Doubling Up On Europe: From "Less Bad" to Actually Interesting

The pessimism trade is over. The momentum phase has begun

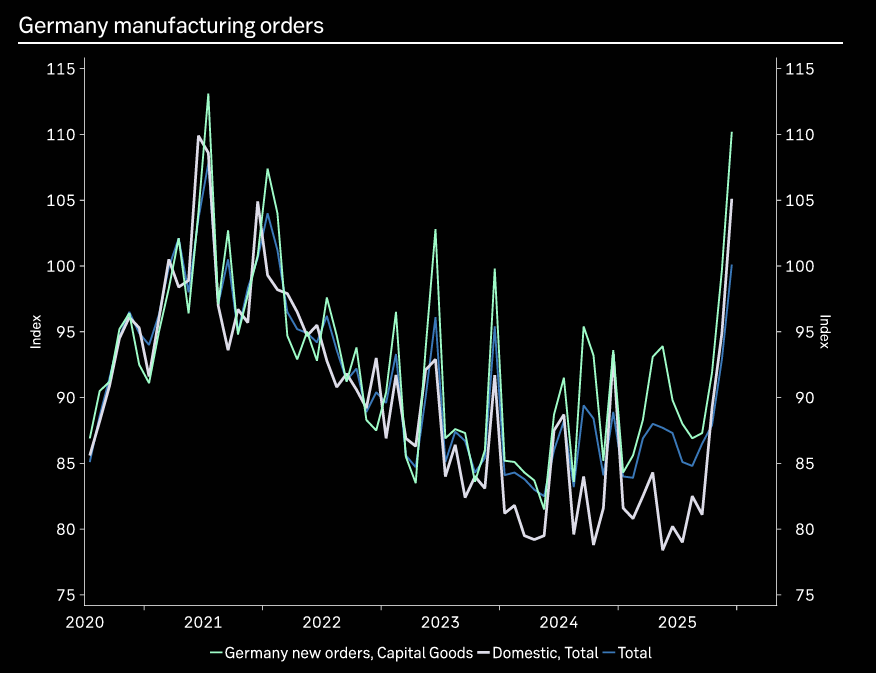

We’ve been pounding the table on Europe for a while, arguing that things could only get less worse. Now the data is moving from “less bad” to genuinely constructive: German manufacturing is improving, loan growth is turning, earnings are beating, and money is flowing in. Knowing Europe, that likely means risks are rising—but it also means the trade may be entering its most profitable stretch and we are doubling up on our long position.

Source: LSEG Workspace

Look who’s growing now…

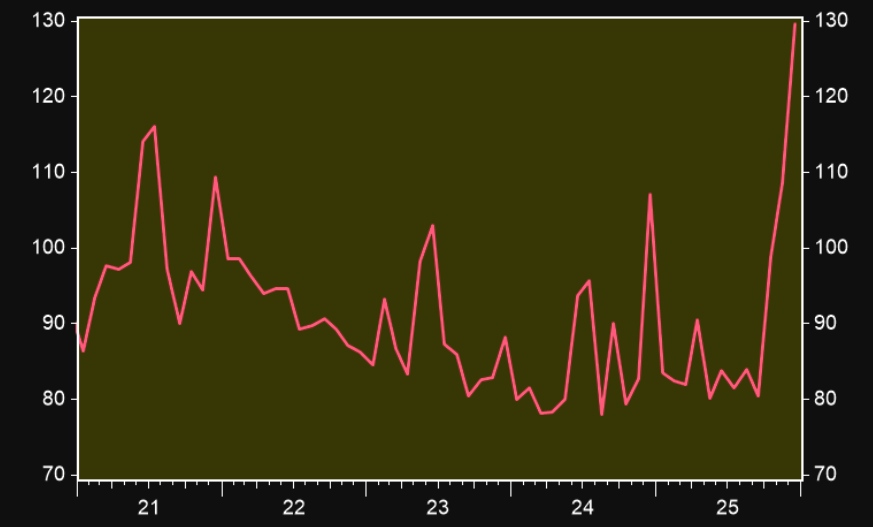

Germany! Partly one-off big-ticket orders, but something is happening here for sure.

Source: Macrobond

Have another look

The German manufacturing numbers and chart is compelling for everyone that loves how a bombed out turnaround story gathers further momentum.

Source: Haver

Confident

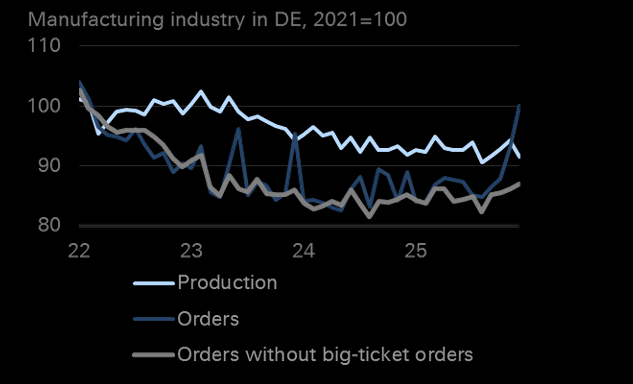

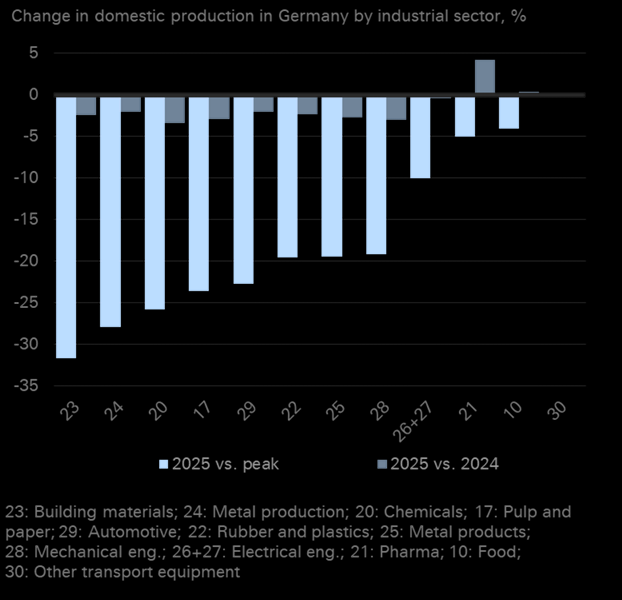

Deutsche on Deutschland: "For 2026, we are confident that production in the manufacturing sector in Germany will rise again. An increase of 2 to 3% seems realistic. This would be the first increase in industrial production since 2021 and only the second since 2019."

Source: Deutsche

Even sentiment

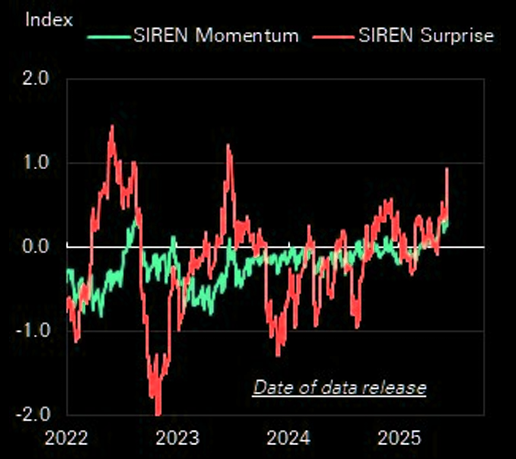

Sentiment indicators are improving from bombed out levels.

Source: IFO

New cyclical high

SIREN indices reached a new cyclical high after strong German orders.

Source: Deutsche

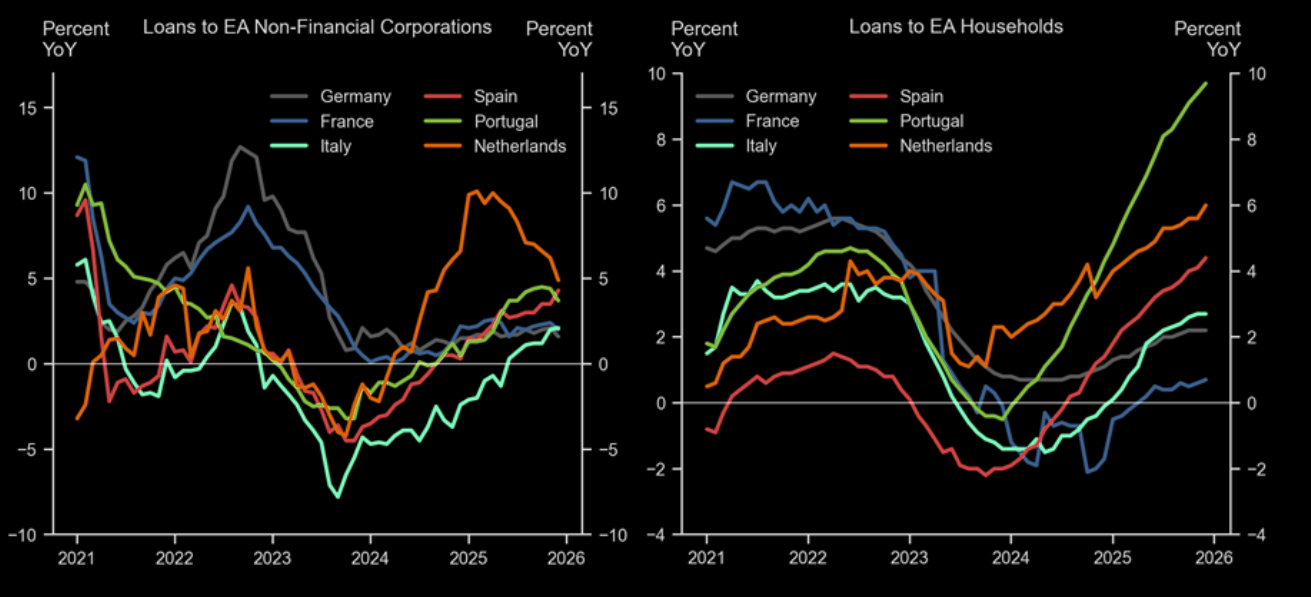

Loan growth picking up

Since 2024 most Euro area member states have already started to experience a notable turnaround in bank lending growth. The increase has been the highest in Spain, Portugal and the Netherlands. Other member states, including Germany, France and Italy, have seen more modest gains but are also likely to turn the corner.

Source: Haver

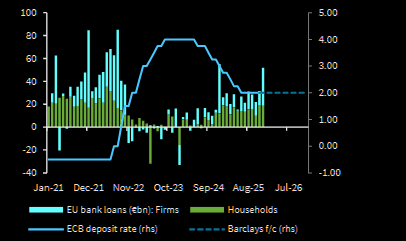

Healthy

Another chart on how European loan growth is picking up.

Source: Barclays

So much potential

Production way below former peaks in most sectors.

Source: DB

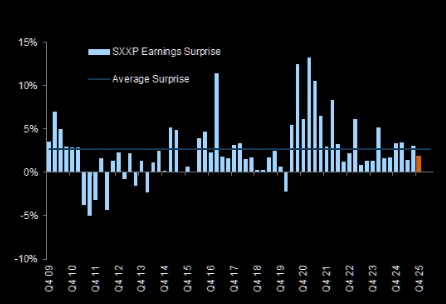

Earnings beating

Aggregate EPS surprise is 2.5% to the upside for Europe.

Source: FactSet

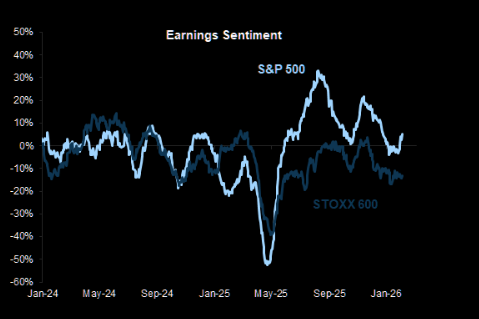

Potential to get less bad

2026 earnings sentiment for Europe remains subdued. Only room for upside...

Source: FactSet

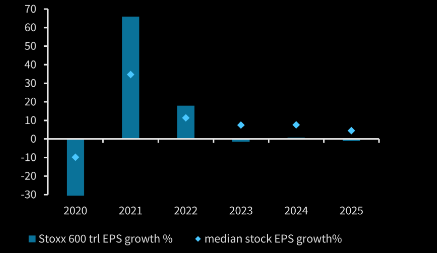

Things can only get better

Aggregate EPS growth in Europe has been flat for three years. So much "easy win" potential for improvement.

Source: Barclays

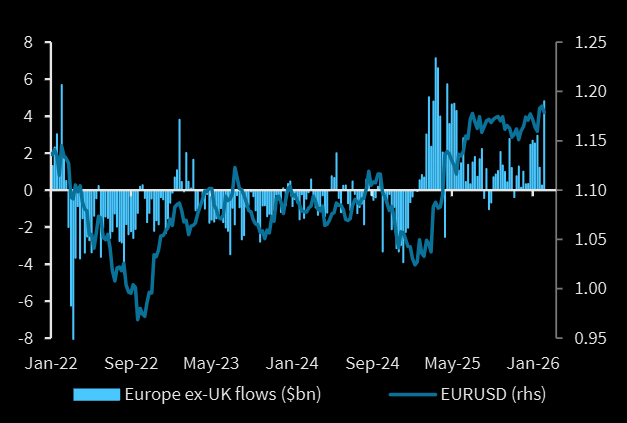

What a week

Europe ex UK see most inflows since Mar'25 this week.

Source: Barclays

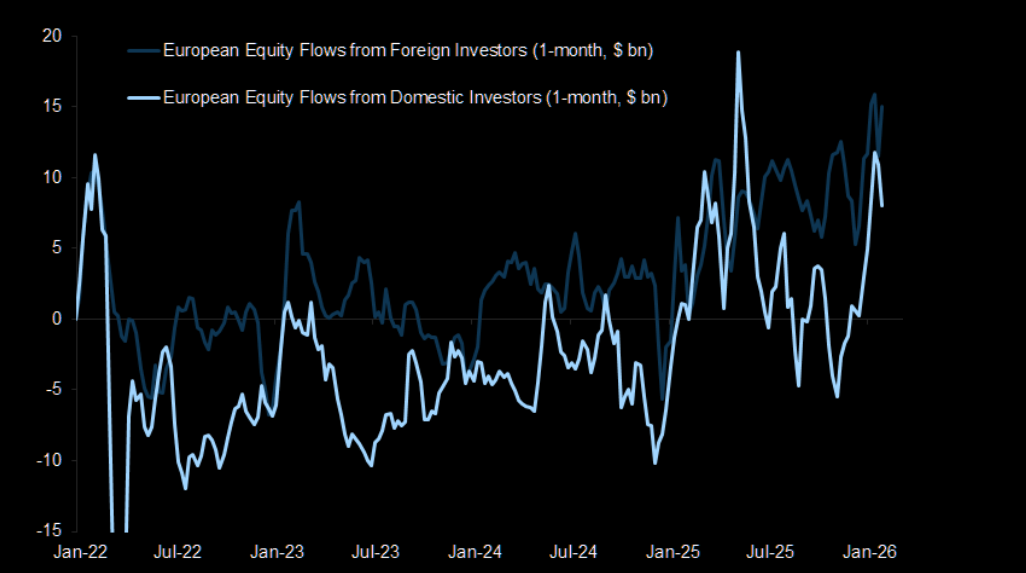

Continued rising allocations

EPFR: "We continue to see rising allocation to Europe by both domestic and international investors"

Source: EPFR

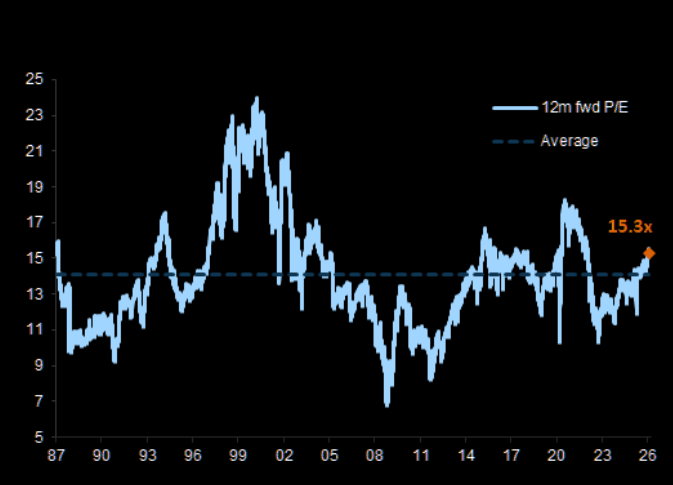

Valuation

STOXX Europe 600 12m forward P/E - we think we will see it trading at 17x before year-end.

Source: Datastream

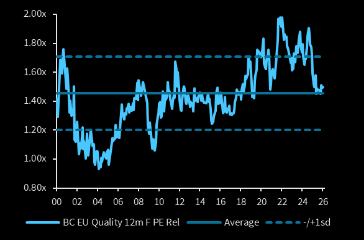

Bargain

European quality stocks have seriously de-rated lately and could be considered a bargain.

Source: Barclays

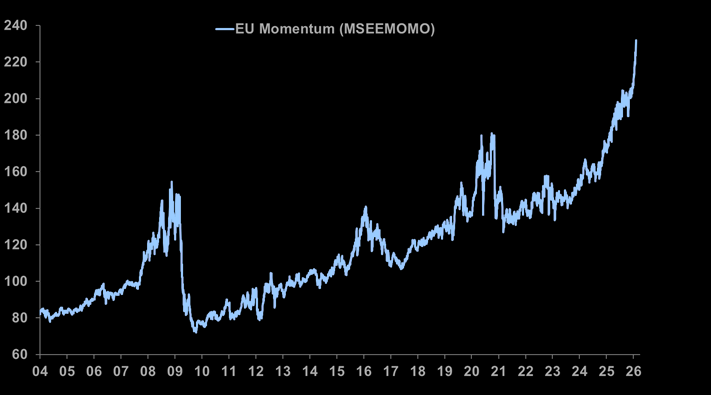

A risk

Maybe not chase EU Momentum right here right now.