Europe Edges Higher as the ‘Less Bad’ Narrative Holds

A fragile recovery gains ground

We’re still long Europe’s “it can only get less bad” trade. No fireworks, but we’re 1% off highs with barely any drawdown — good enough for now. Still, it’s Europe: optimism requires a helmet, and you always stay close to the exit. Here’s the latest read.

Source: LSEG Workspace

Trust the price & the trend

Cyclicals vs Defensives in Europe at an all-time-high.

Source: Bloomberg

DAX

The DAX has kept pace with the S&P 500 since 2022. DAX and S&P 500 performance in local currency since the start of 2022 (in total returns).

Source: Datastream

Banks

Overall US bank market cap vs. overall market is shrinking. Totally opposite in Europe. When European banks are doing well - Europe is doing well.

European strength

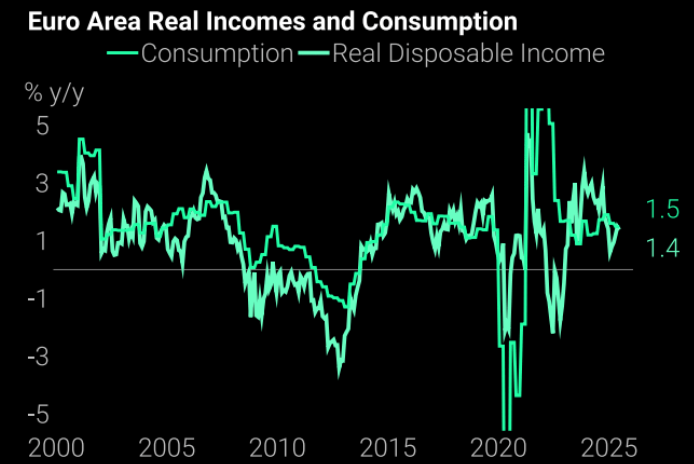

Consumption is likely to be one of the bright spots as fundamentals generally look healthy. Consumer sentiment is buoyant and real income growth has recovered. This chart show how real income growth is solid.

Source: TS Lombard

More European strength

Consumer sentiment is upbeat.

Source: TS Lombard

Die Wirtschaft erholt sich

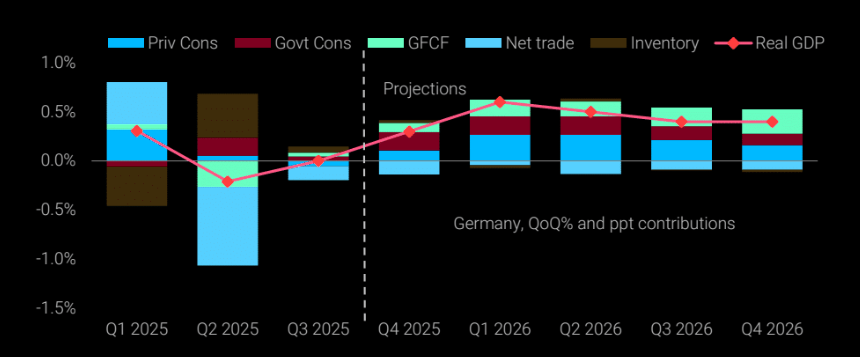

Germany rebounding in 2026.

Source: TS Lombard

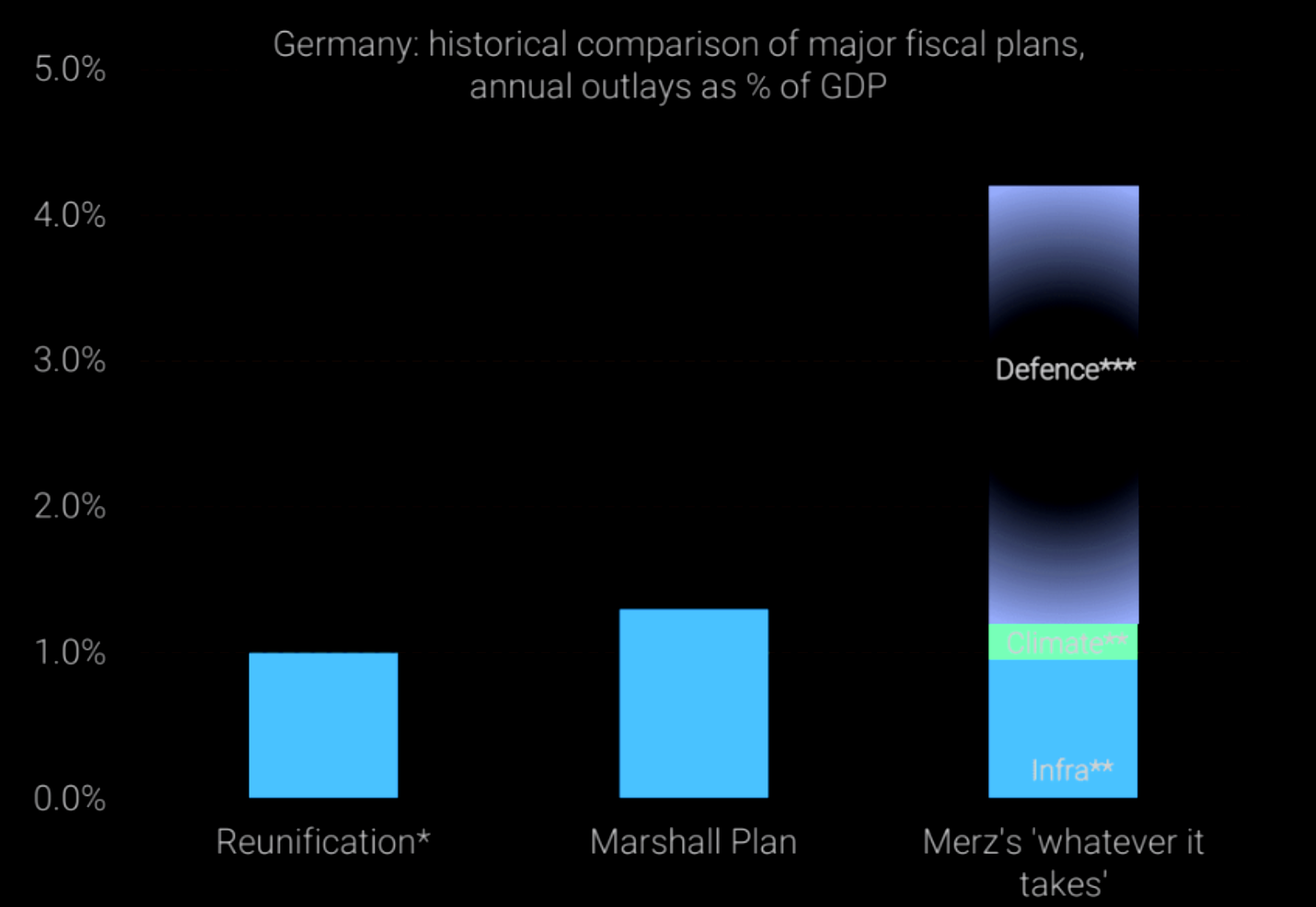

Whatever it takes

TS Lombard: "Germany’s policy pivot could have been faster, but it will be impactful"

Source: TS Lombard

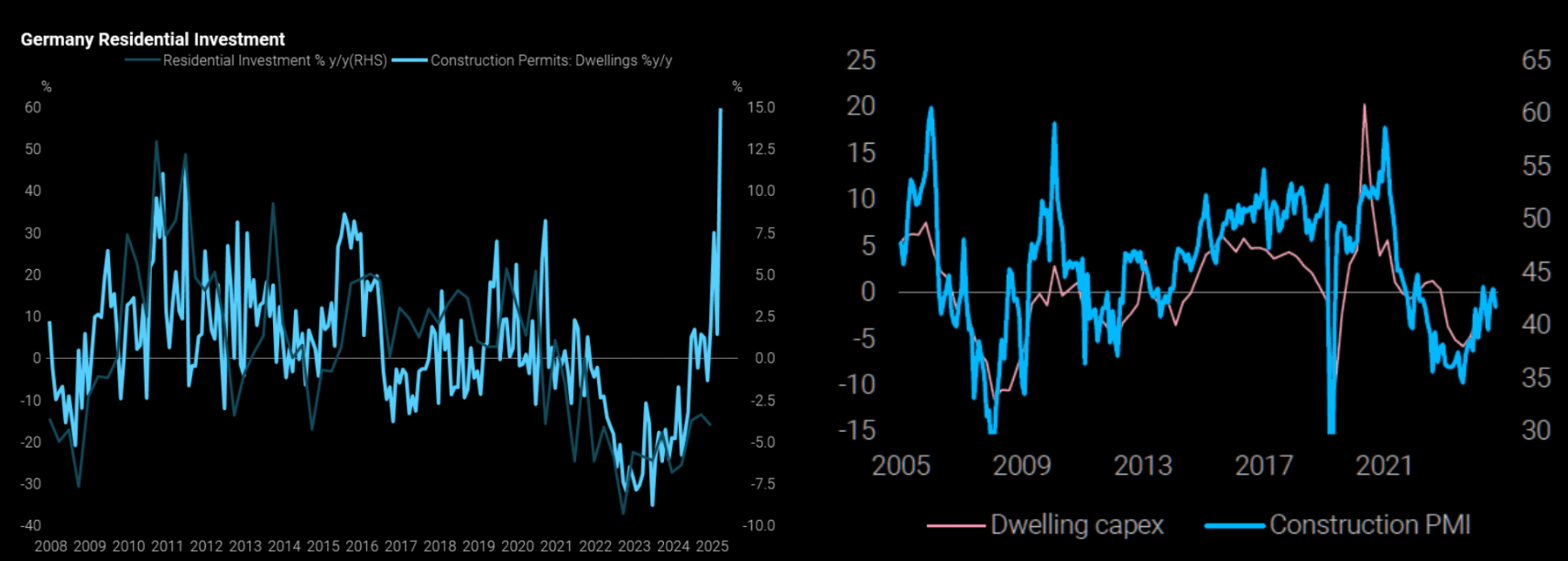

Housing too

Lagged monetary easing will also help German housing.

Source: TS Lombard

Remember the Greek miracle?

"Greece’s economic activity remains robust, with prevailing confidence and key indicators signalling continued growth. Since 2019, productivity has steadily recovered, and GDP per capita has registered the highest growth within Southern Europe, also outpacing the Euro area average. However, average real income is still 10% below the 2007-08 peak, pointing to room for continued recovery."

Is this the blueprint for what can happen in all of Europe?

Source: Goldman

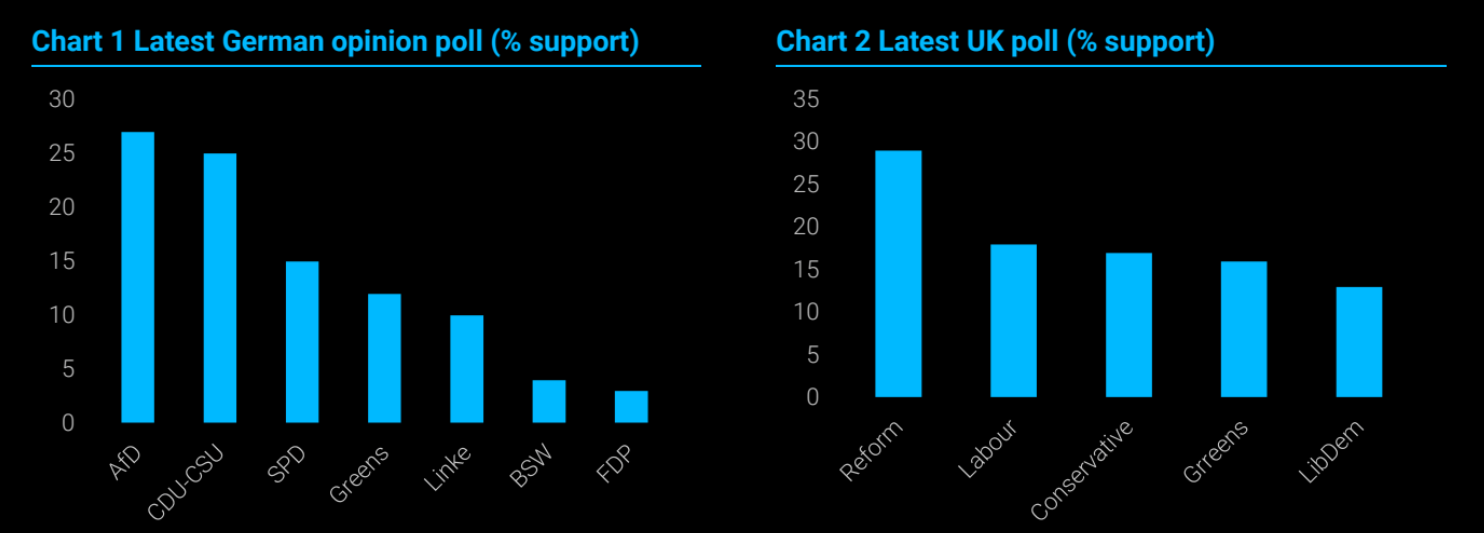

Populism: Bearish or bullish?

"On closer inspection, right-wing populists in power might prove largely harmless for asset prices (regardless of other potential harms). That points to buying opportunities in the event of instant negative (‘knee-jerk’) market reactions. There is also a particular perspective in which European populist government(s) could be bullish. This stems from the positive effect on risk-adjusted returns of a combination of rearmament and détente"

Source: TS Lombard

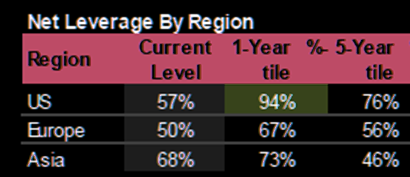

European net leverage

Still some room for hedge funds to add EU long exposure (if we compare with the US).