Europe Begins to Find Its Footing. Perhaps.

Different this time?

Europe has spent years being written off as slow, divided, and structurally constrained. Yet recent geopolitical resolve, improving economic data, and a turning credit cycle suggest the region may be entering a different phase — one that investors have been slow to price in. That said, Europe has taught us to be skeptical. Whenever we catch ourselves saying “this time is different” about Europe, our instinct is to pause, second-guess it, and demand more proof. Let´s once again examine the latest datapoints, especially how Europe stacks up versus the US.

Europe is standing up

"Europe passed an important geopolitical test in January. The firm response to US pressure over Greenland was the first time Europe acted as a major power, emulating what China did last year, and the US backed down. We believe the commitment to massive investment in geopolitical security is firmer now. At the same time, improving macro indicators reinforce the case for stronger growth in Europe, with the credit cycle now also turning higher. This could be this year’s positive surprise." (SEB X-Asset)

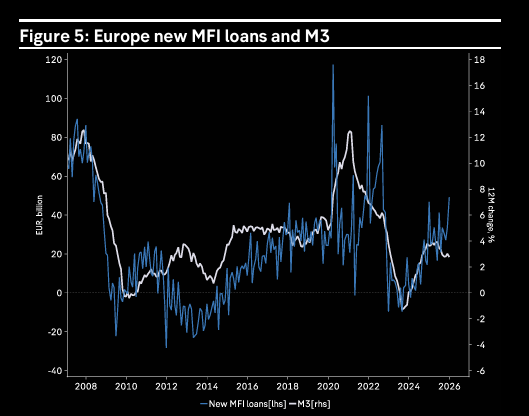

Source: Macrobond

ECB easing

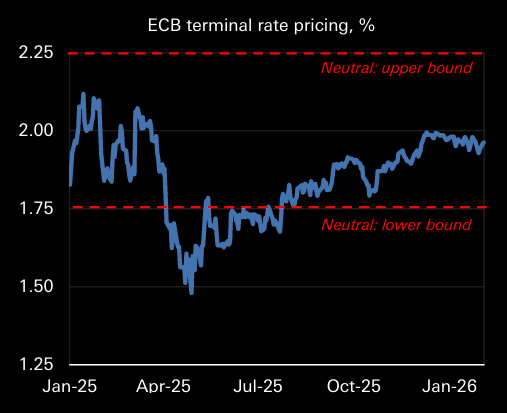

The market is starting to price more probability of a further easing of ECB rates.

Source: Deutsche Bank

GDP trackers rising

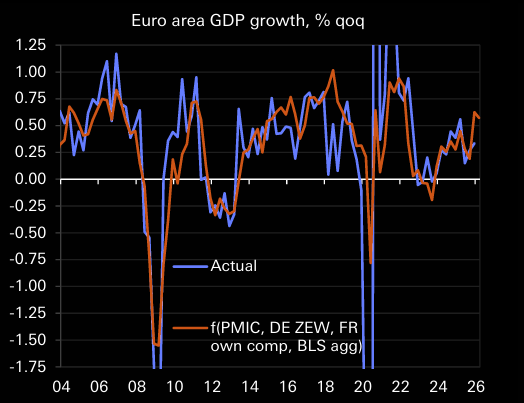

GDP trackers are rising again. Could Europe challenge its poor historic track record on growth?

Source: Deutsche

Data momentum

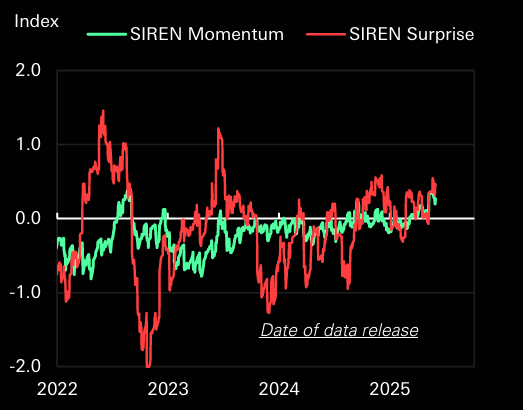

Data momentum and surprises are increasingly positive.

Source: Deutsche Bank

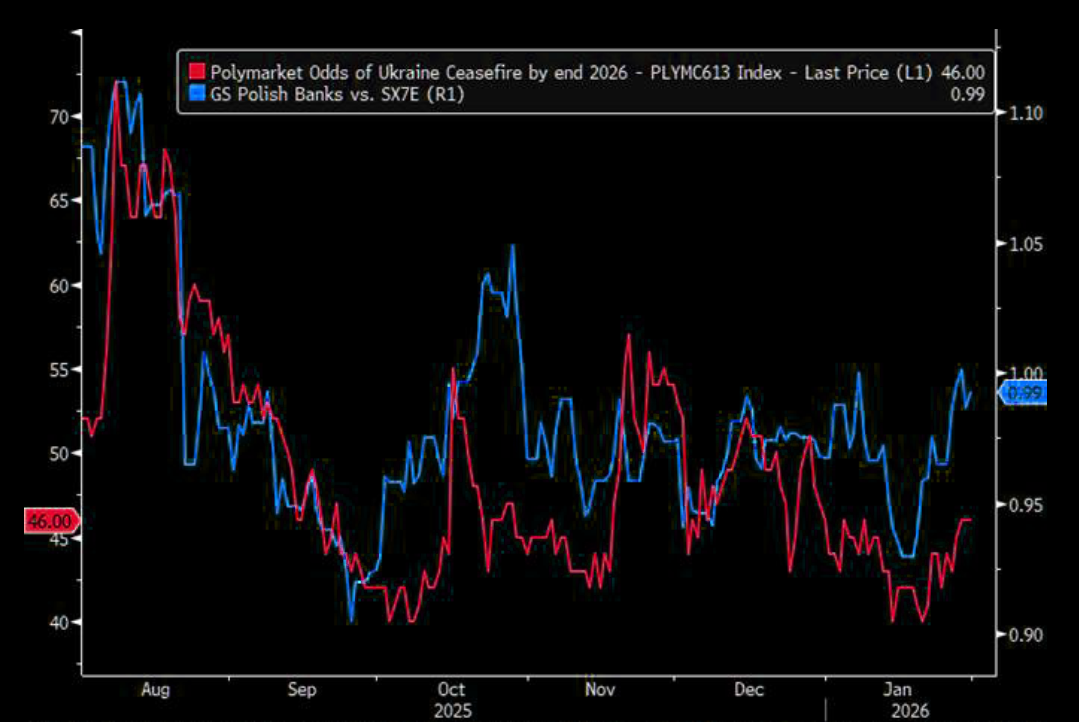

Peace probabilities

While still depressed, Polymarket odds of Ukraine Ceasefire are starting to pick up.

Source: Polymarket

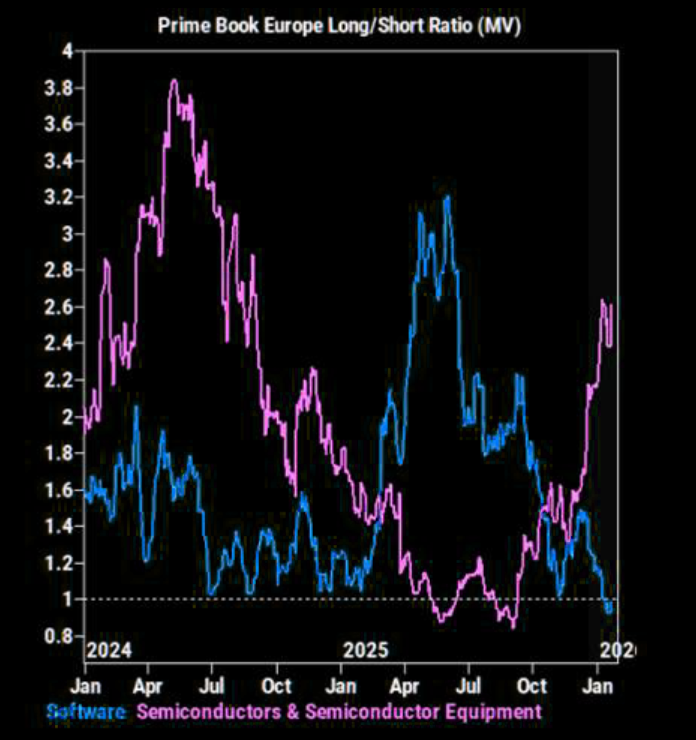

Not the same semis positioning problem

HF positioning in EU Semis does not look stretched vs 2024 highs, and is not as stretched as in the US.

Source: GS Prime

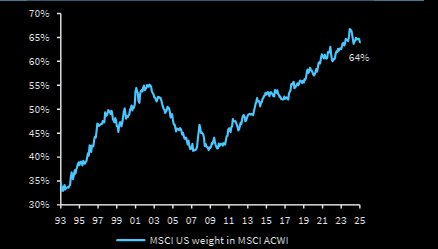

A blip?

Chart shows US share of global market cap is no longer rising. Is this just a blip or is this a major turning point?

Source: Barclays

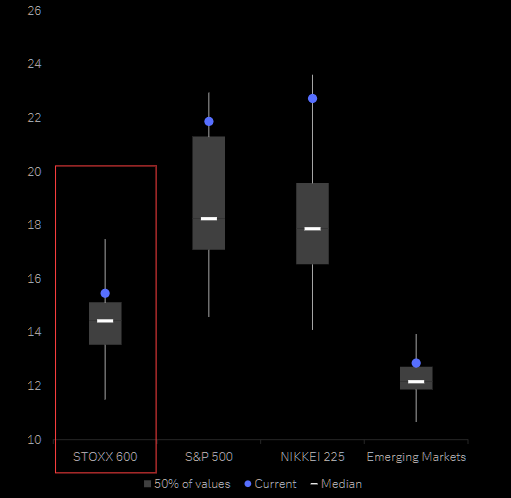

Cheap

EU still relatively cheaper than RoW.

Source: Deutsche Bank

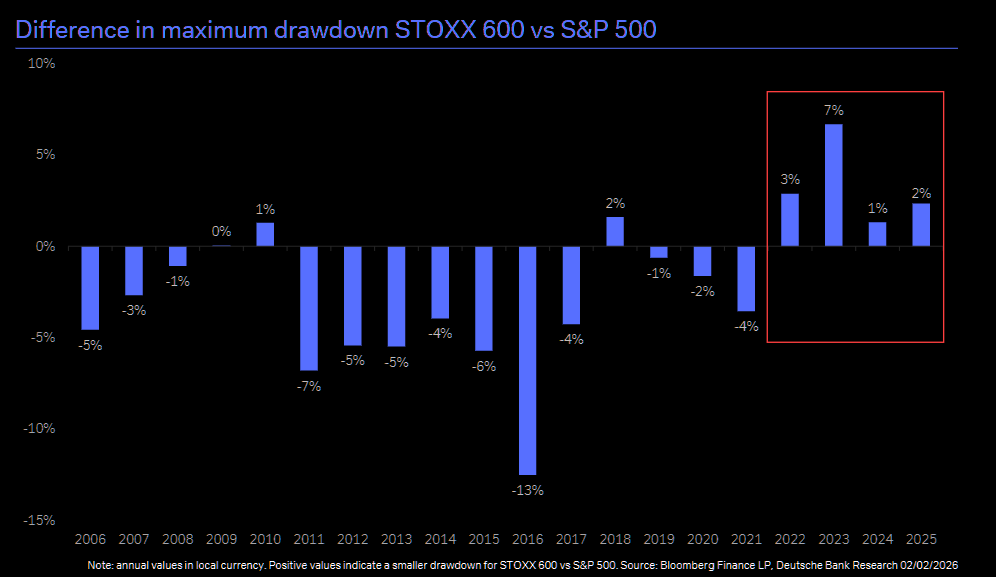

Less drawdowns

Sell-offs have been sharper in the US compared to European equities in recent years.

Source: Deutsche bank

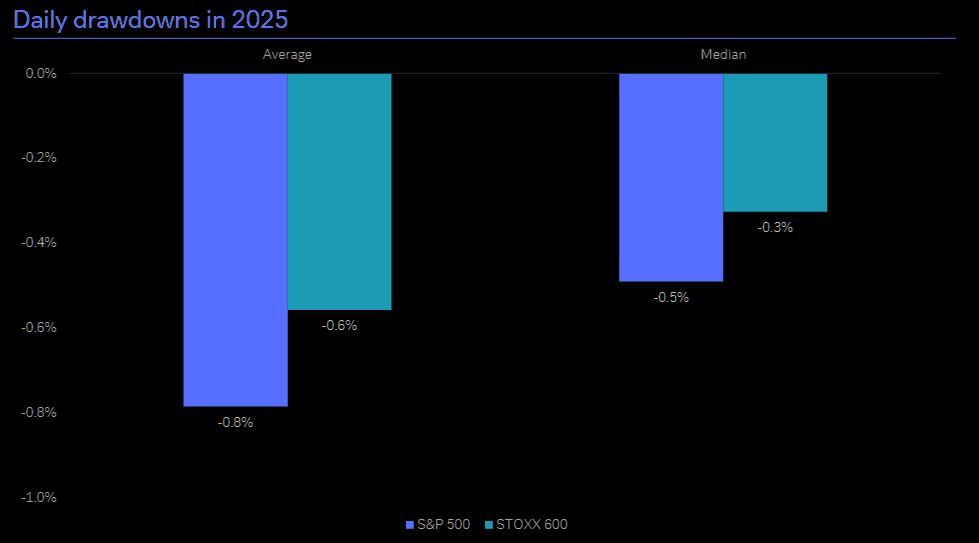

More on the drawdown comparison

In 2025, the S&P 500 has seen twice as many daily sell-offs >1% compared to the STOXX 600.