Dead Brand Walking? Tesla Goes Parabolic As Fundamentals Collapse

The return of the king

Everybody loves a good comeback story. Tesla shares are up 27% MTD vs. the S&P 500 up 2%, bringing Tesla shares to positive territory for the year. There are a combination of factors including the recent CEO incentive plan, the CEO purchase of about $1 bn of stock on 9/12, better delivery momentum at least in 3Q and extreme negative positioning post prior YTD underperformance. We have come a long way from liberal wokes attacking Tesla cars and the share price flirting with 200 back in the spring. It looks like Elon is staging yet another comeback.

Winning

Tesla trades green for 7 consecutive days, its longest winning streak since June 2024. We just took out big levels, but we are getting very overbought, although Tesla tends to see RSI even higher during proper squeezes. Next resistance: $440 and then the huge $480 area.

Source: LSEG Workspace

Tesla's terrible threes

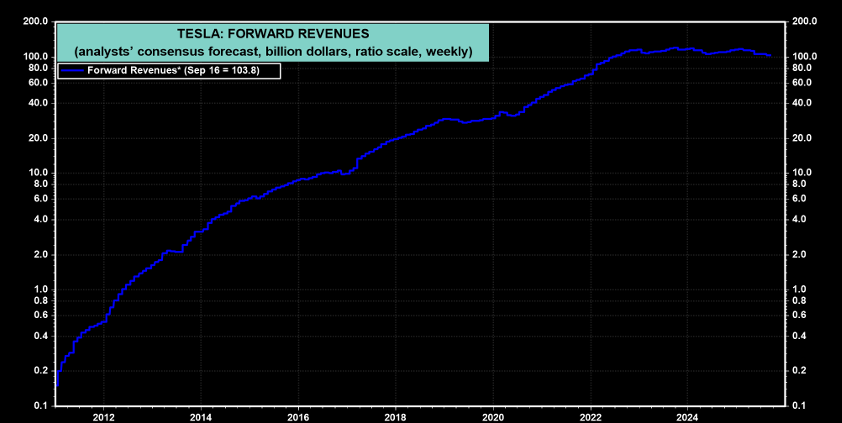

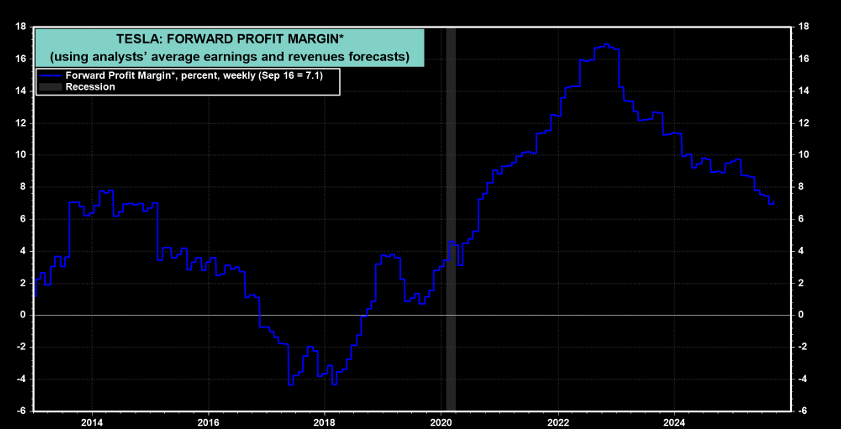

Tesla fundamentals have looked awful lately. Tesla has failed to grow its earnings in recent years. Its forward revenues have plateaued since 2023, and its forward profit margin has shrunk from a high of 16.9% in October 2022 to 7.1% recently. As a result, forward operating earnings per share has been more than halved to $2.07.

Source: Yardeni

Source: Yardeni

Source: Yardeni

Got growth? Not yet

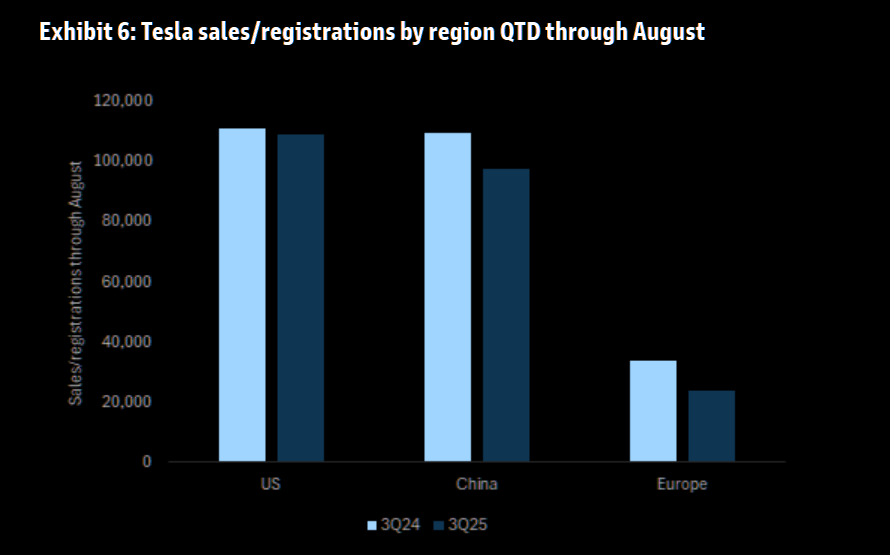

GS: "Regional delivery data QTD suggests in our opinion that Tesla's global volumes could still be down yoy (relative to the 463K it delivered in 3Q24), but we think the rate of decline could be modest if Tesla has a strong month of September."

Source: Goldman

But growth will return

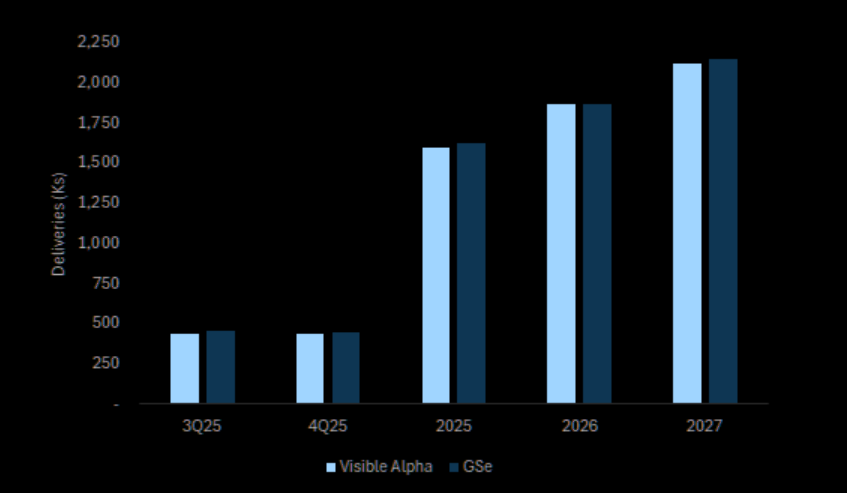

GS estimates compared to Visible Alpha consensus for 3Q/4Q25 and FY25/26/27.

Source: Visible Alpha

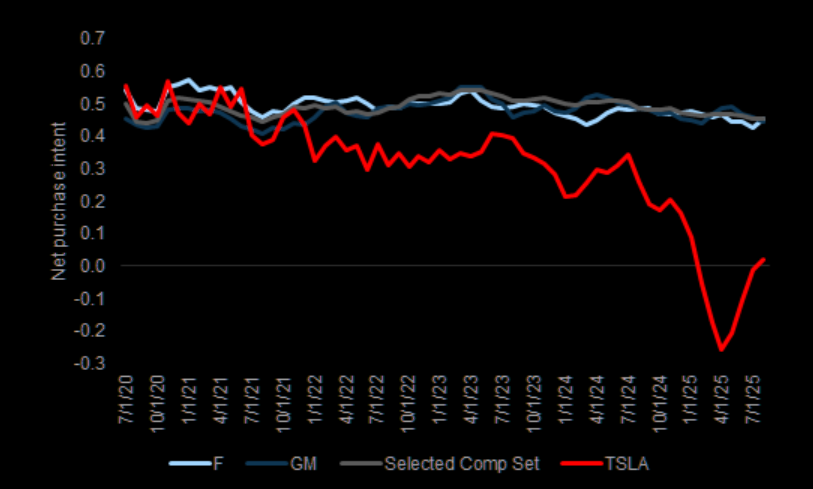

A recovery in intent

Tesla's net purchase intent (NPI) score in the US has recovered from the lows but remains below the peer set.

Source: HundredX

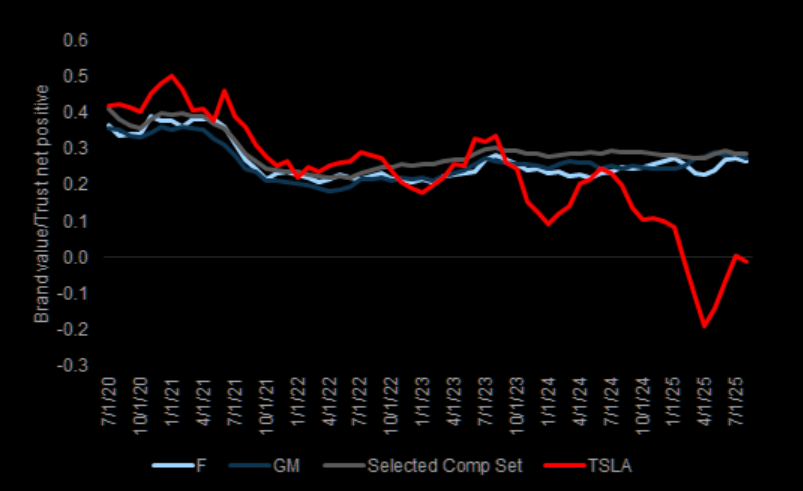

The trust issue

Similarly brand values/trust net sentiment in the US has recovered from the lows but remains lower than historical trends.

Source: HundredX

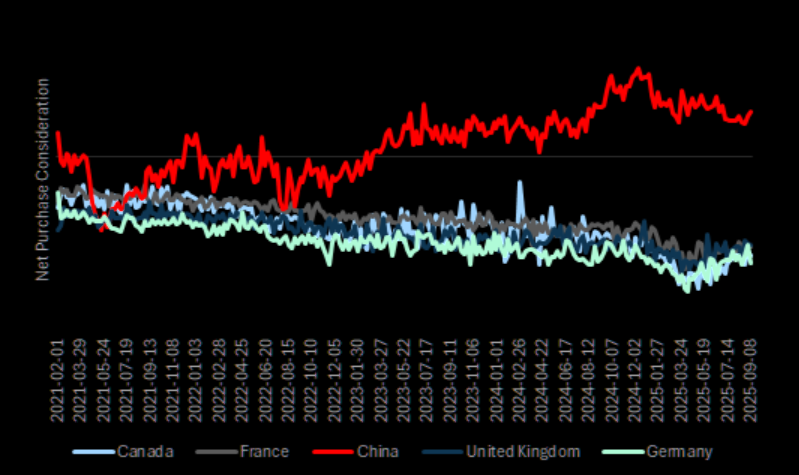

China still approves of successful self-made men...

Net Purchase Considerations in key international regions varies by geography.

Source: Morning Consult

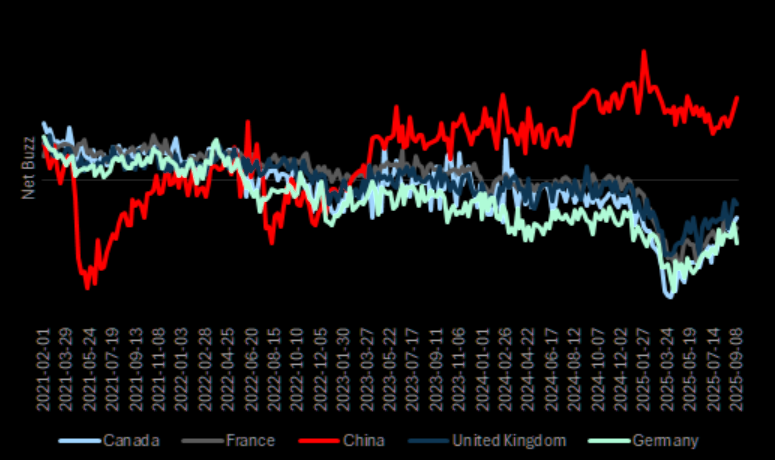

The buzz

Net buzz has improved in key regions (and not that buzz that you allegedly get from Ketamine...).

Source: Morning Consult

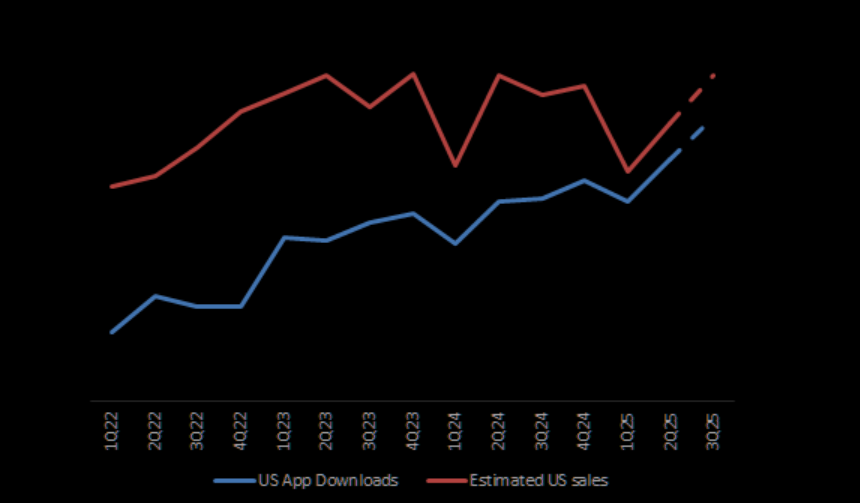

App downloads

GS: "App download growth in the US has accelerated in 3Q QTD, and we believe this implies its US deliveries can grow yoy in 3Q, in part as consumers purchase vehicles prior to the end of IRA credits."

Source: Sensor Tower

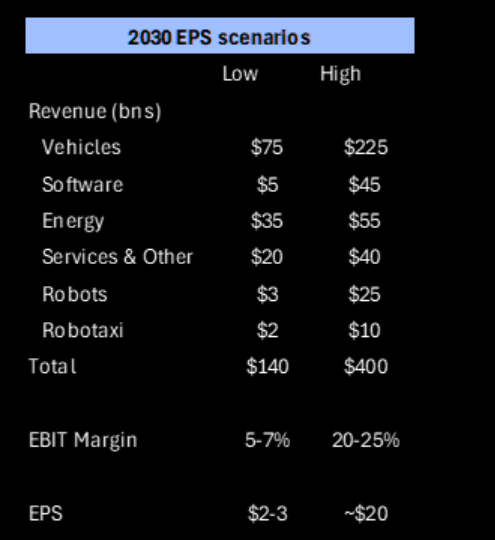

You could drive a Tesla bus trough that estimate range...

GS framing the 2030 EPS debate: "We estimate that 2030 EPS could range from ~$2-3 to $20."

Source: Goldman

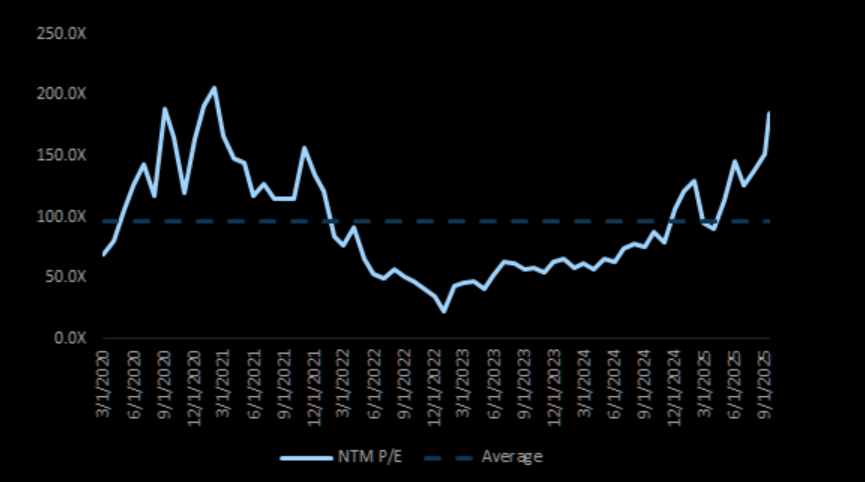

Why not 300x...?

Tesla historical NTM P/E multiple on Street estimates (ex. SBC).

Source: FactSet

Now even above Jonas's price target

As a friendly reminder, Morgan Stanley's $410 price target is based on five components, but we are sure there will be a reason soon to gravitate toward the bull case.

1. Core Auto ($76/share): 4.6m units by 2030, 16.2% exit EBITDA margin, valued at 14x 2030 exit EBITDA, using a 9.0% WACC.

2. Network Services ($159/share): 65% attach rate with $200 ARPU by 2040.

3. Tesla Mobility ($90/share): DCF based on ~7.5m cars generating ~$1.46/mile by 2040.

4. Energy ($68/share).

5. Third-Party Supplier ($17/share).