Everything Ex-Hot Is Getting Sold

AI changes

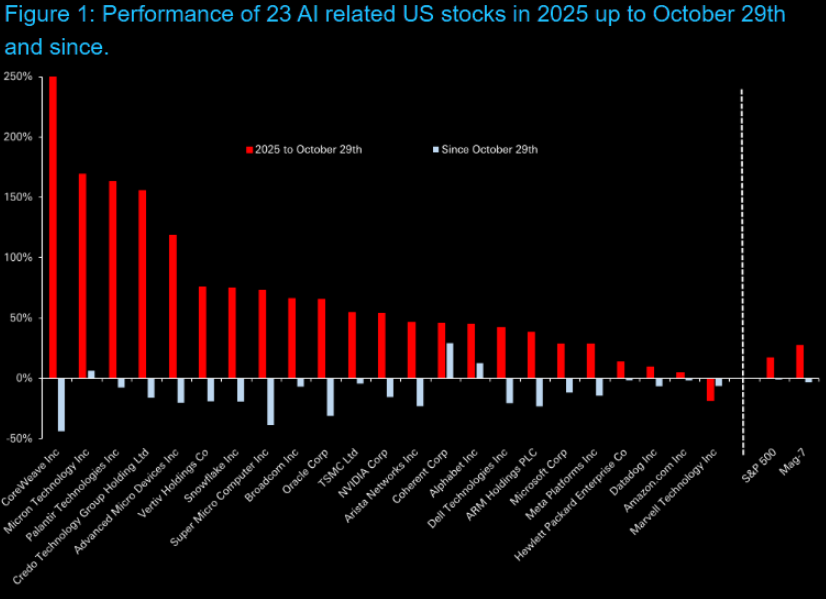

DB's chart of the day tracks 23 AI-related stocks, comparing year-to-date performance up to 29 October with returns over the roughly six weeks since. Before 29 October, just one stock was down on the year and the group had posted an average unweighted gain of +70%; since then, the picture has shifted sharply, with 20 of the 23 now trading lower.

Source: DB

Just in time

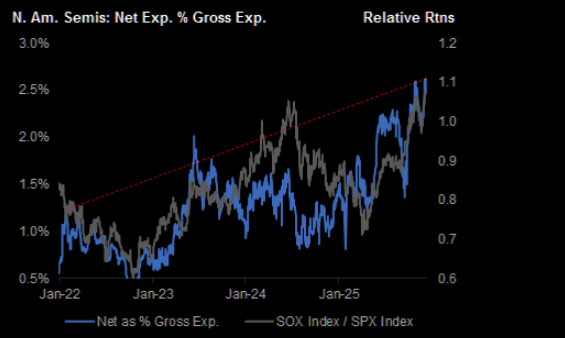

Hedge fund positioning in North American semis got back to peak levels just in time for the biggest SOX puke in a very long time. Pain is huge. More on the "problematic" AI trade here.

Source: JPM

Japan rates and the AI connection

We’ve written extensively about the implications of the rise in Japan’s long end. This isn’t a local story, it carries global spillover risk. Notably, NVDA topped almost perfectly as the Japanese 10-year kicked off its latest explosive move. More here.

Source: LSEG Workspace

Will big brother follow?

Small tech going to lead big tech even lower?

Source: LSEG Workspace

Not pretty

Is BTC about to seriously take out the big trend line? Full note here.

Source: LSEG Workspace

Same same?

Are we just seeing psychology on steroids being washed out? All these ex hot assets have moved in close tandem for a long time. Chart shows BTC, NVDA and ORCL.

Source: LSEG Workspace

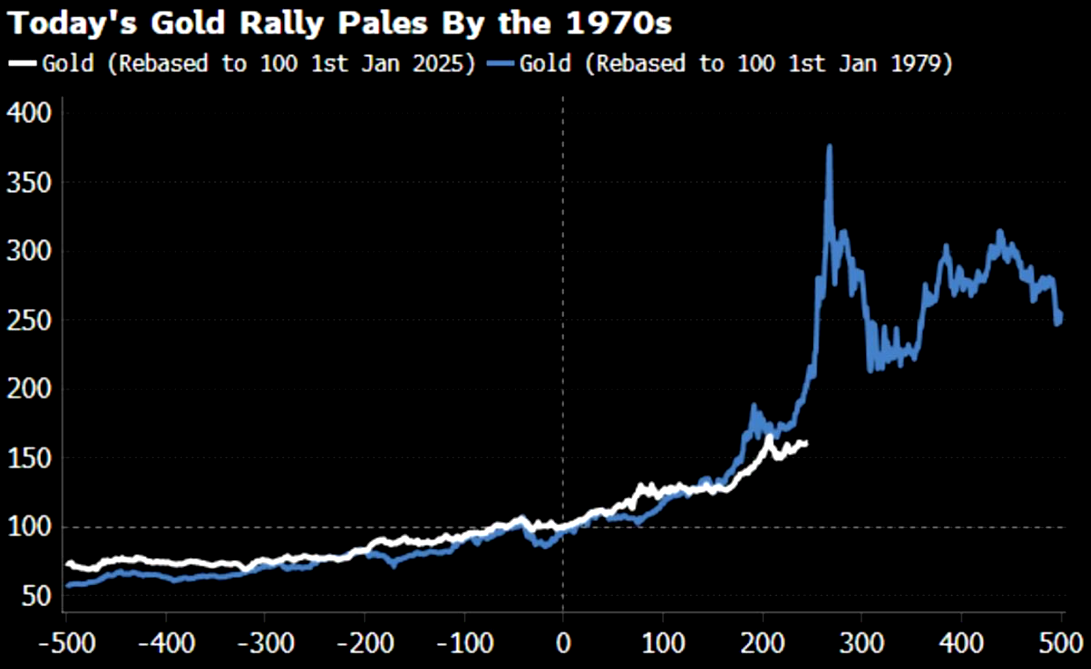

Gold - just getting started?

Imagine the pain if we were to follow the 1970's trajectory...More on gold here.

Source: Bloomberg

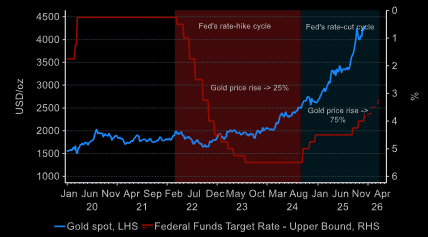

Loving rate cuts

"Since the onset of the current easing cycle in September 2024, gold prices have increased by 75%, while during hiking in 2022–23 the gains were moderate at 25%, as geopolitical risks and other structural shifts offset the negative impacts of the rate increase."

Source: ANZ

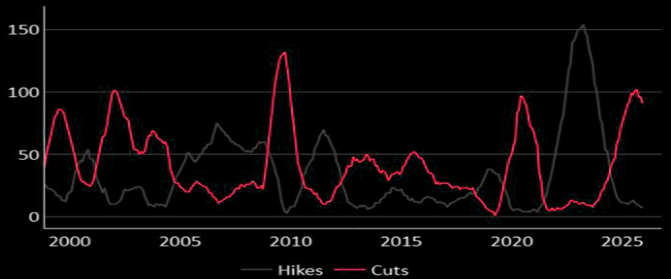

Over

Soc Gen's Global Central Bank Tracker shows the easing cycle is over (12 month rolling policy moves).

Source: Soc Gen

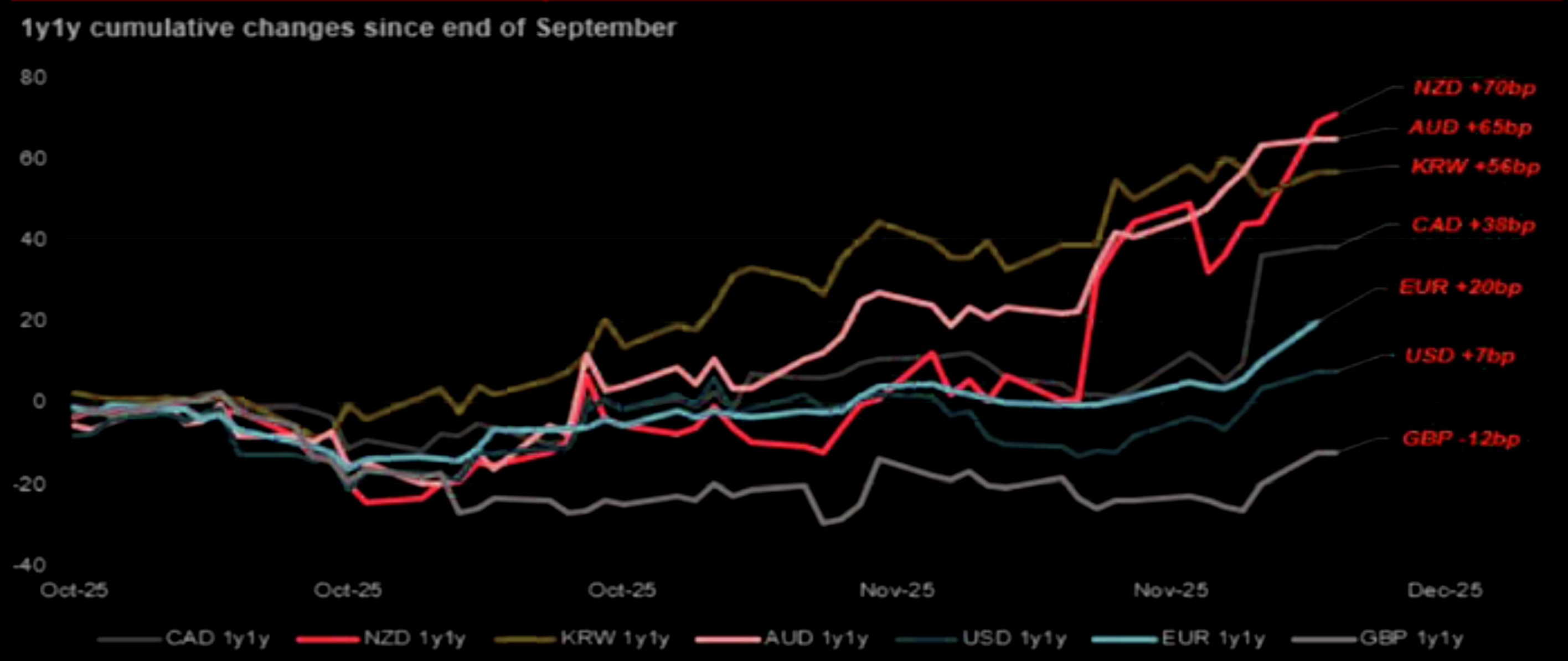

Watching Asia closely

The last few weeks have seen a surge in expectations of higher rates, led by Asia. Soc Gen's Spratt: "...violent price action in KRW, AUD and NZD as investors rapidly shift from easing, to pausing, to tightening bias. The market has been reluctant to price a pause. Once the policy direction is clear, the risk reward has been to lean into that direction." Full read on the long end here.