Europe Continues To Trade With A Steadier Rhythm

Measured confidence

Europe traded with a steadier rhythm last week, even as headline indices oscillated. Macro prints were largely in line. The bigger picture remains one of gradual stabilization rather than acceleration, with policymakers increasingly focused on competitiveness – including discussions around simplifying EU rules, encouraging “buy European” initiatives, and advancing trade deals. The tone doesn’t feel euphoric, but neither does it feel fragile. Instead, Europe appears to be navigating this phase with measured confidence – valuations remain supportive, earnings dispersion is creating idiosyncratic opportunity, and policy momentum around competitiveness could quietly provide a tailwind into 2026.

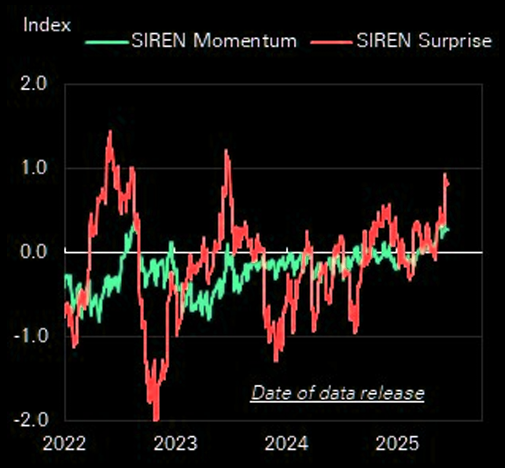

SIREN

SIREN indices have dipped slightly last week on the back of weak December IP prints of euro-area countries, however, the momentum remains strong.

Source: DB

Less bad

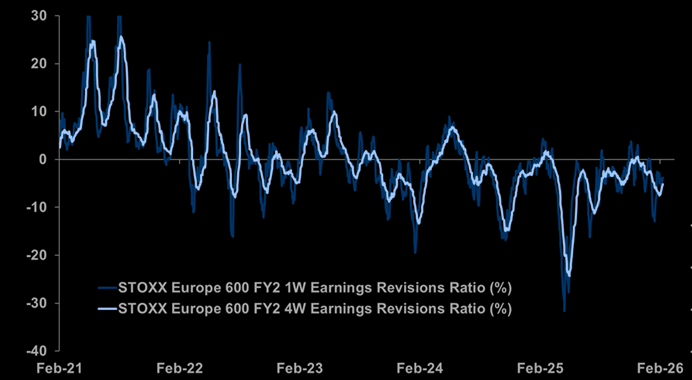

Earnings revisions in Europe have turned less bad - just the way we like it.

Source: MS Alpha

Printing

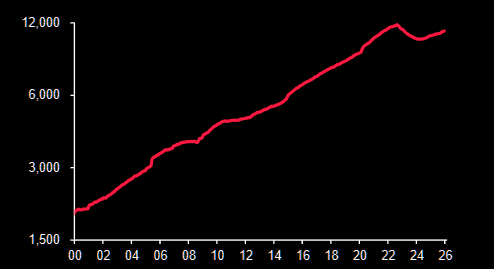

Eurozone Money Supply: M1 (€bn, log scale).

Source: SG cross asset

Beating US

Not very often do we see such consistent performance from good old Europe.

Source: MS

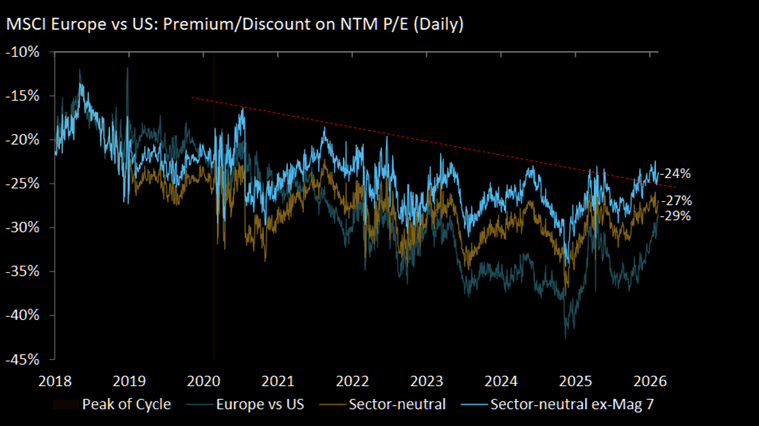

Breaking out

The negative trend in terms of valuation vs. the US seems to be under attack. Make Europe great again. Do we stop first when we trade at a premium to the US?

Source: Morgan Stanley

Potential

S&P 500 outperformance vs. Europe’s Stoxx 600 over the longer term.

Source: Bloomberg

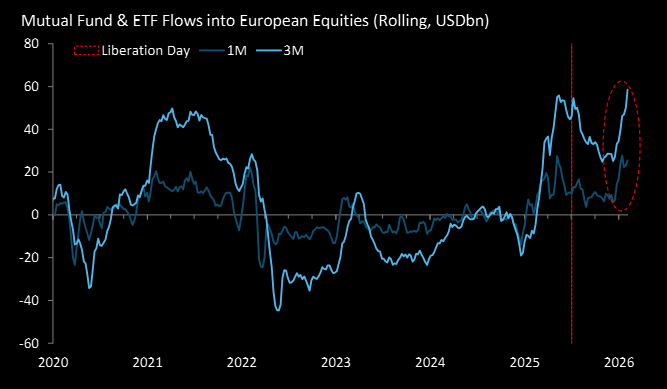

The flow is with you

EU equities are seeing rising diversification flows...

Source: EPFR

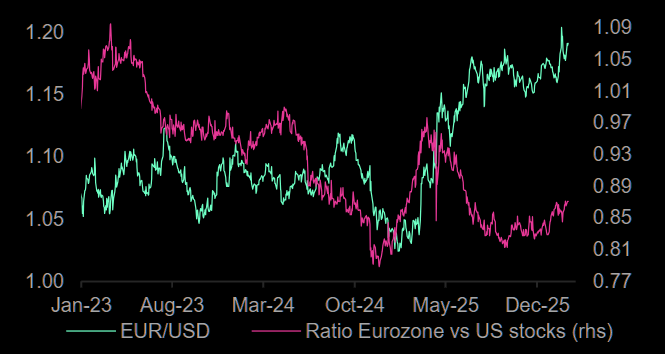

Catch-up?

EUR/USD vs. ratio of Eurozone vs US stocks.