Fancy Frontier FX?

When carry gets carried away

Nothing screams “late-cycle confidence” like piling into Nigerian naira and Turkish lira for yield. Goldman’s latest idea: clip ~14% carry and aim for 7.5% upside. International reserves are high, disinflation is coming and correlation is low. Risk curve? Fully extended.

Nibbling in Naira

The bulls say that frontier currencies offer high carry levels relative to EM counterparts, as well as healthy valuation buffers. Macro fundamentals have also been improving: international reserves have reached historical highs, cushioning FX returns, and broad-based disinflation supports local rates.

GS: "Our constructive view of Frontier FX is best expressed via currencies that offer high carry and that can either see further appreciation or limited depreciation based on favourable valuations"

If you always fancied buying some Nigerian Naira, Ghanaian Cedi and Kazakhstani Tenge, this is for you.

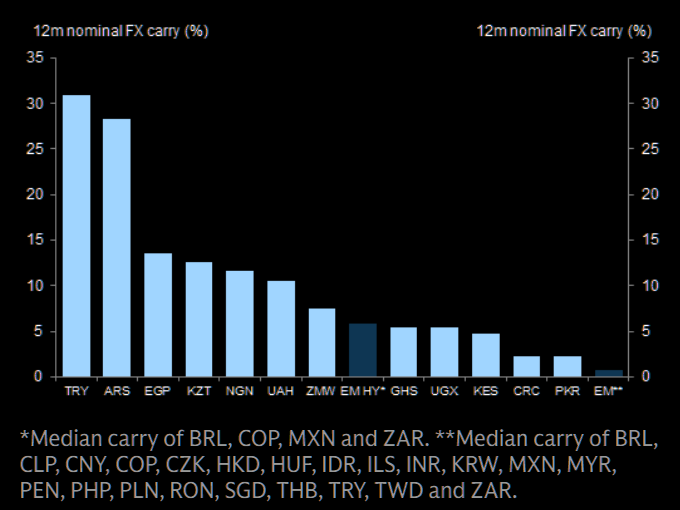

Frontier FX carry

Currencies such as TRY, EGP, KZT and NGN have significantly higher carry levels than their EM FX counterparts.

Source: Goldman

International reserves

International reserves have reached multi-year highs across a range of frontier economies. Historically high international reserves constitute another factor cushioning spot rates across frontier markets.

Source: Haver

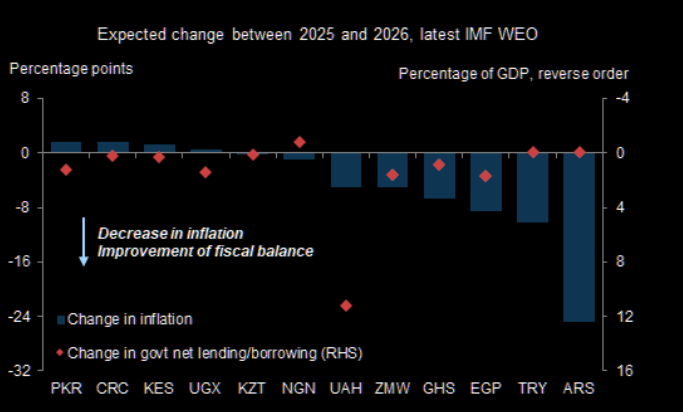

Disinflation

The IMF projects disinflation to continue this year, with moderate fiscal improvements.

Source: IMF

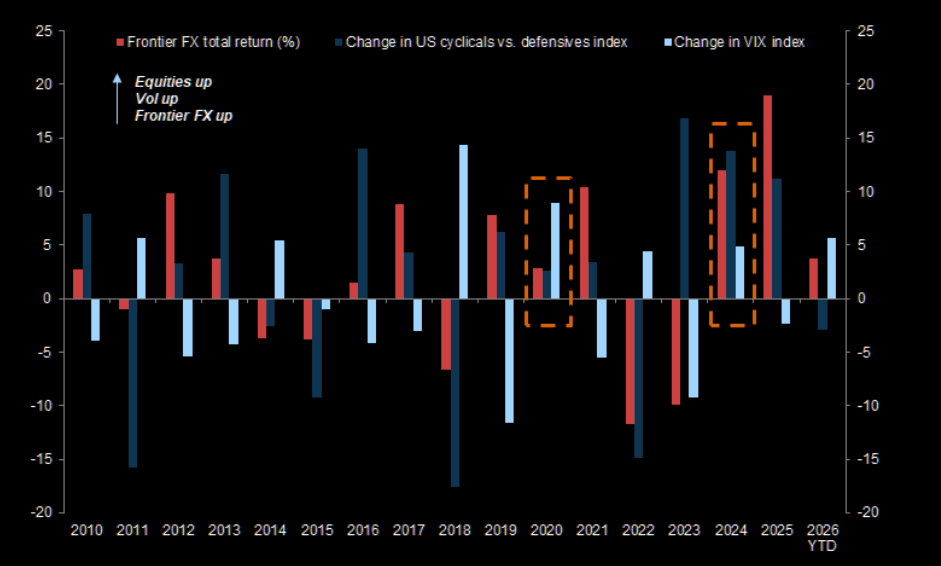

Frontier FX loves this backdrop

Frontier FX total returns have remained resilient in the 'equities up/vol up' years.

Source: Goldman

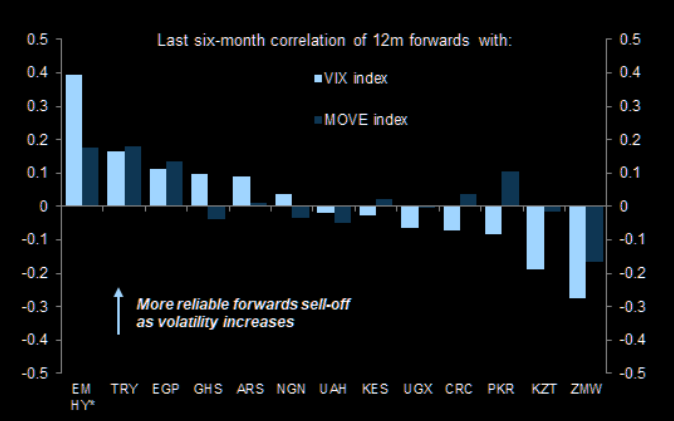

Less correlated

Frontier currencies are much less correlated with global volatility than EM and EM HY FX counterparts ...

Source: Goldman

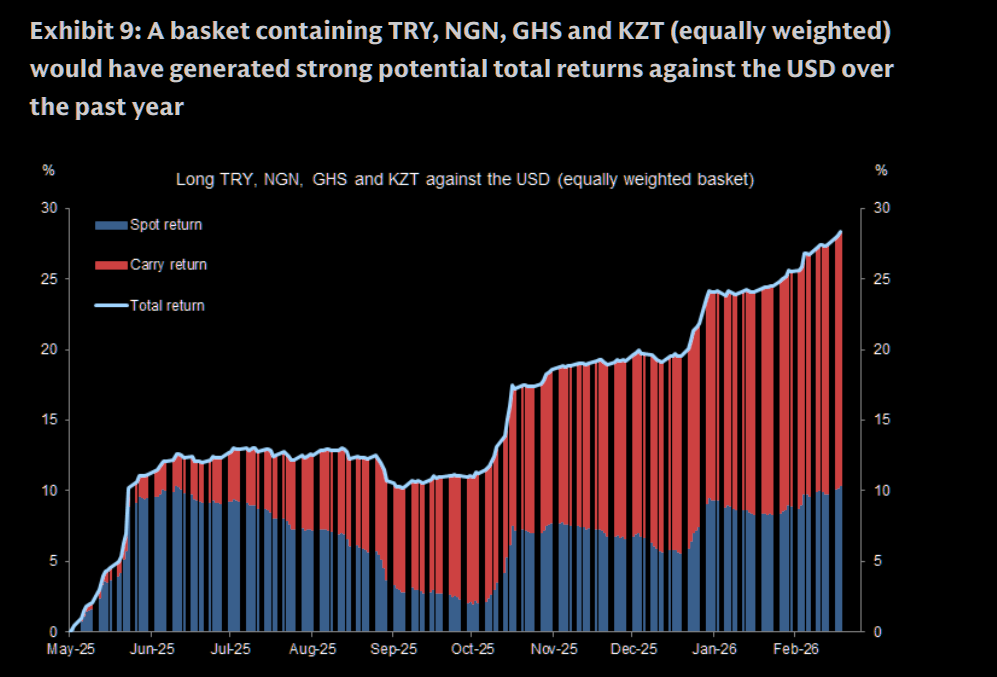

The trade

GS FX: "we recommend going long an equally weighted basket of TRY, NGN, GHS and KZT against the USD as an equally weighted basket, with a total return target of 7.5%, and a stop of -3.5%, with a 12-month nominal carry of ~14%. This basket would have generated strong potential total returns since May of last year"