in recent commentary from Morgan Stanley. As Kolanovic noted last week, “To rally, ironically, market will need a hyperscaler or a software company to say they will stop investing in AI (stop buying inflated memory) and refocus on cash flow.” Credit investors may therefore wait for either time or a deeper price reset before stepping back in; while defaults remain low, ongoing AI-driven disruption could broaden pressures across business models, and when defaults eventually rise, recoveries may fall short of historical averages given the asset-light nature of many of these companies.

Source: MS

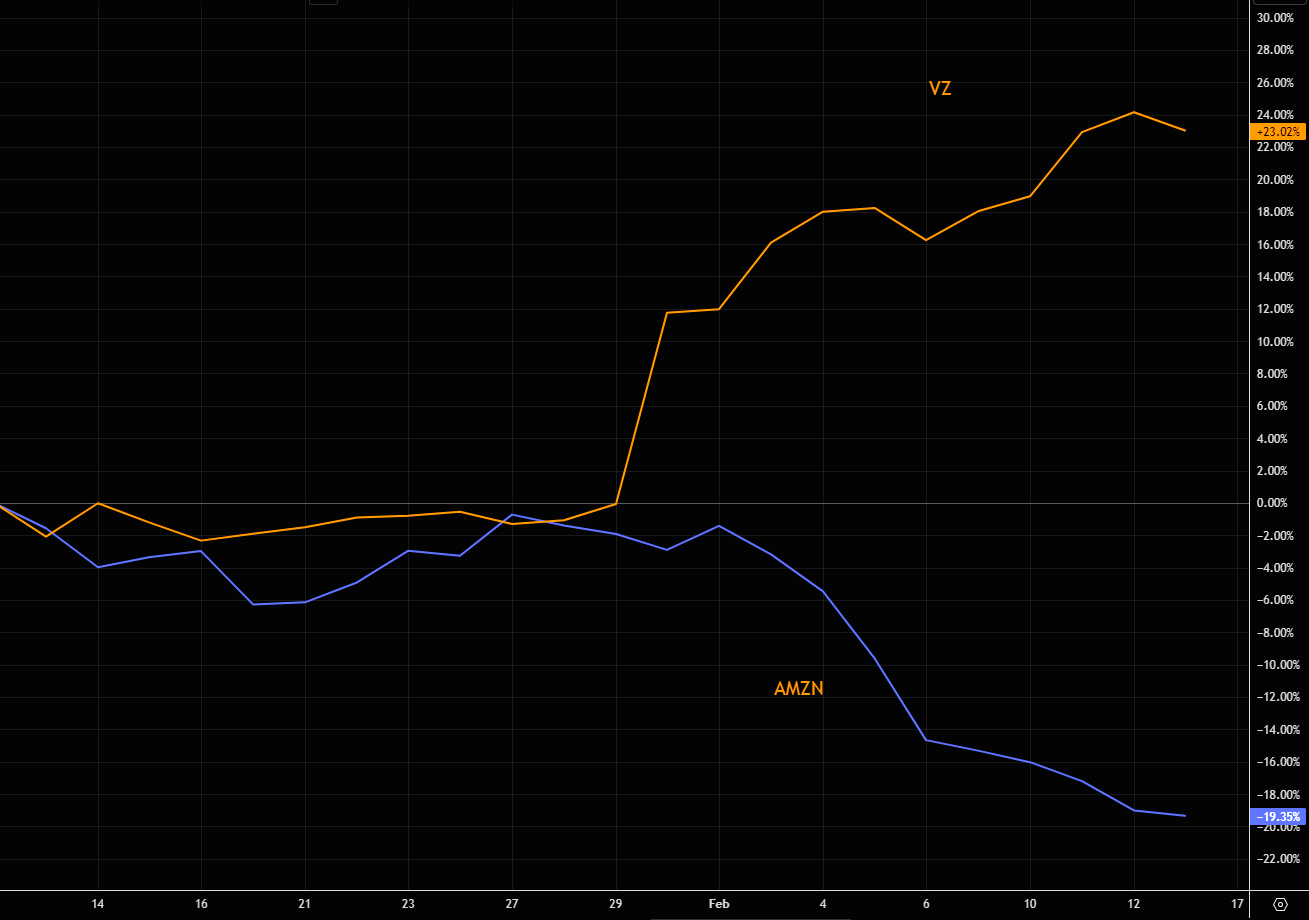

Tale of the tape

Verizon up 23%, AMZN -20% over the past month.

Source: LSEG Workspace

Defense is the best offense

The YTD tale of the tape between XLP and the “MAG 7” needs little commentary, defensives are quietly winning while the former leaders struggle to keep their footing.

Source: LSEG Workspace

If You Can’t Beat AI, Join It

A few bullets worth considering via Matt Shumer:

1. Commit to using AI 1 hour a day — and pay for the latest models.

2. Master the tools and show others what’s possible.

3. Get your finances in order — avoid unnecessary debt; the next 2–5 years could be disorienting.

4. Teach your kids to use these tools — curiosity and adaptability will win.

5. Barriers to building are collapsing.

6. Companies will keep pouring trillions into AI.

7. Lean into what’s hardest to replace: relationships, regulated roles, and positions requiring accountability.