Fear Running High Into The Long Weekend

Fearful

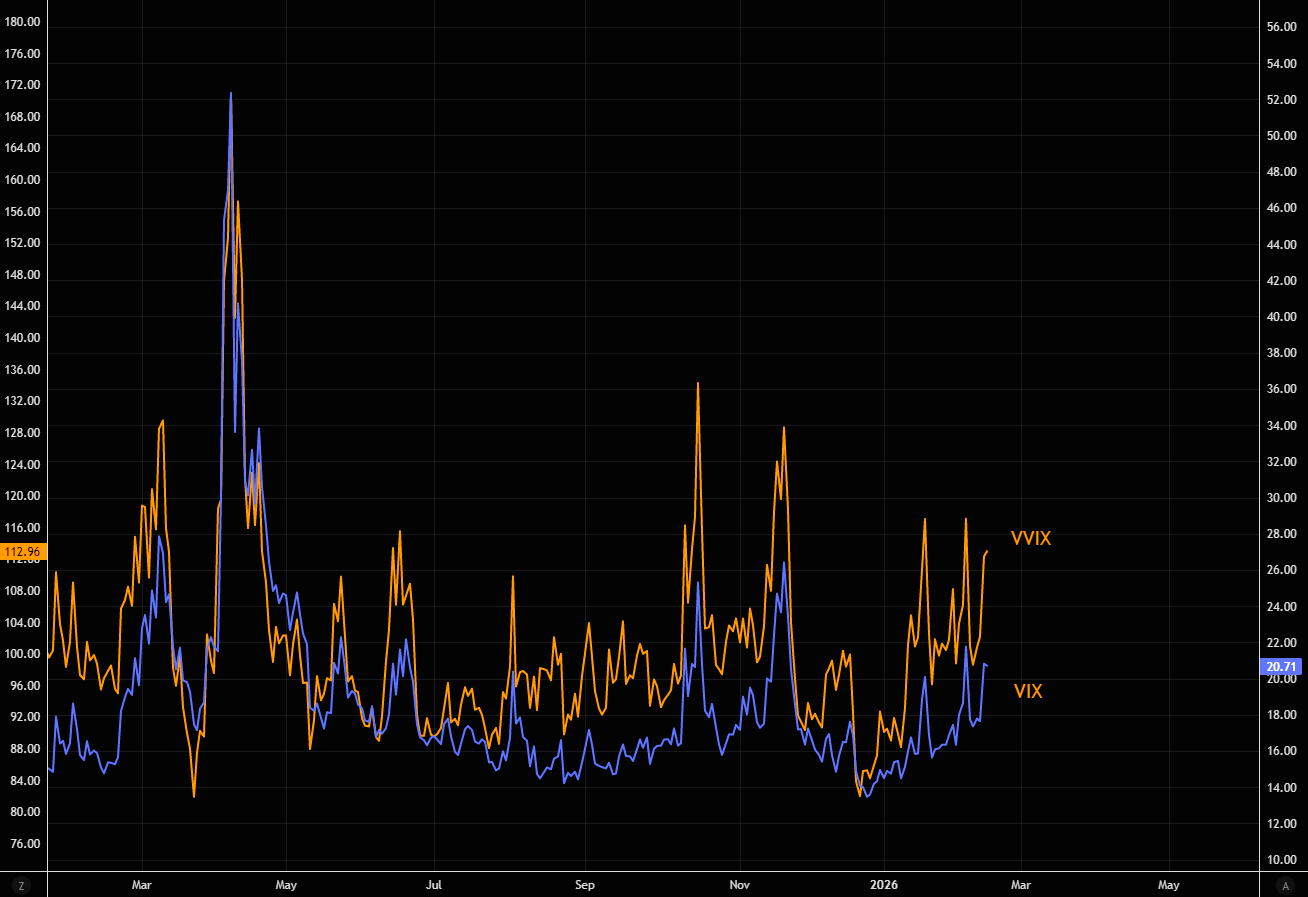

With VVIX at 113, the market is still pricing elevated fear. The VVIX–VIX gap remains wide.

Source: LSEG Workspace

Fear still running high

NDX volatility is hovering near recent “panic” levels, even as the index is relatively flat and we head into a long weekend (expensive theta). Chart shows NDX vs VXN (inverted).

Source: LSEG Workspace

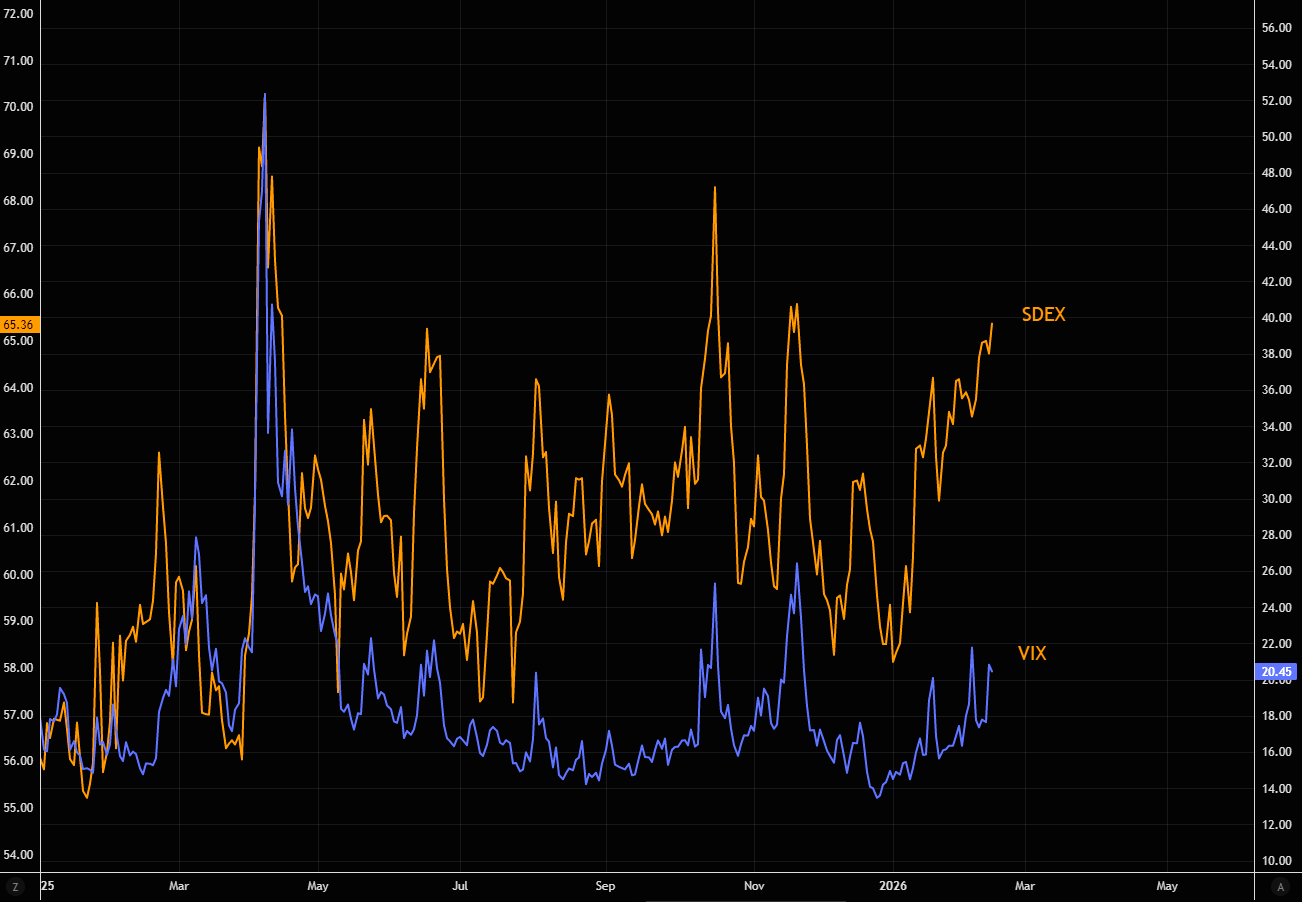

That downside bid

Skew remains aggressively bid and has significantly outperformed the VIX in recent sessions, signaling persistent demand for downside protection.

Source: LSEG Workspace

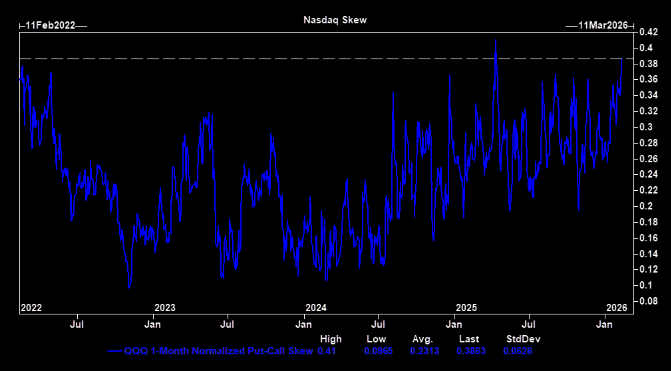

NDX as well

NDX put-call skew has exploded higher, now trading not far from Liberation Day panic levels. The crowd is nervous about tech downside.

Source: LSEG Workspace

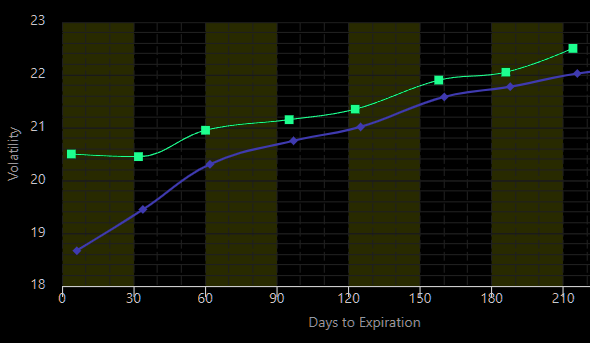

Still stressed

The sharp move higher in the front end of the VIX curve suggests investors remain heavily focused on near-term stress. Chart shows today vs Wednesday.

Source: Vixcentral

Downside convexity

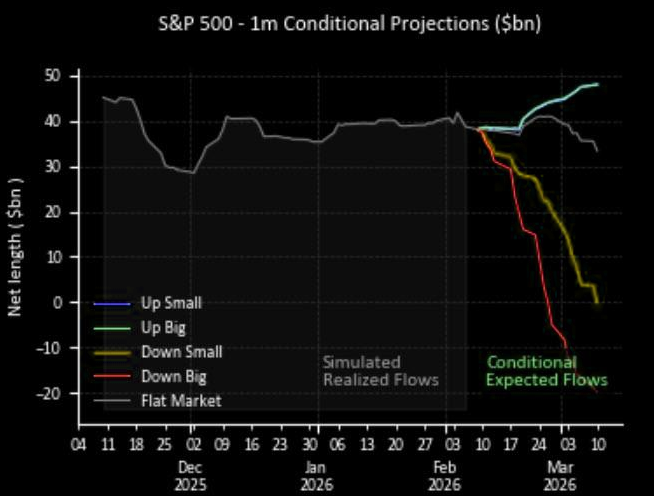

GS estimates CTAs will sell $1.5–2bn of US equities over the next week. The S&P 500 is still above the key medium-term trigger at 6,723, a break below would likely accelerate systematic selling.