Everything Goes — Again

Déjà Vu

We outlined our déjà vu logic recently, and that narrative continues to look relevant. Markets consolidated from October 2024 to February 2025, followed by an aggressive sell-off. A very similar technical setup is now playing out. Momentum is fading, and 6,800 (futures) is the key level to watch.

Source: LSEG Workspace

NASDAQ technicals

NDX putting in a massive down candle as of writing. We remain trading inside the consolidation that has been in place for months, but this space also looks similar to what we saw last year before the big sell off. Watch the 50 day MA closely as well as the lower trend line.

Source: LSEG Workspace

Big under the hood stress

2026 has so far seen the largest cumulative rise in skew since the Liberation Day crash. Positioning suggests the crowd is long and increasingly desperate for downside protection, aggressively bidding low-delta puts and pushing skew sharply higher.

Source: LSEG Workspace

Never underestimate...

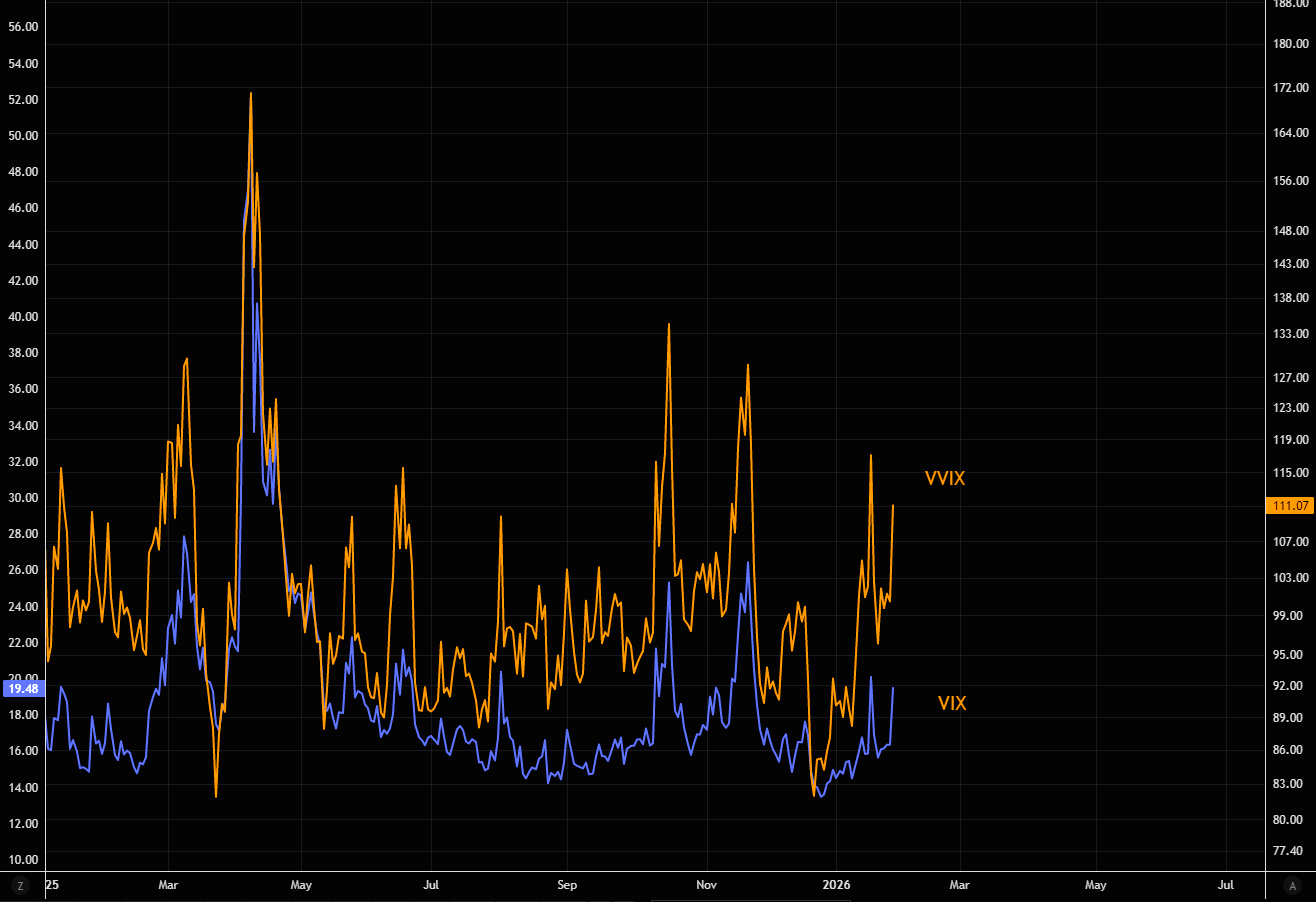

...the power of the VVIX. The gap between VVIX and VIX continues to stay very wide.

Source: LSEG Workspace

Supply to consider

If the S&P 500 closes down 1%, estimated equity supply over the next week remains modest at around $15bn (-0.5 z-score). A 1.5% decline pushes that figure to roughly $25–30bn (-0.9 z-score), while a 2% drop would imply $40–45bn of equity supply over the following week (-1.3 z-score). Some of this would hit today, but most would be spread across the coming days. (MS QDS)

Don't confuse hedges

We’ve consistently warned against chasing gold as an "overall hedge". VIX has been the cleaner hedge instead. VIX near 20 is less attractive than before, but gold is still not the hedge du jour in our book.

Source: LSEG Workspace

It never matters...

...until it matters. The massive move in the JPY has implications for global macro books. Moves like the ones we have seen in the JPY tend to spill over to other assets.

Source: LSEG Workspace

Bro

BTC has become the number one soggy asset. The question is whether it’s trying to tell us something about the broader psychology of this market.

Source: LSEG Workspace

Watching tech crap

Small cap tech is puking by some 4% as of writing. Watch this space closely as it tends to be early.

Source: LSEG Workspace

Some longer term stuff you don't see at lows

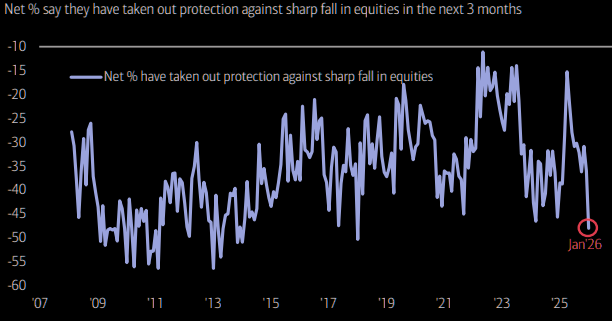

Protection is for suckers?

Almost 50% of investors in BofA's FMS haven't taken out protection against big sell offs. What could possibly go wrong?

Source: BofA

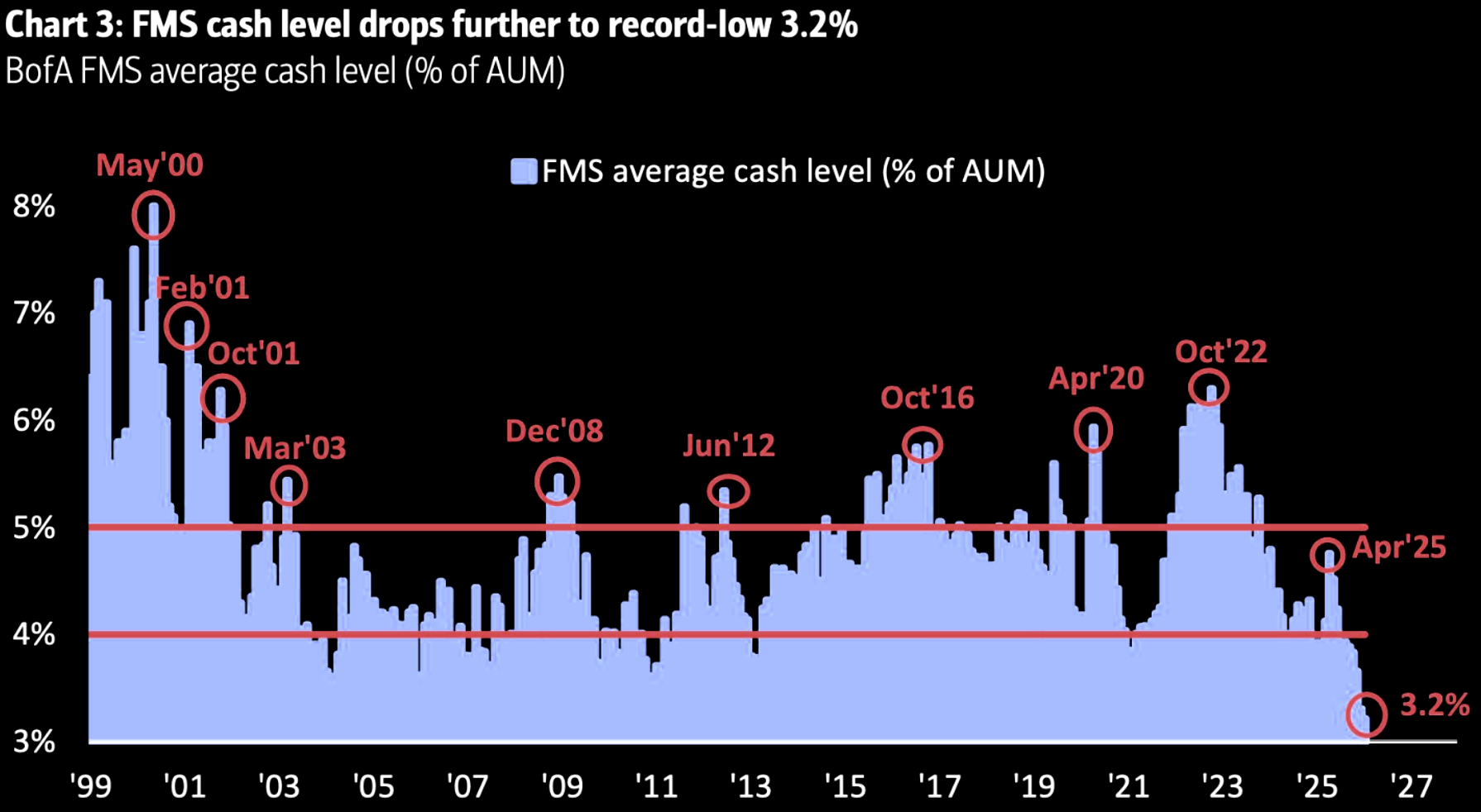

Got no cash

Record low cash pile according to BofA's latest FMS.