Extreme Shorts

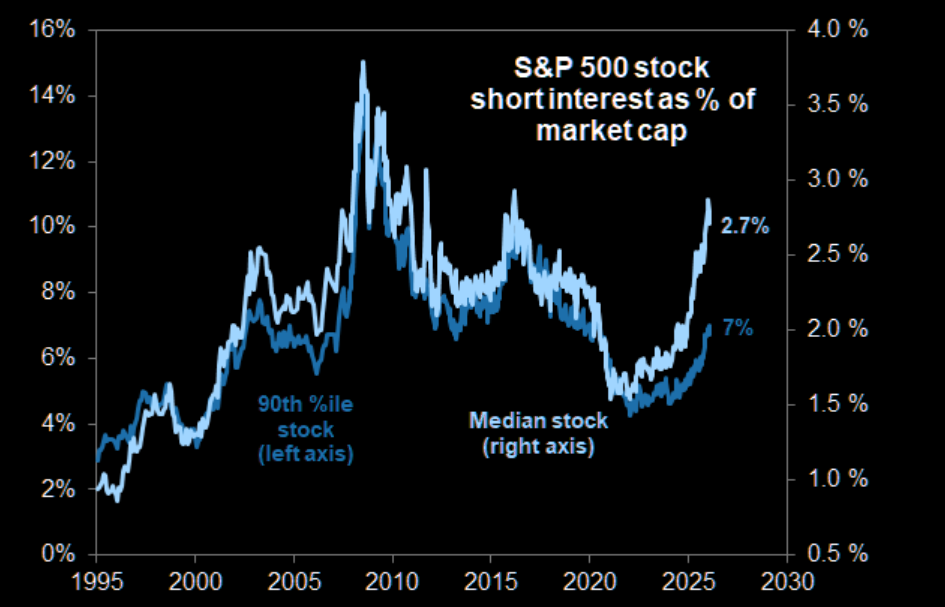

97th percentile

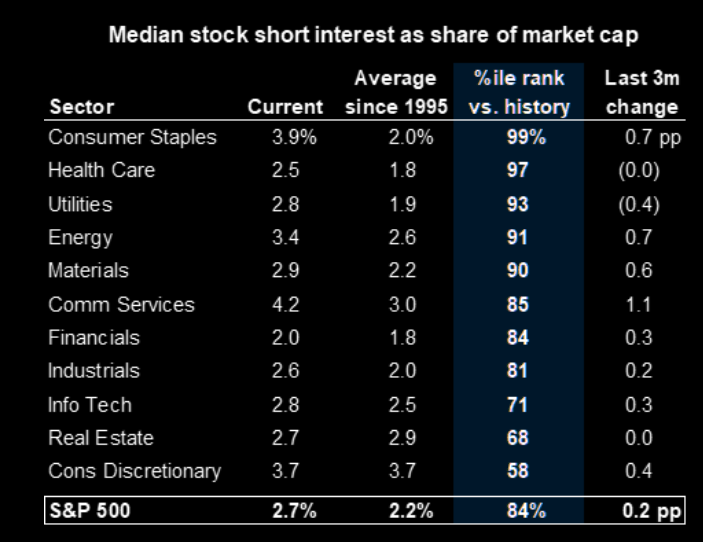

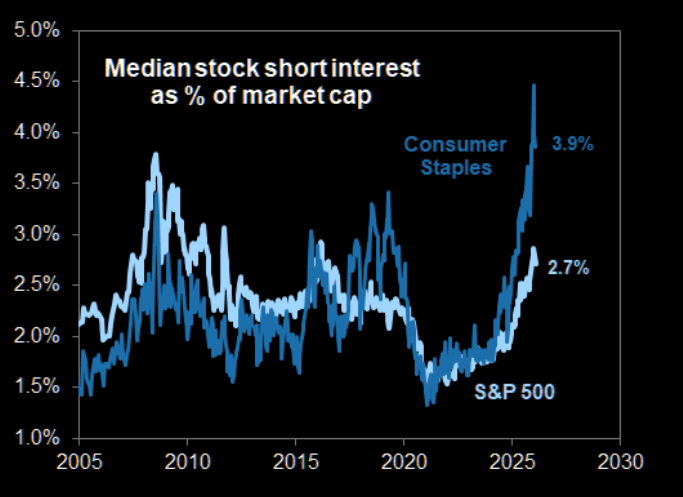

Short interest is at very elevated levels. The median S&P 500 stock carries short interest equivalent to 2.7% of market cap, which ranks in the 84th percentile since 1995 and the 97th percentile relative to the last five years.

Source: FactSet

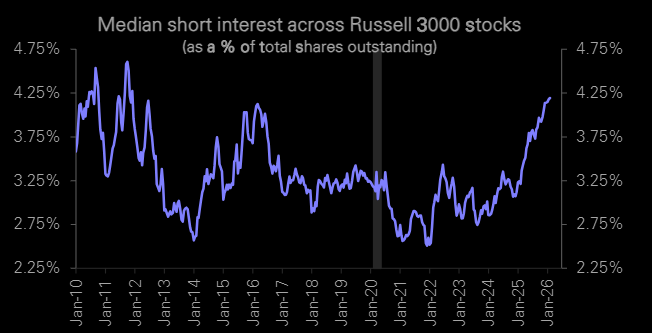

13 year high

13 year high in this short metric. Median cash shorts taken as % of shares outstanding for the Russell 3000.

Source: Compustat

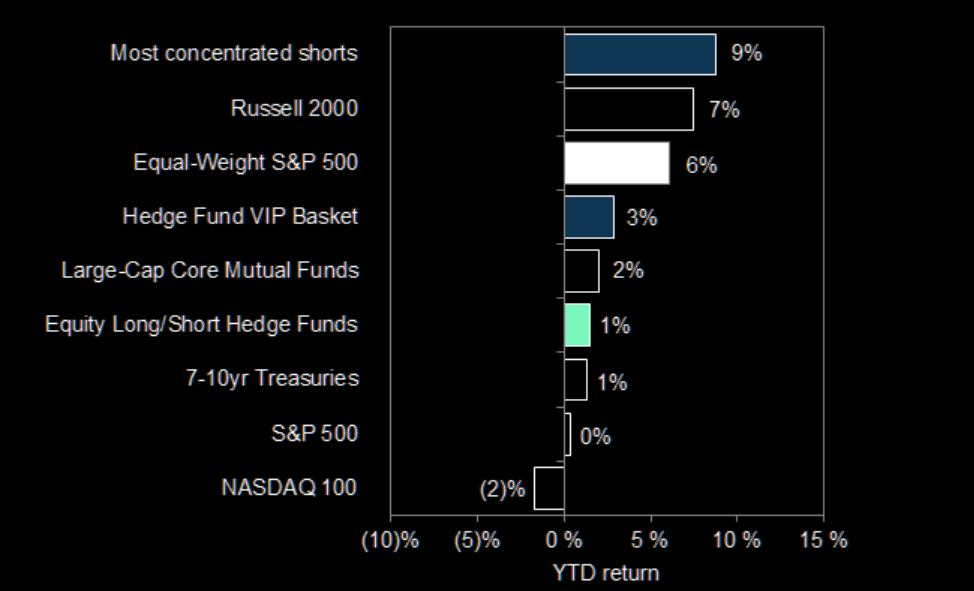

Most concentrated shorts performance

The Hedge Fund VIP basket of the most popular hedge fund long positions has returned +3% YTD, compared with +9% for a basket of stocks with the most concentrated short interest.

Source: GS Prime

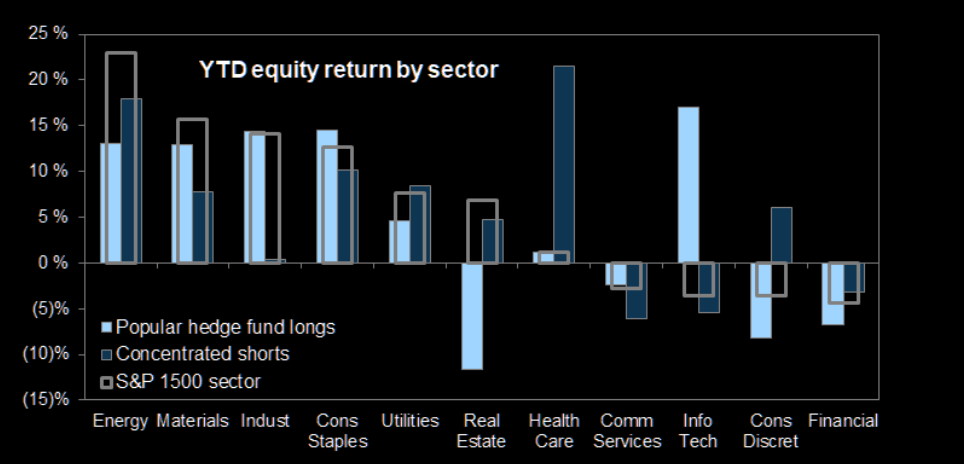

The recent short squeeze

The recent short squeeze has affected nearly every sector. The most concentrated short positions have outperformed popular longs in 6 of 11 sectors YTD. Concentrated shorts have declined outright YTD in Communication Services, Info Tech, and Financials.

Source: GS Prime

Vol up

Realized volatility in the most concentrated short positions has recently spiked. A basket of the most concentrated short positions squeezed higher by more than 20% during the first three weeks of the year, and the basket's recent volatility has registered the highest level since last year's tariff shock.

Source: Goldman

Most elevated in defensive sectors

Within the market, short interest remains the most elevated relative to history in defensive sectors. Short interest is close to 30-year highs in Consumer Staples and Health Care. Elevated short interest is likely one driver of Consumer Staples' +13% YTD return.

Source: FactSet

Consumer Staples shorts

Consumer Staples short interest is extremely high.

Source: FactSet

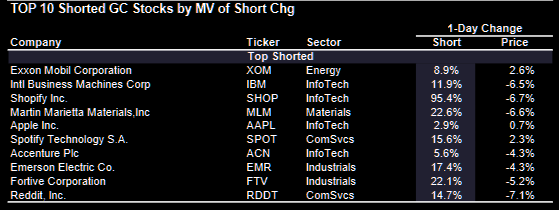

Largest short increase

Large cap stocks with the largest recent increases in short interest.

Source: FactSet

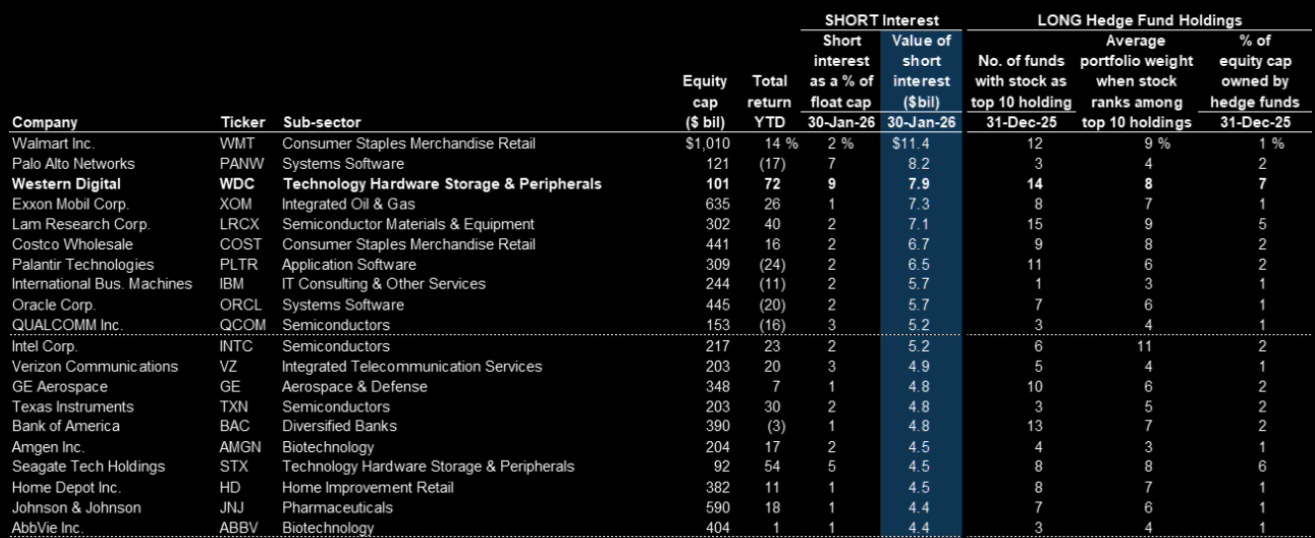

Largest dollar shorts

Highest dollar value of shorts outstanding.

Source: GS Prime

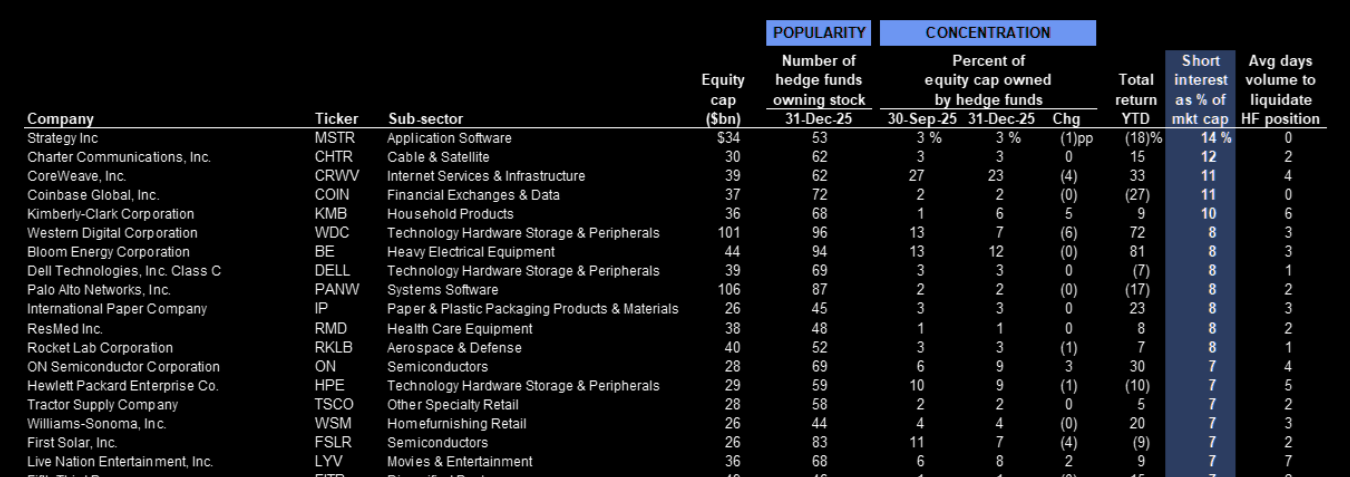

Highest short interest

Highest short interest: Stocks over $25 billion in market cap.

Source: FactSet

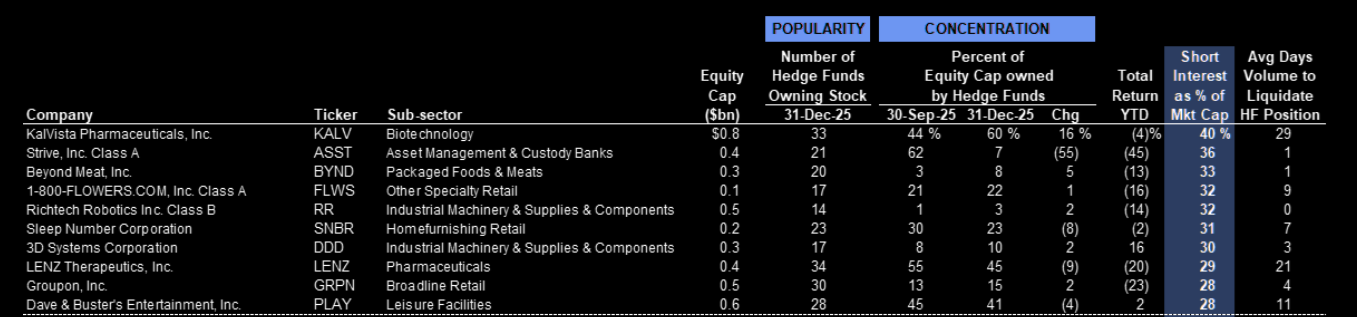

The extreme shorts

Highest short interest: Stocks under $1 billion in market cap.

Source: FactSet

Short squeeze risk

Apple is in Goldman's high short interest squeeze risk table.