This Earnings Trend Is A Bulls' Best Friend

Bodes well

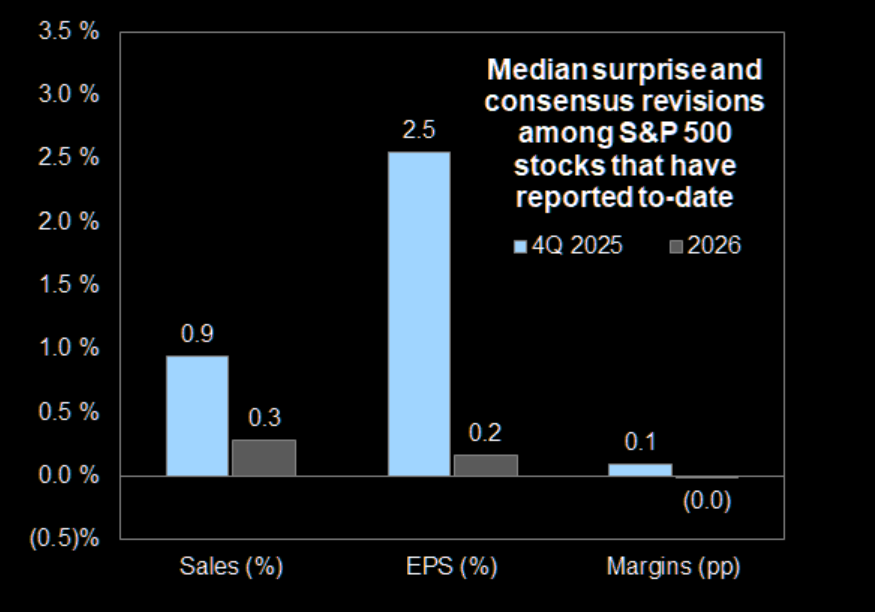

Corporate America is delivering on all cylinders. Companies are beating and numbers are being revised up. The current earnings backdrop bodes very well for equities.

Unusually bullish

Consensus estimates for 2026 full-year EPS forecasts are unusually being raised in Q1.

Source: FactSet

Sales up too

Consensus 2026 sales forecasts have also been revised higher this earnings season.

Source: FactSet

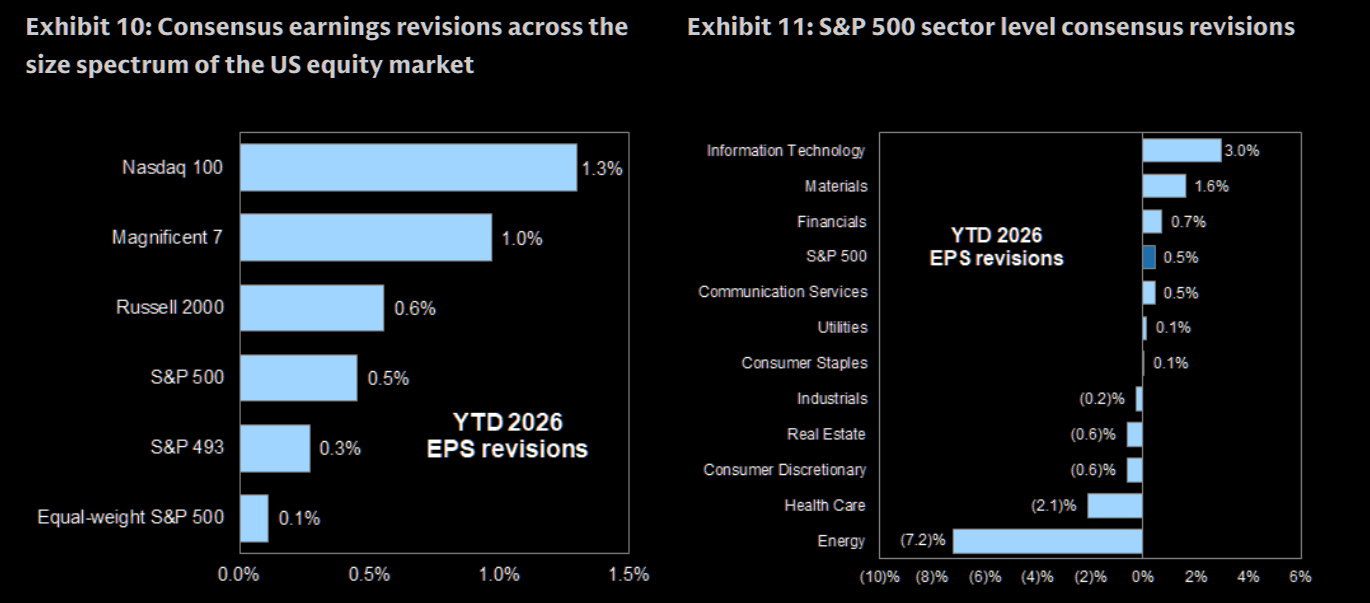

Usual suspects

EPS revisions have been strongest for the mega-cap tech stocks. Cyclical pockets of the market, such as the Russell 2000 as well as the Materials and Financials sectors, have also experienced above-average revisions to 2026 EPS estimates.

Source: Goldman

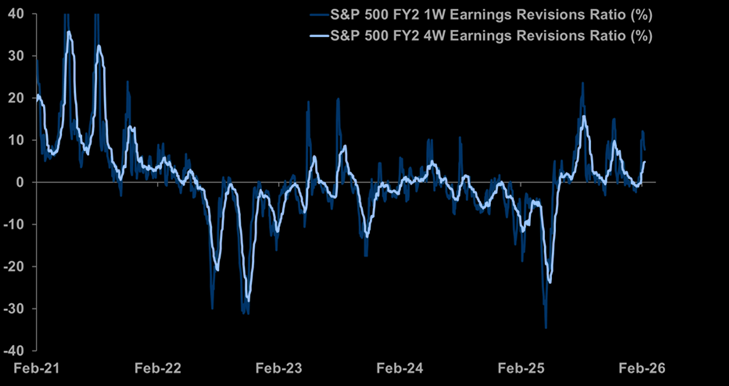

Re-accelerating

Morgan Stanley says that US earnings upgrades are re-accelerating.

Source: MS Alpha

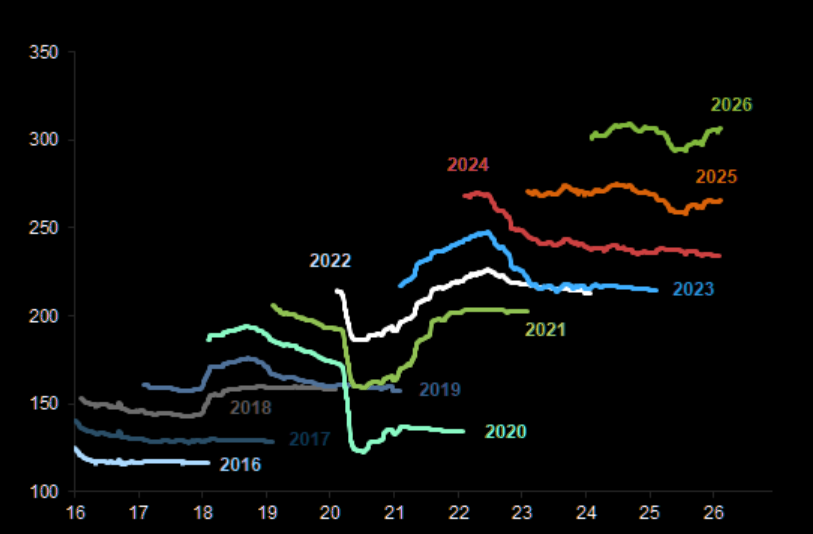

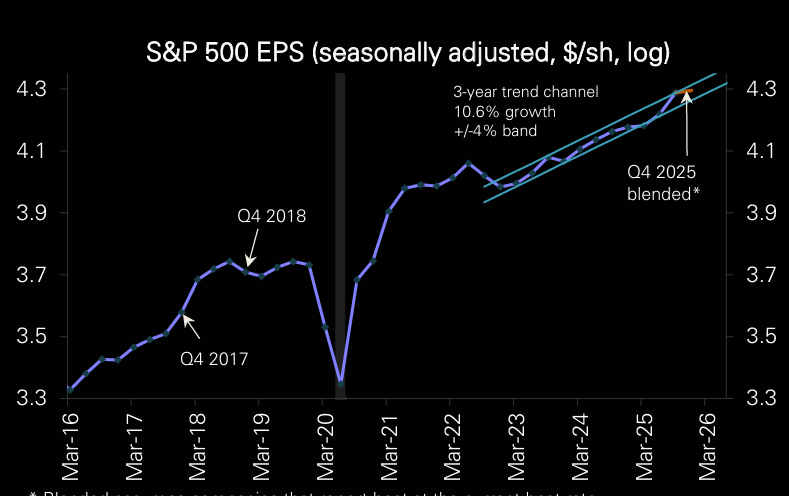

The earnings trend is the bulls' friend

Deutsche Bank: "The level of earnings for the S&P 500 (adjusted for seasonality) continued to move along the top of its 3-year trend channel."

Source: DB

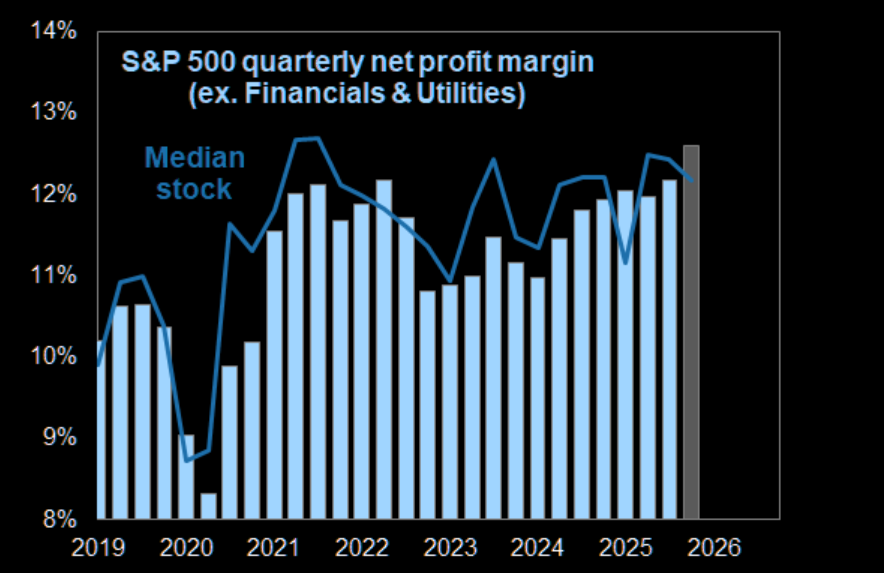

On the margins

Profit margins have climbed to new record highs.

Source: FactSet

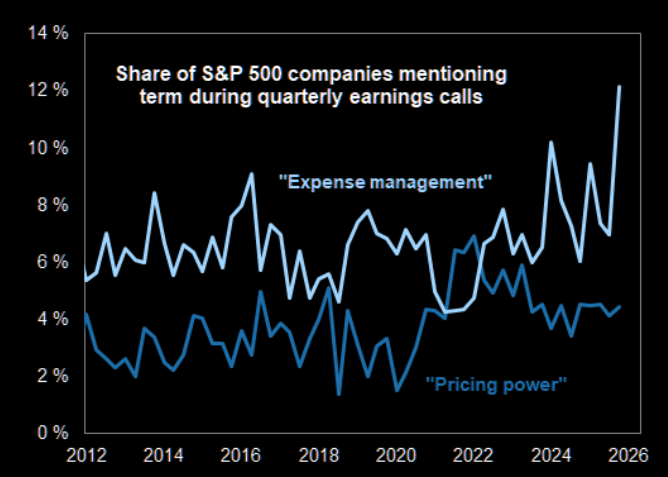

Cost conscious

S&P 500 companies are increasingly focused on managing costs.

Source: Goldman

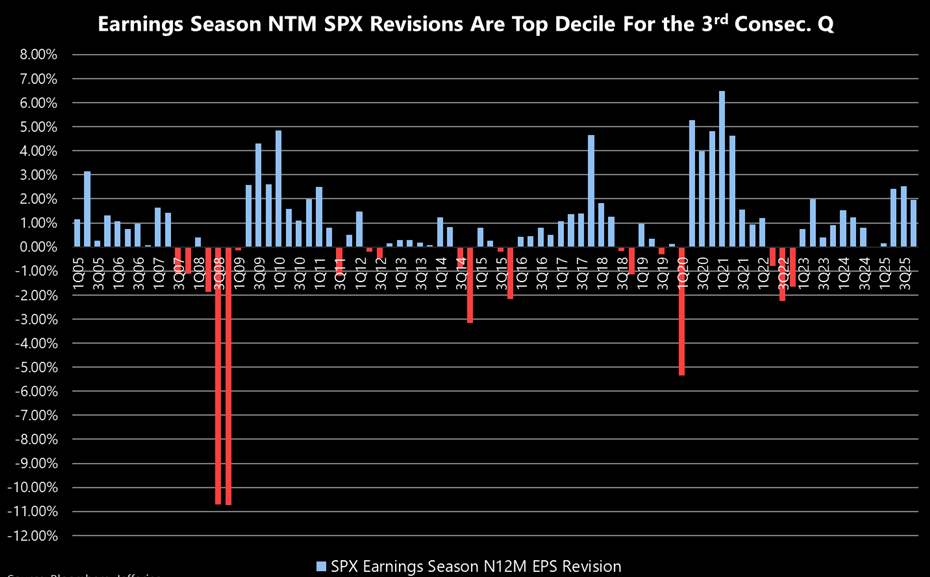

Best of times

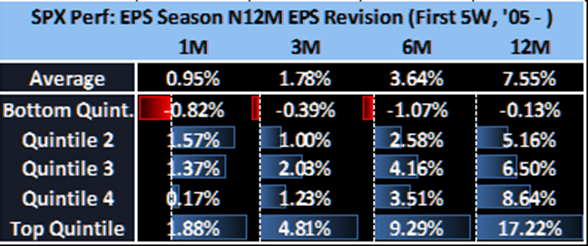

Jefferies shows that despite the dip in the beat rate, intra-earnings EPS revisions have been fairly stellar and that the current backdrop bodes very well for equities.

"The +2% markup to the SPX’s NTM EPS is good enough for top quintile looking back over the past 20Y. This is the third such Q in a row and the fourth positive Q for this earnings revision cycle. Notably, typical cycles over the past 20Y tend to last 8-10 Qs and when revisions are as good as we have seen over the past 5W, forward SPX performance tends to be stellar, +17% on a 12mo basis."

Source: Jefferies